Comparing 31 vendors in AI API Startups across 0 criteria.

✔️ What You Get with This Report

- 📊

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

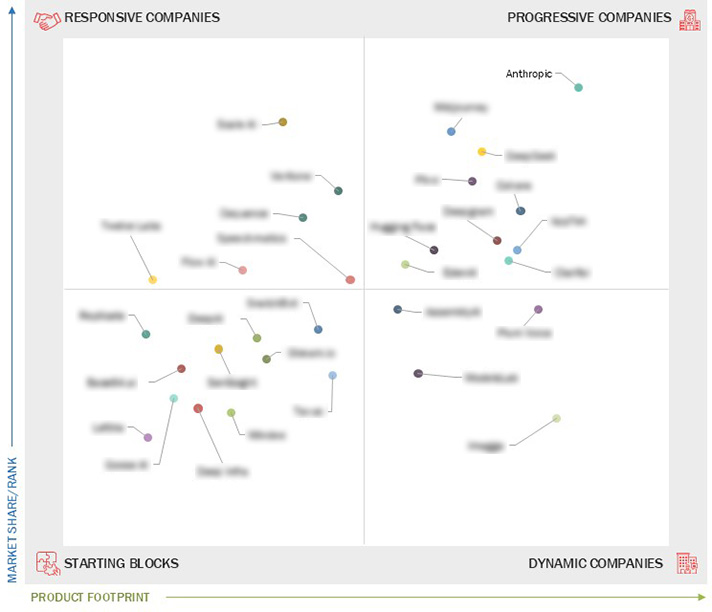

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

Summary

In recent years, the AI Application Programming Interface (API) market has experienced significant growth due to accelerated digital transformation across various industries. With the development of cloud-based solutions and the advent of big data, businesses are continually seeking ways to optimize operations, enhance customer experiences, and foster innovation through artificial intelligence. This shift is driven by key technological advancements such as machine learning, natural language processing (NLP), and computer vision, which are integrated into diverse applications ranging from customer service to autonomous vehicles. These solutions provide scalable and efficient options for enterprises lacking in-house AI capabilities, allowing them to deploy cutting-edge technologies without extensive infrastructure investments.

The market is characterized by intense competition among tech giants like Microsoft, Google, and OpenAI, which dominate the space with comprehensive AI offerings and a strategic focus on enterprise-grade solutions. These major players are supported by strategic partnerships and continuous investments in research and development, reinforcing their leadership positions. Startups and smaller players also contribute to this dynamic landscape by introducing specialized AI API solutions and leveraging innovative technologies to differentiate themselves.

However, the rapidly evolving AI market also presents challenges, including issues related to security, data privacy, and the ethical use of AI technologies. Companies must navigate these complexities while addressing customer demands for high-performance AI models and seamless integration capabilities. The AI API space is poised for continued development and innovation as the market continues to grow, driven by increasing demand for automated and data-driven decision-making processes.

Startups in the Market

Anthropic: Founded in 2021, this San Francisco-based startup focuses on AI safety and ethics. Its offerings include the Claude chatbot and large language models. Anthropic aims to ensure AI benefits society and has received substantial investment to support its mission.

Cohere: Based in Toronto, Cohere provides enterprise-grade large language models with a strong focus on data security. The company offers cloud-agnostic solutions that help businesses enhance language capabilities.

DeepAI: Known for its innovative approach to AI development, DeepAI is among the industry's responsive companies, focused on progressing its technology disruptively.

AssemblyAI: This startup provides speech-to-text APIs that enable businesses to integrate speech recognition into their applications seamlessly. It emphasizes high accuracy and is utilized across various sectors.

