Comparing 18 vendors in Legal AI Software Startups across 103 criteria.

✔️ What You Get with This Report

- 📊

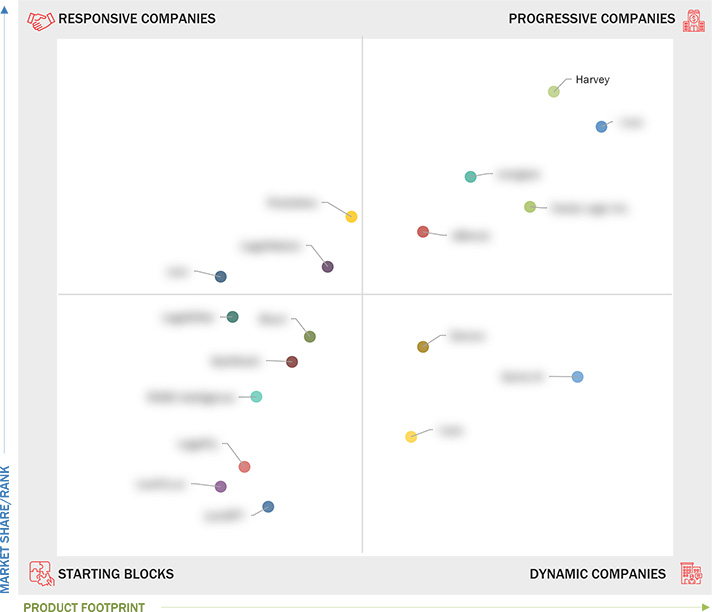

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

The landscape of legal AI software is undergoing a transformative phase, driven predominantly by the integration of artificial intelligence to enhance legal processes. This dynamic sector is characterized by deploying advanced technologies such as machine learning, natural language processing (NLP), and predictive analytics. These technologies collectively augment legal functions ranging from eDiscovery and contract management to litigation analysis and compliance. The demand for such advanced solutions escalates as law firms and corporate legal departments seek to increase efficiency, reduce operational costs, and make informed decisions with predictive insights.

Recent advancements have highlighted the importance of strategic partnerships and innovations. Key players in the market, such as Microsoft, IBM, and LexisNexis, have harnessed AI to offer comprehensive solutions that cater to diverse legal needs. Their focus on innovation has involved integrating AI models into existing platforms to streamline workflows and improve document management and analysis capabilities. For instance, Microsoft's integration of OpenAI’s models into Azure services exemplifies the enhancement of legal workflows through advanced AI tools.

Furthermore, the legal AI market is seeing a surge in strategic collaborations. These partnerships leverage complementary strengths to deliver enhanced services and expand market reach. Mergers and acquisitions are also pivotal, as they enable companies to quickly embed innovative capabilities into their offerings, thus staying competitive in a rapidly evolving market landscape.

In this vibrant market, startups and SMEs play a crucial role, contributing innovative solutions that democratize access to AI technologies for smaller law firms and legal departments. These entities provide specialized tools catering to specific market demands, ensuring a broad distribution of AI benefits across legal sectors.

Startups in the Market

Neota: Established in New York, Neota offers a no-code platform that simplifies and automates legal processes through a user-friendly drag-and-drop interface. Providing pre-configured templates allows rapid development of scalable applications, significantly reducing costs while enhancing service delivery.

Juro: A London-based startup, Juro specializes in contract management with an AI-powered platform that integrates with tools like Slack and CRMs, making contract lifecycle management faster and more collaborative. By facilitating over 5,000 integrations, Juro enables teams to manage contracts efficiently, mitigating risks and administrative burdens.

