Comparing 13 vendors in Natural Disaster Management Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

The natural disaster management market has become crucial for technological advancement and strategic innovation. Rapid environmental changes have intensified the frequency and severity of natural disasters, including floods, earthquakes, and storms, pushing for immediate enhancements in preparedness and response mechanisms. This landscape has spawned a significant expansion in developing and deploying disaster management solutions integrating cutting-edge technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and satellite imaging. Companies within this space are racing to offer tools that enhance the accuracy and speed of disaster response, which is vital for minimizing human and economic losses. The market dynamics are shaped by a growing commitment from governments worldwide to bolster national emergency response capabilities through enhanced public-private partnerships and regulatory frameworks.

Additionally, the market has been invigorated by the proliferation of remote sensing and AI-powered predictive analytics, which are crucial for preemptive disaster management strategies. However, the market faces challenges such as cybersecurity vulnerabilities, data privacy concerns, and interoperability issues which need to be addressed to optimize disaster management systems. The demand for these solutions is further underscored by a global emphasis on sustainable urban planning and infrastructure resilience to mitigate the impacts of catastrophic events. As the market evolves, the focus remains on creating adaptable, efficient, and comprehensive systems that can withstand the increasing complexities of natural calamities.

Startups in the Market

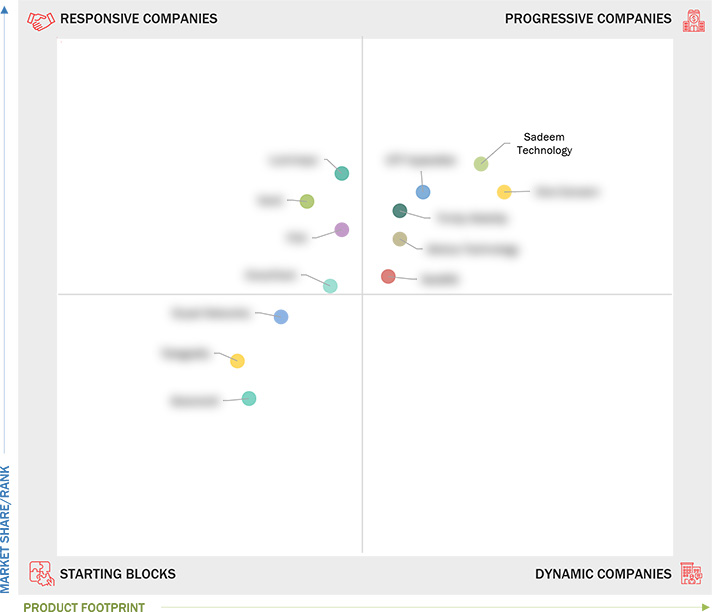

Sadeem Technology: This private company leads the way in flood and disaster mitigation solutions in Saudi Arabia. It utilizes patented technologies to deploy solar-powered sensor networks and machine learning software for real-time monitoring and alerts, significantly contributing to creating smart and sustainable urban environments.

Lumineye: This company is recognized for its innovative approach to disaster management. Its advanced X-ray and imaging technologies enable better situational awareness during natural disasters, enhancing the safety and efficiency of rescue operations.

Venti LLC: Known for its emphasis on comprehensive data analytics and AI-driven insights, Venti LLC provides robust solutions that optimize disaster readiness and response through enhanced predictive modeling and real-time scenario analysis.

One Concern: This startup focuses on delivering precise geographic intelligence and critical infrastructure resilience analysis, thereby aiding government and private entities in strengthening their disaster response and recovery plans.

