Cloud Gaming Services Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

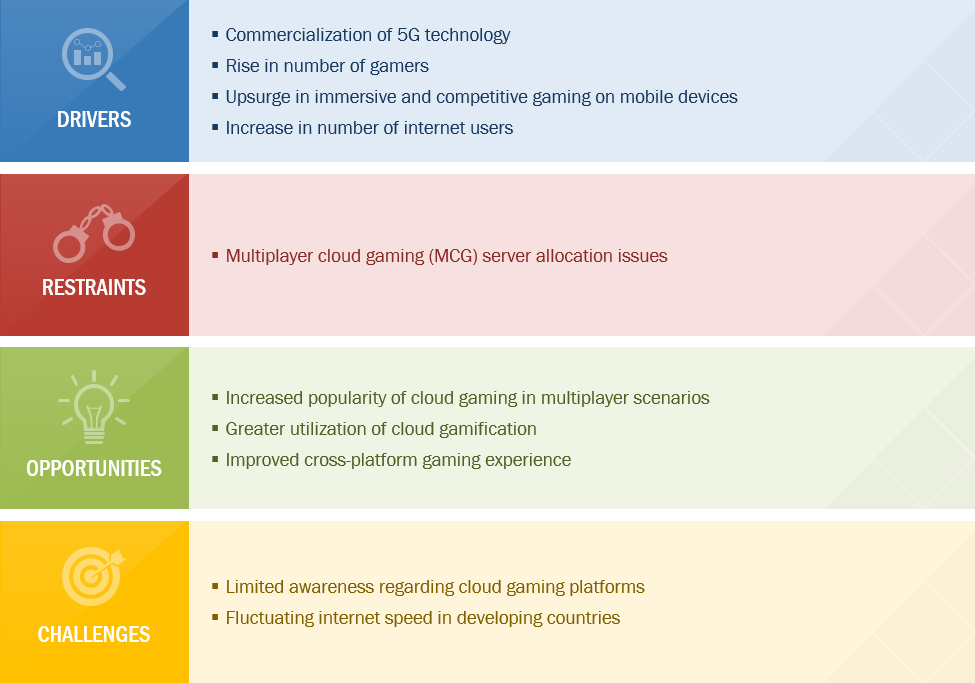

Figure 1 Cloud Gaming Market: Drivers, Restraints, Opportunities, and Challenges

2.2.1 Drivers

Figure 2 Cloud Gaming Market Drivers and Their Impact

2.2.1.1 Commercialization of 5G Technology

2.2.1.2 Rise in Number of Gamers

2.2.1.3 Upsurge in Immersive and Competitive Gaming on Mobile Devices

2.2.1.4 Increase in Number of Internet Users

Figure 3 Internet Users Traffic, 2010–2017

2.2.2 Restraints

Figure 4 Cloud Gaming Market Restraint and Its Impact

2.2.2.1 Multiplayer Cloud Gaming Server Allocation Issues

2.2.3 Opportunities

Figure 5 Cloud Gaming Market Opportunities and Their Impact

2.2.3.1 Increased Popularity of Cloud Gaming in Multiplayer Scenarios

2.2.3.2 Greater Utilization of Cloud Gamification

2.2.3.3 Improved Cross-Platform Gaming Experience

2.2.4 Challenges

Figure 6 Cloud Gaming Market Challenges and Their Impact

2.2.4.1 Limited Awareness Regarding Cloud Gaming Platforms

2.2.4.2 Fluctuating Internet Speed in Developing Countries

2.3 Value Chain Analysis

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 7 Cloud Gaming Market (Global) Company Evaluation Quadrant

