Comparing 16 vendors in Software Defined Vehicle across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

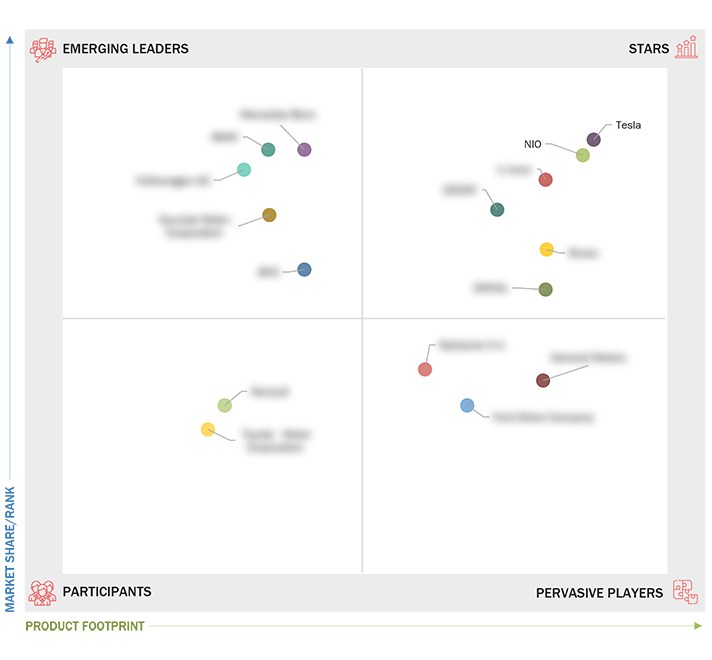

The Software Defined Vehicle Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Software Defined Vehicle. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and industry trends. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 16 Software Defined Vehicle Companies were categorized and recognized as the quadrant leaders.

Several factors are driving the growing demand for Software-Defined Vehicles (SDVs) in the global market. Over-the-air updates ensure that vehicle software remains current with the latest features and security enhancements. This capability allows Original Equipment Manufacturers (OEMs) to address issues remotely through regular software updates, significantly reducing recall costs. Additionally, innovative business models, such as real-time remote diagnostics, enhance maintenance by enabling quicker problem identification and resolution.

The adoption of 5G technology in vehicles and advancements in autonomous driving, particularly in emerging markets, are expected to boost the demand for SDV solutions worldwide. Furthermore, the rising popularity of electric vehicles (EVs) and the increasing demand for enhanced driving experiences and intelligent cockpits are anticipated to create lucrative growth opportunities for the SDV market in the coming years.

The 360 Quadrant maps the Software Defined Vehicle companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the Software Defined Vehicle quadrant. The top criteria for product footprint evaluation included SDV Type (Semi-SDV and SDV), E/E Architecture(Distributed Architecture, Domain Centralised Architecture and Zonal Control Architecture) and Application(Passenger Car and Light Commercial Vehicle).

Key Players:

Some of the prominent players are Tesla (US), Li Auto Inc. (China), NIO (China), Rivian (US), XPENG Inc. (China), and ZEEKR (China) among others. These players increasingly focus on product launches and enhancements, investments, partnerships, collaborations, joint ventures, funding, acquisition, expansions, agreements, sales contracts, and alliances to strengthen their presence in the global market. 1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Reduced recall and manufacturing costs

2.1.2 Personalized client engagement

2.1.3 Integration of ADAS digital cockpits

2.1.4 Increasing adoption of 5G technology

2.2 RESTRAINTS

2.2.1 Limited over-the-air updates

2.2.2 Increase in risk of cyberattacks in SDVs

2.3 OPPORTUNITIES

2.3.1 Remote diagnostics

2.3.2 Pay-per-use mobility

2.3.3 SDV platform monetization

2.3.4 Digital twin for emergency repair

2.4 CHALLENGES

2.4.1 Complex software updates and security patching

2.4.2 Risk of data breach

2.5 ECOSYSTEM ANALYSIS

2.5.1 OEMS

2.5.2 TIER 1 HARDWARE PROVIDERS

2.5.3 TIER 2 PLAYERS

2.5.4 CHIP PROVIDERS

2.5.5 SOFTWARE PROVIDERS

2.5.6 CLOUD PROVIDERS

3.1 INTRODUCTION

3.2 KEY PLAYER STRATEGIES

3.3 MARKET SHARE ANALYSIS, 2023

3.4 REVENUE ANALYSIS, 2019–2023

3.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.6 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.6.1 Company footprint

