Learning Management System Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview and Industry Trends

2.1 Introduction

2.2 Market Dynamics

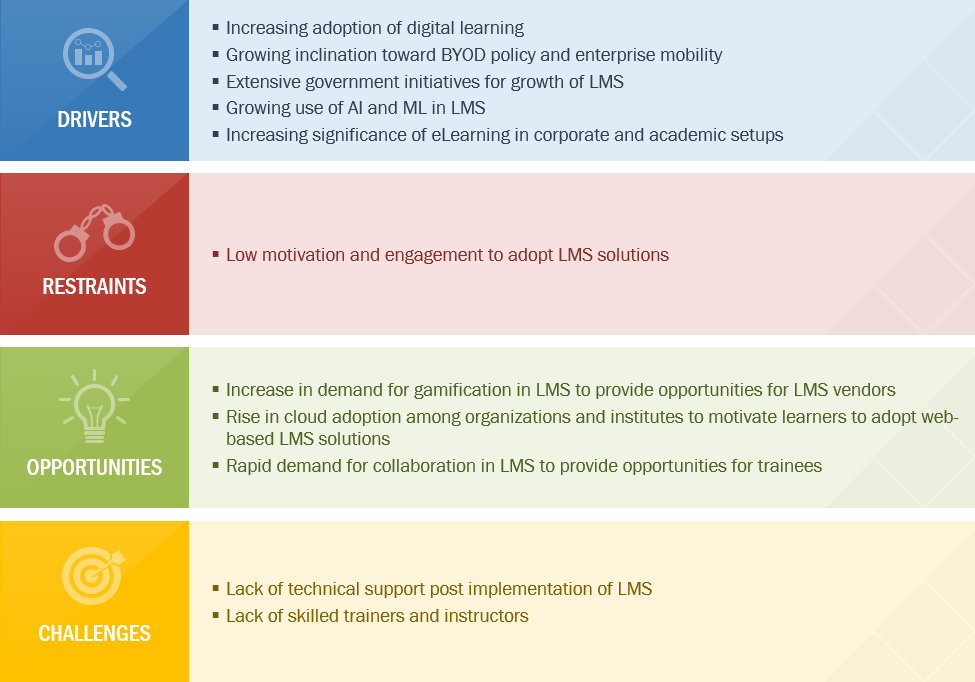

Figure 1 Drivers, Restraints, Opportunities, and Challenges: Learning Management System Market

