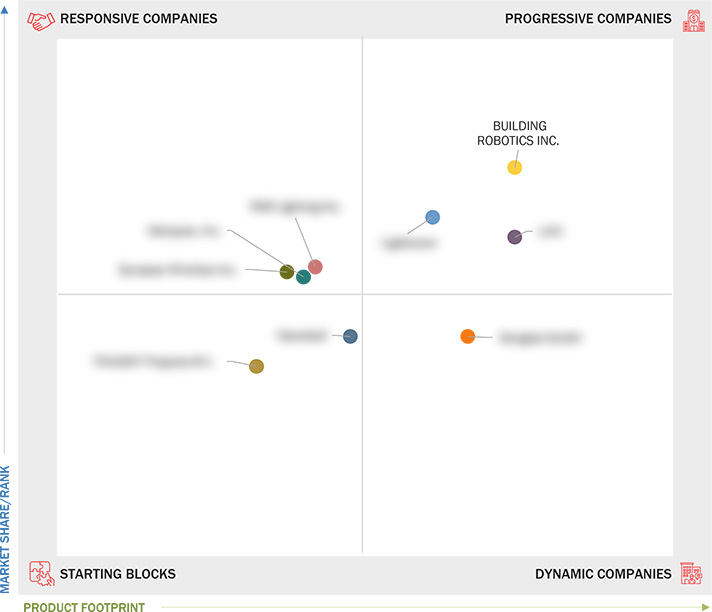

Comparing 9 vendors in Smart Lighting Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

Summary

The global smart lighting market is experiencing a transformative phase, driven by rapid advancements in digital technology, urbanization, and the global push towards sustainability. At its core, smart lighting involves the integration of automation, connectivity, and intelligent control features with traditional lighting systems. These systems typically utilize LED luminaires and advanced sensors, coupled with wireless or wired communication technologies, enabling remote operations, real-time adjustments, and improved energy efficiency. Whether controlled through mobile apps, voice assistants, or centralized platforms, smart lighting allows seamless customization of lighting conditions based on occupancy, daylight, or user preferences.

Smart city initiatives are accelerating worldwide, showcasing smart lighting's importance in optimizing energy usage and enhancing public safety. The rising demand in public sectors such as smart cities and offices for energy-efficient solutions ensures that smart lighting plays a pivotal role in urban development strategies. Globally, regions like Asia Pacific are spearheading the market's growth, fueled by government initiatives, rapid urbanization, and smart city projects. The shift towards sustainable economic growth through the adoption of interconnected and data-driven lighting solutions sets the stage for unprecedented market expansion. Companies are responding to these trends through strategic partnerships, product innovations, and embracing AI-driven solutions, further securing their market positions.

Startup Summaries

Building Robotics Inc. (US): Known for its strong portfolio, Building Robotics focuses on offering smart lighting solutions that align with customer needs. Under the umbrella of Siemens, it has gained traction by expanding its regional presence .

Lightwave (UK): As a progressive company, Lightwave excels in the smart lighting sector with innovative hardware solutions, emphasizing growth through strategic market expansions in Europe and beyond .

LIFX (US): Distinguished for its vibrant smart lighting products, LIFX has marked its presence in both indoor and outdoor lighting solutions, reaching multiple global markets with its broad product offerings .

Nanoleaf (Canada): Positioned as a starting block, Nanoleaf is expanding its reach with niche products that significantly lower energy consumption, growing steadily across North American and European markets .

Sengled GmbH (Germany): Recognized as a dynamic entity, Sengled capitalizes on its network of channel partners to enhance market adoption, particularly in Germany and select European markets .

TVILIGHT Projects B.V. (Netherlands): Despite being in the starting blocks category, TVILIGHT has focused on strategic acquisitions, aiming to boost sales and extend its service offerings across Europe .

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Unit Considered

1.4 Limitations

1.5 Stakeholders

1.6 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising Smart City Initiatives Globally

