Comparing 5 vendors in Livestock Monitoring Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

Summary

The livestock monitoring market is experiencing a significant transformation driven by technological advancements and changing consumer demands. As of 2025, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) has become a key trend, enabling more precise and data-driven farming practices. This transition is particularly crucial for meeting the growing global demand for meat and dairy products. By utilizing smart wearables and AI-enabled monitoring systems, farmers can now engage in real-time animal health tracking, predictive disease analytics, and efficient resource management. These technologies not only enhance productivity but also ensure higher standards of animal welfare and sustainability in farming practices.

The industry's shift towards smart and automated systems marks a departure from traditional husbandry methods. Advanced monitoring solutions, such as automated sorting, weighing systems, and smart livestock tracking, have become essential components of modern farming. These innovations facilitate real-time data collection and analysis, offering significant benefits like improved herd management and operational efficiency. Furthermore, the use of blockchain technology for traceability and the emphasis on organic farming practices are reshaping the market landscape.

Market dynamics are influenced by several factors, including the high initial costs of technology implementation and varying technology adoption rates across different regions, especially in developing countries. Despite these challenges, opportunities abound in the increased use of smart wearables and the focus on reproductive and breeding optimization . This shifting landscape is characterized by competitive rivalry, with established firms and emerging startups adopting strategies such as mergers, acquisitions, and partnerships to maintain market share and exploit growth opportunities. The evolution of this market is a testament to the innovative strategies and adaptability of industry players, setting the stage for a more efficient and sustainable future in livestock management.

Startups

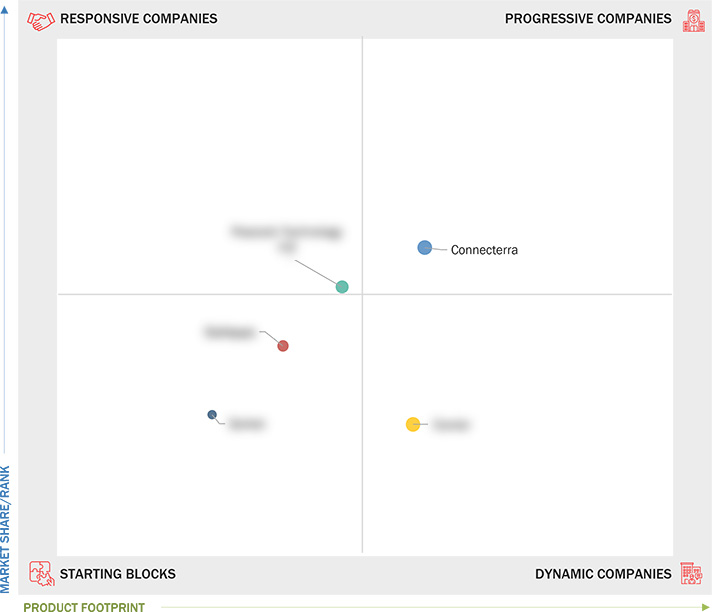

Connecterra

Connecterra, based in the Netherlands, is classified as a progressive company. They are noted for their strong product portfolio in livestock monitoring solutions, emphasizing AI and IoT integration to offer innovative and efficient farm management practices.

Stellapps

Headquartered in Bengaluru, India, Stellapps is a prominent startup recognized in the "starting blocks" category. They focus on offering scalable and cost-effective solutions tailored to the needs of large and small-scale farmers, helping streamline operations and improve productivity .

Cowlar

A dynamic company from Tennessee, US, Cowlar is known for its innovative wearable solutions that deliver real-time data analytics, helping farmers optimize herd management and enhance operational efficiency .

Peacock Technology Ltd

Operating from Stirling, Scotland, Peacock Technology Ltd. classifies as a responsive company due to their ability to swiftly adapt to market needs, providing diverse services in livestock monitoring that cater to evolving agricultural demands .

Serket

Serket, another significant startup from Amsterdam, specializes in software solutions for livestock health monitoring. They focus on using AI-driven analytics to enhance traceability and efficiency in livestock management.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growth in meat production

2.2.1.2 Increasing focus on real-time monitoring and early disease

detection

2.2.1.3 Integration of AI and IoT

2.2.2 Restraints

2.2.2.1 High initial cost of implementation

2.2.2.2 Limited awareness and technology adoption in developing

regions

2.2.3 Opportunities

2.2.3.1 Increasing Use of smart wearables for livestock

2.2.3.2 Growing focus on reproductive monitoring and breeding

optimization

2.2.3.3 Integration of blockchain technology

2.2.3.4 Rising demand for organic and sustainable livestock

practices

2.2.4 Challenges

2.2.4.1 Managing large volumes of data generated from multiple

monitoring devices

2.2.4.2 Concerns about environmental impacts associated with

livestock farming

2.2.4.3 Trade barriers and government regulations

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.5 Investment and Funding Scenario

2.6 Trends and Disruptions Impacting Customer Business

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Camera-based systems

2.7.1.2 Automated sorting systems

2.7.2 Complementary Technologies

2.7.2.1 AI and blockchain

2.7.2.2 Agriculture drones

2.7.3 Adjacent Technologies

2.7.3.1 Body condition scoring (BCS) systems

2.8 Pricing Analysis

2.8.1 Average Selling Price Trend of Ear Tags, By Key Players,

2021–2024

2.8.2 Average Selling Price Trend of Livestock Monitoring Products, By

Region, 2021–2024

2.9 Porter’s Five Forces Analysis

2.9.1 Threat of New Entrants

2.9.2 Threat of Substitutes

2.9.3 Bargaining Power of Suppliers

2.9.4 Bargaining Power of Buyers

2.9.5 Intensity of Competitive Rivalry

2.10 Key Stakeholders and Buying Criteria

2.10.1 Key Stakeholders in Buying Process

2.10.2 Buying Criteria

2.11 Case Study Analysis

2.11.1 Serket and Kanters Collaborate on AI-Based Heat Stress Detection

for Pig Welfare

2.11.2 Objectspectrum Revolutionizing Livestock Tracking with Lorawan

Technology

2.11.3 Well Cow and Ttp: Advancing Dairy Cow Health with Ingestible

Bolus Technology

2.12 Trade Analysis

2.12.1 Import Scenario (HS Code 01)

2.12.2 Export Scenario (HS Code 01)

2.12.3 Import Scenario (HS Code 8436)

2.12.4 Export Scenario (HS Code 8436)

2.13 Patent Analysis

2.14 Tariff and Regulatory Landscape

2.14.1 Tariff Analysis (HS Code 01)

2.14.2 Regulatory Bodies, Government Agencies, and Other Organizations

2.14.3 Standards

2.14.3.1 ISO and IEC standards

2.14.3.2 European Union standards

2.15 Key Conferences and Events, 2025–2026

2.16 Impact of AI/Gen AI on Livestock Monitoring Market

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2020–2023

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2024

3.7.5.1 Company footprint

3.7.5.2 Region footprint

3.7.5.3 Offering footprint

3.7.5.4 Farm size footprint

3.7.5.5 Livestock type footprint

3.7.5.6 Application footprint

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2023

3.8.5.1 Detailed list of startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4 COMPANY PROFILES

4.1 CONNECTERRA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 PEACOCK TECHNOLOGY LTD.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 STELLAPPS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 COWLAR

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 SERKET

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

Latest

Automated cow-milking company Lely and AI company Connecterra enter strategic partnership

Dec 2021

Dec 2021 Robotics and Automation News

Robotics and Automation NewsConnecterra to launch AI technology in New Zealand

Nov 2021

Nov 2021 www.thecattlesite.com

www.thecattlesite.comCompany List