Automotive V2X Quadrant Report

Table of Contents

1 Introduction

1.1 Market Definition

1.1.1 Inclusions & Exclusions

Table 1 Inclusions & Exclusions for Automotive V2X Market

2 Market Overview

2.1 Introduction

Table 2 Comparison of V2X Technologies

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Demand for Fully Autonomous Driving and Safe Vehicles

Table 3 Safety Facts Concerning V2X Communication

2.2.1.2 Increasing Concerns Over Environmental Pollution Caused By Vehicles

Table 4 Environmental Pollution Facts

2.2.2 Restraints

2.2.2.1 Latency/Reliability Challenges

2.2.3 Opportunities

2.2.3.1 Increase in Support From Government for V2X Technology

2.2.3.2 Advancements in 5G Technology

Figure 1 High Speed Data and Performance Level

Table 5 Speed Comparison of Various Network Types

Table 6 5G-V2X Use Case Performances

2.2.4 Challenges

2.2.4.1 Vulnerability to Cyberattacks

Table 7 Base Standards for Security and Privacy in ITS Developed By ETSI (European Telecommunications Standards Institute)

2.3 Value Chain Analysis

Figure 2 Value Chain Analysis of Automotive V2X Market

2.4 Technological Analysis

Table 8 C-V2X Technical Advantages Over IEEE 802.11p (ITS-G5 or DSRC)

2.4.1 Cellular V2X (C-V2X)

Table 9 Cumulative Gain While Using 5G NR (New Radio) C-V2X

2.4.1.1 LTE-V2X

2.4.1.2 5G-V2X

3 Company Evaluation Quadrant (V2X Solution Providers)

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 3 Automotive V2X Solution Providers Market (Global) Company Evaluation Quadrant

