Comparing 36 vendors in Sports Technology across 0 criteria.

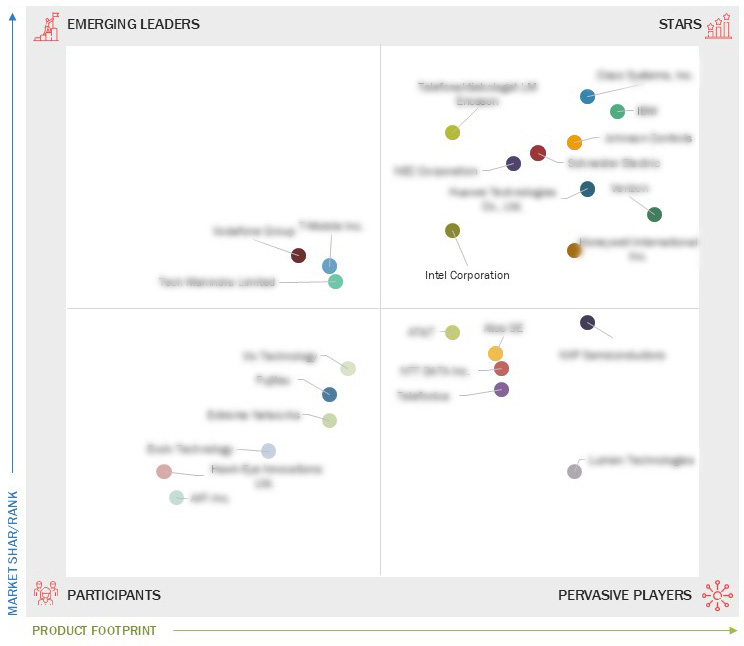

The Sports Technology Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Sports Technology. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 60 companies of which the Top 23 Sports Technology Companies were categorized and recognized as the quadrant leaders.

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Focus on Fan Engagement at Stadiums

2.2.1.2 Pressing Need for Data-Driven Decisions

2.2.1.3 Growing Pressure to Improve Player/ Team Performance

2.2.1.4 Surging Adoption of Esports Technology

2.2.1.5 Rising Implementation of IoT Technologies for Efficient

Management of Stadium Infrastructure

2.2.2 Restraints

2.2.2.1 High Initial Investments and Budget Constraints

2.2.3 Opportunities

2.2.3.1 Advent of AI and Ml Technologies

2.2.3.2 Emergence of Sports Leagues and Events with Large Prize

Pools

2.2.3.3 Increasing Adoption of AR and VR in Sports

2.2.3.4 Increasing Reliance on Real-Time Analysis

2.2.4 Challenges

2.2.4.1 Lack of Professionals with Analytical Skills

2.2.4.2 Complexities in Upgrading and Replacing Legacy Systems

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.5 Investment and Funding Scenario

2.6 Trends/Disruptions Impacting Customer Business

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Artificial Intelligence (AI)

2.7.1.2 Blockchain

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.7.3.1 Augmented Reality and Virtual Reality (AR and VR)

2.8 Porter’s Five Force Analysis

2.8.1 Threat of New Entrants

2.8.2 Threat of Substitutes

2.8.3 Bargaining Power of Suppliers

2.8.4 Bargaining Power of Buyers

2.8.5 Intensity of Competitive Rivalry

2.9 Trade Analysis

2.9.1 Import Data for Hs Code 910212

2.9.2 Export Data for Hs Code 910212

2.10 Patent Analysis, 2013–2024

2.11 Key Conferences and Events, 2025–2026

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Key Players in Sports Technology

Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Valuation & Financial Metrics, 2024

3.6 Brand/Product Comparison

3.6.1 Wearables

3.6.2 Smart Stadiums

3.7 Company Evaluation Market: Key Players, 2023

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2023

3.7.5.1 Company Footprint

3.7.5.2 Region Footprint

3.7.5.3 Type Footprint

3.7.5.4 Platform Footprint

3.7.5.5 Sport Footprint

3.8 Competitive Scenario

3.8.1 Product/Service/Solution Launches

3.8.2 Deals

4.1 APPLE INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SAMSUNG

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ALPHABET INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 CISCO SYSTEMS, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 IBM

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 TELEFONAKTIEBOLAGET LM ERICSSON

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 HUAWEI TECHNOLOGIES CO., LTD.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 JOHNSON CONTROLS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 EXLSERVICE HOLDINGS, INC.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 GARMIN LTD.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 SAP SE

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 CATAPULT

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 HUDL

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 AMAZON WEB SERVICES, INC.

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 SAS INSTITUTE INC.

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

4.16 ORACLE

4.16.1 Business overview

4.16.2 Products/Solutions/Services offered

4.16.3 Recent developments

4.17 SCHNEIDER ELECTRIC

4.17.1 Business overview

4.17.2 Products/Solutions/Services offered

4.17.3 Recent developments

4.18 INTEL CORPORATION

4.18.1 Business overview

4.18.2 Products/Solutions/Services offered

4.18.3 Recent developments

4.19 NEC CORPORATION

4.19.1 Business overview

4.19.2 Products/Solutions/Services offered

4.19.3 Recent developments

4.20 NIPPON TELEGRAPH AND TELEPHONE CORPORATION

4.20.1 Business overview

4.20.2 Products/Solutions/Services offered

4.20.3 Recent developments

Latest Industry News

Company List

Frequently Asked Questions (FAQs)

Sports technology refers to the application of technological innovations to improve athletic performance, enhance training, increase fan engagement, and optimize the business side of sports. This includes wearable devices, smart equipment, analytics software, VR training, and more.

Wearable devices like fitness trackers, smartwatches, and heart rate monitors provide real-time data on an athlete’s physical condition, such as heart rate, distance traveled, steps taken, sleep quality, and muscle strain. This information can help coaches and athletes optimize training, prevent injuries, and track performance progress.

Sports analytics is the use of data and statistical analysis to evaluate performance, strategies, and tactics in sports. Teams and coaches analyze data on player performance, team dynamics, and even game conditions to make informed decisions, develop strategies, and gain competitive advantages.

- Smart basketballs: These track shooting accuracy and spin.

- Connected soccer balls: Measure speed, trajectory, and power of kicks.

- Smart golf clubs: Track swings and provide feedback on technique.

- Smart tennis rackets: Record the speed and type of shots.

- Smart football helmets: Equipped with sensors that measure impact and help prevent concussions.

Virtual reality is used in sports for immersive training experiences, such as simulating game situations to help athletes practice decision-making, reaction times, and situational awareness. It can also be used for fan engagement, providing virtual stadium tours or interactive experiences.

AI is used to analyze large amounts of data to predict outcomes, optimize training plans, and improve tactics. It can also be used in video analysis to track player movements, identify patterns, and even referee decisions (like in VAR technology in soccer).

Biomechanics focuses on studying the mechanical aspects of body movements. In sports technology, biomechanics helps to analyze and optimize an athlete’s movements for better performance and injury prevention. Technologies like motion capture and force plates are often used in biomechanical assessments.

The future of sports technology may include advancements in AI-driven performance analysis, more interactive fan experiences using AR/VR, bio-tracking wearables, and the continued use of data-driven decision-making. Other possibilities include advancements in equipment materials and robotics for injury rehabilitation.

AT&T

AT&T

Oct 2025

Oct 2025