Trinity Mobility: By integrating IoT and smart city technologies, Trinity Mobility enhances urban resilience against disasters, empowering municipalities with real-time infrastructure monitoring and management tools.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Escalating frequency and intensity of climate-related disasters

2.2.1.2 Technological advancements in IoT and AI

2.2.1.3 Increased government initiatives and regulatory frameworks

2.2.2 Restraints

2.2.2.1 Funding limitations in emerging economies

2.2.2.2 Interoperability and data integration issues

2.2.2.3 Lack of skilled personnel and training

2.2.3 Opportunities

2.2.3.1 Expansion of remote sensing and satellite technologies

2.2.3.2 Development of AI-powered predictive analytics

2.2.3.3 Growth of public-private partnerships

2.2.4 Challenges

2.2.4.1 Cybersecurity vulnerabilities

2.2.4.2 Data privacy and ethical concerns

2.2.4.3 Rapid urbanization and natural land encroachment

2.3 Evolution of Natural Disaster Management

2.4 Ecosystem Analysis

2.6 Supply Chain Analysis

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Geographic information systems (GIS)

2.9.1.2 Internet of Things (IoT)

2.9.1.3 Artificial intelligence & machine learning (AI/ML)

2.9.1.4 Emergency response systems

2.9.1.5 Remote sensing

2.9.1.6 Early warning systems

2.9.2 Complementary Technologies

2.9.2.1 Edge computing

2.9.2.2 Big data and analytics

2.9.2.3 5G

2.9.2.4 Cloud computing

2.9.3 Adjacent Technologies

2.9.3.1 Robotics

2.9.3.2 Wearable technology

2.9.3.3 Blockchain

2.10 Patent Analysis

2.10.1 Methodology

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of New Entrants

2.11.2 Threat of Substitutes

2.11.3 Bargaining Power of Buyers

2.11.4 Bargaining Power of Suppliers

2.11.5 Intensity of Competitive Rivalry

2.13 Trends/Disruptions Impacting Customer Business

2.14 Key Conferences and Events, 2025–2026

2.15 Technology Roadmap for Natural Disaster Management Market

2.15.1 Natural Disaster Management Technology Roadmap Till 2030

2.15.1.1 Short-term roadmap (2024–2026)

2.15.1.2 Mid-term roadmap (2026–2028)

2.15.1.3 Long-term roadmap (2028–2030)

2.16 Best Practices for Natural Disaster Management

2.17 Current and Emerging Business Models

2.18 Tools, Frameworks, and Techniques Used in Natural Disaster Management

2.19 Trade Analysis

2.19.1 Export Scenario of Beacons and Other Floating Structures

2.19.2 Import Scenario of Beacons and Other Floating Structures

2.20 Investment and Funding Scenario

2.21 Impact of AI/Generative AI on Natural Disaster Management Market

2.21.1 Use Cases of Generative AI in Natural Disaster Management

3 COMPETITIVE LANDSCAPE

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Market Ranking Analysis

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches/Developments

3.8.2 Deals

3.9 Product Comparison

3.10 Company Valuation and Financial Metrics

4 COMPANY PROFILES

4.1 SADEEM TECHNOLOGY

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 LUMINEYE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 VENTI LLC

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 ONE CONCERN

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TRINITY MOBILITY

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 F24

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ALERTUS TECHNOLOGY

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ORORATECH

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 DRYAD NETWORKS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 GEOSIG

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 TELEGRAFIA

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 SEISMICAI

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 OTT HYDROMET

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

Latest

Raptor Technologies and Alertus Technologies Partner to Provide Comprehensive Solution for Keeping K-12 Schools Safe

Aug 2022

Aug 2022 Raptor Technologies

Raptor Technologies

Alertus Technologies Expands Baltimore, Maryland, Operations

Jan 2022

Jan 2022 areadevelopment

areadevelopmentDryad Networks Leads the Charge in Global Wildfire Mitigation With Record Growth in 2024

Jan 2025

Jan 2025 businesswire

businesswireDryad Networks raises €8.9m for drone system to combat wildfires

Oct 2024

Oct 2024 RCR Wireless News

RCR Wireless NewsDryad Networks receives €6.3m for wildfire detection

Oct 2024

Oct 2024 iotinsider

iotinsiderDesjardins Insurance Survey Shows Distracted Driving Number One Concern For Drivers

Mar 2025

Mar 2025 muskoka411.com

muskoka411.comBismarck’s Homeless – Safety Number One Concern For Everyone

Sep 2024

Sep 2024 Hot 975

Hot 975Company List