Digital Twin Quadrant Report

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 Markets Covered

1.3.2 Inclusions And Exclusions

1.3.3 Geographical Scope

1.3.4 Years Considered

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

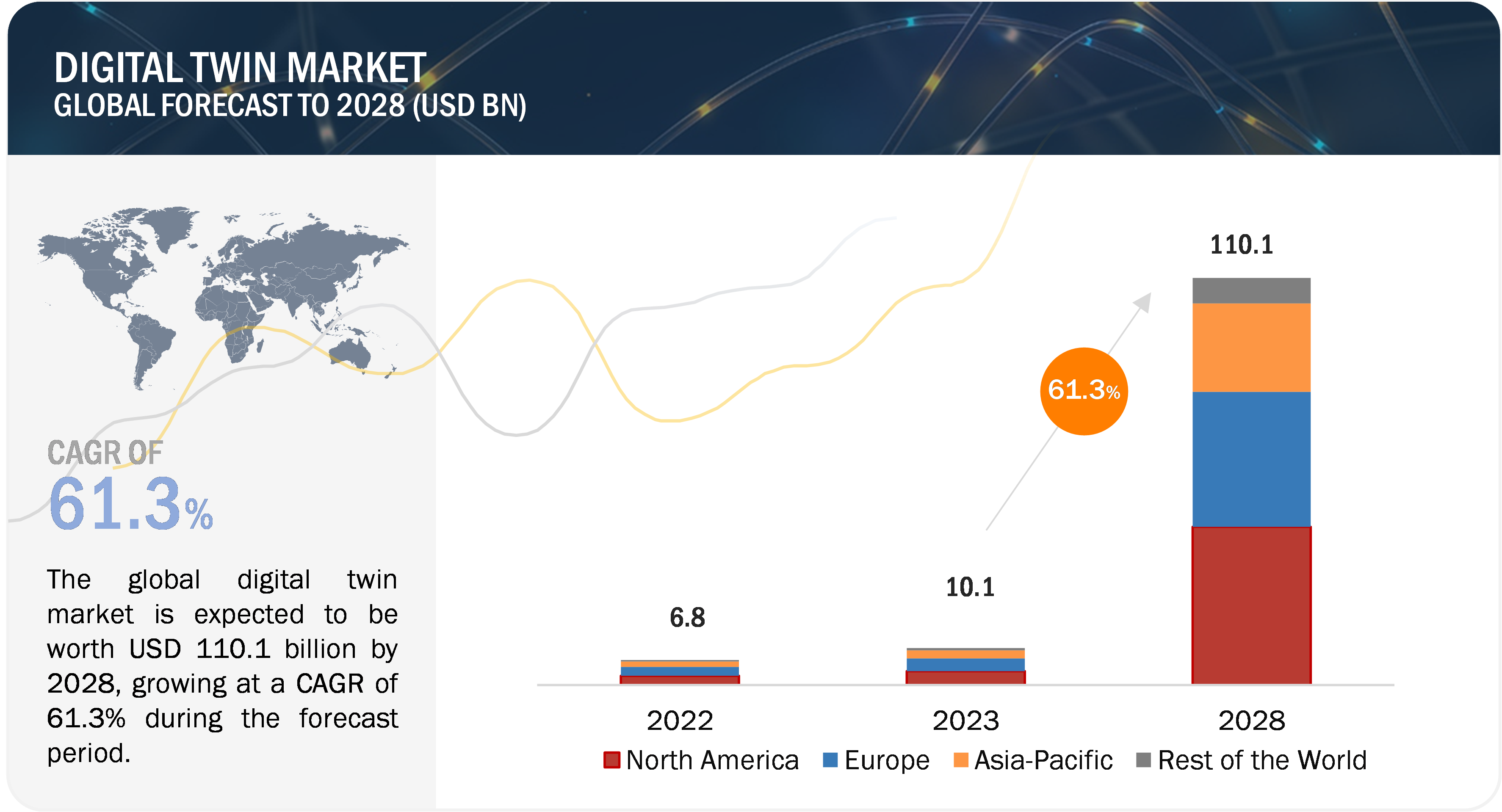

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.2.1 DRIVERS

2.2.1.1 Growing use of digital twin technology to reduce costs and improve supply chain operations

2.2.1.2 Surging demand for digital twin technology from healthcare industry

2.2.1.3 Increasing adoption of predictive maintenance model across industries

2.2.2 RESTRAINTS

2.2.2.1 High capital requirement to implement digital twin technology

2.2.2.2 Susceptibility of digital twin technology to cyberattacks

2.2.3 OPPORTUNITIES

2.2.3.1 Surging demand for advanced real-time data analytics

2.2.3.2 Increasing adoption of Industry 4.0 principles

2.2.3.3 Development of human-centered digital twins

2.2.4 CHALLENGES

2.2.4.1 Complexities associated with data collection and mathematical models

2.2.4.2 Shortage of skilled workforce

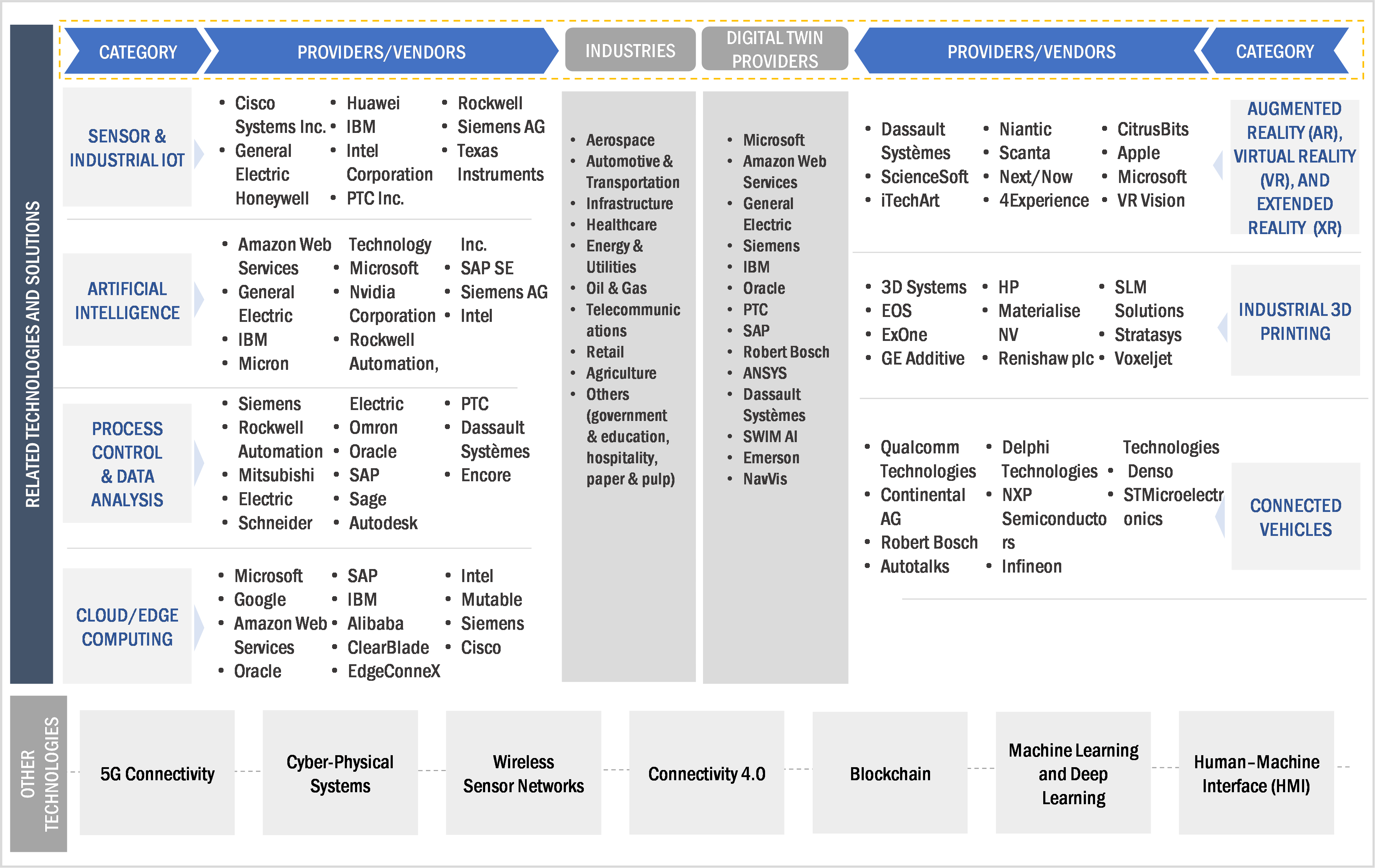

2.3 VALUE CHAIN ANALYSIS

2.4 ECOSYSTEM MAPPING

2.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

2.6 PORTER’S FIVE FORCES ANALYSIS

2.6.1 THREAT OF NEW ENTRANTS

2.6.2 THREAT OF SUBSTITUTES

2.6.3 BARGAINING POWER OF BUYERS

2.6.4 BARGAINING POWER OF SUPPLIERS

2.6.5 INTENSITY OF COMPETITIVE RIVALRY

2.7 CASE STUDY ANALYSIS

2.7.1 TEMPLE UNIVERSITY, US, USES DIGITAL TWIN TECHNOLOGY TO ENHANCE OPERATIONS ACROSS CAMPUS

2.7.2 FAURECIA ADOPTS 3DEXPERIENCE DIGITAL TWIN PLATFORM TO OPTIMIZE AGV INBOUND LOGISTICS

2.7.3 DOOSAN OPTIMIZES ENERGY OUTPUT IN WIND FARMS BY IMPLEMENTING AZURE DIGITAL TWINS

2.7.4 IBM INCORPORATES DIGITAL TWINS TO IMPROVE SPARE PART INVENTORY

