Life Science Analytics Quadrant Report

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 INCLUSIONS & EXCLUSIONS

1.3.3 YEARS CONSIDERED

1.3.4 CURRENCY CONSIDERED

1.4 STAKEHOLDERS

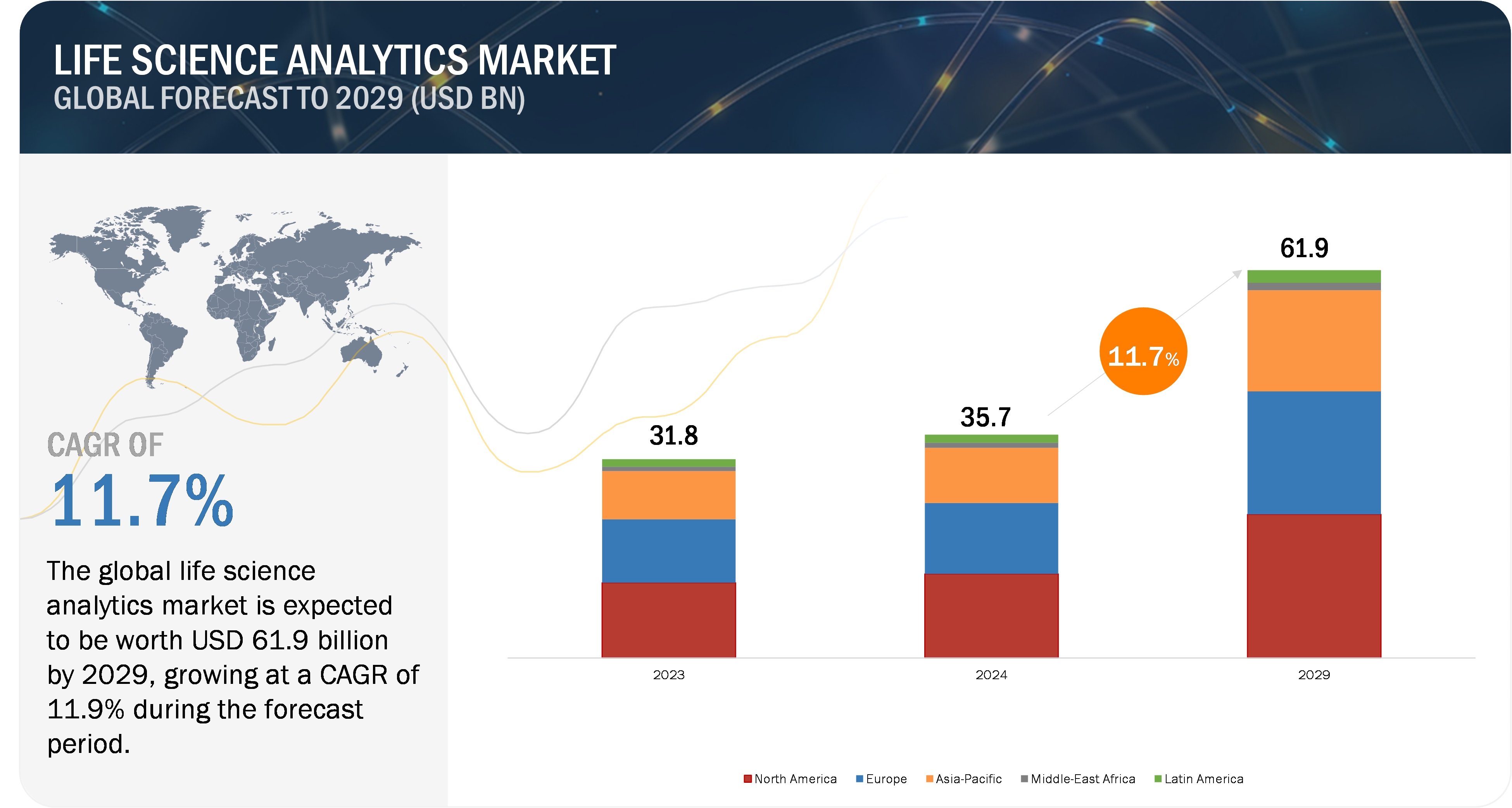

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.2.1 DRIVERS

2.2.1.1 Rising pressure to curb healthcare spending

2.2.1.2 Need for improved data standardization

2.2.1.3 Technological advancements in analytical solutions

2.2.1.4 Heterogeneity and complexity of big data in life sciences

2.2.1.5 Growing adoption of analytical solutions in clinical trials

2.2.1.6 Increasing R&D expenditure in pharmaceutical & biotechnology companies

2.2.2 RESTRAINTS

2.2.2.1 High implementation costs of advanced analytical solutions

2.2.2.2 Data privacy concerns

2.2.3 OPPORTUNITIES

2.2.3.1 Growing focus on value-based care

2.2.3.2 Use of analytics in precision & personalized medicine

2.2.3.3 Big data analytics for R&D productivity

2.2.3.4 Growing adoption of cloud-based analytics

2.2.4 CHALLENGES

2.2.4.1 Issues associated with data integration

