Machine Vision Solutions Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

1.1.1 Inclusions and Exclusions

2 Market Overview

2.1 Introduction

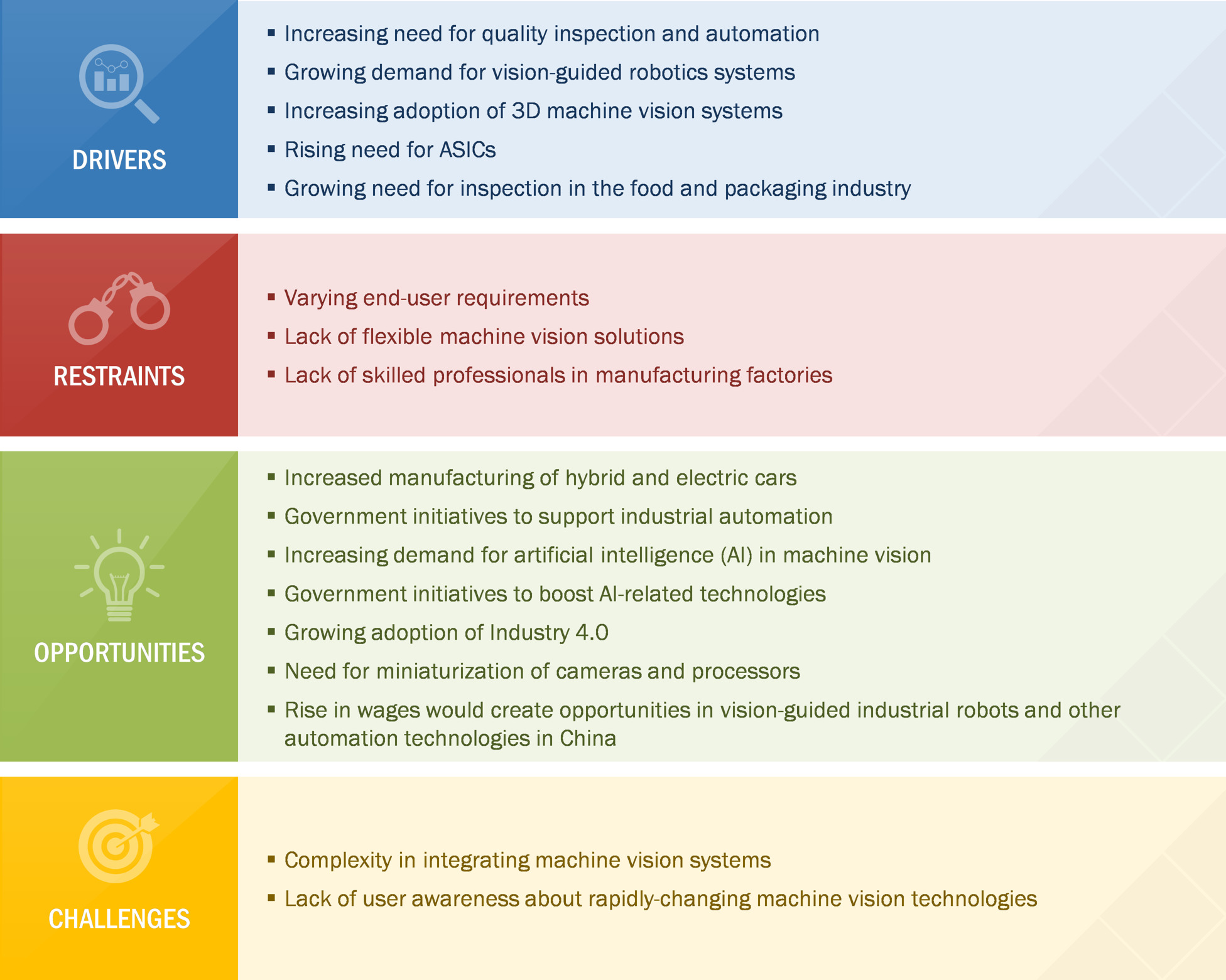

2.2 Market Dynamics

Figure 1 Increasing Manufacturing of Hybrid and Electric Cars to Drive the Growth of the Machine Vision Market

