Plant-based Meat Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Supply Chain

Figure 1 Plant-Based Meat: Supply Chain

2.3 Market Dynamics

Figure 2 Market Dynamics: Plant-Based Meat

2.3.1 Drivers

2.3.1.1 Growth in Vegan and Flexitarian Population Across the World

Figure 3 UK: Vegan Population, 2014–2018

2.3.1.2 Rise in Awareness About the Health Benefits of Plant-Based Meat Over Animal Meat

Table 1 Nutrients Present in Sources of Plant-Based Meat

2.3.1.3 Growth in Government Initiatives Along With Significant Investments

Table 2 Top Universities Funded for Plant-Based Meat Research

2.3.1.4 Major Food Industry Pioneer Investing and Introducing Plant-Based Meat Products

2.3.2 Restraints

2.3.2.1 Population Allergic to Plant-Based Meat Sources Such as Soy and Wheat

2.3.3 Opportunities

2.3.3.1 An Alternative Solution to Meet the Tremendously Growing Demand for Animal Meat Products in the Future

Figure 4 Global Meat Export Value, 2005 Vs. 2050 (Million Ton)

2.3.3.2 Favorable Marketing and Correct Positioning of Plant-Based Meat

2.3.4 Challenges

2.3.4.1 Perception of Taste

2.3.4.2 Genetically Modified (GM) Soybeans

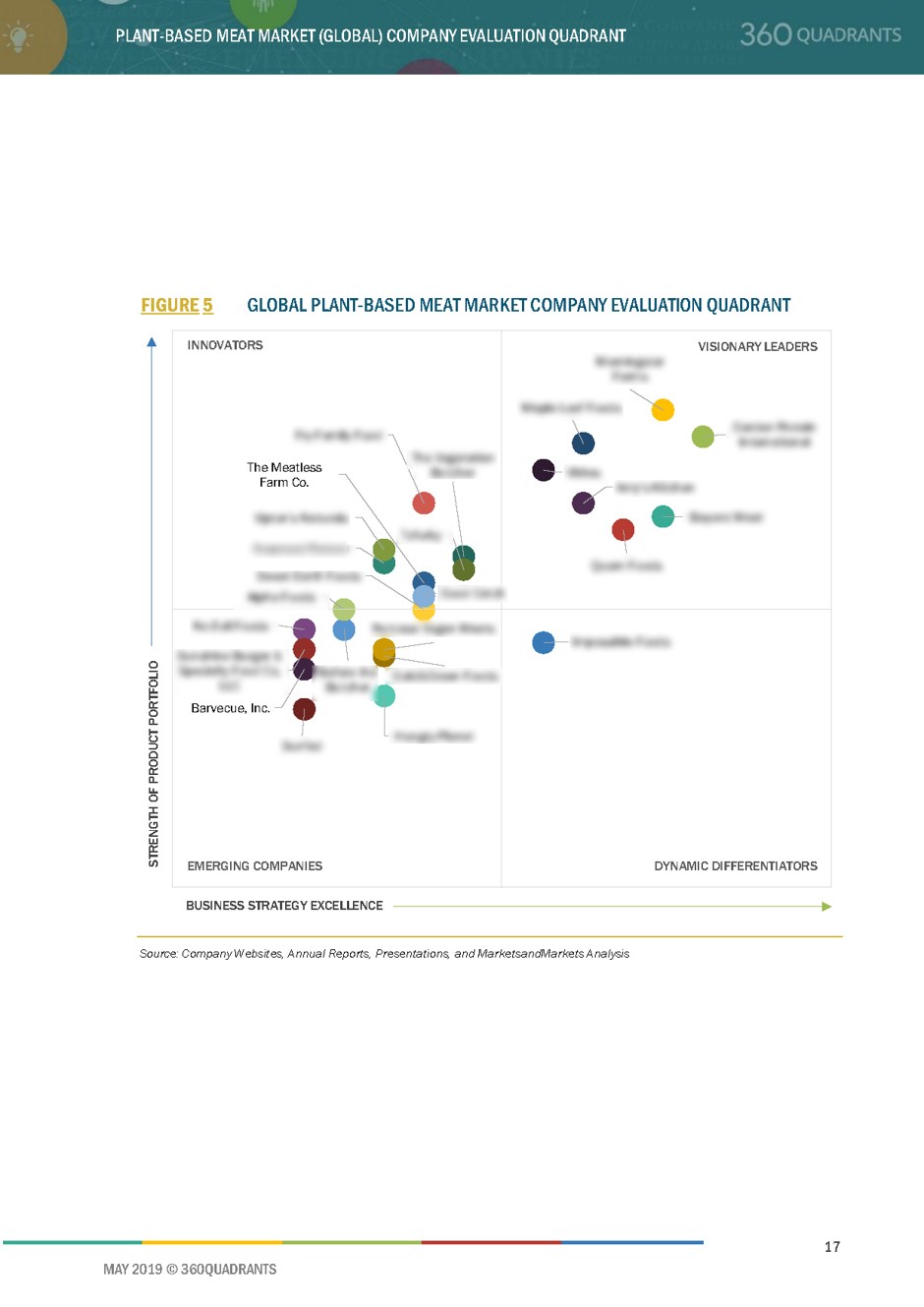

3 Company Evaluation Quadrant

3.1 Terminology/Nomenclature

3.1.1 Visionary Leaders

3.1.2 Innovators

3.1.3 Dynamic Differentiators

3.1.4 Emerging Companies

Figure 5 Global Plant-Based Meat Market Company Evaluation Quadrant

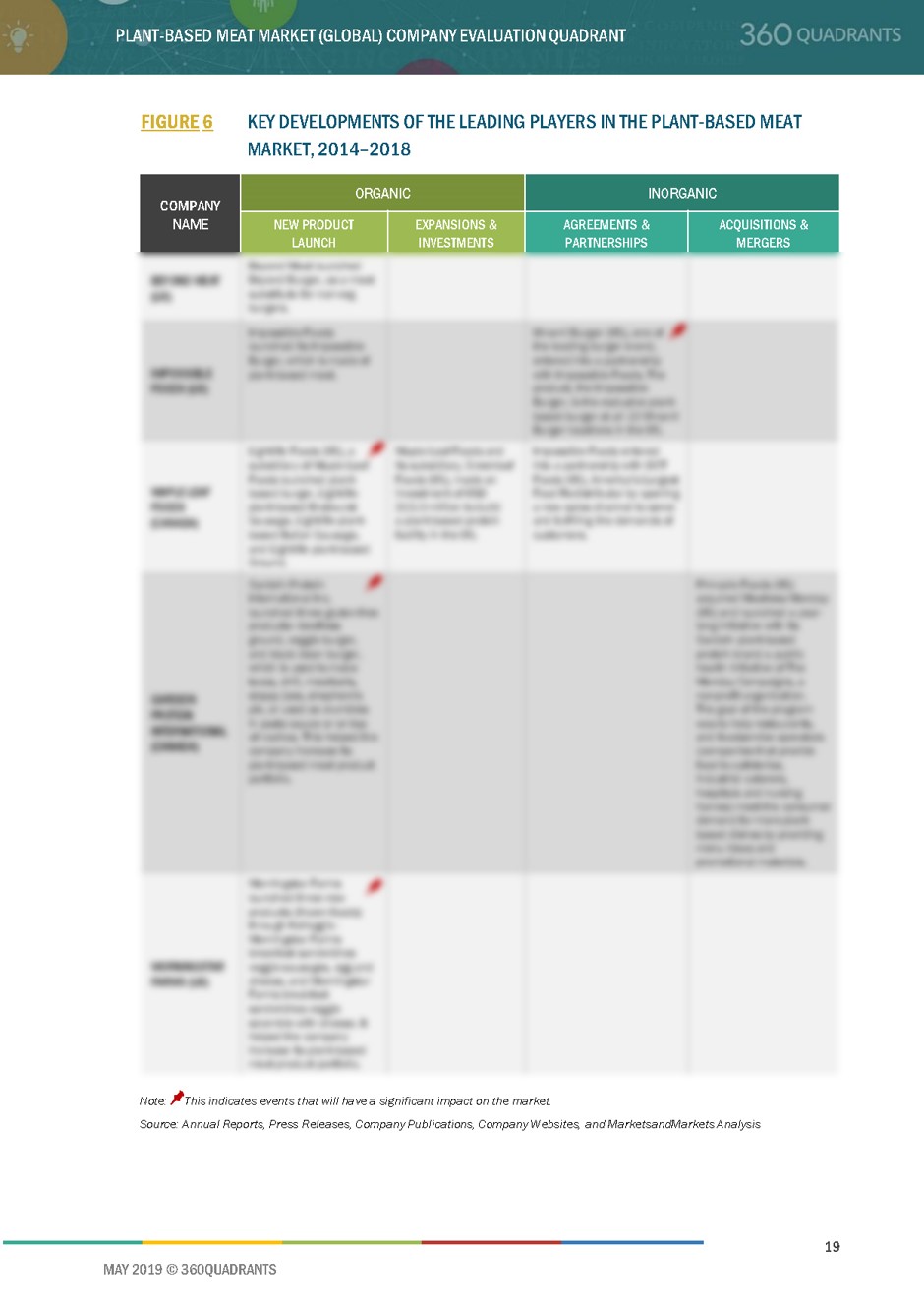

4 Competitive Landscape

4.1 Overview

Figure 6 Key Developments of the Leading Players in the Plant-Based Meat Market, 2014–2018

4.2 Ranking of Key Players, 2018

Figure 7 Beyond Meat Dominated the Plant-Based Meat Market in 2018

4.2.1 New Product Launches

Table 3 New Product Launches, 2013–2019

4.2.2 Expansions & Investments

Table 4 Expansions & Investments, 2014–2019

4.2.3 Acquisitions

Table 5 Acquisitions, 2018

4.2.4 Agreements & Partnerships

Table 6 Agreements & Partnerships, 2017 - 2018

5 Company Profiles

5.1 Beyond Meat

5.1.1 Business Overview*

5.1.2 Products Offered*

5.1.3 Recent Developments*

Figure 8 Beyond Meat: SWOT Analysis

5.1.4 MnM View*

(*Above sections are present for all of below companies)

