Industrial IoT (IIoT) Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

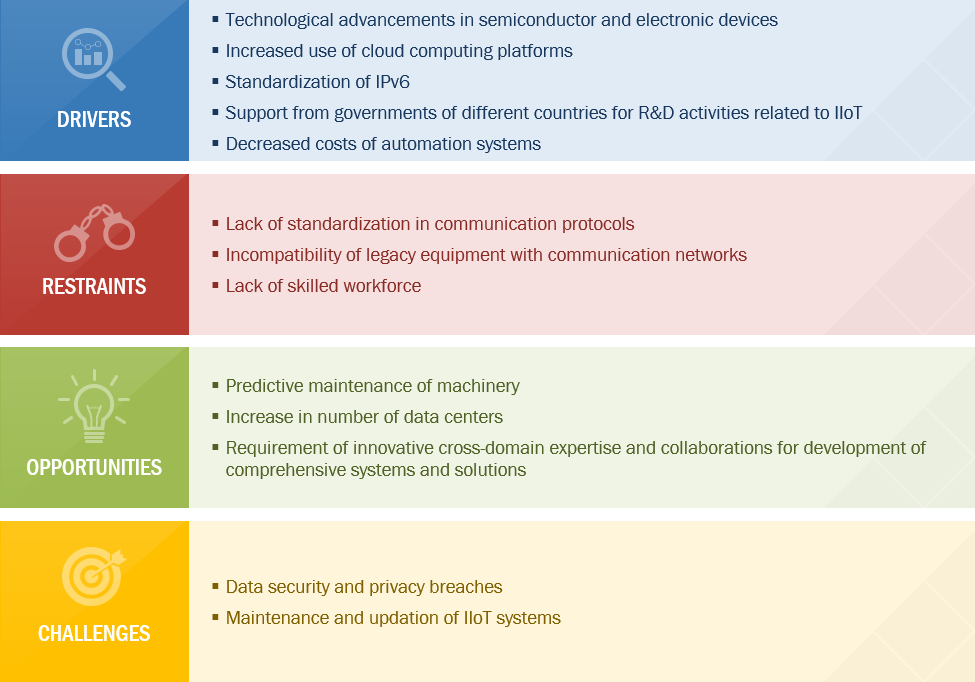

Figure 1 Technological Advancements in Semiconductor and Electronic Devices to Drive Growth of IIoT Market

2.2.1 Drivers

2.2.1.1 Technological Advancements in Semiconductor and Electronic Devices

Figure 2 Advancements in Computing Power of Devices From 1900 to 2024

2.2.1.2 Increased Use of Cloud Computing Platforms

2.2.1.3 Standardization of IPV6

Figure 3 Adoption of IPV6 Across Various Regions

2.2.1.4 Support From Governments of Different Countries for R&D Activities Related to IIoT

2.2.1.5 Decreased Costs of Automation Systems

2.2.2 Restraints

2.2.2.1 Lack of Standardization in Communication Protocols

2.2.2.2 Incompatibility of Legacy Equipment With Communication Networks

2.2.2.3 Lack of Skilled Workforce

2.2.3 Opportunities

2.2.3.1 Predictive Maintenance of Machinery

2.2.3.2 Increase in Number of Data Centers

2.2.3.3 Requirement of Innovative Cross-Domain Expertise and Collaborations for the Development of Comprehensive Systems and Solutions