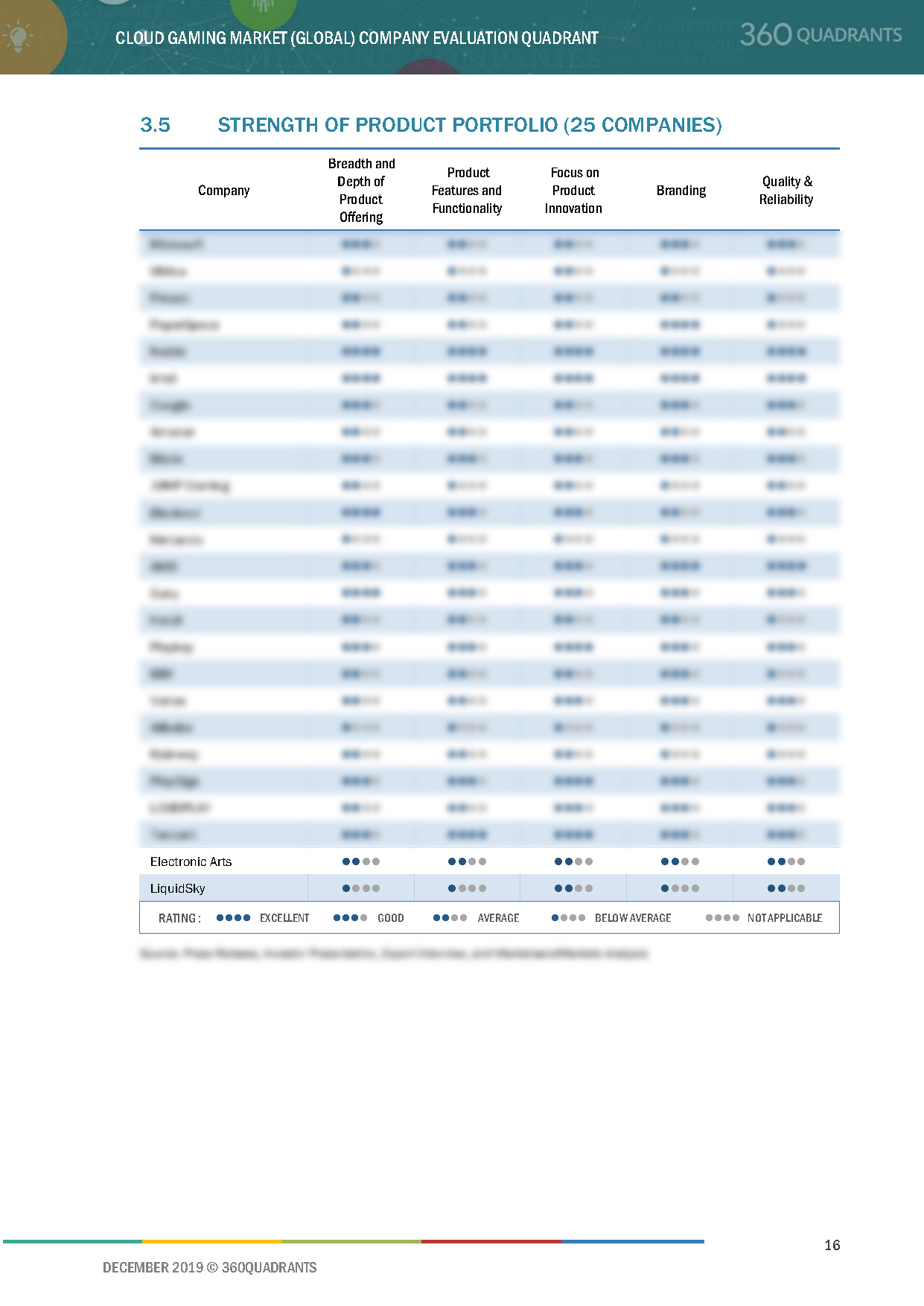

3.5 Strength of Product Portfolio (25 Companies)

3.6 Business Strategy Excellence (25 Companies)

4 Competitive Landscape

4.1 Overview

Figure 8 Companies Adopted Product Launches and Partnerships & Acquisitions as Key Growth Strategies From 2018 to 2019

4.2 Market Ranking Analysis, 2019

Figure 9 Ranking of Key Players in Cloud Gaming Market, 2019

4.3 Right-To-Win (Company Business Snapshot)

4.4 Competitive Situation and Trends

Figure 10 Market Evaluation Framework: Expansions, Partnerships, and Acquisitions have Fueled Growth of Cloud Gaming Market From 2018 to 2019

4.4.1 Partnerships, Collaborations, and Agreements

Table 1 Partnerships, Collaborations, and Agreements, 2018–2019

4.4.2 Product Launches

Table 2 Product Launches, 2018–2019

4.4.3 Expansions

Table 3 Expansions, 2018–2019

4.4.4 Acquisitions

Table 4 Acquisitions, 2018–2019

5 Company Profiles

5.1 Key Players

5.1.1 NVIDIA

5.1.1.1 Business Overview*

Figure 11 NVIDIA: Company Snapshot

5.1.1.2 Products, Solutions, and Services Offered*

5.1.1.3 Recent Developments*

5.1.1.4 SWOT Analysis*

5.1.1.5 MnM View*

(*Above sections are present for all of below companies)

5.1.2 Intel Corporation

Figure 12 Intel Corporation: Company Snapshot

5.1.3 Google

Figure 13 Google: Company Snapshot

5.1.4 Microsoft

Figure 14 Microsoft: Company Snapshot

5.1.5 Amazon

Figure 15 Amazon: Company Snapshot

5.1.6 Advanced Micro Devices

Figure 16 Advanced Micro Devices (AMD): Company Snapshot

5.1.7 Sony

Figure 17 Sony: Company Snapshot

5.1.8 IBM

Figure 18 IBM: Company Snapshot

5.1.9 Tencent

Figure 19 Tencent: Company Snapshot

5.1.10 Alibaba

Figure 20 Alibaba: Company Snapshot

6 Appendix

6.1 Other Significant Players

6.1.1 Blade

6.1.2 Blacknut

6.1.3 Paperspace

6.1.4 Vortex

6.1.5 Playgiga

6.1.6 Activision

6.1.7 Ubitus

6.1.8 Playkey

6.1.9 Loudplay

6.1.10 Electronic Arts

6.1.11 Hatch Entertainment

6.1.12 Jump Gaming

6.2 Methodology

This report identifies and benchmarks the key market players in the Cloud Gaming market such as NVIDIA (US), Intel (US), Google (US), Microsoft (US), Amazon (US) and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Cloud Gaming ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More