Laboratory Information Management System Quadrant Report

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

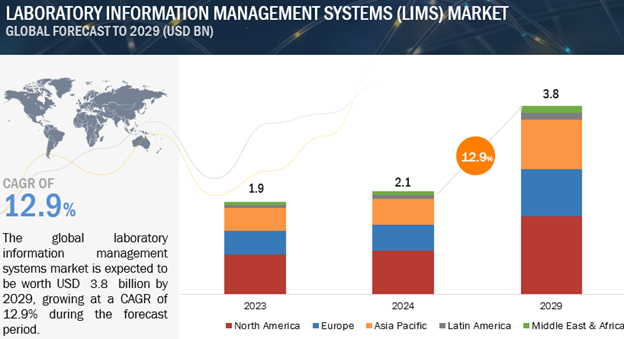

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.3.4 CURRENCY CONSIDERED

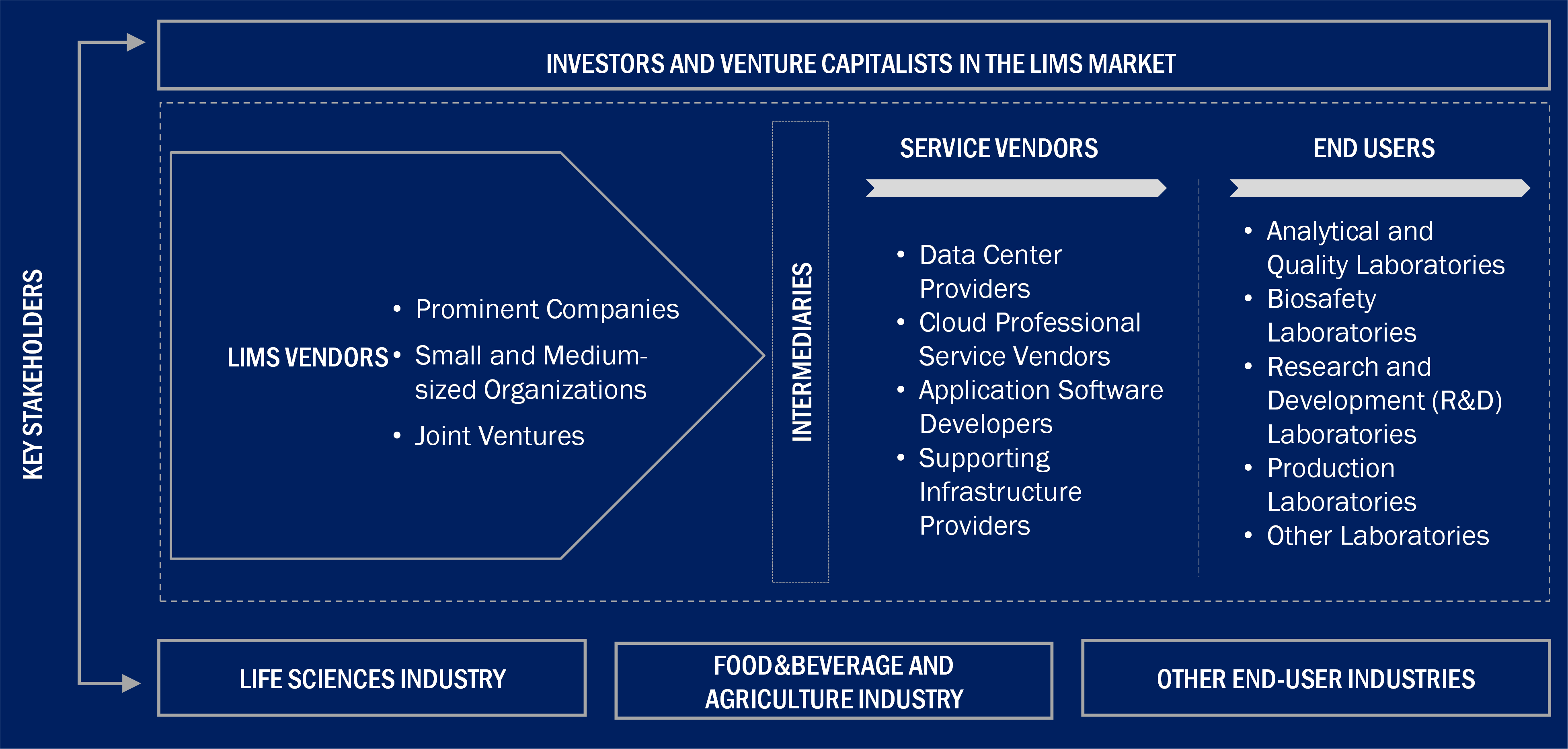

1.4 STAKEHOLDERS

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.2.1 DRIVERS

2.2.1.1 Growing use of LIMS to comply with stringent regulatory requirements

2.2.1.2 Growing requirement for customizable solutions

2.2.1.3 Increasing adoption of cloud-based and integrated LIMS

2.2.1.4 Growing R&D expenditure in pharmaceutical and biotechnology companies

2.2.1.2 Demand for real-time data access in food & beverage industry

2.2.2 RESTRAINTS

2.2.2.1 High maintenance and service costs

2.2.2.2 Lack of integration standards for LIMS

2.2.2.3 Interoperability challenges

2.2.2.4 Limited adoption of LIMS in small and medium-sized companies

2.2.3 OPPORTUNITIES

2.2.3.1 Growing use of LIMS in cannabis industry

2.2.3.2 Significant growth potential in emerging economies

2.2.4 CHALLENGES

2.2.4.1 Dearth of trained professionals

2.2.4.2 Interfacing challenges with informatics software

2.3 INDUSTRY TRENDS

2.3.1 CLOUD-BASED SOLUTIONS

2.3.2 ADVANCED DATA MANAGEMENT SYSTEMS

2.3.3 MOBILE APPLICATIONS

2.3.4 AUGMENTED REALITY & MIXED REALITY

2.3.5 ADVANCED ANALYTICS AND AI

2.3.6 FUTURE OF LABORATORIES

2.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

2.5 VALUE CHAIN ANALYSIS

2.6 ECOSYSTEM ANALYSIS

2.7 PORTER’S FIVE FORCES ANALYSIS

3 COMPETITIVE LANDSCAPE

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET

3.3 REVENUE ANALYSIS

3.4 MARKET SHARE ANALYSIS

3.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.5.5.1 Company footprint

3.5.5.2 Component footprint

3.5.5.3 Type footprint

3.5.5.4 Industry footprint

3.5.5.5 Region footprint

3.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

3.6.1 PROGRESSIVE COMPANIES

3.6.2 RESPONSIVE COMPANIES

3.6.3 DYNAMIC COMPANIES

3.6.4 STARTING BLOCKS

3.6.5 COMPETITIVE BENCHMARKING

3.7 VALUATION & FINANCIAL METRICS OF KEY LABORATORY INFORMATION MANAGEMENT SYSTEMS VENDORS

3.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

3.9 COMPETITIVE SITUATION

3.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

3.9.2 DEALS

