Geographic Information System (GIS) Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition and Scope

1.1.1 Inclusions & Exclusions

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

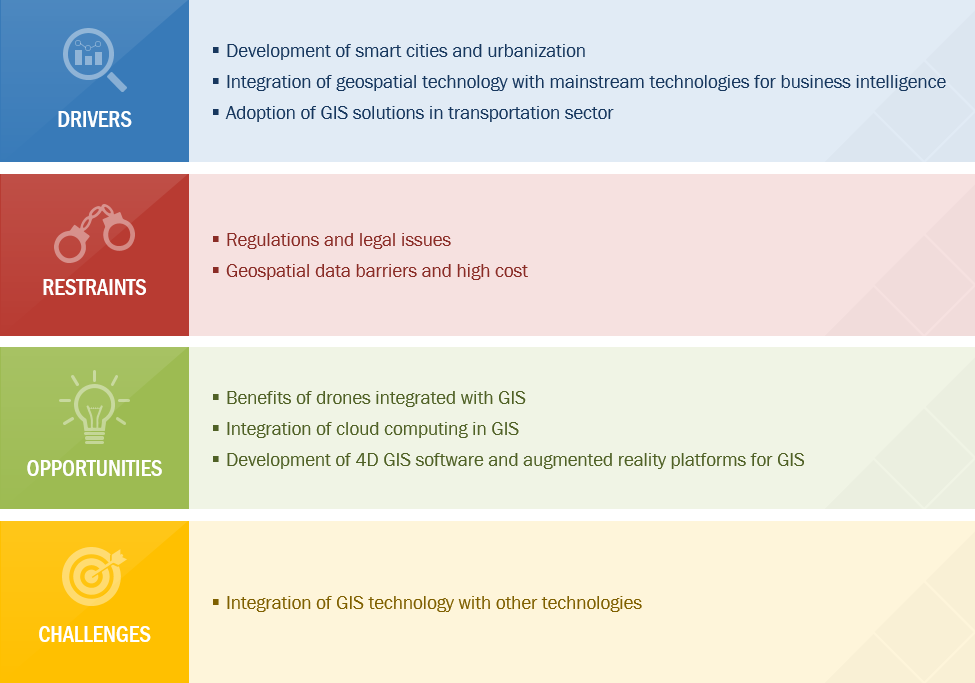

Figure 1 Geographic Information System Market: Drivers, Restraints, Opportunities, and Challenges

