Battery Technology Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

1.1.1 Inclusions and Exclusions

2 Market Overview

2.1 Introduction

2.2 Market Dynamics

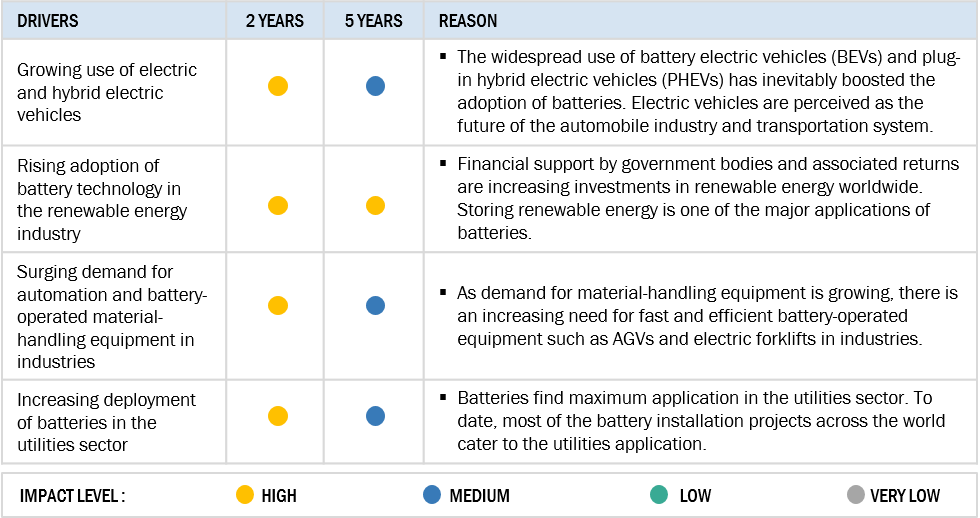

2.2.1 Drivers

2.2.1.1 Growing Use of Electric and Hybrid Electric Vehicles

2.2.1.2 Rising Adoption of Battery Technology in Renewable Energy Industry

2.2.1.3 Surging Demand for Automation and Battery-Operated Material-Handling Equipment in Industries

2.2.1.4 Increasing Deployment of Batteries in Utilities Sector

2.2.2 Restraints

2.2.2.1 Safety Issues Related to Storage Transportation of Spent Batteries

2.2.3 Opportunities

2.2.3.1 Large Storage Requirements in Data Centers

2.2.3.2 Advancements in Wearable Devices is Likely to Provide Growth Opportunity for Batteries

2.2.4 Challenges

2.2.4.1 Alternative Technologies Such as Compressed Air, Energy Storage, and Pumped Hydro Technology

2.2.4.2 High Cost of Battery-Operated Industrial Vehicles

2.3 Value Chain Analysis

Figure 1 Value Chain Analysis: Battery Technology Market

2.4 Regulations for Transportation of Batteries

2.4.1 Responsibilities

2.4.2 Legislation

2.4.3 Battery Tests

2.5 Latest Developments in Battery Technology

2.5.1 Solid-State Batteries

2.5.2 Multi-Valent Batteries

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 2 Battery Technology Market (Global) Company Evaluation Quadrant