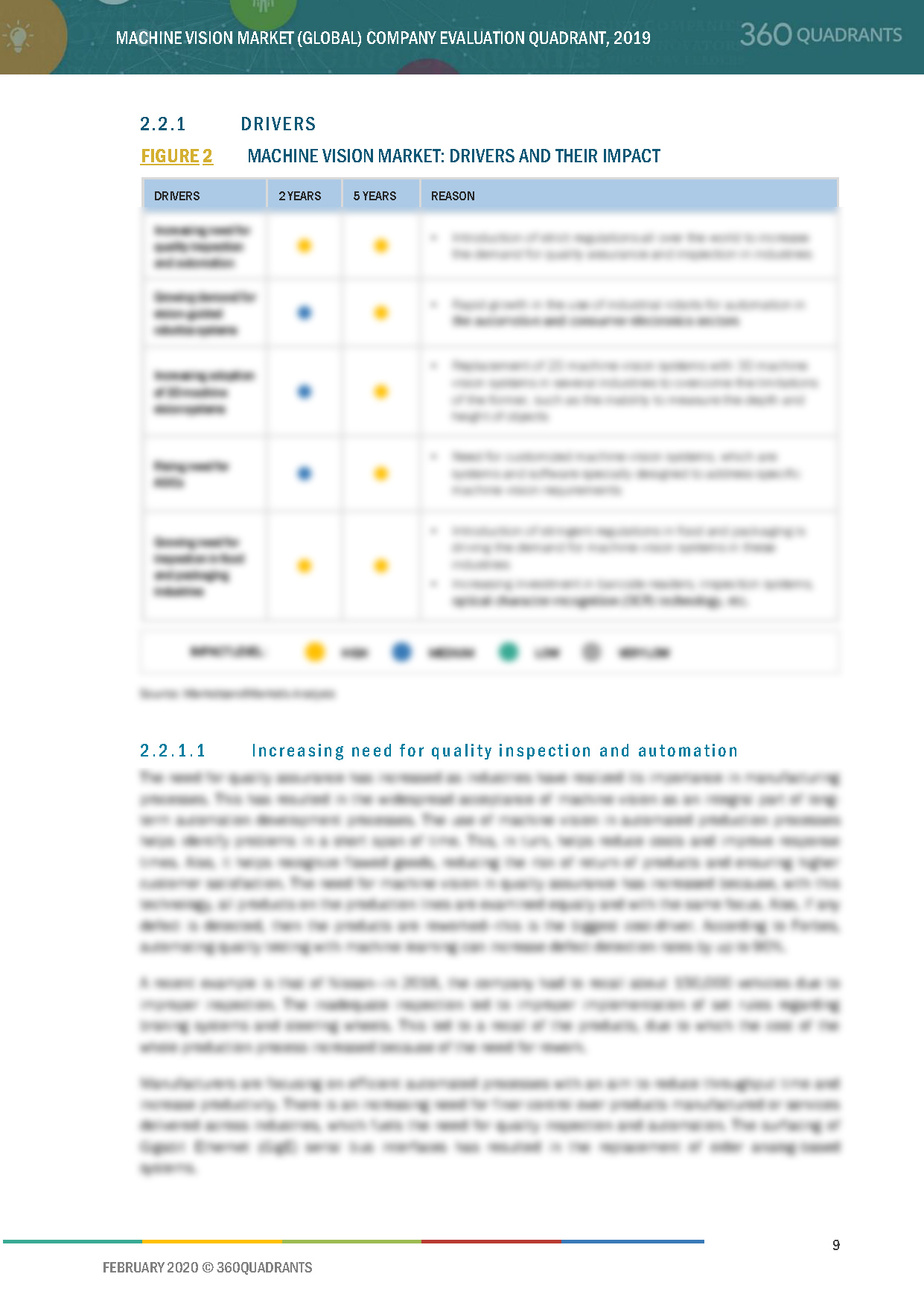

2.2.1 Drivers

Figure 2 Machine Vision Market: Drivers and Their Impact

2.2.1.1 Increasing Need for Quality Inspection and Automation

2.2.1.2 Growing Demand for Vision-Guided Robotics Systems

Figure 3 Growth of Industrial Robotics, in Terms of Shipment, Between 2012 and 2018