2.2.1 Drivers

2.2.1.1 Development of Smart Cities and Urbanization

2.2.1.2 Integration of Geospatial Technology With Mainstream Technologies for Business Intelligence

2.2.1.3 Adoption of GIS Solutions in Transportation Sector

Figure 2 GIS Market Drivers and Their Impact

2.2.2 Restraints

2.2.2.1 Regulations and Legal Issues

2.2.2.2 Geospatial Data Barriers and High Cost

2.2.3 Opportunities

2.2.3.1 Benefits of Drones Integrated With GIS

2.2.3.2 Integration of Cloud Computing in GIS

2.2.3.3 Development of 4D GIS Software and Augmented Reality Platforms for GIS

Figure 3 GIS Market Opportunities and Their Impact

2.2.4 Challenges

2.2.4.1 Integration of GIS Technology With Other Technologies

Figure 4 GIS Market Restraints & Challenges and Their Impact

3 Industry Trends

3.1 Introduction

3.2 Value Chain Analysis

Figure 5 Value Chain Analysis of Geographic Information System Ecosystem

3.3 GIS Data

3.3.1 Types of GIS Data Models

3.3.1.1 Vector Data Model

3.3.1.2 Raster Data Model

3.4 Trends in GIS Market

3.4.1 AR and VR Technologies

3.4.2 Unmanned Aerial Vehicles

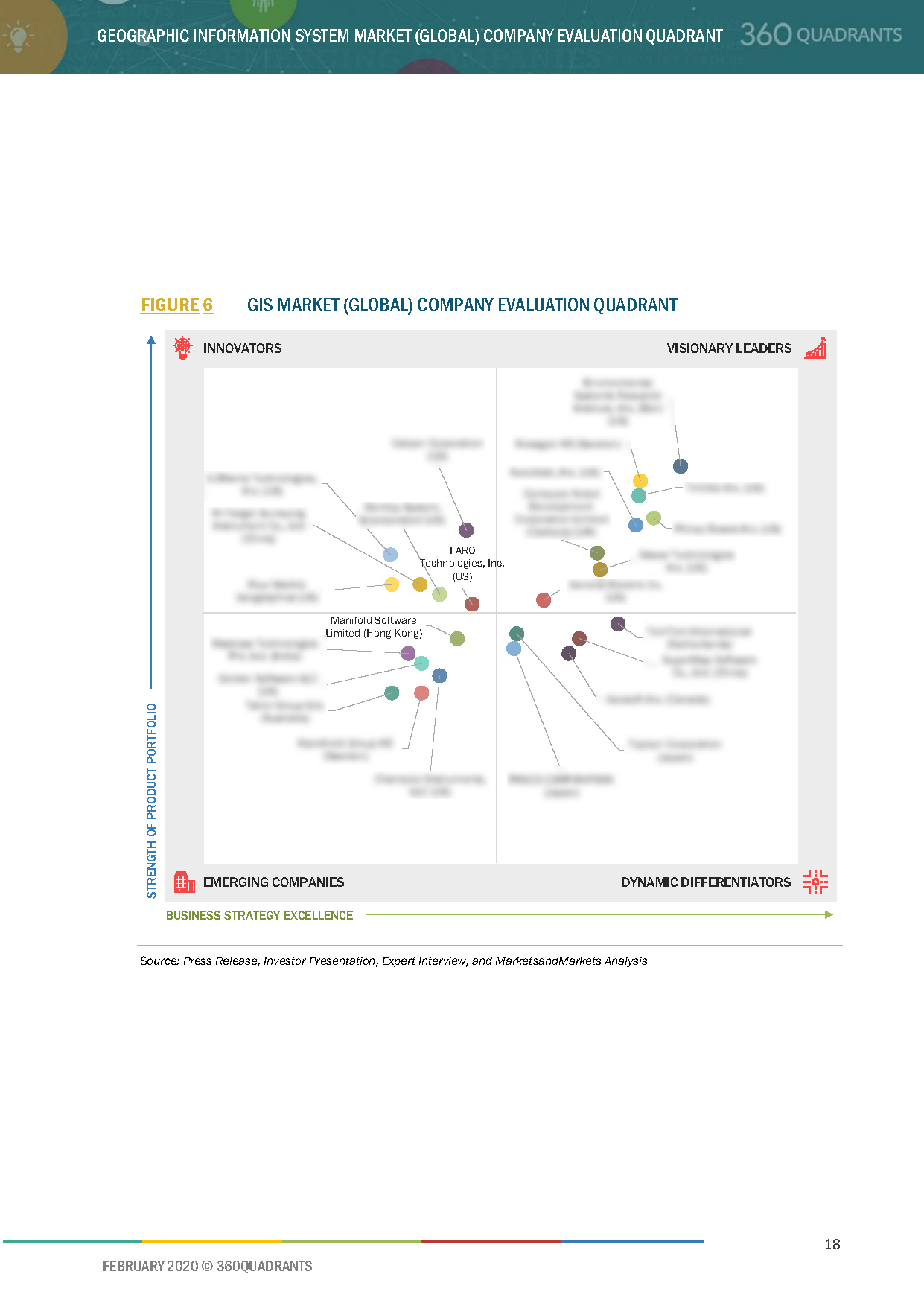

4 Company Evaluation Quadrant

4.1 Visionary Leaders

4.2 Innovators

4.3 Dynamic Differentiators

4.4 Emerging Companies

Figure 6 GIS Market (Global) Company Evaluation Quadrant

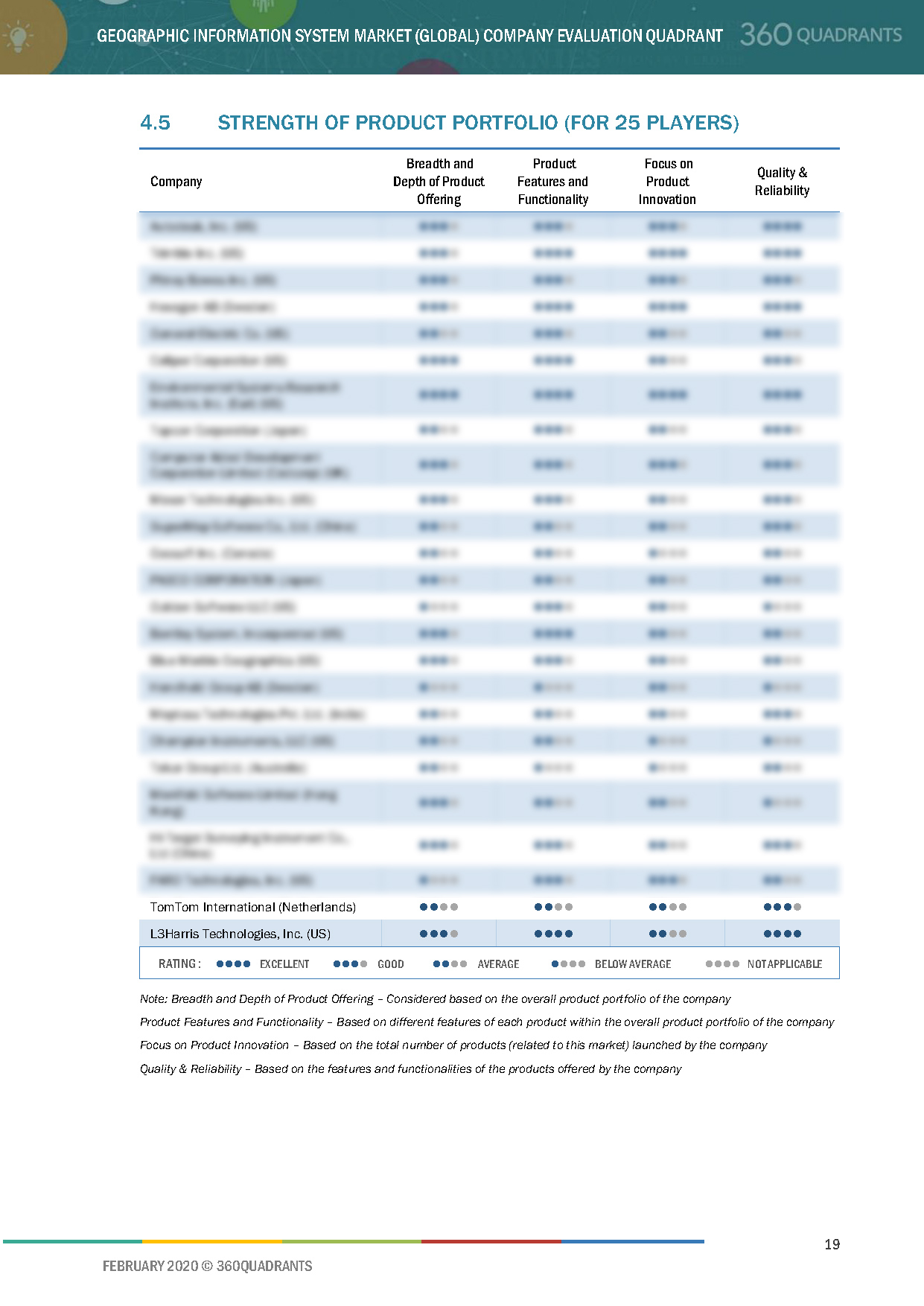

4.5 Strength of Product Portfolio (For 25 Players)

4.6 Business Strategy Excellence (For 25 Players)

5 Competitive Landscape

5.1 Introduction

Figure 7 Key Growth Strategies Adopted By Companies from 2018 to 2020

5.2 Market Ranking Analysis

Figure 8 Ranking of Key Players in GIS Software Market, 2019