2.7.5 USE HEALTHCARE PROFESSIONALS USE DIGITAL TWINS TO DEVELOP PERSONALIZED AND BETTER CARE PLANS

3 COMPETITIVE LANDSCAPE

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES ADOPTED BY MAJOR PLAYERS

3.3 FIVE-YEAR REVENUE ANALYSIS OF TOP COMPANIES, 2018–2022

3.4 MARKET SHARE ANALYSIS, 2022

3.5 DIGITAL TWIN MARKET: COMPANY EVALUATION MATRIX, 2022

3.2.1 STARS

3.2.2 EMERGING LEADERS

3.2.3 PERVASIVE PLAYERS

3.2.4 PARTICIPANTS

3.6 DIGITAL TWIN MARKET: COMPANY FOOTPRINT

3.7 DIGITAL TWIN MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

3.7.1 PROGRESSIVE COMPANIES

3.7.2 RESPONSIVE COMPANIES

3.7.3 DYNAMIC COMPANIES

3.7.4 STARTING BLOCKS

3.8 DETAILED LIST OF KEY STARTUPS/SMES

3.9 COMPETITIVE SCENARIOS AND TRENDS

3.9.1 PRODUCT LAUNCHES

3.9.2 DEALS

3.9.3 OTHERS

4 COMPANY PROFILES

4.1 KEY PLAYERS

4.1.1 GENERAL ELECTRIC

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.3.1 Product launches

4.1.1.3.2 Deals

4.1.1.4 MnM view

4.1.1.4.1 Key strengths/Right to win

4.1.1.4.2 Strategic choices

4.1.1.4.3 Weaknesses and competitive threats

4.1.2 MICROSOFT

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths/Right to win

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.3 SIEMENS

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches

4.1.3.3.2 Deals

4.1.3.4 MnM view

4.1.3.4.1 Key strengths/Right to win

4.1.3.4.2 Strategic choices

4.1.3.4.3 Weaknesses and competitive threats

4.1.4 AMAZON WEB SERVICES, INC. (AWS)

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches

4.1.4.3.2 Deals

4.1.4.4 MnM view

4.1.4.4.1 Key strengths/Right to win

4.1.4.4.2 Strategic choices

4.1.4.4.3 Weaknesses and competitive threats

4.1.5 DASSAULT SYSTÈMES

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths/Right to win