2.2.1.3 Increasing Adoption of 3D Machine Vision Systems

2.2.1.4 Rising Need for ASICs

2.2.1.5 Growing Need for Inspection in Food and Packaging Industries

2.2.2 Restraints

Figure 4 Machine Vision Market Restraints and Their Impact

2.2.2.1 Varying End-User Requirements

2.2.2.2 Lack of Flexible Machine Vision Solutions

2.2.2.3 Lack of Skilled Professionals in Manufacturing Factories

Figure 5 Underqualified Workers in Various Countries, in 2019

2.2.3 Opportunities

Figure 6 Machine Vision Market Opportunities and Their Impact

2.2.3.1 Increasing Manufacturing of Hybrid and Electric Cars

Figure 7 Increasing Demand for Hybrid and Electric Vehicles Between 2020 and 2040

2.2.3.2 Government Initiatives to Support Industrial Automation

2.2.3.3 Increasing Demand for Artificial Intelligence (AI) in Machine Vision

2.2.3.4 Government Initiatives to Boost AI-Related Technologies

2.2.3.5 Growing Adoption of Industry 4.0

2.2.3.6 Need for Miniaturization of Cameras and Processors

2.2.3.7 Increasing Wages Leading to Opportunities in Vision-Guided Industrial Robots and Other Automation Technologies in China