3.9.3 EXPANSIONS

3.9.4 OTHER DEVELOPMENTS

4 COMPANY PROFILES

4.1 KEY PLAYERS

4.1.1 LABWARE, INC.

4.1.1.1 Business overview

4.1.1.2 Products/solutions/services offered

4.1.1.3 Recent developments

4.1.1.3.1 Product launches & upgrades

4.1.1.3.2 Deals

4.1.1.3.3 Expansions

4.1.1.3.4 Other developments

4.1.1.4 MnM view

4.1.1.4.1 Right to win

4.1.1.4.2 Strategic choices

4.1.1.4.3 Weaknesses & competitive threats

4.1.2 LABVANTAGE SOLUTIONS, INC.

4.1.2.1 Business overview

4.1.2.2 Products/solutions/services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches, upgrades, and enhancements

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Right to win

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses & competitive threats

4.1.3 THERMO FISHER SCIENTIFIC INC.

4.1.3.1 Business overview

4.1.3.2 Products/solutions/services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches & upgrades

4.1.3.3.2 Deals

4.1.3.3.3 Expansions

4.1.3.4 MnM view

4.1.3.4.1 Right to win

4.1.3.4.2 Strategic choices

4.1.3.4.3 Weaknesses & competitive threats

4.1.4 STARLIMS CORPORATION

4.1.4.1 Business overview

4.1.4.2 Products/solutions/services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches & upgrades

4.1.4.3.2 Deals

4.1.4.3.3 Other developments

4.1.4.4 MnM view

4.1.4.4.1 Right to win

4.1.4.4.2 Strategic choices

4.1.4.4.3 Weaknesses & competitive threats

4.1.5 AGILENT TECHNOLOGIES, INC.

4.1.5.1 Business overview

4.1.5.2 Products/solutions/services offered

4.1.5.3 Recent developments

4.1.5.3.1 Deals

4.1.5.4 MnM view

4.1.5.4.1 Right to win

4.1.5.4.2 Strategic choices

4.1.5.4.3 Weaknesses & competitive threats

4.1.6 LABLYNX, INC.

4.1.6.1 Business overview

4.1.6.2 Products/solutions/services offered

4.1.6.3 Recent developments

4.1.6.3.1 Product launches & upgrades

4.1.7 CLINISYS

4.1.7.1 Business overview

4.1.7.2 Products/solutions/services offered

4.1.7.3 Recent developments

4.1.7.3.1 Product launches & upgrades

4.1.7.3.2 Deals

4.1.8 AUTOSCRIBE INFORMATICS (XYBION CORPORATION)

4.1.8.1 Business overview

4.1.8.2 Products/solutions/services offered

4.1.8.3 Recent developments

4.1.8.3.1 Product launches & upgrades

4.1.8.3.2 Deals

4.1.8.3.3 Expansions

4.1.8.3.4 Other developments

4.1.9 LABWORKS

4.1.9.1 Business overview