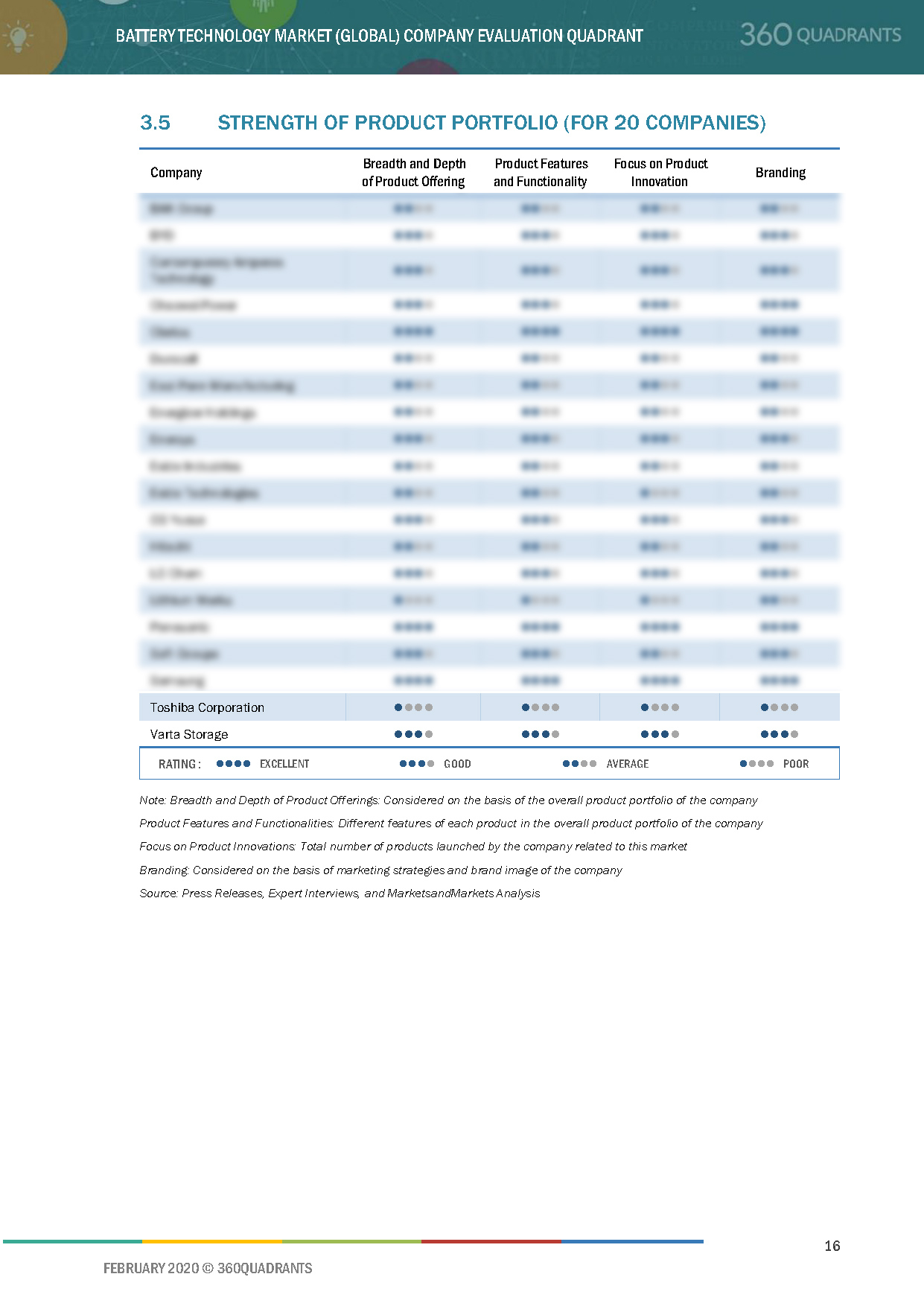

3.5 Strength of Product Portfolio (For 20 Companies)

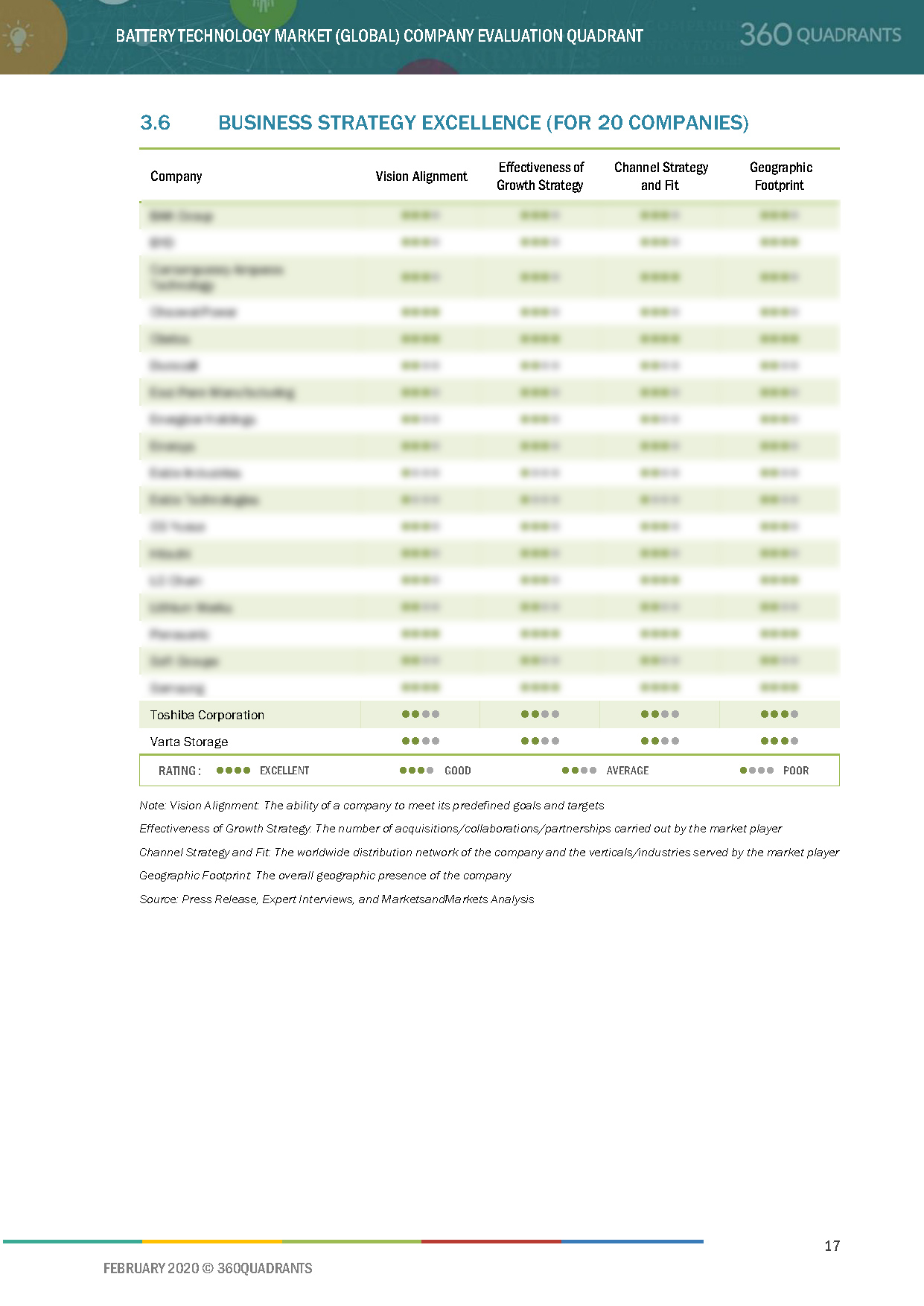

3.6 Business Strategy Excellence (For 20 Companies)

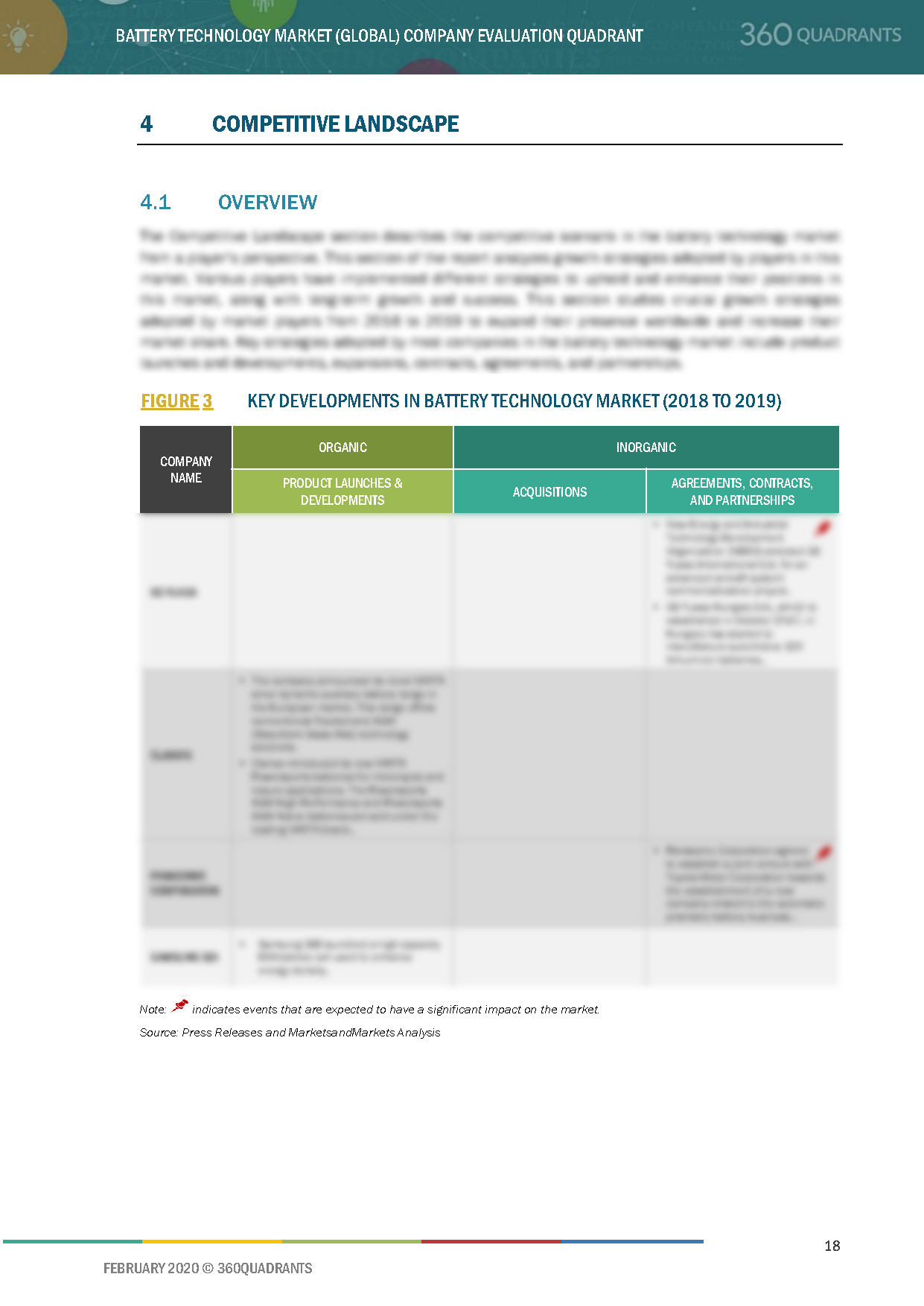

4 Competitive Landscape

4.1 Overview

Figure 3 Key Developments in Battery Technology Market (2018 to 2019)

4.2 Market Ranking Analysis: Battery Technology Market

Table 1 Ranking of Key Players in Battery Technology Market, 2019

4.3 Right to Win (Company Business Snapshot)

4.4 Competitive Situations and Trends

4.4.1 Contracts, Expansions, Agreements, Collaborations, Partnerships, and Joint Ventures

Table 2 Contracts, Expansions, Agreements, Collaborations, Partnerships, and Joint Ventures, 2018–2019