Eden AI: A dynamic company in the AI API market, Eden AI focuses on specific technologies and has shown significant progress in business strategy, although product excellence slightly lags.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Inclusions & Exclusions

1.3.2 Market Segmentation

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2 MARKET OVERVIEW AND INDUSTRY TRENDS

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Accelerated Digital Transformation Across Key Industries

2.2.1.2 High Business Efficiency, Cost Savings, and Scalability

2.2.1.3 Enhanced Security, Innovation, and Operational Efficiency

2.2.2 Restraints

2.2.2.1 Exposure to Cyber Threats Due to Unsecured Shadow and Zombie APIs

2.2.3 Opportunities

2.2.3.1 Accelerated Innovation with Edge Computing for Real-Time Intelligence

2.2.3.2 GraphQL and Asynchronous Processing for Efficiency

2.2.4 Challenges

2.2.4.1 AI API Latency – Critical Bottleneck in Efficiency and User Experience

2.2.5 Ecosystem Analysis

2.2.5.1 Computer Vision APIs

2.2.5.2 Speech/Voice APIs

2.2.5.3 Translation APIs

2.2.5.4 Text APIs

2.2.5.5 Document Parsing APIs

2.2.5.6 Generative AI APIs

2.2.5.7 Autonomous Agents, AI Recommendations, Knowledge Graph

2.2.5.8 End Users

2.2.6 Technology Analysis

2.2.6.1 Key Technologies

2.2.6.1.1 NLP and Deep Learning

2.2.6.1.2 Computer Vision

2.2.6.1.3 Generative AI

2.2.6.1.3.1 Rule-Based Models

2.2.6.1.3.2 Statistical Models

2.2.6.1.3.3 Deep Learning Models

2.2.6.1.3.4 Generative Adversarial Networks

2.2.6.1.3.5 Autoencoders

2.2.6.1.3.6 Convolutional Neural Networks

2.2.6.1.3.7 Transformer-Based Large Language Models

2.2.6.1.4 Speech Recognition and Synthesis

2.2.6.1.5 AI Model Training and Optimization

2.2.6.2 Adjacent Technologies

2.2.6.2.1 Blockchain

2.2.6.2.2 Robotics

2.2.6.2.3 Quantum Computing

2.2.6.2.4 Internet of Things

2.2.6.2.5 5G and Advanced Connectivity

2.2.6.3 Complementary Technologies

2.2.6.3.1 Cybersecurity

2.2.6.3.2 Augmented Reality and Virtual Reality

2.2.6.3.3 Cloud Computing

2.2.6.3.4 Edge Computing

2.2.7 Regulatory Landscape

2.2.7.1 Regulatory Bodies, Government Agencies, and Other Organizations

2.2.7.2 Regulatory Framework

2.2.7.2.1 North America

2.2.7.2.1.1 US

2.2.7.2.1.2 Canada

2.2.7.2.2 Europe

2.2.7.2.2.1 UK

2.2.7.2.2.2 Germany

2.2.7.2.2.3 France

2.2.7.2.3 Asia Pacific

2.2.7.2.3.1 Australia

2.2.7.2.3.2 India

2.2.7.2.3.3 China

2.2.7.2.3.4 Japan

2.2.7.2.3.5 South Korea

2.2.7.2.4 Middle East & Africa

2.2.7.2.4.1 Saudi Arabia

2.2.7.2.4.2 UAE

2.2.7.2.4.3 Bahrain

2.2.7.2.4.4 Kuwait

2.2.7.2.4.5 Africa

2.2.7.2.5 Latin America

2.2.7.2.5.1 Brazil

2.2.7.2.5.2 Mexico

2.2.7.2.5.3 Argentina

2.2.8 Supply Chain Analysis

2.3 Industry Trends

2.3.1 Evolution of AI API Market

2.3.2 Case Study Analysis

2.3.2.1 Perplexity Supercharges Search with Anthropic’s Claude 3 Family

2.3.2.2 Deepbrain AI Revolutionizes Contactless Customer Engagement with AI Banker

2.3.2.3 Edgetier Unlocks New Markets & Accelerates Growth with AssemblyAI’s Speech-To-Text

2.3.2.4 Sonic Transcript & Eden AI: Seamless AI Translation for Global Research

2.3.2.5 Plivo and Flight Vector: Delivering Reliable Communication in Life-Or-Death Situations

2.3.3 Porter’s Five Forces Analysis

2.3.3.1 Threat of New Entrants

2.3.3.2 Threat of Substitutes

2.3.3.3 Bargaining Power of Suppliers

2.3.3.4 Bargaining Power of Buyers

2.3.3.5 Intensity of Competitive Rivalry

2.3.4 Key Conferences and Events

2.3.5 Patent Analysis

2.3.5.1 Methodology