4.1.9.2 Products/solutions/services offered

4.1.9.3 Recent developments

4.1.9.3.1 Product upgrades

4.1.10 DASSAULT SYSTÈMES

4.1.10.1 Business overview

4.1.10.2 Products/solutions/services offered

4.1.11 ACCELERATED TECHNOLOGY LABORATORIES

4.1.11.1 Business overview

4.1.11.2 Products/solutions/services offered

4.1.11.3 Recent developments

4.1.11.3.1 Deals

4.1.11.3.2 Other developments

4.1.12 CLOUDLIMS

4.1.12.1 Business overview

4.1.12.2 Products/solutions/services offered

4.1.12.3 Recent developments

4.1.12.3.1 Product upgrades

4.1.12.3.2 Deals

4.1.13 COMPUTING SOLUTIONS, INC.

4.1.13.1 Business overview

4.1.13.2 Products/solutions/services offered

4.1.14 SIEMENS

4.1.14.1 Business overview

4.1.14.2 Products/solutions/services offered

4.1.15 NOVATEK INTERNATIONAL

4.1.15.1 Business overview

4.1.15.2 Products/solutions/services offered

4.1.15.3 Recent developments

4.1.15.3.1 Other developments

4.1.16 OVATION

4.1.16.1 Business overview

4.1.16.2 Products/solutions/services offered

4.1.16.3 Recent developments

4.1.16.3.1 Service launches

4.1.16.3.2 Deals

4.1.16.3.3 Other developments

4.1.17 ILLUMINA, INC.

4.1.17.1 Business overview

4.1.17.2 Products/solutions/services offered

4.1.17.3 Recent developments

4.1.17.3.1 Product upgrades

4.1.17.3.2 Deals

4.1.18 EUSOFT LTD.

4.1.18.1 Business overview

4.1.18.2 Products/solutions/services offered

4.1.19 CALIBER TECHNOLOGIES

4.1.19.1 Business overview

4.1.19.2 Products/solutions/services offered

4.1.20 LABTRACK

4.1.20.1 Business overview

4.1.20.2 Products/solutions/services offered

4.2 OTHER PLAYERS

4.2.1 AGILAB

4.2.2 AGARAM TECHNOLOGIES

4.2.3 ASSAYNET INC.

4.2.4 BLAZE SYSTEMS CORPORATION

4.2.5 THIRD WAVE ANALYTICS, INC.

COMPANY PROFILES

KEY PLAYERS

LABWARE, INC

LABVANTAGE SOLUTIONS, INC

THERMO FISHER SCIENTIFIC INC

STARLIMS CORPORATION

AGILENT TECHNOLOGIES, INC

LABLYNX, INC

CLINISYS

AUTOSCRIBE INFORMATICS (XYBION CORPORATION)

LABWORKS

DASSAULT SYSTÈMES

ACCELERATED TECHNOLOGY LABORATORIES

CLOUDLIMS

COMPUTING SOLUTIONS, INC

SIEMENS

NOVATEK INTERNATIONAL

OVATION

ILLUMINA, INC

EUSOFT LTD

LABTRACK

OTHER PLAYERS

AGILAB

AGARAM TECHNOLOGIES

ASSAYNET INC

BLAZE SYSTEMS CORPORATION

THIRD WAVE ANALYTICS, INC

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More