2.2.1 Drivers

2.2.1.1 Increasing Adoption of Digital Learning

2.2.1.2 Growing Inclination Toward BYOD Policy and Enterprise Mobility

2.2.1.3 Extensive Government Initiatives for Growth of LMS

2.2.1.4 Growing Use of AI and ML in LMS

2.2.1.5 Increasing Significance of Elearning in Corporate and Academic Setups

2.2.2 Restraints

2.2.2.1 Low Motivation and Engagement to Adopt LMS Solutions

2.2.3 Opportunities

2.2.3.1 Increase in Demand for Gamification in LMS to Provide Opportunities for LMS Vendors

2.2.3.2 Rise in Cloud Adoption Among Organizations and Institutes to Motivate Learners to Adopt Web-Based LMS Solutions

2.2.3.3 Rapid Demand for Collaborative Learning in LMS to Provide Opportunities for Trainees

2.2.4 Challenges

2.2.4.1 Lack of Technical Support Post Implementation of LMS

2.2.4.2 Lack of Skilled Trainers and Instructors

2.3 Learning Management System Architecture

2.4 Industry Standards and Regulations

2.4.1 Aviation Industry Computer-Based Training Committee

2.4.2 Learning Tools Interoperability

2.4.3 Shareable Content Object Reference Model

2.4.4 Australian Education Act

2.4.5 Education Services for Overseas Students Act

2.4.6 Common Cartridge

2.4.7 Experience API

2.5 Use Cases

2.5.1 Use Case 1: Cornerstone

2.5.2 Use Case 2: Blackboard

2.5.3 Use Case 3: Instrucutre Inc

2.5.4 Use Case 4: Disprz

3 Company Evaluation Quadrant

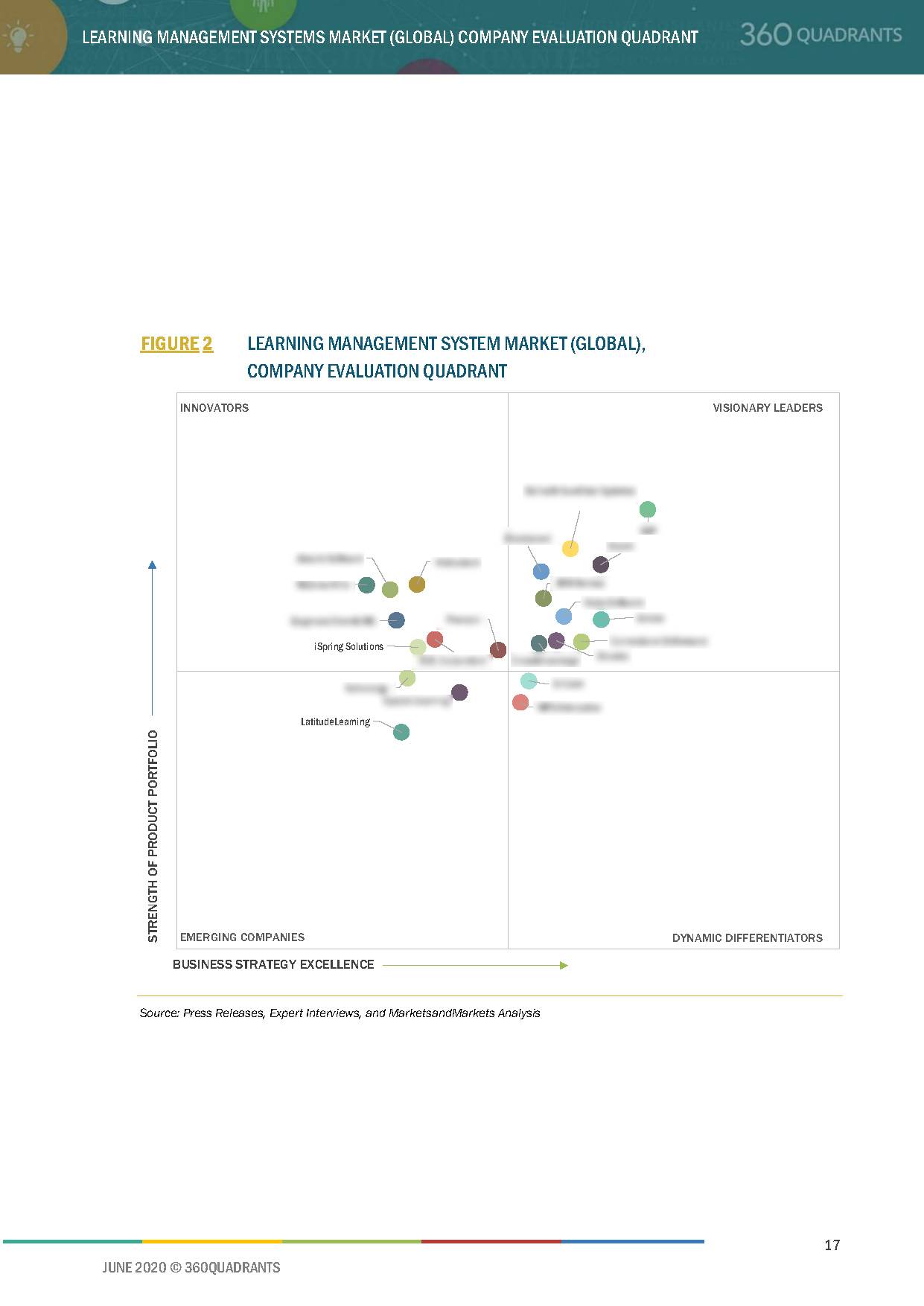

3.1 Company Evaluation Quadrant (Overall Market)

3.1.1 Visionaries

3.1.2 Innovators

3.1.3 Dynamic Differentiators

3.1.4 Emerging Companies

Figure 2 Learning Management System Market (Global), Company Evaluation Quadrant

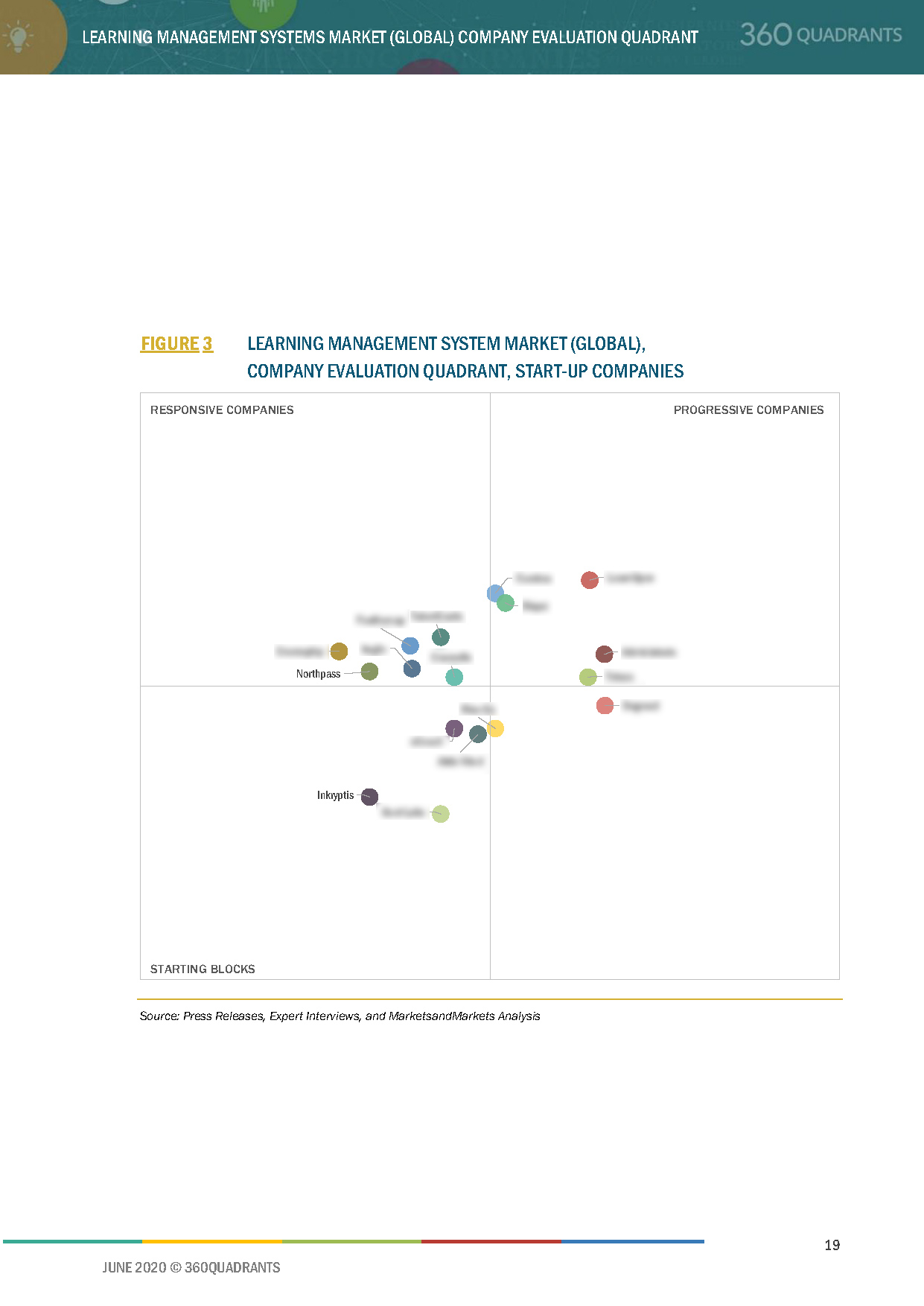

4 Company Evaluation Quadrant – Start-Up/SME

4.1 Company Evaluation Quadrant (Start-Up/SME)

4.1.1 Progressive Companies

4.1.2 Starting Blocks

4.1.3 Responsive Companies

4.1.4 Dynamic Companies

Figure 3 Learning Management System Market (Global), Company Evaluation Quadrant, Start-Up Companies