2.2.4 Challenges

2.2.4.1 Data Security and Privacy Breaches

2.2.4.2 Maintenance and Updation of IIoT Systems

2.3 Industry Trends

2.4 Value Chain Analysis

Figure 4 Value Chain Analysis: IIoT Market

2.5 Emerging Trends

2.5.1 Digital Twin Technology

2.5.2 Edge Computing Technology

2.5.3 MQTT Protocol

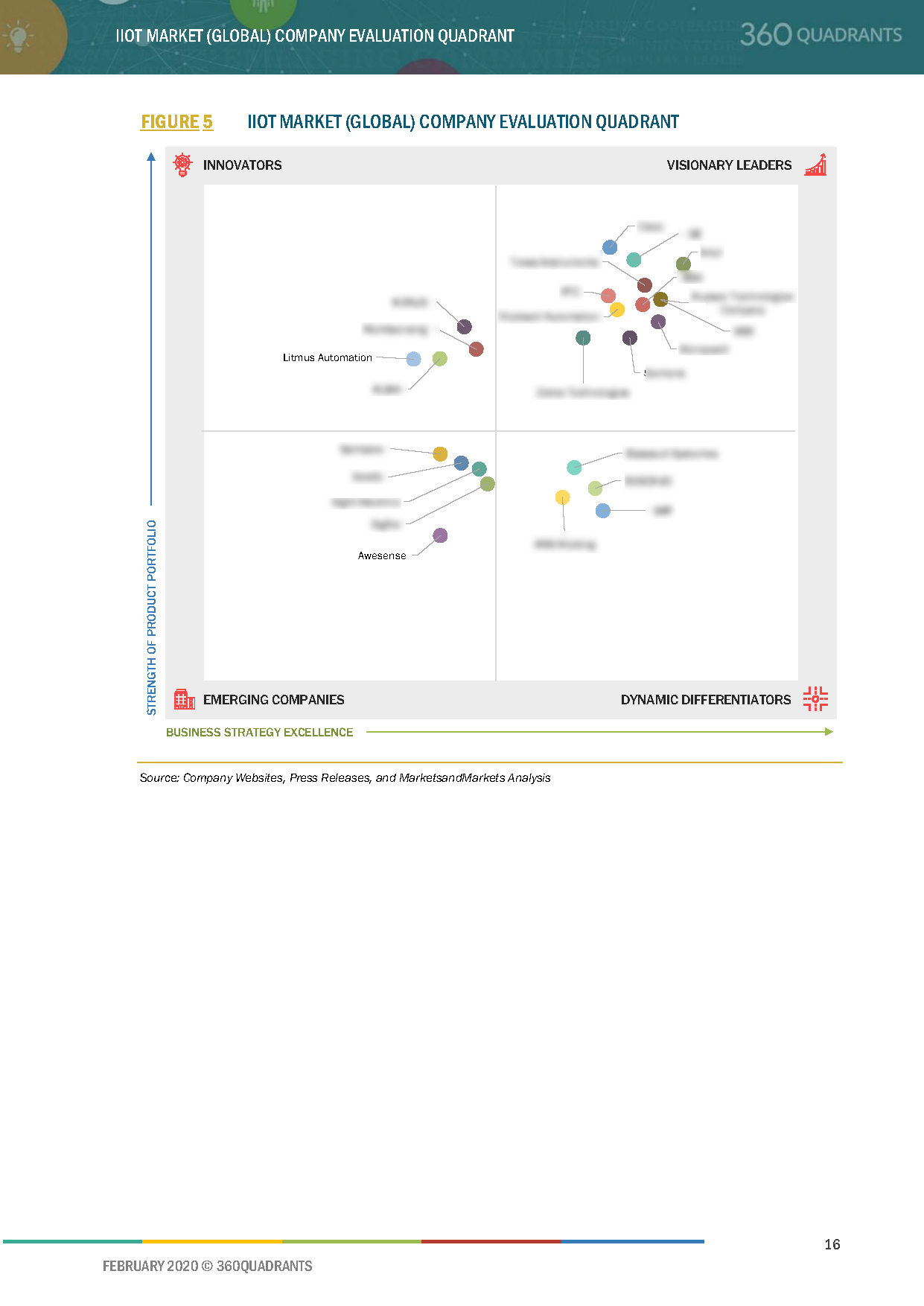

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Dynamic Differentiators

3.3 Innovators

3.4 Emerging Companies

Figure 5 IIoT Market (Global) Company Evaluation Quadrant

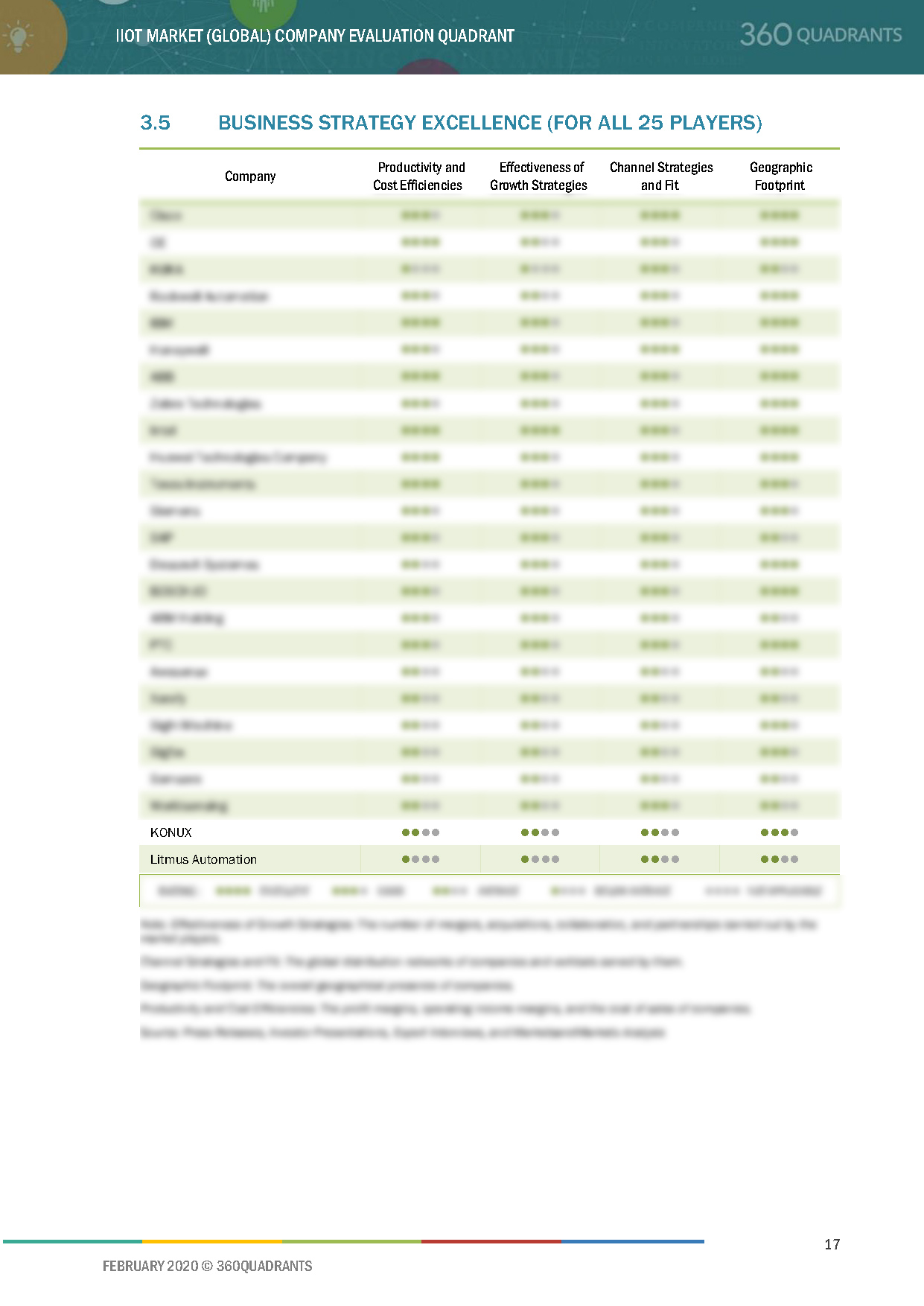

3.5 Business Strategy Excellence (For All 25 Players)

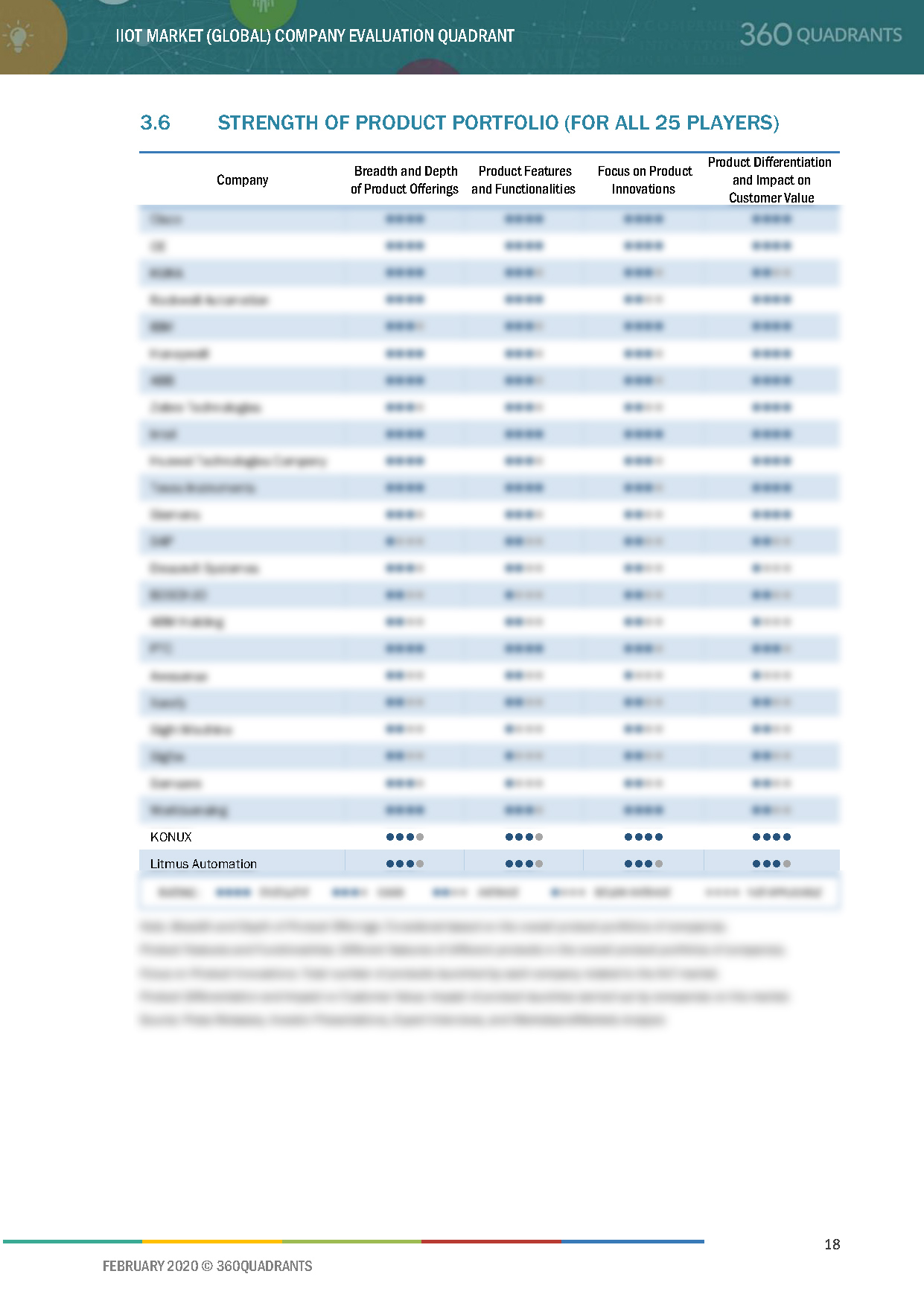

3.6 Strength of Product Portfolio (For All 25 Players)

4 Competitive Landscape

4.1 Overview

Figure 6 Growth Strategies Adopted By Companies in IIoT Market From 2017 to 2019

