AI Chip Quadrant Report

-

INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED AND REGIONAL SCOPE

1.3.2 INCLUSIONS AND EXCLUSIONS

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

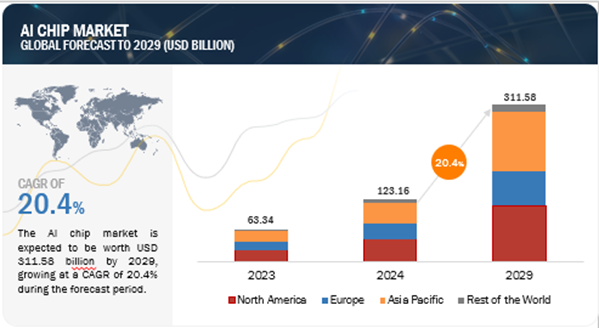

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.2.1 DRIVERS

2.2.1.1 Pressing need for large-scale data handling and real-time analytics

2.2.1.2 Rising adoption of autonomous vehicles

2.2.1.3 Surging use of GPUs and ASICs in AI servers

2.2.1.4 Continuous advancements in machine learning and deep learning technologies

2.2.1.5 Increasing penetration of AI servers

2.2.2 RESTRAINTS

2.2.2.1 Shortage of skilled workforce with technical know-how

2.2.2.2 Computational workloads and power consumption in AI Chip

2.2.2.3 Unreliability of AI algorithms

2.2.3 OPPORTUNITIES

2.2.3.1 Elevating demand for AI-based FPGA chips

2.2.3.2 Government initiatives to deploy AI-enabled defense systems

2.2.3.3 Rising trend of AI-driven diagnostics and treatments

2.2.3.4 Increasing investments in AI-enabled data centers by cloud service providers

2.2.3.5 Rise in adoption of AI-based ASIC technology

2.2.4 CHALLENGES

2.2.4.1 Data privacy concerns associated with AI platforms

2.2.4.2 Availability of limited structured data to develop efficient AI systems

2.2.4.3 Supply chain disruptions

2.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

2.4 PRICING ANALYSIS

2.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY COMPUTE

2.4.2 AVERAGE SELLING PRICE TREND, BY REGION

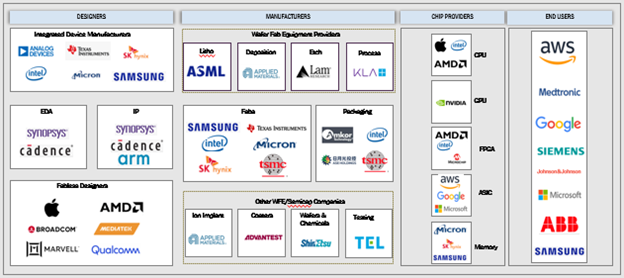

2.5 VALUE CHAIN ANALYSIS

2.6 ECOSYSTEM ANALYSIS

2.7 INVESTMENT AND FUNDING SCENARIO

2.8 CASE STUDY ANALYSIS

2.8.1 CDW INTEGRATED AMD EPYC SOLUTIONS TO ENSURE ENERGY EFFICIENCY AND OPTIMUM SPACE UTILIZATION

2.8.2 OVH SAS LEVERAGED AMD EPYC PROCESSOR TO OPTIMIZE PERFORMANCE OF CLOUD SOLUTIONS IN AI WORKLOADS

2.8.3 INTEL XEON SCALABLE PROCESSORS POWER TENCENT CLOUD’S XIAOWEI INTELLIGENT SPEECH AND VIDEO SERVICE ACCESS PLATFORM

2.8.4 AIC HELPS WESTERN DIGITAL TO ENHANCE SSD TESTING AND VALIDATION EFFICIENCY USING AMD PROCESSOR

3 COMPETITIVE LANDSCAPE

3.1 INTRODUCTION

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024

3.3 REVENUE ANALYSIS, 2021–2023

3.4 MARKET SHARE ANALYSIS, 2023

3.2 COMPANY VALUATION AND FINANCIAL METRICS

3.6 BRAND/PRODUCT COMPARISON

3.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.7.1 STARS

3.7.2 EMERGING LEADERS

3.7.3 PERVASIVE PLAYERS

3.7.4 PARTICIPANTS

3.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.7.5.1 Company footprint

3.7.5.2 Compute footprint

3.7.5.3 Memory footprint

3.7.5.4 Network footprint

3.7.5.5 Technology footprint

3.7.5.6 Function footprint

3.7.5.7 End user footprint

3.7.5.8 Region footprint

3.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

3.8.1 PROGRESSIVE COMPANIES

3.8.2 RESPONSIVE COMPANIES

3.8.3 DYNAMIC COMPANIES

3.8.4 STARTING BLOCKS

3.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 COMPETITIVE SCENARIO

3.9.1 PRODUCT LAUNCHES

3.9.2 DEALS

4 COMPANY PROFILES

4.1 KEY PLAYERS

4.1.1 NVIDIA CORPORATION

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.3.1 Product launches

4.1.1.3.2 Deals

4.1.1.4 MnM view

4.1.1.4.1 Key strengths

4.1.1.4.2 Strategic choices

4.1.1.4.3 Weaknesses and competitive threats

4.1.2 ADVANCED MICRO DEVICES, INC.

