Contactless Payment Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

1.1.1 Inclusions and Exclusions

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

Figure 1 Enhanced Purchase Experience to Drive the Growth of the Contactless Payment Market

2.2.1 Drivers

2.2.1.1 Contactless Payments Ensure Faster Transactions

2.2.1.2 Increased Customer Satisfaction and Improved Loyalty Programs

2.2.1.3 Enhanced Purchase Experience

2.2.2 Restraints

2.2.2.1 Risk of Stolen or Lost Contactless Cards

2.2.2.2 High Cost of Deploying Contactless Payment Technologies

2.2.3 Opportunities

2.2.3.1 Use of Security Features of Emerging Technologies, Such as Blockchain and 5G

2.2.3.2 Rising Demand for Mobile and Wearable Payment Devices

2.2.4 Challenges

2.2.4.1 Lack of Consumer Awareness

2.2.4.2 Banking Laws and Payment Association Rules

2.3 Standards and Regulations

2.3.1 ISO/IEC 14443

2.3.1.1 Part 1

2.3.1.2 Part 2

2.3.1.3 Part 3

2.3.1.4 Part 4

2.3.2 ISO/IEC 15693

2.3.2.1 Part 1

2.3.2.2 Part 2

2.3.2.3 Part 3

2.3.3 ISO/IEC 18092

2.3.3.1 Read/Write

2.3.3.2 Peer-to-Peer

2.4 Use Cases

2.4.1 Use Case: Transport and Logistics

2.4.2 Use Case: Hospitality

2.4.3 Use Case: Transportation and Logistics

2.5 Impact of Disruptive Technologies

2.5.1 Blockchain

2.5.2 5G

2.5.3 Augmented Reality

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Dynamic Differentiators

3.3 Innovators

3.4 Emerging Companies

Figure 2 Contactless Payment Market (Global) Company Evaluation Quadrant

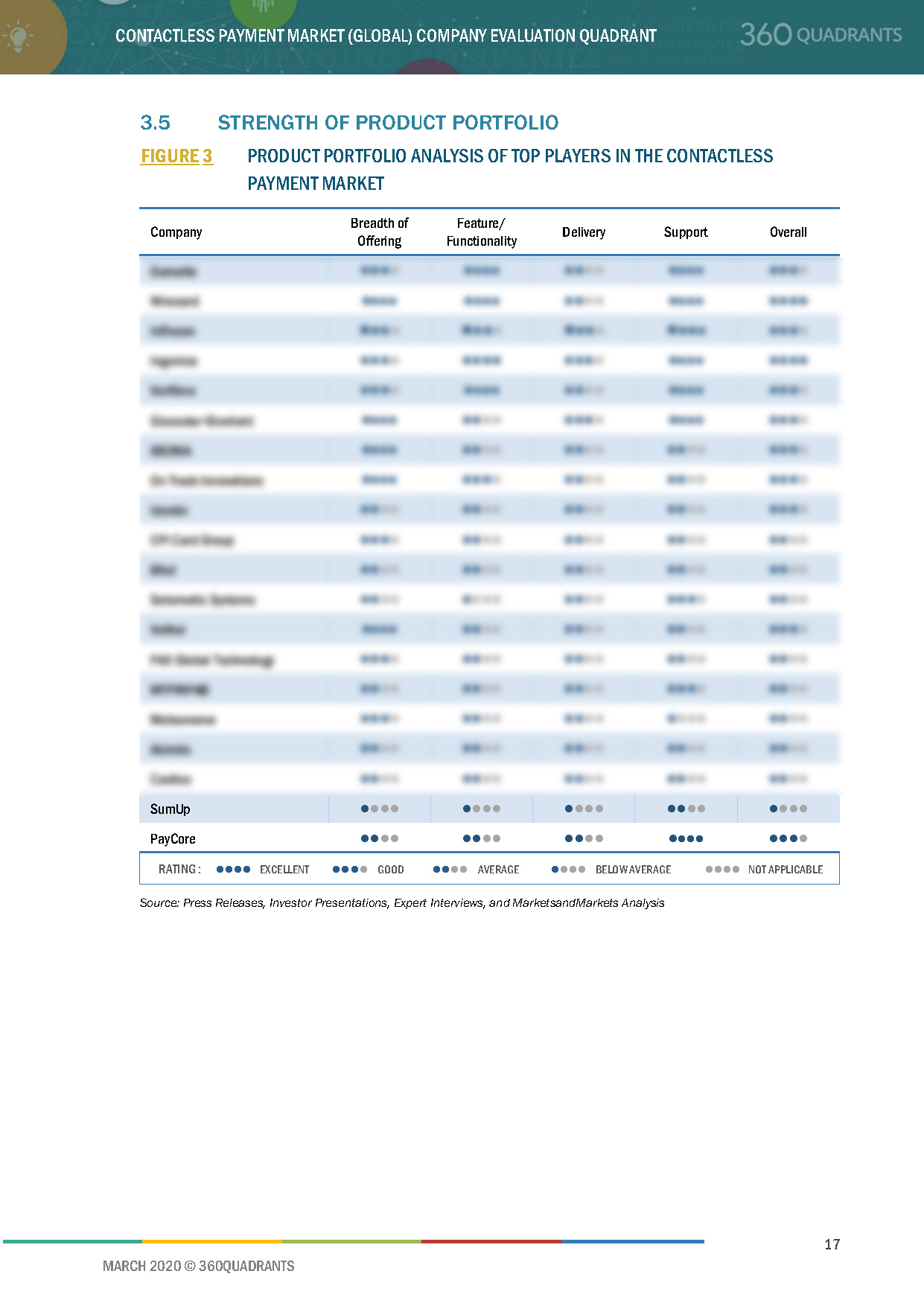

3.5 Strength of Product Portfolio

Figure 3 Product Portfolio Analysis of Top Players in the Contactless Payment Market

3.6 Business Strategy Excellence

Figure 4 Business Strategy Excellence of Top Players in the Contactless Payment Market