4.2 Market Ranking Analysis

Figure 7 IIoT Market Ranking, 2019

4.3 Competitive Situation and Trends

4.3.1 Product Launches

Table 1 Product Launches, 2017–2019

4.3.2 Partnerships, Collaborations, and Agreements

Table 2 Partnerships, Collaborations, and Agreements, 2017–2019

4.3.3 Mergers and Acquisitions

Table 3 Mergers and Acquisitions, 2017–2019

4.3.4 Expansions

Table 4 Expansions, 2017–2019

5 Company Profiles

5.1 Key Players

5.1.1 Cisco

5.1.1.1 Business Overview*

Figure 8 Cisco: Company Snapshot

5.1.1.2 Products/Solutions/Services Offered*

5.1.1.3 Recent Developments*

5.1.1.4 SWOT Analysis*

5.1.1.5 MnM View*

(*Above sections are present for all of below companies)

5.1.2 GE

Figure 9 GE: Company Snapshot

5.1.3 Honeywell

Figure 10 Honeywell: Company Snapshot

5.1.4 Intel

Figure 11 Intel: Company Snapshot

5.1.5 IBM

Figure 12 IBM: Company Snapshot

5.1.6 ABB

Figure 13 ABB Ltd: Company Snapshot

5.1.7 Rockwell Automation

Figure 14 Rockwell Automation: Company Snapshot

5.1.8 Siemens

Figure 15 Siemens: Company Snapshot

5.1.9 KUKA

Figure 16 KUKA: Company Snapshot

5.1.10 Texas Instruments

Figure 17 Texas Instruments: Company Snapshot

6 Appendix

6.1 Other Significant Players

6.1.1 Arm Holding

6.1.2 PTC

6.1.3 Dassault Systèmes

6.1.4 SAP

6.1.5 Huawei

6.1.6 Sigfox

6.1.7 Bosch.IO

6.1.8 NEC

6.1.9 Ansys

6.1.10 Worldsensing SL

6.2 Methodology

This report identifies and benchmarks the IIoT market leaders such as ABB (Switzerland), Cisco (US), GE (US), Honeywell (US), and IBM (US) and evaluates them on the basis of business strategy excellence and strength of product portfolio within the IIoT market ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More