5.2 Impossible Food Inc.

Figure 9 Impossible Foods Inc: SWOT Analysis

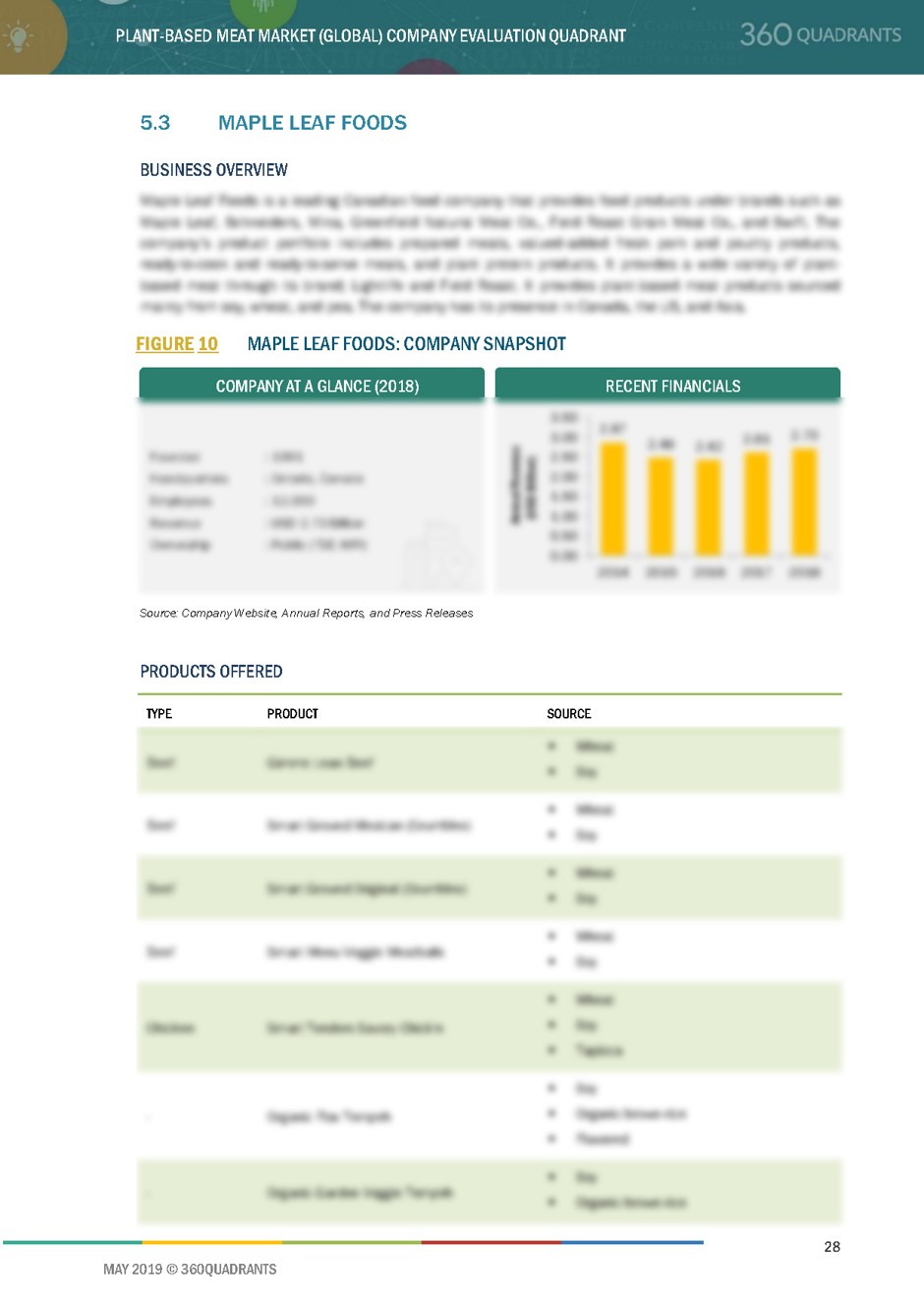

5.3 Maple Leaf Foods

Figure 10 Maple Leaf Foods: Company Snapshot

Figure 11 Maple Leaf Foods: SWOT Analysis

5.4 The Vegetarian Butcher

Figure 12 The Vegetarian Butcher: SWOT Analysis

5.5 Gardein Protein International (Pinnacle Foods)

Figure 13 Gardein Protein International: SWOT Analysis

5.6 Morningstar Farms

5.7 Quorn Foods

5.8 Amy’s Kitchen

5.9 Tofurky

5.10 Gold&Green Foods Ltd.

5.11 Sunfed

5.12 VBites Foods Limited

6 Appendix

6.1 Methodology

6.2 List of Abbreviations

This report identifies and benchmarks the top plant based meat producers such as Impossible Foods (US), Beyond Meat (US), Garden Protein International (US), Morningstar Farms (US), Quorn Foods (UK), Amy’s Kitchen (US), Maple Leaf Foods (Canada) and evaluates them on the basis of business strategy excellence and strength of product portfolio within the plant-based meat ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More