4 Company Evaluation Quadrants (OEMs)

4.1 Visionary Leaders

4.2 Innovators

4.3 Dynamic Differentiators

4.4 Emerging Companies

Figure 4 Automotive V2X OEMs Market (Global) Company Evaluation Quadrant

5 Competitive Landscape

5.1 Overview

5.2 Market Ranking Analysis

Figure 5 Automotive V2X Market: Market Ranking 2020

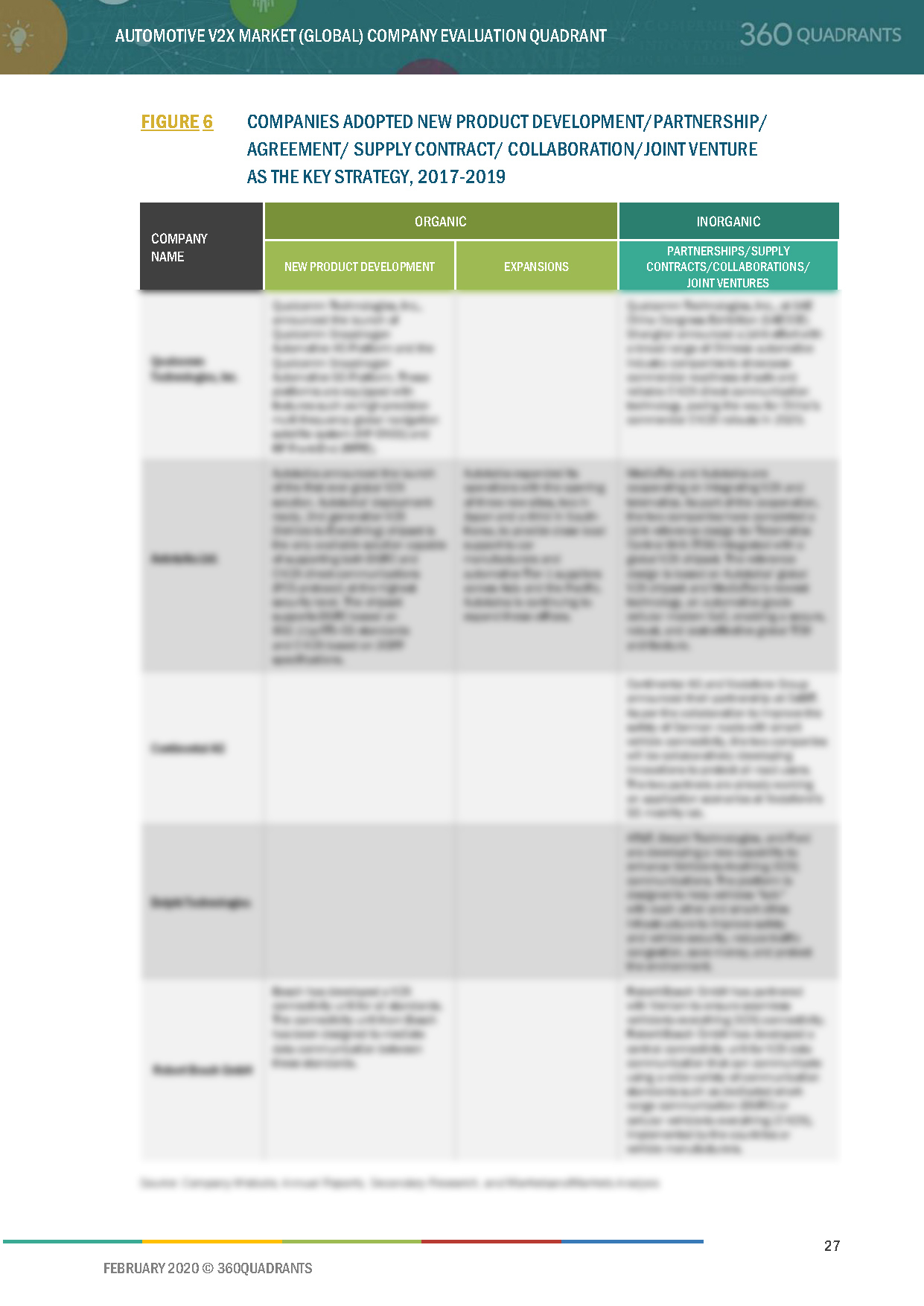

Figure 6 Companies Adopted New Product Development/Partnership/Agreement/Supply Contract/Collaboration/Joint Venture as the Key Strategy, 2017-2019

5.3 Competitive Scenario

Table 10 New Product Developments, 2018–2019

5.3.1 Partnerships/Supply Contracts/Collaborations/Joint Ventures/License Agreements

Table 11 Partnerships/Supply Contracts/Collaborations/Joint Ventures/Agreements, 2017–2019