2.2.4.2 Shortage of skilled personnel

2.2.4.3 Reluctance to adopt life science analytics solutions in emerging countries

2.3 INDUSTRY TRENDS

2.3.1 GROWING ADOPTION OF ANALYTICS IN COMMERCIAL OPERATIONS

2.3.2 LEVERAGING DATA & ANALYTICS TO ACCELERATE DRUG DISCOVERY & DEVELOPMENT

2.3.3 FOCUS ON REAL-TIME DATA ANALYTICS

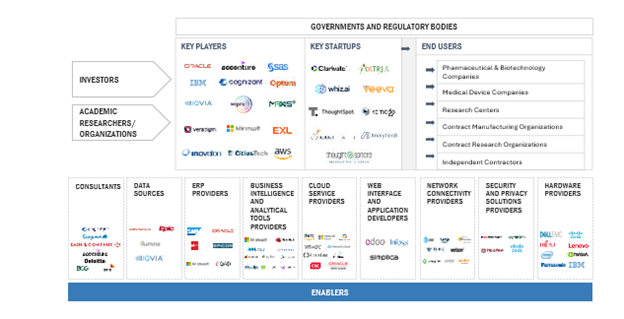

2.4 ECOSYSTEM ANALYSIS

2.5 VALUE CHAIN ANALYSIS

2.6 PORTER’S FIVE FORCES ANALYSIS

2.6.1 THREAT OF NEW ENTRANTS

2.6.2 THREAT OF SUBSTITUTES

2.6.3 BARGAINING POWER OF SUPPLIERS

2.6.4 BARGAINING POWER OF BUYERS

2.6.2 INTENSITY OF COMPETITIVE RIVALRY

2.7 CASE STUDY ANALYSIS

2.7.1 NOVARTIS USES MULTI-CLOUD DATA ANALYTICS PLATFORM TO OPTIMIZE OPERATIONS AND ACCELERATE INNOVATION

2.7.2 SAS VISUAL ANALYTICS HELPS MAXIMIZE PROFITABILITY THROUGH PRESCRIPTIVE ANALYTICS & DATA VISUALIZATION

2.7.3 STREAMLINING REGULATORY MONITORING AND IMPACT ASSESSMENTS: GEDEON RICHTER’S PARTNERSHIP WITH CLARIVATE

3 COMPETITIVE LANDSCAPE

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN LIFE SCIENCE ANALYTICS MARKET