5.3 Right to Win (Company Business Snapshot)

5.4 Competitive Scenario

5.4.1 Product Launches and Product Developments

Table 1 Product Launches & Product Developments, 2018–2020

5.4.2 Mergers, Acquisitions, Partnerships, and Collaborations

Table 2 Mergers, Acquisitions, Partnerships, and Collaborations, 2018–2020

6 Company Profiles

6.1 Introduction

6.2 Key Players

6.2.1 Autodesk

6.2.1.1 Business Overview*

Figure 9 Autodesk: Company Snapshot

6.2.1.2 Products Offered*

6.2.1.3 Recent Developments*

6.2.1.4 SWOT Analysis*

6.2.1.5 MnM View*

(*Above sections are present for all of below companies)

6.2.2 Esri

6.2.3 Trimble

Figure 10 Trimble: Company Snapshot

6.2.4 Pitney Bowes

Figure 11 Pitney: Company Snapshot

6.2.5 Hexagon

Figure 12 Hexagon: Company Snapshot

6.2.6 Topcon

Figure 13 Topcon: Company Snapshot

6.2.7 Maxar Technologies

Figure 14 Maxar Technologies: Company Snapshot

6.2.8 Caliper Corporation

6.2.9 Bentley Systems

7 Appendix

7.1 Other Significant Players

7.1.1 TomTom International

7.1.2 SuperMap Software

7.1.3 General Electric

7.1.4 FARO Technologies

7.1.5 L3Harris Technologies

7.1.6 Takor Group

7.1.7 Maptoss Technologies

7.1.8 Computer Aided Development Corporation Limited (Cadcorp)

7.1.9 Hi-Target Surveying Instrument

7.1.10 Blue Marble Geographics

7.1.11 PASCO CORPORATION

7.2 Methodology

This report identifies and benchmarks the key market players such as Esri, Hexagon, Pitney Bowes, Trimble, and Autodesk, and evaluates them on the basis of business strategy excellence and strength of product portfolio within the geographic information system ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More