4 Competitive Landscape

4.1 Overview

4.2 Market Rank Analysis

Figure 5 Ranking of Key Players in the Contactless Payment Market, 2020

4.3 Right-To-Win (Company Business Snapshot)

5 Company Profiles

5.1 Introduction

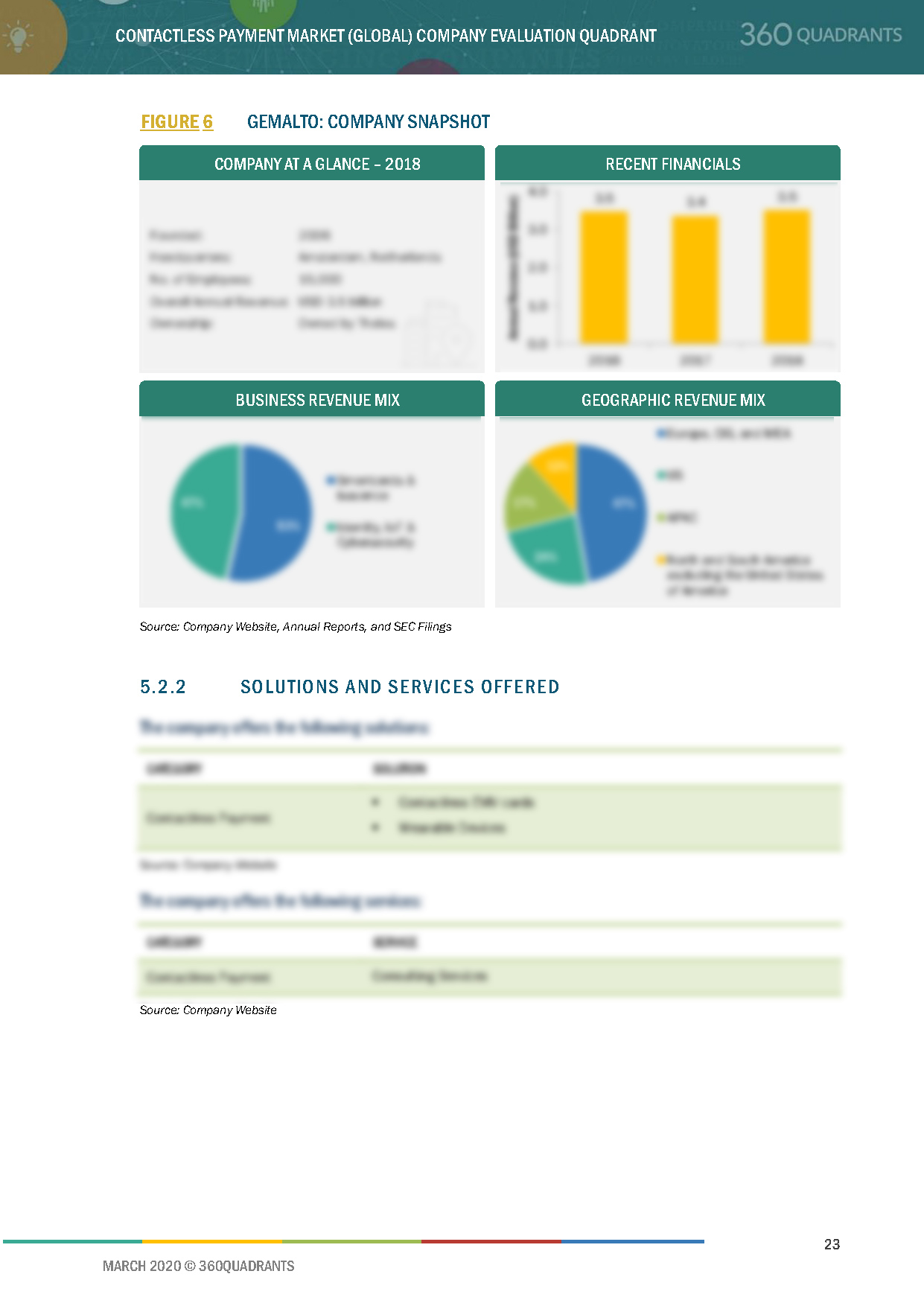

5.2 Gemalto

5.2.1 Business Overview*

Figure 6 Gemalto: Company Snapshot

5.2.2 Solutions and Services Offered*

5.2.3 Recent Developments*

5.2.4 SWOT Analysis*

Figure 7 Gemalto: SWOT Analysis

(*Above sections are present for all of below companies)

5.3 Infineon

Figure 8 Infineon: Company Snapshot

Figure 9 Infineon: SWOT Analysis

5.4 Ingenico

Figure 10 Ingenico: Company Snapshot

Figure 11 Ingenico: SWOT Analysis

5.5 Wirecard

Figure 12 Wirecard: Company Snapshot

Figure 13 Wirecard: SWOT Analysis

5.6 Verifone

5.7 Giesecke+Devrient

Figure 14 Giesecke+Devrient: Company Snapshot

5.8 IDEMIA

5.9 On Track Innovations

Figure 15 On Track Innovations: Company Snapshot

5.10 Identiv

Figure 16 Identiv: Company Snapshot

5.11 CPI Card Group

Figure 17 CPI Card Group: Company Snapshot

6 Appendix

6.1 Methodology

Top Contactless Payment Companies - Quadrant report identifies and benchmarks Top Contactless Payment Companies such as Gemalto (Netherlands), Infineon (Germany), Ingenico (France), Wirecard (Germany), Verifone (US), Giesecke+Devrient (Germany), and evaluates them based on business strategy excellence and strength of product portfolio within the Contactless Payment ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders ( Best Contactless Payment Companies ), Dynamic Differentiators, Innovators, or Emerging companies.

The report includes market-specific company profiles of all 20 Best Contactless Payment Companies and assesses the recent developments that shape the competitive landscape of this highly fragmented market.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More