Point of Care Diagnostics Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

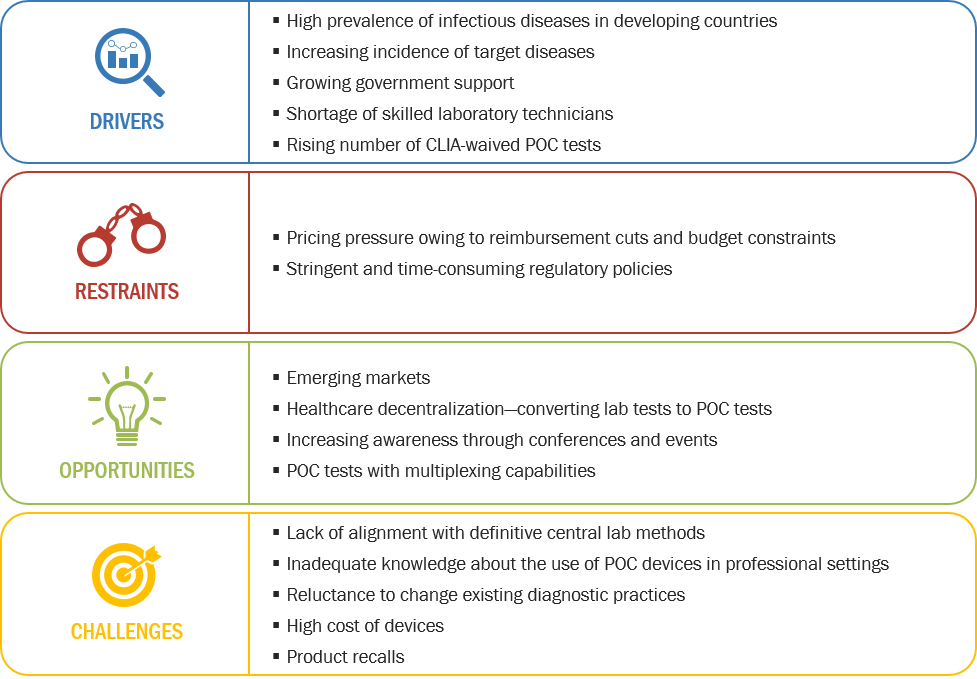

Figure 1 POC Diagnostics Market: Drivers, Restraints, Opportunities, and Challenges

2.2.1 Drivers

2.2.1.1 High Prevalence of Infectious Diseases in Developing Countries

2.2.1.2 Increasing Incidence of Target Conditions

2.2.1.3 Growing Government Support

2.2.1.4 Shortage of Skilled Laboratory Technicians

2.2.1.5 Rising Number of Clia-Waived POC Tests

Table 1 Recent Waivers for Market Products

2.2.2 Restraints

2.2.2.1 Pricing Pressure Owing to Reimbursement Cuts and Budget Constraints

2.2.2.2 Stringent and Time-Consuming Regulatory Policies

2.2.3 Opportunities

2.2.3.1 Emerging Markets

2.2.3.2 Healthcare Decentralization—Converting Lab Tests to POC Tests

2.2.3.3 Increasing Awareness Through Conferences and Events

2.2.3.4 POC Tests With Multiplexing Capabilities

2.2.4 Challenges

2.2.4.1 Lack of Alignment With Definitive Central Lab Methods

2.2.4.2 Inadequate Knowledge About the Use of POC Devices in Professional Settings

2.2.4.3 Reluctance to Change Existing Diagnostic Practices

2.2.4.4 High Cost of Devices

2.2.4.5 Product Recalls

2.2.5 Emerging Applications of Point-Of-Care Testing

2.2.5.1 Sepsis Biomarkers

2.2.5.2 Stroke Markers

2.2.5.3 Thyroid Testing

2.2.5.4 DNA Testing

2.2.5.5 Endocrine Testing

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 2 Point of Care Diagnostics Market (Global) Company Evaluation Quadrant

4 Competitive Landscape

4.1 Introduction

4.2 Global Market Share Analysis, 2018

Figure 3 Roche Diagnostics Held the Leading Position in the Point-Of-Care Diagnostics Market in 2018

4.3 Competitive Scenario

4.3.1 Product Launches, Enhancements, and Approvals

4.3.2 Agreements, Partnerships, and Collaborations

4.3.3 Acquisitions

5 Company Profiles

5.1 Abbott Laboratories

5.1.1 Business Overview*

Figure 4 Abbott Laboratories: Company Snapshot

5.1.2 Products Offered*

5.1.3 Recent Developments*

5.1.4 MnM View*

(*Above sections are present for all of below companies)

5.2 Becton, Dickinson and Company

Figure 5 BD: Company Snapshot

5.3 Chembio Diagnostics

Figure 6 Chembio Diagnostics: Company Snapshot

5.4 Danaher Corporation

Figure 7 Danaher Corporation: Company Snapshot

5.5 Johnson & Johnson

Figure 8 Johnson & Johnson: Company Snapshot

5.6 Roche Diagnostics (A Subsidiary of F. Hoffmann-La Roche Ltd.)

Figure 9 Roche Diagnostics: Company Snapshot

5.7 Siemens Healthineers Group

Figure 10 Siemens Healthineers Group: Company Snapshot

5.8 EKF Diagnostics

Figure 11 EKF Diagnostics: Company Snapshot

5.9 Quidel

Figure 12 Quidel: Company Snapshot

5.10 Trinity Biotech

Figure 13 Trinity Biotech: Company Snapshot

5.11 AccuBioTech

5.12 Instrumentation Laboratory (A Werfen Company)

5.13 Nova Biomedical

5.14 PTS Diagnostics (A Part of Sinocare, Inc.)

5.15 Sekisui Diagnostics

6 Appendix

6.1 Methodology

The report profiles the key market players in the Point of Care Diagnostics Market such as Abbott (US), Roche (Switzerland), Siemens (Germany), Danaher (US), Becton, Dickinson and Company (US). The report identifies, and benchmarks these key market players and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Point of Care Diagnostics ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix called as ‘Company Evaluation Quadrant’ and identified as Visionary Leaders, Dyamic Differentiators, Innovators, or Emerging Companies.

The report includes market specific company profiles of all 25 players and assesses the recent developments that shape the competitive landscape of this highly fragmented market.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More