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.6 ANSYS, INC.

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.6.3.1 Product launches

4.1.6.3.2 Deals

4.1.6.4 MnM view

4.1.6.4.1 Key strengths/Right to win

4.1.6.4.2 Strategic choices

4.1.6.4.3 Weaknesses and competitive threats

4.1.7 IBM CORPORATION

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.7.3.1 Product launches

4.1.7.3.2 Deals

4.1.8 PTC

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offer

4.1.8.3 Recent developments

4.1.8.3.1 Product launches

4.1.8.3.2 Deals

4.1.9 SAP SE

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.9.3.1 Deals

4.1.10 ORACLE

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.10.3.1 Product launches

4.1.10.3.2 Deals

4.1.10.3.3 Others

4.1.11 ROBERT BOSCH GMBH

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.11.3 Recent developments

4.1.11.3.1 Product launches

4.1.11.3.2 Deals

4.2 OTHER KEY PLAYERS

4.2.1 EMERSON ELECTRIC CO.

4.2.2 ABB

4.2.3 HONEYWELL INTERNATIONAL INC.

4.2.4 SCHNEIDER ELECTRIC

4.2.2 NAVVIS

4.2.6 DNV AS

4.2.7 AUTODESK INC.

4.2.8 ANDRITZ AG

4.2.9 SOFTWARE AG

4.2.10 BENTLEY SYSTEMS, INCORPORATED

4.2.11 RIVER LOGIC, INC.

4.2.12 ALTAIR ENGINEERING INC.

4.2.13 JOHNSON CONTROLS

4.2.1 nSTREAM

COMPANY PROFILES

KEY PLAYERS

GENERAL ELECTRIC

MICROSOFT

SIEMENS

AMAZON WEB SERVICES, INC. (AWS)

DASSAULT SYSTÈMES

ANSYS, INC.

IBM CORPORATION

PTC

SAP SE

ORACLE

ROBERT BOSCH GMBH

OTHER KEY PLAYERS

EMERSON ELECTRIC CO.

ABB

HONEYWELL INTERNATIONAL INC.

SCHNEIDER ELECTRIC

NAVVIS

DNV AS

AUTODESK INC.

ANDRITZ AG

SOFTWARE AG

BENTLEY SYSTEMS, INCORPORATED

RIVER LOGIC, INC.

ALTAIR ENGINEERING INC.

JOHNSON CONTROLS

nSTREAM

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More