3.6.2 Vehicle type footprint

3.6.3 Region footprint

3.7 COMPETITIVE SCENARIOS AND TRENDS

3.7.1 PRODUCT LAUNCHES

3.7.2 DEALS

4.1 KEY PLAYERS

4.1.1 TESLA

4.1.1.1 Business overview

4.1.1.2 Products offered

4.1.1.3 Recent developments

4.1.1.4 MnM view

4.1.2 LI AUTO INC.

4.1.2.1 Business overview

4.1.2.2 Products offered

4.1.2.3 Recent developments

4.1.2.4 MnM view

4.1.3 ZEEKR

4.1.3.1 Business overview

4.1.3.2 Products offered

4.1.3.3 Recent developments

4.1.3.4 MnM view

4.1.4 XPENG INC.

4.1.4.1 Business overview

4.1.4.2 Products offered

4.1.4.3 Recent developments

4.1.4.4 MnM view

4.1.5 NIO

4.1.5.1 Business overview

4.1.5.2 Products offered

4.1.5.3 Recent developments

4.1.5.4 MnM view

4.1.6 RIVIAN

4.1.6.1 Business overview

4.1.6.2 Products offered

4.1.6.3 Recent developments

4.1.6.4 MnM view

4.2 KEY OEMS SHIFTING TO SDV

4.2.1 VOLKSWAGEN AG

4.2.1.1 Business overview

4.2.1.2 Products offered

4.2.1.3 Recent developments

4.2.2 HYUNDAI MOTOR CORPORATION

4.2.2.1 Business overview

4.2.2.2 Products offered

4.2.2.3 Recent developments

4.2.3 FORD MOTOR COMPANY

4.2.3.1 Business overview

4.2.3.2 Products offered

4.2.3.3 Recent developments

4.2.4 GENERAL MOTORS

4.2.4.1 Business overview

4.2.4.2 Products offered

4.2.4.3 Recent developments

4.2.5 RENAULT GROUP

4.2.5.1 Business overview

4.2.5.2 Products offered

4.2.5.3 Recent developments

4.2.6 TOYOTA MOTOR CORPORATION

4.2.6.1 Business overview

4.2.6.2 Products offered

4.2.6.3 Recent developments

4.2.7 STELLANTIS

4.2.7.1 Business overview

4.2.7.2 Products offered

4.2.7.3 Recent developments

4.2.8 MERCEDES-BENZ AG

4.2.8.1 Business overview

4.2.8.2 Products offered

4.2.8.3 Recent developments

4.2.9 BYD

4.2.9.1 Business overview

4.2.9.2 Products offered

4.2.9.3 Recent developments

4.2.10 BMW

4.2.10.1 Business overview

4.2.10.2 Products offered

4.2.10.3 Recent developments

Latest

BMW M340i LCI1 Review | B58 engine with a car around it

Apr 2025

Apr 2025 Team-BHP

Team-BHPBMW patent unveils its best-kept secret: Only engines 100% with this fuel

Apr 2025

Apr 2025 ecoticias.com

ecoticias.comBYD Auto Selects Dürr Technology for Vehicle Painting

Jan 2025

Jan 2025 Products Finishing

Products FinishingBOMAG BW 177 BVO-5 PL Single Drum Roller

Jan 2025

Jan 2025 uploadedByExcel

uploadedByExcelRantizo Adds New XAG P150 To Spray Drone Lineup

Jan 2025

Jan 2025 uploadedByExcel

uploadedByExcelFord Sounds Alarm: How Donald Trump’s Tariffs Could Shift NASCAR’s Future

Apr 2025

Apr 2025 Slicks & Sticks

Slicks & SticksNYC ‘taxi cops’ to get new Ford Mustang Mach-E electric cars

Apr 2025

Apr 2025 New York Daily News

New York Daily NewsCompany List