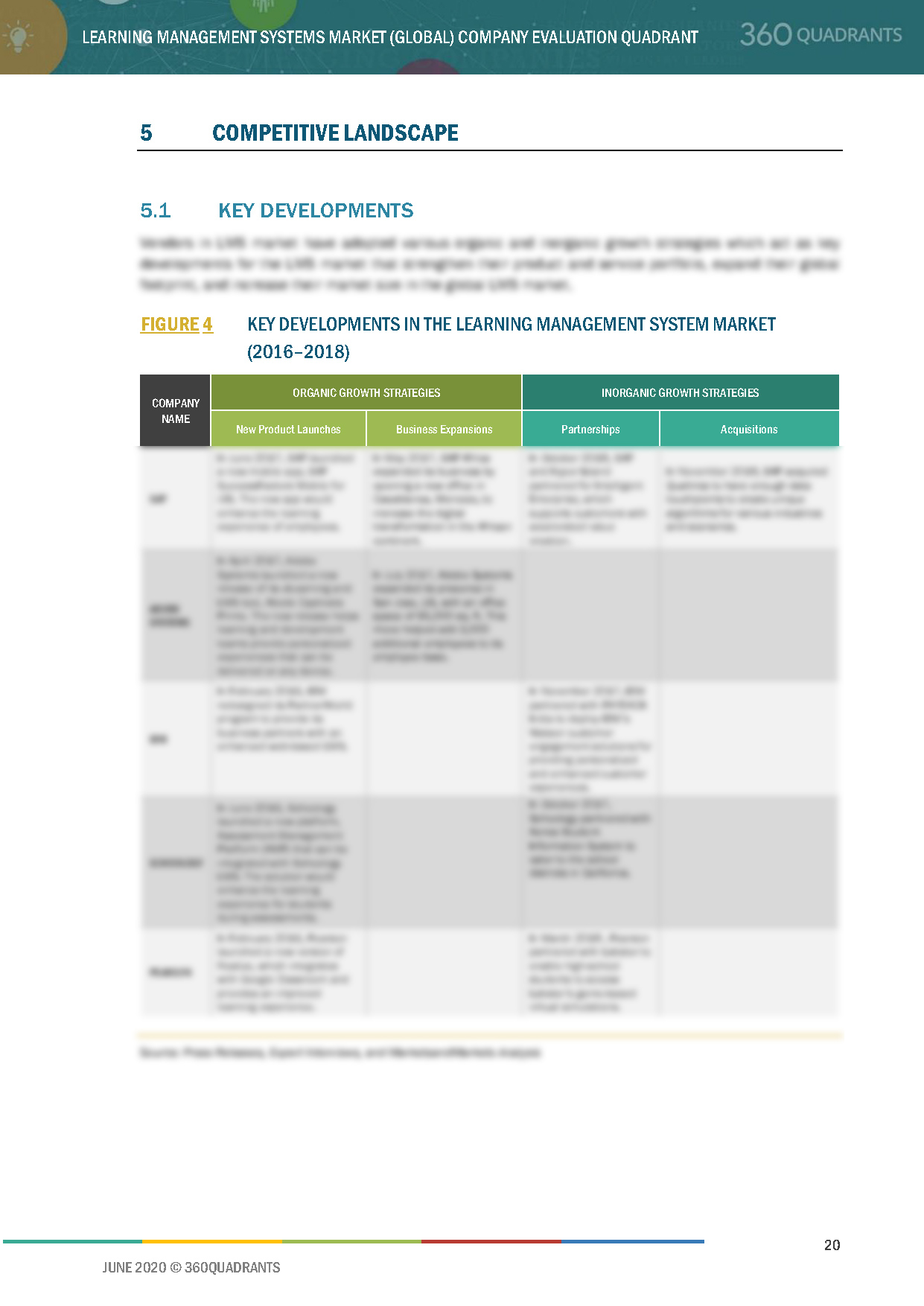

5 Competitive Landscape

5.1 Key Developments

Figure 4 Key Developments in the Learning Management System Market (2016–2018)

5.2 Competitive Scenario

Figure 5 Market Evaluation Framework, 2015–2018

5.2.1 Partnerships

Table 1 Partnerships, 2017–2018

5.2.2 New Product Launches

Table 2 New Product/Service Launches and Product Enhancements, 2016–2018

5.2.3 Acquisitions

Table 3 Acquisitions, 2018

5.2.4 Business Expansions

Table 4 Business Expansions, 2015–2018

6 Company Profiles

6.1 Cornerstone Ondemand, Inc.

6.1.1 Business Overview*

Figure 6 Cornerstone Ondemand: Company Snapshot

6.1.2 Products Offered*

6.1.3 Recent Developments*

6.1.4 MnM View*

(*Above sections are present for all of below companies)

6.2 Blackboard

Figure 7 SWOT Analysis: Blackboard

6.3 Saba Software

6.4 D2L Corporation

6.5 Adobe Systems

Figure 8 Adobe Systems: Company Snapshot

Figure 9 SWOT Analysis: Adobe Systems

6.6 CrossKnowledge

Figure 10 SWOT Analysis: Crossknowledge

6.7 Oracle

Figure 11 Oracle: Company Snapshot

Figure 12 SWOT Analysis: Oracle

6.8 SAP

Figure 13 SAP: Company Snapshot

Figure 14 SWOT Analysis: SAP

6.9 Docebo

6.10 Schoology

6.11 IBM

Figure 15 IBM: Company Snapshot

6.12 MPS

Figure 16 MPS Limited: Company Snapshot

6.13 Pearson

Figure 17 Pearson: Company Snapshot

6.14 McGraw-Hill

Figure 18 McGraw-Hill: Company Snapshot

6.15 Instructure

Figure 19 Instructure: Company Snapshot

7 Appendix

7.1 Other Significant Players in Learning Management Systems Market

7.1.1 Epignosis

7.1.2 Sumtotal Systems

7.1.3 Absorb Software

7.1.4 Ispring Solutions

7.1.5 G-Cube

7.1.6 Lattitude CG

7.1.7 Upside LMS

7.1.8 Paradiso

7.1.9 Skyprep Inc

7.1.10 Knowledge Anywhere

7.2 Methodology

7.3 List of Abbreviations

This report identifies and benchmarks the world's best LMS companies, such as Cornerstone OnDemand (US), Blackboard (US), Saba Software (Canada), D2L Corporation (Canada), Adobe Systems US), and evaluates them based on business strategy excellence and strength of product portfolio within the Learning Management System ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More