5.3.2 Expansions

Table 12 Expansions, 2017

6 Company Profiles

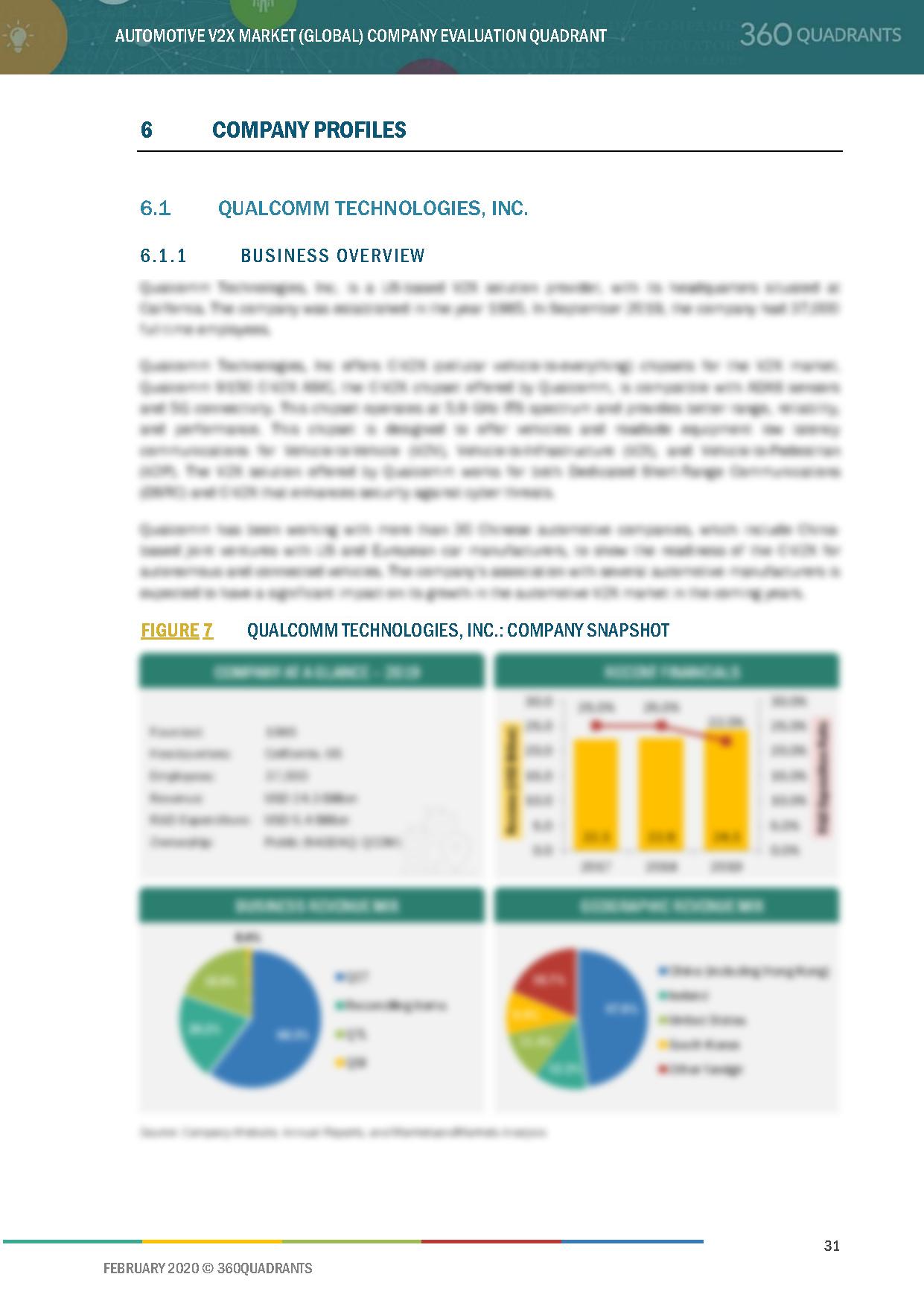

6.1 Qualcomm Technologies, Inc.

6.1.1 Business Overview*

Figure 7 Qualcomm Technologies, Inc.: Company Snapshot

6.1.2 Product Offerings*

6.1.3 Recent Developments*

6.1.4 SWOT Analysis*

Figure 8 Qualcomm Technologies, Inc.: SWOT Analysis

6.1.5 MnM View*

(*Above sections are present for all of below companies)

6.2 Continental AG

Figure 9 Continental AG: Company Snapshot

Figure 10 Continental AG: SWOT Analysis

6.3 Robert Bosch GmbH

Figure 11 Robert Bosch GmbH: Company Snapshot

Figure 12 Robert Bosch GmbH: SWOT Analysis

6.4 Autotalks Ltd.

Figure 13 Autotalks Ltd.: SWOT Analysis

6.5 Delphi Technologies

Figure 14 Delphi Technologies: Company Snapshot

Figure 15 Delphi Technologies: SWOT Analysis

6.6 NXP Semiconductors

Figure 16 NXP Semiconductors: Company Snapshot

6.7 Infineon Technologies AG

Figure 17 Infineon Technologies AG: Company Snapshot

6.8 Denso Corporation

Figure 18 Denso Corporation: Company Snapshot

6.9 STMicroelectronics

Figure 19 STMicroelectronics: Company Snapshot

6.10 Harman International

Figure 20 Harman International: Company Snapshot

6.11 Cohda Wireless

6.12 Savari, Inc.

7 Appendix

7.1 Other Significant Players

7.1.1 Europe

7.1.1.1 Kapsch Group

7.1.1.2 Marben Products

7.1.1.3 Altran

7.1.1.4 Nokia

7.1.1.5 dSPACE GmbH

7.1.1.6 Ficosa Internacional SA

7.1.1.7 ESCRYPT

7.1.1.8 Vector Informatik GmbH

7.1.1.9 Volkswagen AG

7.1.1.10 BMW AG

7.1.1.11 Daimler AG

7.1.1.12 Audi AG

7.1.1.13 Groupe Renault

7.1.1.14 McLaren Group

7.1.2 Asia Pacific

7.1.2.1 Unex Technology Corp.

7.1.2.2 Mitsubishi Corporation

7.1.2.3 Flex Ltd.

7.1.2.4 Huawei Technologies Co., Ltd.

7.1.2.5 Tata Motors

7.1.2.6 Hitachi Solutions, Ltd.

7.1.2.7 Hyundai Motor Company

7.1.2.8 Nissan Motor Corporation

7.1.3 North America

7.1.3.1 Lear Corporation

7.1.3.2 Intel Corporation

7.1.3.3 Danlaw, Inc.

7.1.3.4 Commsignia Ltd

7.1.3.5 General Motors

7.1.3.6 Ford Motor Company

7.2 Methodology

This report identifies and benchmarks the world’s best Automotive V2X companies, such as Autotalks Ltd. (Israel), Cohda Wireless (Australia), Continental AG (Germany), Delphi Technologies (UK), and Denso Corporation (Japan) and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Automotive V2X market ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases of best Automotive V2X companies. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More