2.3.5.2 Patents Filed, By Document Type

2.3.5.3 Innovations and Patent Applications

2.3.6 Trends/Disruptions Impacting Customer Business

2.3.7 Investment Landscape and Funding Scenario

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2021–2025

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.4.1 Market Share Analysis of Key Players

3.4.2 Market Ranking Analysis

3.5 Comparative Analysis of Products Offered

3.5.1 Generative API Comparative Analysis

3.5.1.1 GPT-4, DALL-E, ChatGPT API (OpenAI)

3.5.1.2 Vertex AI, Bard API, Imagen (Google)

3.5.1.3 Claude API (Anthropic)

3.5.2 Product Comparative Analysis, By Text API

3.5.2.1 Amazon Comprehend (AWS)

3.5.2.2 Azure Text Analytics (Microsoft)

3.5.2.3 Cohere Classify and Embed API (Cohere)

3.5.3 Speech Recognition API Comparative Analysis

3.5.3.1 Rev.AI API

3.5.3.2 Speech-To-Text API (AssemblyAI)

3.5.3.3 Twilio Speech Recognition

3.6 Company Valuation and Financial Metrics of Key Vendors

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed List of Key Startups/SMEs

3.7.5.2 Competitive Benchmarking of Key Startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches & Enhancements

3.8.2 Deals

4 COMPANY PROFILES

4.1 ANTHROPIC

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 COHERE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 DEEPAI

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 WIT.AI

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 DEEPSEEK

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ASSEMBLYAI

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 LETTRIA

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 CEQUENCE SECURITY

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 EDEN AI

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 CLARIFAI

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 APPTEK

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 HUGGING FACE

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 BASE64

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 TWELVE LABS

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 PLIVO

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 TAVUS

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 IMAGGA

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 DEEP INFRA

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

4.19 DEEPGRAM

4.19.1 Business overview

4.19.2 Products/Solutions/Services offered

4.19.3 Recent developments

4.20 GOOSE AI

4.20.1 Business overview

4.20.2 Products/Solutions/Services offered

4.20.3 Recent developments

4.21 SNATCHBOT

4.21.1 Business overview

4.21.2 Products/Solutions/Services offered

4.21.3 Recent developments

4.22 PLUM VOICE

4.22.1 Business overview

4.22.2 Products/Solutions/Services offered

4.22.3 Recent developments

4.23 MINDEE

4.23.1 Business overview

4.23.2 Products/Solutions/Services offered

4.23.3 Recent developments

4.24 REPLICATE

4.24.1 Business overview

4.24.2 Products/Solutions/Services offered

4.24.3 Recent developments

4.25 MODELSLAB

4.25.1 Business overview

4.25.2 Products/Solutions/Services offered

4.25.3 Recent developments

Latest

EdgeTier Leverages AssemblyAI's Speech-to-Text for Market Expansion and Growth

Feb 2025

Feb 2025 Blockchain News

Blockchain NewsAssemblyAI Partners with Langflow to Enhance Generative AI Capabilities

Oct 2024

Oct 2024 Blockchain News

Blockchain NewsAssemblyAI Launches Postman Collection for Enhanced API Testing

Sep 2024

Sep 2024 Blockchain News

Blockchain NewsCompany List