3.3 REVENUE ANALYSIS

3.4 MARKET SHARE ANALYSIS

3.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.5.5.1 Company footprint

3.5.5.2 Type footprint

3.5.5.3 Application footprint

3.5.5.4 Component footprint

3.5.5.5 End-user footprint

3.5.5.6 Region footprint

3.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

3.6.1 PROGRESSIVE COMPANIES

3.6.2 RESPONSIVE COMPANIES

3.6.3 DYNAMIC COMPANIES

3.6.4 STARTING BLOCKS

3.6.5 COMPETITIVE BENCHMARKING

3.7 BRAND/SOFTWARE COMPARATIVE ANALYSIS

3.8 VALUATION & FINANCIAL METRICS

3.9 COMPETITIVE SCENARIO

3.9.1 PRODUCT LAUNCHES & APPROVALS

3.9.2 DEALS

4 COMPANY PROFILES

4.1 KEY PLAYERS

4.1.1 ORACLE

4.1.1.1 Business overview

4.1.1.2 Products & services offered

4.1.1.3 Recent developments

4.1.1.3.Deals

4.1.1.5 MnM view

4.1.1.6 Key strengths

4.1.1.7 Strategic choices

4.1.1.8 Weaknesses & competitive threats

4.1.2 MERATIVE

4.1.2.1 Business overview

4.1.2.2 Products & services offered

4.1.2.3 Deals

4.1.2.4 MnM view

4.1.2.5 Right to win

4.1.2.6 Strategic choices

4.1.2.7 Weaknesses & competitive threats

4.1.3 SAS INSTITUTE INC.

4.1.3.1 Business overview

4.1.3.2 Products & services offered

4.1.3.3 Recent developments

4.1.3.4 Product launches & approvals

4.1.3.5 Deals

4.1.3.6 MnM view

4.1.3.7 Right to win

4.1.3.8 Strategic choices

4.1.3.9 Weaknesses & competitive threats

4.1.4 ACCENTURE

4.1.4.1 Business overview

4.1.4.2 Products offered

4.1.4.3 Recent developments

4.1.4.4 Deals

4.1.4.5 MnM view

4.1.4.6 Right to win

4.1.4.7 Strategic choices

4.1.4.8 Weaknesses & competitive threats

4.1.5 IQVIA INC.

4.1.5.1 Business overview

4.1.5.2 Products & services offered

4.1.5.3 Recent developments

4.1.5.3 Product launches & approvals

4.1.5.3 Deals

4.1.5.3 Other developments

4.1.5.4 MnM view

4.1.5.4 Right to win

4.1.5.4 Strategic choices

4.1.5.4 Weaknesses & competitive threats

4.1.6 COGNIZANT

4.1.6.1 Business overview

4.1.6.2 Products & services offered

4.1.6.3 Recent developments

4.1.6.4 Product launches & approvals

4.1.6.5 Deals

4.1.7 WIPRO

4.1.7.1 Business overview

4.1.7.2 Products & services offered

4.1.7.3 Recent developments

4.1.7.4 Deals

4.1.8 VERADIGM LLC

4.1.8.1 Business overview

4.1.8.2 Products & services offered

4.1.8.3 Recent developments

4.1.8.4 Deals

4.1.9 OPTUM, INC.

4.1.9.1 Business overview

4.1.9.2 Products & services offered

4.1.9.3 Recent developments

4.1.9.4 Deals

4.1.10 MICROSOFT

4.1.10.1 Business overview

4.1.10.2 Products & services offered

4.1.10.3 Recent developments

4.1.10.4 Product & service launches & enhancements

4.1.10.5 Deals

4.1.11 MAXISIT

4.1.11.1 Business overview

4.1.11.2 Products & services offered

4.1.11.3 Recent developments

4.1.11.4 Product launches

4.1.11.5 Deals

4.1.12 EXLSERVICE HOLDINGS, INC.

4.1.12.1 Business overview

4.1.12.2 Products & services offered

4.1.12.3 Recent developments

4.1.12.4 Product launches

4.1.12.5 Deals

4.1.13 INOVALON

4.1.13.1 Business overview

4.1.13.2 Products & services offered

4.1.13.3 Recent developments

4.1.13.4 Product launches

4.1.13.5 Deals

4.1.14 CITIUSTECH INC.

4.1.14.1 Business overview

4.1.14.2 Products & services offered

4.1.14.3 Recent developments

4.1.14.4 Product launches

4.1.14.5 Deals

4.1.14.6 Expansions

4.1.15 SAAMA

4.1.15.1 Business overview

4.1.15.2 Products & services offered

4.1.15.3 Recent developments

4.1.15.4 Deals

4.1.16 AXTRIA

4.1.16.1 Business overview

4.1.16.2 Products & services offered

4.1.16.3 Recent developments

4.1.16.4 Product launches

4.1.16.5 Deals

4.1.16.6 Expansions

4.1.17 CLARIVATE

4.1.17.1 Business overview

4.1.17.2 Products & services offered

4.1.17.3 Recent developments

4.1.17.4 Product enhancements

4.1.17.5 Deals

4.1.18 THOUGHTSPHERE

4.1.18.1 Business overview

4.1.18.2 Products & services offered

4.1.18.3 Recent developments

4.1.18.4 Deals

4.1.19 THOUGHTSPOT INC.

4.1.19.1 Business overview

4.1.19.2 Products & services offered

4.1.19.3 Recent developments

4.1.19.4 Deals

4.1.19.5 Expansions

4.1.20 SALESFORCE, INC.

4.1.20.1 Business overview

4.1.20.2 Products & services offered

4.1.20.3 Recent developments

4.1.20.4 Deals

4.2 OTHER PLAYERS

4.2.1 GOOGLE LLC

4.2.2 AMAZON WEB SERVICES, INC.

4.2.3 VEEVA SYSTEMS

4.2.4 ELSEVIER

4.2.5 KOMODO HEALTH, INC.

COMPANY PROFILES

KEY PLAYERS

ORACLE

MERATIVE

SAS INSTITUTE INC.

ACCENTURE

IQVIA INC.

COGNIZANT

WIPRO

VERADIGM LLC

OPTUM, INC.

MICROSOFT

MAXISIT

EXLSERVICE HOLDINGS, INC.

INOVALON

CITIUSTECH INC.

SAAMA

AXTRIA

CLARIVATE

THOUGHTSPHERE

THOUGHTSPOT INC.

SALESFORCE, INC.

OTHER PLAYERS

GOOGLE LLC

AMAZON WEB SERVICES, INC.

VEEVA SYSTEMS

ELSEVIER

KOMODO HEALTH, INC.

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More