Precision Farming Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

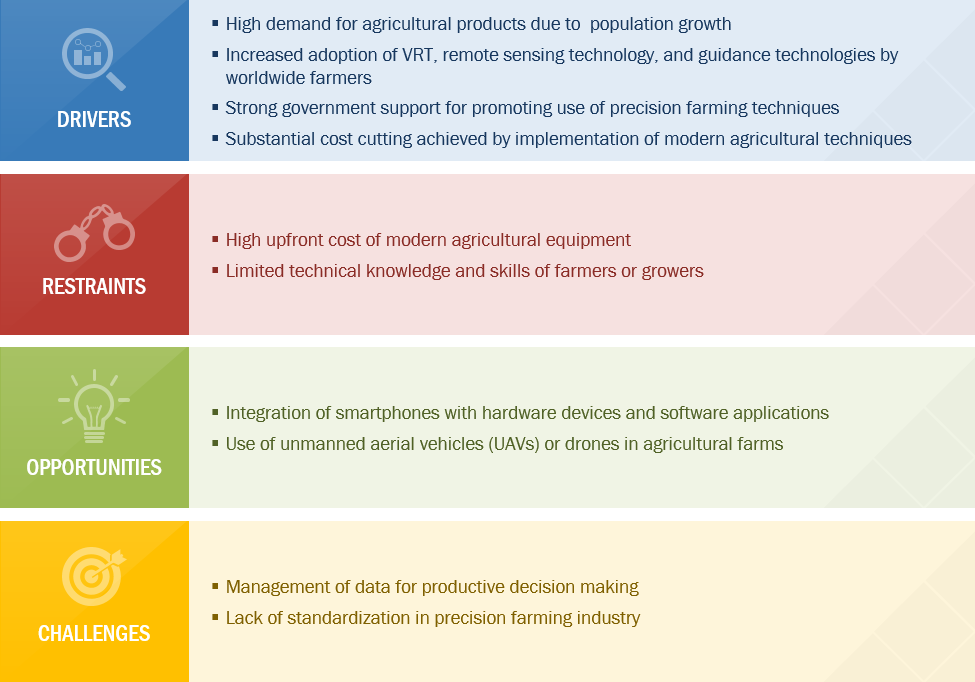

Figure 1 Precision Farming Market: Drivers, Restraints, Opportunities, and Challenges

2.2.1 Drivers

2.2.1.1 High Demand for Agricultural Products Due to Population Growth

Figure 2 Global Consumption of Major Field Crops, 2005–2050

2.2.1.2 Increased Adoption of VRT, Remote Sensing Technology, and Guidance Technologies By Worldwide Farmers

2.2.1.3 Strong Government Support for Promoting Use of Precision Farming Techniques

2.2.1.4 Substantial Cost Cutting Achieved By Implementation of Modern Agricultural Techniques

2.2.2 Restraints

2.2.2.1 High Upfront Cost of Modern Agricultural Equipment

2.2.2.2 Limited Technical Knowledge and Skills of Farmers or Growers

2.2.3 Opportunities

2.2.3.1 Integration of Smartphones With Hardware Devices and Software Applications

2.2.3.2 Use of Unmanned Aerial Vehicles or Drones in Agricultural Farms

2.2.4 Challenges

2.2.4.1 Management of Data for Productive Decision Making

2.2.4.2 Lack of Standardization in Precision Farming Industry

2.2.5 Winning Imperatives

2.2.5.1 Environmental Protection

3 Industry Trends

3.1 Introduction

3.2 Value Chain Analysis

Figure 3 Value Chain: Precision Farming Market

3.2.1 Major Players in Precision Farming Market

3.3 Supply Chain Analysis

Figure 4 Supply Chain: Precision Farming Market

3.4 Technology Roadmap

3.4.1 Technology Roadmap (2010–2025)

Figure 5 Present and Upcoming Technologies in Precision Farming Market

3.4.2 Key Industry Trends

Figure 6 Big Data Opportunities – Leading Trend Among Key Market Players

3.5 Covid-19 Update

4 Company Evaluation Quadrant

4.1 Visionary Leaders

4.2 Dynamic Differentiators

4.3 Innovators

4.4 Emerging Companies

Figure 7 Precision Farming Market (Global) Company Evaluation Quadrant

5 Competitive Landscape

5.1 Introduction

Figure 8 Companies Adopted Collaborations, Agreements, and Partnerships as Key Growth Strategies

5.2 Precision Farming Market Ranking Analysis

Figure 9 Ranking of Top 5 Players in Precision Farming Market (2019)

5.3 Recent Developments

5.3.1 Product Launches & Developments

Table 1 Product Launches and Developments, 2017–2020

5.3.2 Agreements, Partnerships, and Collaborations

Table 2 Partnerships, Agreements, and Collaborations, 2017-2020

5.3.3 Mergers and Acquisitions

Table 3 Merger and Acquisitions, 2017–2019

6 Company Profiles

6.1 Deere & Company

6.1.1 Business Overview*

Figure 10 Deere & Company: Company Snapshot

6.1.2 Products Offered*

6.1.3 Recent Developments*

6.1.4 SWOT Analysis*

6.1.5 MnM View*

(*Above sections are present for all of below companies)

6.2 Trimble

Figure 11 Trimble: Company Snapshot

6.3 AGCO

Figure 12 AGCO: Company Snapshot

6.4 AgJunction

Figure 13 AgJunction: Company Snapshot

6.5 Raven Industries

Figure 14 Raven Industries: Company Snapshot

6.6 AG Leader Technology

6.7 AgEagle

6.8 TeeJet Technologies

6.9 Taranis

6.10 Topcon Positioning Systems

7 Appendix

7.1 Other Significant Players

7.1.1 Hexagon Agriculture

7.1.2 Granular

7.1.3 Prospera Technologies

7.1.4 Autonomous Tractor Corporation

7.1.5 AutoCopter Corp.

7.2 Start-Up Companies

7.2.1 The Climate Corporation (Subsidiary of Monsanto)

7.2.2 Vision Robotics

7.2.3 Cropx Technologies

7.2.4 Descartes Labs

7.2.5 ec2ce

7.3 Methodology

This report identifies and benchmarks the key market players such as John Deere, AGCO Corporation, Trimble, AgJunction, and Raven Industries, and evaluates them on the basis of business strategy excellence and strength of product portfolio within the precision farming ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More