Contract Research Organization Services (CRO) Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

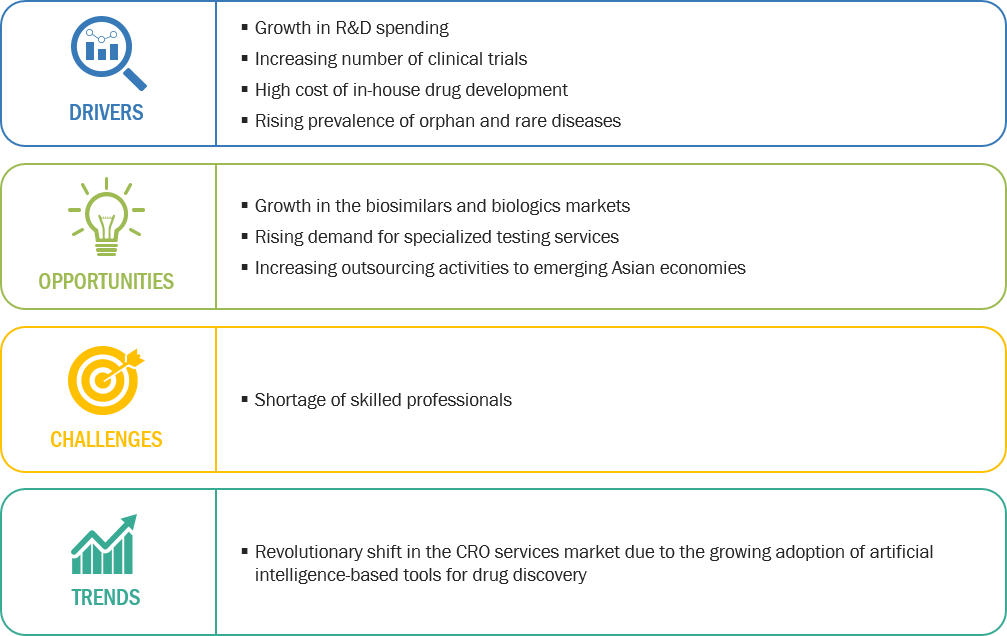

Figure 1 CRO Services Market: Drivers, Opportunities, Challenges, and Trends

2.2.1 Drivers

2.2.1.1 Growth in R&D Spending

Figure 2 Increasing R&D Spending of Pharma Member Companies, 2010–2018

Figure 3 Active Pharmaceutical Pipeline, 2009–2019

2.2.1.2 Increasing Number of Clinical Trials

Figure 4 Increasing Number of Clinical Trials Worldwide (2002–2020)

2.2.1.3 High Cost of In-House Drug Development

Figure 5 Average Cost to Develop A Pharmaceutical Compound From Discovery to Launch, 2013–2019 (USD Billion)

2.2.1.4 Rising Prevalence of Orphan and Rare Diseases

Table 1 Research Projects Funded By the International Rare Diseases Research Consortium, 2019

2.2.2 Opportunities

2.2.2.1 Growth in the Biosimilars and Biologics Markets

Figure 6 Total Number of New Biologic License Application Filings, Approvals, and NDA Approvals (2005–2019)

Table 2 List of Biological License Application Approvals in the US, 2019

2.2.2.2 Rising Demand for Specialized Testing Services

2.2.2.3 Increasing Outsourcing Activities to Emerging Asian Economies

2.2.3 Challenges

2.2.3.1 Shortage of Skilled Professionals

2.2.4 Trends

2.2.4.1 Revolutionary Shift in the CRO Services Market Due to the Growing Adoption of Artificial Intelligence-Based Tools for Drug Discovery

3 Company Evaluation Quadrant

3.1 Company Evaluation Quadrant

3.1.1 Visionary Leaders

3.1.2 Innovators

3.1.3 Dynamic Differentiators

3.1.4 Emerging Companies

Figure 7 CRO Services Market: Company Evaluation Quadrant

4 Competitive Landscape

4.1 Overview

Figure 8 Agreements, Partnerships, and Collaborations—Key Growth Strategy Adopted By Some Market Players From January 2017 to January 2020

4.2 Market Share Analysis: CRO Services Market (2019)

Figure 9 CRO Services Market Share, By Key Player, 2019

4.3 Competitive Situation and Trends

4.3.1 Service Launches

Table 3 Service Launches, 2017–2020

4.3.2 Expansions

Table 4 Expansions, 2017–2020

4.3.3 Acquisitions

Table 5 Acquisitions, 2017–2020

4.3.4 Partnerships & Agreements

Table 6 Partnerships & Agreements, 2017–2020

5 Company Profiles

5.1 IQVIA

5.1.1 Business Overview*

Figure 10 IQVIA: Company Snapshot (2019)

5.1.2 Services Offered*

5.1.3 Recent Developments*

5.1.4 MnM View*

5.1.5 Strategic Overview*

(*Above sections are present for all of below companies)

5.2 LabCorp

Figure 11 LabCorp: Company Snapshot (2019)

5.3 Syneos Health Inc.

Figure 12 Syneos Health Inc.: Company Snapshot (2019)

5.4 WuXi AppTec

Figure 13 WuXi AppTec: Company Snapshot (2018)

5.5 Charles River Laboratories

Figure 14 Charles River Laboratories: Company Snapshot (2019)

5.6 Parexel International

5.7 PRA Health Sciences

Figure 15 PRA Health Sciences: Company Snapshot (2018)

5.8 PPD

5.9 ICON plc

Figure 16 ICON plc: Company Snapshot (2019)

5.10 Medpace Holdings

Figure 17 Medpace Holdings: Company Snapshot (2018)

5.11 SGS

Figure 18 SGS: Company Snapshot (2019)

5.12 PSI CRO AG

5.13 Axcent Advanced Analytics (A3)

5.14 BioAgile Therapeutics

5.15 Firma Clinical Research

6 Appendix

6.1 Other Significant Players

6.1.1 Acculab Life Sciences

6.1.2 Azelix

6.1.3 CTServ

6.1.4 PEPGRA

6.1.5 Dove Quality Solutions

6.2 Methodology

6.3 List of Abbreviations

This report identifies and benchmarks world’s best companies in the CRO services market such as IQVIA (US), LabCorp (US), PAREXEL (US), PRA Health Sciences (US), PPD (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the CRO services ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders (top companies), Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More