Figure 8 Average Yearly Wages in the Manufacturing Sector in China

2.2.4 Challenges

Figure 9 Machine Vision Market Challenges and Their Impact

2.2.4.1 Complexity in Integrating Machine Vision Systems

2.2.4.2 Lack of User Awareness About Rapidly Changing Machine Vision Technology

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Dynamic Differentiators

3.3 Innovators

3.4 Emerging Companies

Figure 10 Machine Vision Market (Global) Company Evaluation Quadrant, 2019

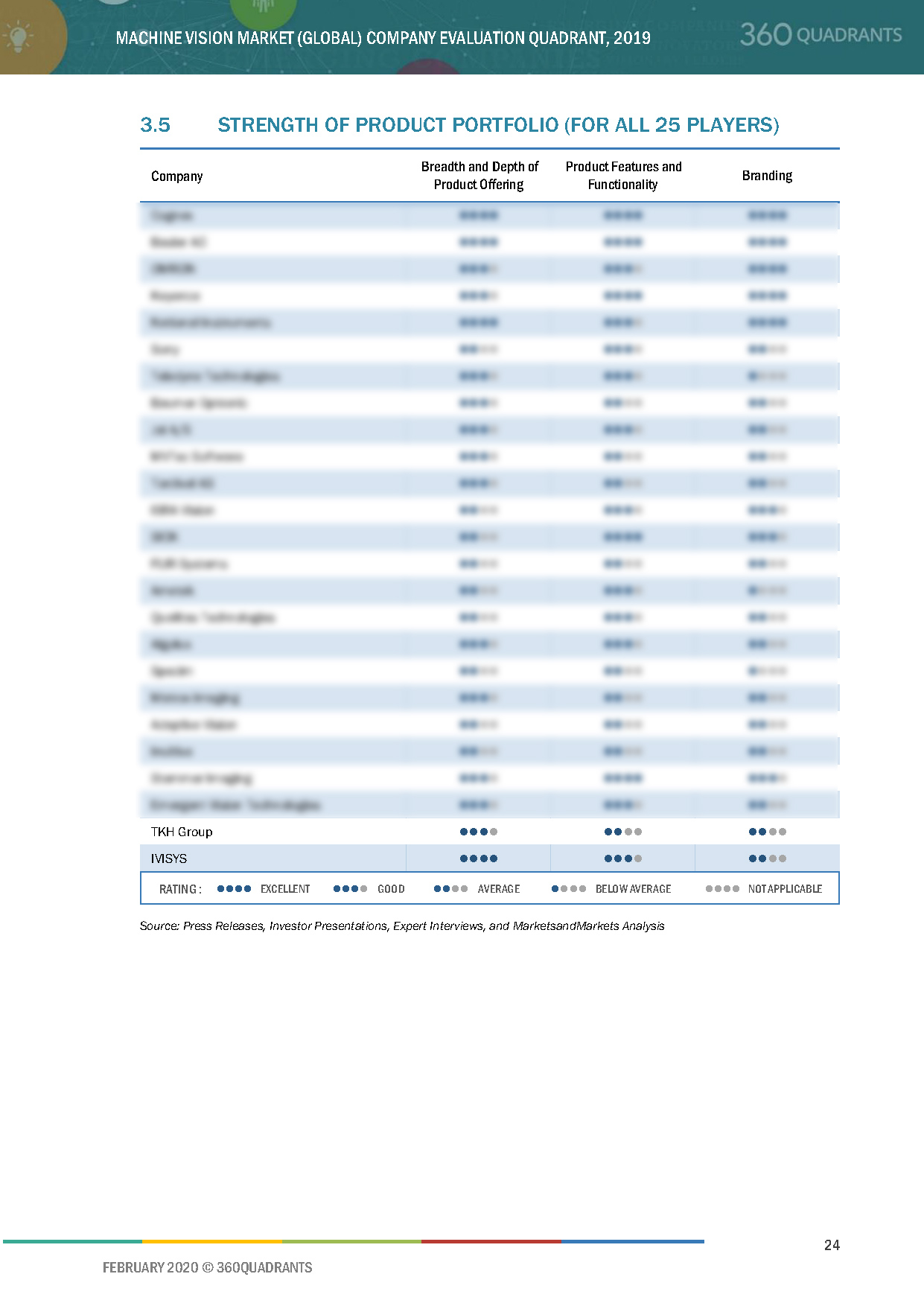

3.5 Strength of Product Portfolio (for All 25 Players)