4.4.2 Product Launches and Developments

Table 3 Product Launches and Developments, 2018–2019

4.4.3 Acquisitions

Table 4 Acquisitions, 2017–2019

5 Company Profiles

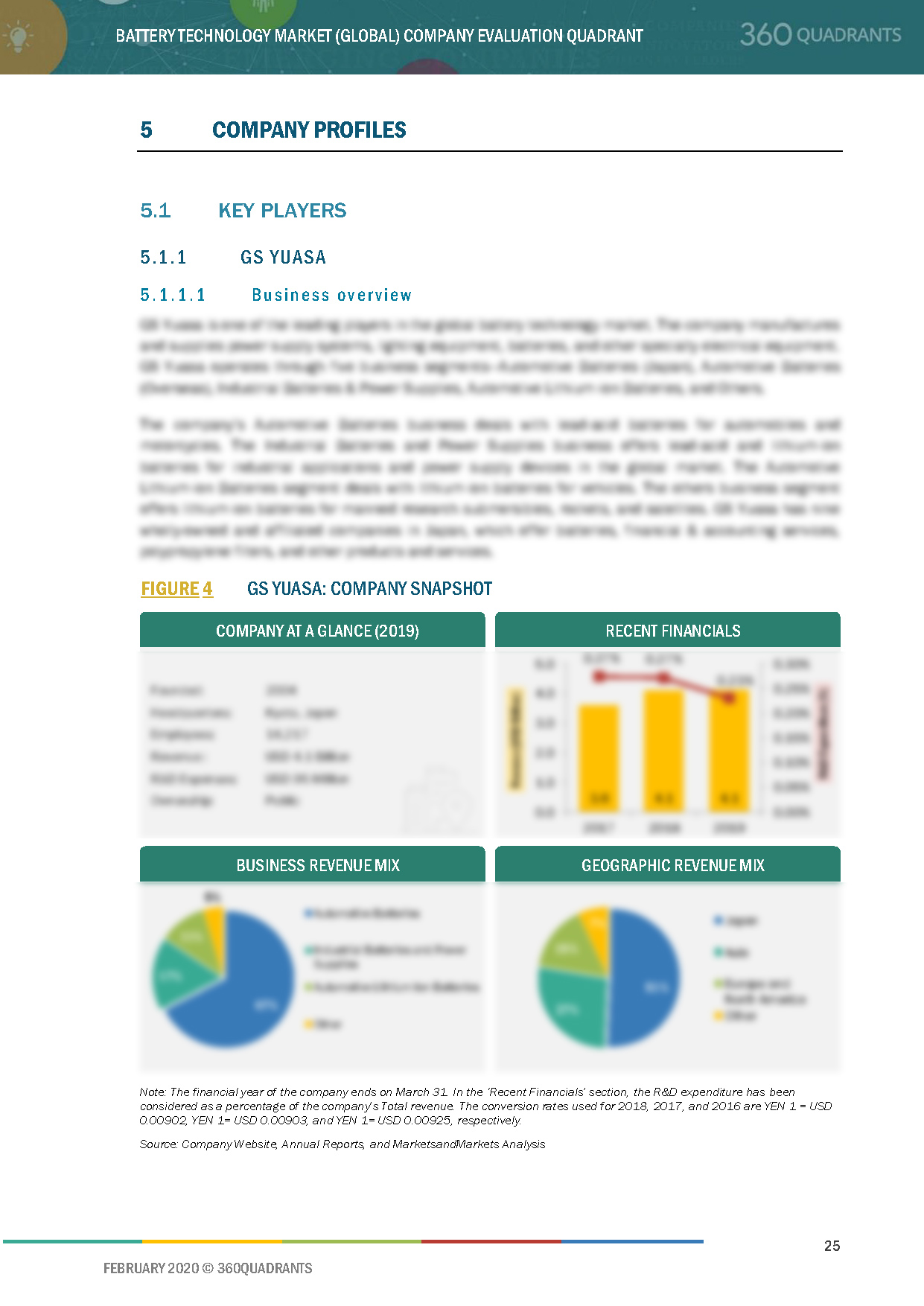

5.1 GS Yuasa

5.1.1 Business Overview*

Figure 4 GS Yuasa: Company Snapshot

5.1.2 Products Offered*

5.1.3 Recent Developments*

5.1.4 SWOT Analysis*

Figure 5 GS Yuasa: SWOT Analysis

5.1.5 MnM View*

(*Above sections are present for all of below companies)

5.2 Clarios

Figure 6 Clarios: SWOT Analysis

5.3 Panasonic Corporation

Figure 7 Panasonic Corporation: Company Snapshot

Figure 8 Panasonic Corporation: SWOT Analysis

5.4 Chaowei Power

Figure 9 Chaowei Power: Company Snapshot

Figure 10 Chaowei Power: SWOT Analysis

5.5 Samsung SDI

Figure 11 Samsung SDI: Company Snapshot

Figure 12 Samsung SDI: SWOT Analysis

5.6 Contemporary Amperex Technology Co. Limited

5.7 EnerSys

Figure 13 EnerSys: Company Snapshot

5.8 LG Chem

Figure 14 LG Chem: Company Snapshot

5.9 BYD Company

Figure 15 BYD Company: Company Snapshot

5.10 Hitachi Chemical

Figure 16 Hitachi: Company Snapshot

6 Appendix

6.1 Other Significant Players

6.1.1 Toshiba Corporation

6.1.2 Saft Groupe

6.1.3 Exide Industries

6.1.4 Lithium Werks

6.1.5 BAK Group

6.1.6 Exide Technologies

6.1.7 VARTA Storage

6.1.8 Energizer Holdings

6.1.9 Duracell

6.1.10 East Penn Manufacturing

6.2 Methodology

This report identifies and benchmarks the Battery Technology market leaders such as Clarios (US), Panasonic Corporation (Japan), Samsung SDI (South Korea), Chaowei Power (China), Contemporary Amperex Technology (China) and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Battery Technology market ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More