Comparing 25 vendors in Digital Twin across 0 criteria.

✔️ What You Get with This Report

- 📊

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

The digital twin market is experiencing significant growth, driven by rising demand within the healthcare industry and an increasing emphasis on predictive maintenance. Digital twin technologies have become more accessible and affordable, making them viable options for small and medium-sized enterprises (SMEs) with limited budgets. These cost-effective solutions allow SMEs to benefit from digital twins without the need for large upfront investments, offering advantages such as enhanced productivity, improved decision-making, and operational optimization. SMEs, often characterized by more streamlined operations, can more easily adopt digital twin technologies and quickly adapt to technological advancements. Furthermore, as competition intensifies, SMEs are seeking innovative ways to stay competitive, and digital twins provide a powerful tool to optimize operations, identify inefficiencies, and make data-driven decisions.

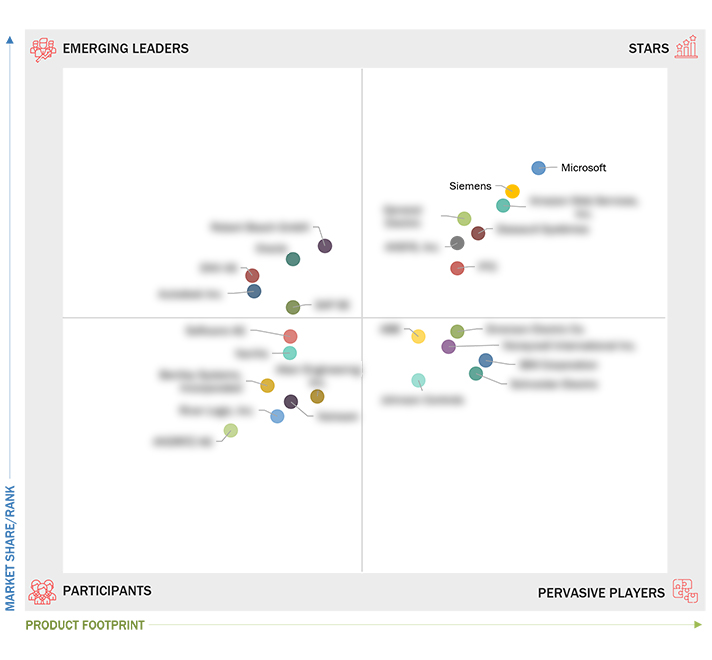

The 360 Quadrant maps the digital twin companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the digital twin quadrant. The top criteria for product footprint evaluation included Type (Large Enterprises and Small & Medium Enterprises), Application(Product Design & Development, Predictive Maintenance, Business Optimization, Performance Monitoring, Inventory Management and Other Applications) and Industry(Automotive & Transportation, Energy & Utilities, Infrastructure, Healthcare, Aerospace, Oil & Gas, Telecommunications, Agriculture, Retail and Other Industries).

Key Market Players

The digital twin players have implemented various types of organic and inorganic growth strategies, such as product launches, product developments, partnerships, and collaborations, to strengthen their offerings in the market. The major players are General Electric (US), Microsoft (US), Siemens (Germany), Amazon Web Services (US), ANSYS (US), Dassault Systèmes (France), PTC (US), and Robert Bosch (Germany). The study includes an in-depth competitive analysis of these key players in the digital twin market with their company profiles, recent developments, and key market strategies. 1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.2.1 DRIVERS