3.6 Business Strategy Excellence (for All 25 Players)

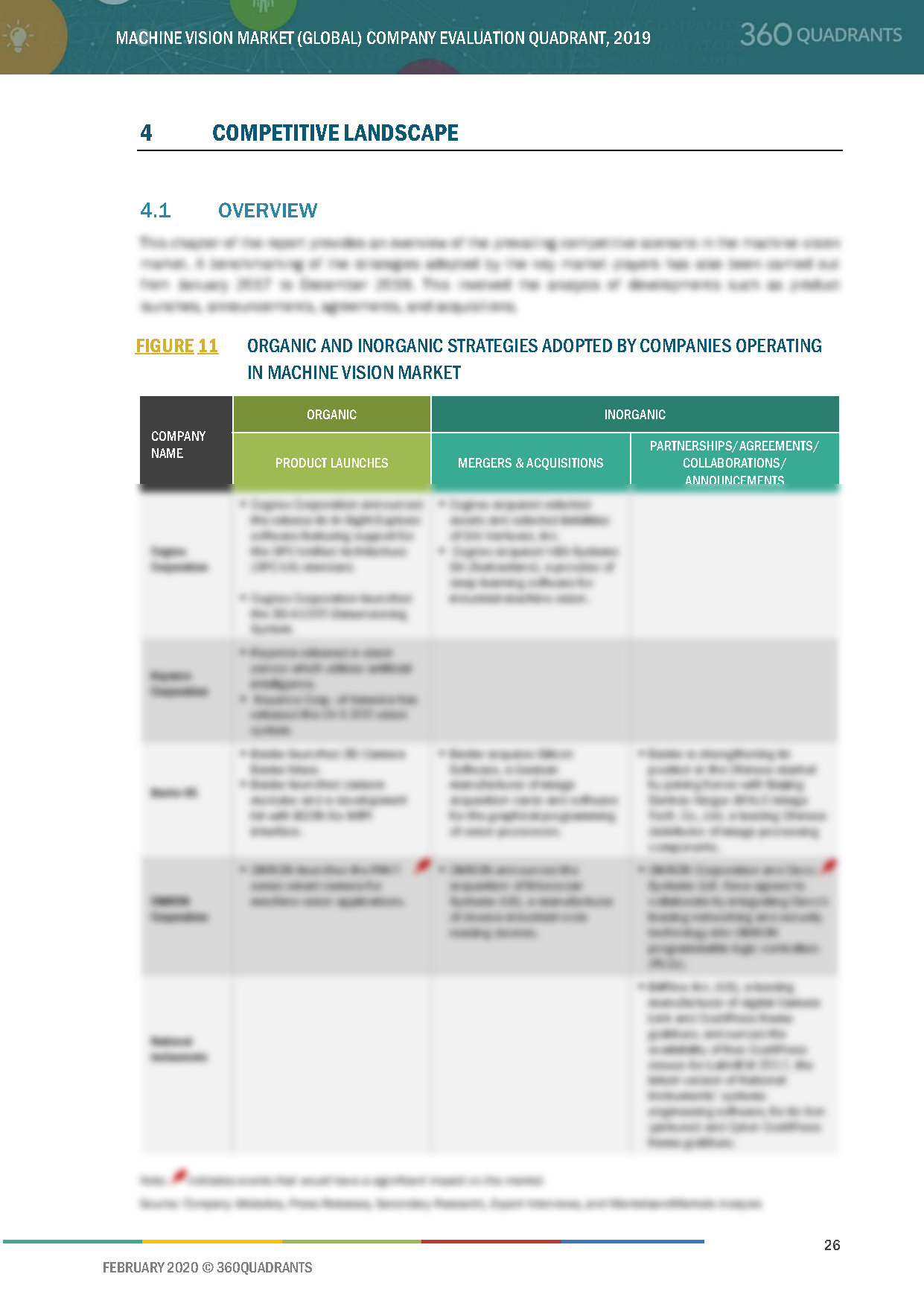

4 Competitive Landscape

4.1 Overview

Figure 11 Organic and Inorganic Strategies Adopted By Companies Operating in Machine Vision Market

4.2 Market Rank Analysis

Figure 12 Major Machine Vision Providers

4.3 Right-To-Win (Company Business Snapshot)

4.3.1 Cognex

4.3.2 Keyence

4.3.3 Basler

4.3.4 Omron

4.3.5 National Instruments

4.4 Competitive Situations and Trends

4.4.1 Product Launches

Table 1 Product Launches (2019)

Table 2 Mergers & Acquisitions (2017- 2018)

4.4.2 Others

Table 3 Agreements (2018)