Pocketlaw: From Stockholm, Pocketlaw offers an intuitive contract lifecycle management solution that enhances contract workflows by minimizing errors and boosting efficiency. The platform seamlessly supports users in creating, reviewing, and storing contracts within a unified system.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2 MARKET OVERVIEW AND INDUSTRY TRENDS

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Significant increase in eDiscovery requirements

2.2.1.2 Surge in NLP adoption in legal operations

2.2.1.3 Government support for judicial efficiency

2.2.1.4 Proliferation of AI-driven knowledge management systems

2.2.2 Restraints

2.2.2.1 Ethical concerns over AI decision-making

2.2.2.2 Lack of skilled AI talent in legal sector

2.2.3 Opportunities

2.2.3.1 Emergence of virtual hearings and online dispute resolution

2.2.3.2 Use of real-time sentiment analysis in courtrooms

2.2.3.3 Expansion of AI-driven arbitration platforms

2.2.4 Challenges

2.2.4.1 Adapting AI to non-standardized legal processes

2.2.4.2 Standardizing AI for litigation-specific applications

2.3 Evolution

2.4 Ecosystem Analysis

2.4.1 Gen AI Legal Tools

2.4.2 Traditional (Other AI) Legal Tools

2.4.3 Deployment Mode

2.4.4 Legal Application

2.4.5 Technology

2.5 Supply Chain Analysis

2.6 Investment and Funding Scenario

2.7 Impact of Generative AI on Legal AI Software Market

2.7.1 Top Use Cases and Market Potential

2.7.1.1 Key Use Cases

2.7.1.1.1 Enhanced legal research efficiency

2.7.1.1.2 Automated document drafting

2.7.1.1.3 Smart contract management

2.7.1.1.4 Predictive case analytics

2.7.1.1.5 Client interaction automation

2.7.1.1.6 Risk management and compliance monitoring

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Natural language processing (NLP)

2.8.1.2 Machine learning (ML)

2.8.1.3 Generative AI models

2.8.1.4 Optical character recognition (OCR)

2.8.1.5 Knowledge graphs

2.8.2 Complementary Technologies

2.8.2.1 Blockchain

2.8.2.2 Robotic process automation (RPA)

2.8.2.3 Document management systems (DMS)

2.8.2.4 Cloud computing

2.8.2.5 Smart contracts

2.8.3 Adjacent Technologies

2.8.3.1 Application programming interfaces (APIs)

2.8.3.2 eDiscovery tools

2.8.3.3 Virtual assistants

2.8.3.4 Identity and access management (IAM)

2.9 Patent Analysis

2.9.1 Methodology

2.9.2 Patents Filed, By Document Type

2.9.3 Innovations and Patent Applications

2.10 Key Conferences and Events, 2025–2026

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of New Entrants

2.11.2 Threat of Substitutes

2.11.3 Bargaining Power of Suppliers

2.11.4 Bargaining Power of Buyers

2.11.5 Intensity of Competition Rivalry

2.12 Trends/Disruptions Impacting Customer Business

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Players Strategies/Right to Win, 2022–2024

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.4.1 Market Share of Key Players Offering Legal AI Software

3.4.1.1 Market ranking analysis

3.5 Product Comparison

3.5.1 Azure OpenAI Services (Microsoft)

3.5.2 IBM Watson Discovery (IBM)

3.5.3 Lexis+ AI (LexisNexis)

3.5.4 Westlaw (Thomson Reuters)

3.5.5 Amazon OpenSearch Service (AWS)

3.6 Company Valuation and Financial Metrics

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Enhancements

3.8.2 Deals

4 COMPANY PROFILES

4.1 NEOTA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 JURO

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 POCKETLAW

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SPELLBOOK

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 BLUEJ

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 LEGALSIFTER

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 LAWGEEX

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ROSS INTELLIGENCE

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 VLEX

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 GENIE AI

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 HARVEY

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 DARROW

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 LEYA

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 EBREVIA

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 LAWGPT

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 LEGALMATION

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 LAWPRO.AI

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 LEGALFLY

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

Latest

What is Genie AI? - Blockchain.News

Mar 2024

Mar 2024 Blockchain.News

Blockchain.NewsHarvey Schiller backing new sports marketing agency, Whittingham Sports

Apr 2025

Apr 2025 Sports Business Journal

Sports Business JournalCSR - Customer Service Representative - Harvey's Oil Ltd | St. John's, NL

Apr 2025

Apr 2025 SimplyHired

SimplyHiredNick Cave, PJ Harvey, Jarvis Cocker Star in LA Rising Compilation: Exclusive Tracks Revealed!

Apr 2025

Apr 2025 The Bangin Beats

The Bangin BeatsCompany List