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.3 INTEL CORPORATION

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches

4.1.3.3.2 Deals

4.1.3.3.3 Other developments

4.1.3.4 MnM view

4.1.3.4.1 Key strengths

4.1.3.4.2 Strategic choices

4.1.3.4.3 Weaknesses and competitive threats

4.1.4 SK HYNIX INC.

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches

4.1.4.3.2 Deals

4.1.4.3.3 Other developments

4.1.4.4 MnM view

4.1.4.4.1 Key strengths

4.1.4.4.2 Strategic choices

4.1.4.4.3 Weaknesses and competitive threats

4.1.5 SAMSUNG

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.6 MICRON TECHNOLOGY, INC.

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.6.3.1 Product launches

4.1.6.3.2 Deals

4.1.7 APPLE INC.

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.7.3.1 Product launches

4.1.7.3.2 Deals

4.1.8 QUALCOMM TECHNOLOGIES, INC.

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offered

4.1.8.3 Recent developments

4.1.8.3.1 Product launches

4.1.8.3.2 Deals

4.1.9 HUAWEI TECHNOLOGIES CO., LTD.

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.9.3.1 Product launches

4.1.9.3.2 Deals

4.1.10 GOOGLE

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.10.3.1 Product launches

4.1.10.3.2 Deals

4.1.11 AMAZON WEB SERVICES, INC.

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.11.3 Recent development

4.1.11.3.1 Product launches

4.1.11.3.2 Deals

4.1.12 TESLA

4.1.12.1 Business overview

4.1.12.2 Products/Solutions/Services offered

4.1.13 MICROSOFT

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches

4.1.3.3.2 Deals

4.1.14 META

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches

4.1.4.3.2 Deals

4.1.15 T-HEAD

4.1.12.1 Business overview

4.1.12.2 Products/Solutions/Services offered

4.1.16 IMAGINATION TECHNOLOGIES

4.1.16.1 Business overview

4.1.16.2 Products/Solutions/Services offered

4.1.16.3 Recent developments

4.1.16.3.1 Product launches

4.1.16.3.2 Deals

4.1.17 GRAPHCORE

4.1.17.1 Business overview

4.1.17.2 Products/Solutions/Services offered

4.1.17.3 Recent developments

4.1.17.3.1 Product launches

4.1.17.3.2 Deals

4.1.18 CEREBRAS

4.1.18.1 Business overview

4.1.18.2 Products/Solutions/Services offered

4.1.18.3 Recent developments

4.1.18.3.1 Product launches

4.1.18.3.2 Deals

4.2 OTHER PLAYERS

4.2.1 MYTHIC

4.2.2 KALRAY

4.2.3 BLAIZE

4.2.4 GROQ, INC.

4.2.5 HAILO TECHNOLOGIES LTD

4.2.6 GREENWAVES TECHNOLOGIES

4.2.7 SIMA TECHNOLOGIES, INC.

4.2.8 KNERON, INC.

4.2.9 RAIN NEUROMORPHICS INC.

4.2.10 TENSTORRENT

4.2.11 SAMBANOVA SYSTEMS, INC.

4.2.12 TAALAS

4.2.13 SAPEON INC.

4.2.14 REBELLIONS INC.

4.2.12 RIVOS INC.

4.2.16 SHANGHAI BIREN TECHNOLOGY CO., LTD.

COMPANY PROFILES

KEY PLAYERS

NVIDIA CORPORATION

ADVANCED MICRO DEVICES, INC

INTEL CORPORATION

SK HYNIX INC

SAMSUNG

MICRON TECHNOLOGY, INC

APPLE INC

QUALCOMM TECHNOLOGIES, INC

HUAWEI TECHNOLOGIES CO, LTD

GOOGLE

AMAZON WEB SERVICES, INC

TESLA

META

T-HEAD

IMAGINATION TECHNOLOGIES

GRAPHCORE

CEREBRAS

OTHER PLAYERS

MYTHIC

KALRAY

BLAIZE

GROQ, INC

HAILO TECHNOLOGIES LTD

GREENWAVES TECHNOLOGIES

SIMA TECHNOLOGIES, INC

KNERON, INC

RAIN NEUROMORPHICS INC

TENSTORRENT

SAMBANOVA SYSTEMS, INC

TAALAS

SAPEON INC

REBELLIONS INC

RIVOS INC

SHANGHAI BIREN TECHNOLOGY CO, LTD

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More