5 Company Profiles

5.1 Cognex Corporation

5.1.1 Business Overview*

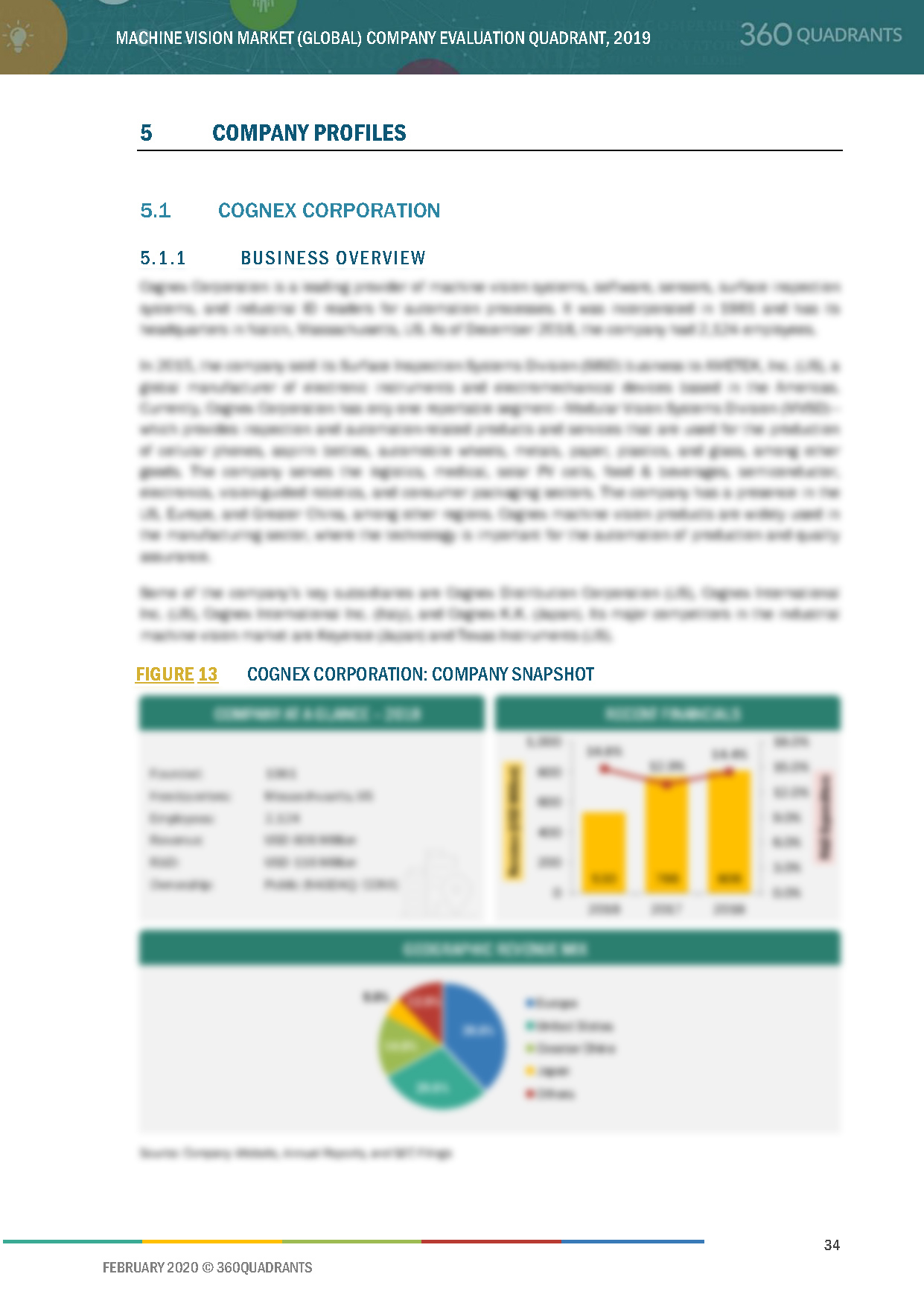

Figure 13 Cognex Corporation: Company Snapshot

5.1.2 Products Offered*

5.1.3 Recent Developments*

5.1.4 SWOT Analysis*

5.1.5 MnM View*

(*Above sections are present for all of below companies)

5.2 Basler AG

Figure 14 Basler AG: Company Snapshot

5.3 Omron Corporation

Figure 15 Omron Corporation: Company Snapshot

5.4 Keyence Corporation

Figure 16 Keyence: Company Snapshot

5.5 National Instruments

Figure 17 National Instruments: Company Snapshot

5.6 Sony Corporation

Figure 18 Sony Corporation: Company Snapshot

5.7 Teledyne Technologies

Figure 19 Teledyne Technologies: Company Snapshot

5.8 Texas Instruments

Figure 20 Texas Instruments: Company Snapshot

5.9 Intel Corporation

Figure 21 Intel Corporation: Company Snapshot

5.10 ISRA Vision AG

Figure 22 ISRA Vision AG: Company Snapshot

5.11 Sick AG

Figure 23 Sick AG: Company Snapshot

5.12 FLIR Systems

Figure 24 FLIR Systems: Company Snapshot

6 Appendix

6.1 Startups in Machine Vision Market

6.1.1 AMETEK, Inc.

6.1.2 Qualitas Technologies

6.1.3 Baumer Optronic

6.1.4 Algolux

6.1.5 Tordivel AS

6.1.6 Inuitive

6.1.7 MVTec Software Gmbh

6.1.8 JAI A/S

6.1.9 Industrial Vision Systems Ltd.

6.1.10 Allied Vision Technologies GmbH

6.2 Methodology

This report identifies and benchmarks the world's best machine vision companies, such as Cognex Corporation (US), Basler AG (Germany), Omron Corporation (Japan), Keyence (Japan), National Instruments (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the machine vision ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More