2.2.1.1 Growing use of digital twin technology to reduce costs and improve supply chain operations

2.2.1.2 Surging demand for digital twin technology from healthcare industry

2.2.1.3 Increasing adoption of predictive maintenance model across industries

2.2.2 RESTRAINTS

2.2.2.1 High capital requirement to implement digital twin technology

2.2.2.2 Susceptibility of digital twin technology to cyberattacks

2.2.3 OPPORTUNITIES

2.2.3.1 Surging demand for advanced real-time data analytics

2.2.3.2 Increasing adoption of Industry 4.0 principles

2.2.3.3 Development of human-centered digital twins

2.2.4 CHALLENGES

2.2.4.1 Complexities associated with data collection and mathematical models

2.2.4.2 Shortage of skilled workforce

2.3 VALUE CHAIN ANALYSIS

2.4 ECOSYSTEM MAPPING

2.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

2.6 PORTER’S FIVE FORCES ANALYSIS

2.6.1 THREAT OF NEW ENTRANTS

2.6.2 THREAT OF SUBSTITUTES

2.6.3 BARGAINING POWER OF BUYERS

2.6.4 BARGAINING POWER OF SUPPLIERS

2.6.5 INTENSITY OF COMPETITIVE RIVALRY

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES ADOPTED BY MAJOR PLAYERS

3.3 FIVE-YEAR REVENUE ANALYSIS OF TOP COMPANIES, 2018–2022

3.4 MARKET SHARE ANALYSIS, 2022

3.5 DIGITAL TWIN MARKET: COMPANY EVALUATION MATRIX, 2022

3.2.1 STARS

3.2.2 EMERGING LEADERS

3.2.3 PERVASIVE PLAYERS

3.2.4 PARTICIPANTS

3.6 DIGITAL TWIN MARKET: COMPANY FOOTPRINT

3.7 COMPETITIVE SCENARIOS AND TRENDS

3.7.1 PRODUCT LAUNCHES

3.7.2 DEALS

3.7.3 OTHERS

4.1 KEY PLAYERS

4.1.1 GENERAL ELECTRIC

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.3.1 Product launches

4.1.1.3.2 Deals

4.1.1.4 MnM view

4.1.1.4.1 Key strengths/Right to win

4.1.1.4.2 Strategic choices

4.1.1.4.3 Weaknesses and competitive threats

4.1.2 MICROSOFT

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths/Right to win

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.3 SIEMENS

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches

4.1.3.3.2 Deals

4.1.3.4 MnM view

4.1.3.4.1 Key strengths/Right to win

4.1.3.4.2 Strategic choices

4.1.3.4.3 Weaknesses and competitive threats

4.1.4 AMAZON WEB SERVICES, INC. (AWS)

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches

4.1.4.3.2 Deals

4.1.4.4 MnM view

4.1.4.4.1 Key strengths/Right to win

4.1.4.4.2 Strategic choices

4.1.4.4.3 Weaknesses and competitive threats

4.1.5 DASSAULT SYSTÈMES

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths/Right to win

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.6 ANSYS, INC.

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.6.3.1 Product launches

4.1.6.3.2 Deals

4.1.6.4 MnM view

4.1.6.4.1 Key strengths/Right to win

4.1.6.4.2 Strategic choices

4.1.6.4.3 Weaknesses and competitive threats

4.1.7 IBM CORPORATION

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.7.3.1 Product launches

4.1.7.3.2 Deals

4.1.8 PTC

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offer

4.1.8.3 Recent developments

4.1.8.3.1 Product launches

4.1.8.3.2 Deals

4.1.9 SAP SE

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.9.3.1 Deals

4.1.10 ORACLE

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.10.3.1 Product launches

4.1.10.3.2 Deals

4.1.10.3.3 Others

4.1.11 ROBERT BOSCH GMBH

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.11.3 Recent developments

4.1.11.3.1 Product launches

4.1.11.3.2 Deals

4.2 OTHER KEY PLAYERS

4.2.1 EMERSON ELECTRIC CO.

4.2.2 ABB

4.2.3 HONEYWELL INTERNATIONAL INC.

4.2.4 SCHNEIDER ELECTRIC

4.2.2 NAVVIS

4.2.6 DNV AS

4.2.7 AUTODESK INC.

4.2.8 ANDRITZ AG

4.2.9 SOFTWARE AG

4.2.10 BENTLEY SYSTEMS, INCORPORATED

4.2.11 RIVER LOGIC, INC.

4.2.12 ALTAIR ENGINEERING INC.

4.2.13 JOHNSON CONTROLS

4.2.1 nSTREAM

Latest

ANDRITZ To Supply Three Spunlace Lines To Alear Silk Road New Materials, China

Apr 2025

Apr 2025 textileworld

textileworldZacks Industry Outlook W.W. Grainger, Ashtead, Andritz and ClearSign

Apr 2025

Apr 2025 TradingView

TradingViewANDRITZ to engineer another 100 MW green hydrogen plant for Germany

Apr 2025

Apr 2025 hydrogen-central

hydrogen-centralInterview: how UCL-C won the IMechE Design Challenge and Ansys Simulation Challenge in 2024

Apr 2025

Apr 2025 Institution of Mechanical Engineers

Institution of Mechanical EngineersQuinn Opportunity Partners LLC Lowers Stake in ANSYS, Inc. (NASDAQ:ANSS)

Apr 2025

Apr 2025 MarketBeat

MarketBeatCompany List