Artificial Lift Quadrant Report

Table of Contents

1 Introduction

1.1 Definition

1.1.1 Artificial Lift Market, By Mechanism: Inclusions Vs. Exclusions

2 Market Overview

2.1 Introduction

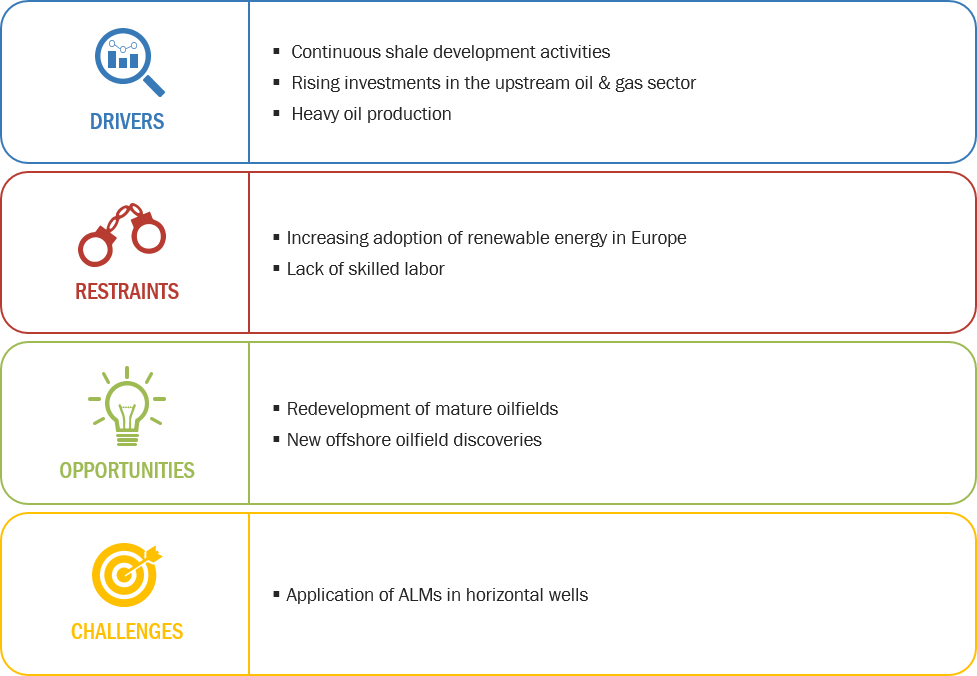

2.2 Market Dynamics

Figure 1 Artificial Lift Market: Drivers, Restraints, Opportunities, and Challenges

2.2.1 Drivers

2.2.1.1 Continuous Shale Development Activities

Table 1 Top Countries With Recoverable Shale Resources, 2018

2.2.1.2 Rising Investments in the Upstream Oil & Gas Sector

Figure 2 Global Oil & Gas Upstream Capital Spending (2016–2019)

2.2.1.3 Heavy Oil Production

2.2.2 Restraints

2.2.2.1 Increasing Adoption of Renewable Energy in Europe

2.2.2.2 Lack of Skilled Labor

2.2.3 Opportunities

2.2.3.1 Redevelopment of Mature Oilfields

2.2.3.2 New Offshore Oilfield Discoveries

Figure 3 New Offshore Oilfields, By Operator, 2018

2.2.4 Challenges

2.2.4.1 Application of ALMs in Horizontal Wells

Table 2 Horizontal Well: Artificial Lift Methods

2.3 Supply Chain Overview

Figure 4 Artificial Lift Supply Chain

2.3.1 Key Influencers

2.3.1.1 Equipment Manufacturers

2.3.1.2 Service Providers

2.3.1.3 Oilfield Operators

3 Company Evaluation Quadrant

3.1 Visionary Leaders

3.2 Innovators

3.3 Dynamic Differentiators

3.4 Emerging Companies

Figure 5 Artificial Lift Market (Global) Company Evaluation Quadrant

4 Competitive Landscape

4.1 Overview

Figure 6 Key Developments in the Artificial Lift Market, 2017–February 2019

4.2 Ranking of Players and Industry Concentration, 2019

Figure 7 Ranking of Key Players & Industry Concentration, 2019

4.3 Competitive Scenario

Table 3 Developments of Key Players in the Market, 2017–2019

4.3.1 New Product Launches

4.3.2 Contracts & Agreements

4.3.3 Mergers & Acquisitions

4.3.4 Investments & Expansions

4.3.5 Partnerships, Collaborations, Alliances, and Joint Ventures

5 Company Profiles

5.1 Schlumberger

5.1.1 Business Overview*

Figure 8 Schlumberger: Company Snapshot

5.1.2 Products Offered*

5.1.3 Recent Developments*

5.1.4 SWOT Analysis*

Figure 9 Schlumberger: SWOT Analysis

5.1.5 MnM View*

(*Above sections are present for all of below companies)

5.2 Weatherford International

Figure 10 Weatherford International: Company Snapshot

Figure 11 Weatherford: SWOT Analysis

5.3 Halliburton

Figure 12 Halliburton: Company Snapshot

Figure 13 Halliburton: SWOT Analysis

5.4 Baker Hughes Company

Figure 14 Baker Hughes Company: Company Snapshot

Figure 15 Baker Hughes Company: SWOT Analysis

5.5 NOV

Figure 16 NOV: Company Snapshot

Figure 17 NOV: SWOT Analysis

5.6 Borets International

Figure 18 Borets International: Company Snapshot

5.7 Apergy

Figure 19 Apergy: Company Snapshot

5.8 DistributionNOW

Figure 20 DistributionNOW: Company Snapshot

5.9 JJ Tech

5.10 OiLSERV

5.11 Novomet

5.12 AccessESP

5.13 PCM Artificial Lift Solutions Inc.

5.14 Priority Artificial Lift Services

5.15 Camco

5.16 Valiant Artificial Lift Solutions

5.17 Middle East Oilfield Services

5.18 EPIC Lift Systems

5.19 Maktoom Trading & Contracting Company

5.20 Production Lift Companies

6 Appendix

6.1 Methodology

This report identifies and benchmarks best artificial lift manufacturers such as Schlumberger, Weatherford, Halliburton, Baker Hughes Company, Borets International, and evaluates them on the basis of business strategy excellence and strength of product portfolio within the artificial lift ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More