2.2.1.2 Advancements in Artificial Intelligence (AI) and Edge

Computing Technologies

2.2.1.3 Establishment of Standard and Digital Protocols By

Authorized Bodies

2.2.1.4 Growing Demand for Internet of Things (IoT)-Integrated Smart

Lighting Solutions

2.2.1.5 Rising Adoption of Led Lights and Luminaires in Outdoor

Applications

2.2.1.6 Increasing Incorporation of Data Analytics Into Smart

Lighting

2.2.2 Restraints

2.2.2.1 Cybersecurity Concerns Associated with Internet-Connected

Lighting Systems

2.2.2.2 Difficulties Associated with Retrofitting of Traditional

Lighting Infrastructure

2.2.3 Opportunities

2.2.3.1 Development of Solar-Powered and Hybrid Smart Lighting

Solutions

2.2.3.2 Emerging Smart Office and Smart Retail Trends

2.2.3.3 Rising Adoption of Human-Centric Lighting Solutions

2.2.3.4 Growing Adoption of Power Over Ethernet (POE)-Based Lighting

Solutions in Commercial and Healthcare Applications

2.2.3.5 Increasing Demand for Personalized Lighting Control

Solutions

2.2.4 Challenges

2.2.4.1 High Upfront Costs of Equipment and Accessories

2.2.4.2 Interoperability and Compatibility Issues

2.3 Trends/disruptions Impacting Customer Business

2.4 Pricing Analysis

2.4.1 Average Selling Price Trend of Key Players, By Offering, 2024

2.4.2 Average Selling Price Trend, By Region, 2020–2024

2.5 Value Chain Analysis

2.6 Ecosystem Analysis

2.7 Investment and Funding Scenario

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Internet of Things (IoT)

2.8.1.2 Communication Protocols

2.8.1.3 Smart Sensors

2.8.2 Complementary Technologies

2.8.2.1 Artificial Intelligence (AI) and Machine Learning (ML)

2.8.2.2 Light Fidelity (LI-FI)

2.8.2.3 Geofencing Technology

2.8.3 Adjacent Technologies

2.9 Patent Analysis

2.10 Trade Analysis

2.10.1 Import Scenario (HS Code 9405)

2.10.2 Export Scenario (HS Code 9405)

2.11 Key Conferences and Events, 2025–2026

2.12 Case Study Analysis

2.12.1 Uline Uses Cree Lighting Luminaires Integrated with Synapse

Simplysnap Controls to Help Achieve Operational Excellence and

Reliability

2.12.2 German Municipality Implements Signify Holding’s Brightsites

Solution to Advance Smart City Goals

2.13 Tariff and Regulatory Landscape

2.13.1 Tariff Analysis

2.13.2 Regulatory Bodies, Government Agencies, and Other Organizations

2.13.3 Regulations

2.13.3.1 Restriction of Hazardous Substances (ROHS) and Waste

Electrical and Electronic Equipment (WEEE)

2.13.3.2 Registration, Evaluation, Authorisation and Restriction of

Chemicals (REACH)

2.13.3.3 United Nations Framework Convention on Climate Change

(UNFCCC)

2.13.3.4 General Data Protection Regulation (GDPR)

2.14 Porter’s Five Forces Analysis

2.14.1 Intensity of Competitive Rivalry

2.14.2 Threat of New Entrants

2.14.3 Threat of Substitutes

2.14.4 Bargaining Power of Buyers

2.14.5 Bargaining Power of Suppliers

2.15 Key Stakeholders and Buying Criteria

2.15.1 Key Stakeholders in Buying Process

2.15.2 Buying Criteria

2.16 Impact of AI/Gen AI on Smart Lighting Market

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/right to Win, January 2021– January 2025

3.3 Revenue Analysis, 2020–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation

3.5.2 Financial Metrics

3.6 Brand/product Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2024

3.7.5.1 Company Footprint

3.7.5.2 Region Footprint

3.7.5.3 Installation Type Footprint

3.7.5.4 Offering Footprint

3.7.5.5 End-use Application Footprint

3.7.5.6 Communication Technology Footprint

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed List of Startups/SMEs

3.8.5.2 Competitive Benchmarking of Key Startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches/developments

3.9.2 Deals

3.9.3 Expansions

4 COMPANY PROFILES

4.1 RAB LIGHTING INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 UBICQUIA, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SYNAPSE WIRELESS INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 LIGHTWAVE

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 BUILDING ROBOTICS INC. (SIEMENS COMPANY)

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 LIFX

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 SENGLED GMBH

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 TVILIGHT PROJECTS B.V.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 NANOLEAF

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

Latest

Siemens Healthineers' Peter Shen On Why AI Is the Future of Healthcare

Apr 2025

Apr 2025 Medical Device and Diagnostic industry

Medical Device and Diagnostic industryBombardier to digitally transform the aircraft engineering process from concept through to production with Siemens Xcelerator

Apr 2025

Apr 2025 Siemens Industry Software

Siemens Industry SoftwareLifx’s first ever smart lamp landing this month

Mar 2025

Mar 2025 The Ambient

The AmbientLifx SuperColor Ceiling light review

Jan 2025

Jan 2025 The Ambient

The AmbientNanoleaf launches 3-in-1 gaming pegboard

Apr 2025

Apr 2025 Electronics360

Electronics360Nanoleaf’s new pegboard dock lights up your accessories and room

Apr 2025

Apr 2025 The Verge

The VergeCompany List