Comparing 4 vendors in Livestock Identification Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

Summary

The livestock identification market is an evolving sector characterized by the integration of advanced technologies aimed at improving animal management, traceability, and welfare. This market is driven by the increasing demand for sustainable farming practices, heightened regulatory requirements, and technological advancements in identification systems. The implementation of Electronic Identification (EID) technologies, such as RFID tags, plays a pivotal role in enhancing traceability and biosecurity measures. These systems provide accurate and real-time data essential for managing livestock health, productivity, and movement efficiently.

A significant driver for this market is the growing emphasis on the transparency of livestock products, spurred by consumer demand for sustainably sourced and ethically treated animal products. The integration of blockchain technology further streamlines these processes, enabling secure and verifiable data regarding animal credentials, thus preventing fraud and supporting claims of organic and quality standards .

Key players in the market, including startups and established companies, are leveraging a mix of organic and inorganic growth strategies to expand their portfolios and market presence. Companies are increasingly focusing on product innovation and strategic collaborations to enhance their competitive edge. For instance, partnerships and acquisitions are common strategies adopted to extend product offerings and enhance technical capabilities .

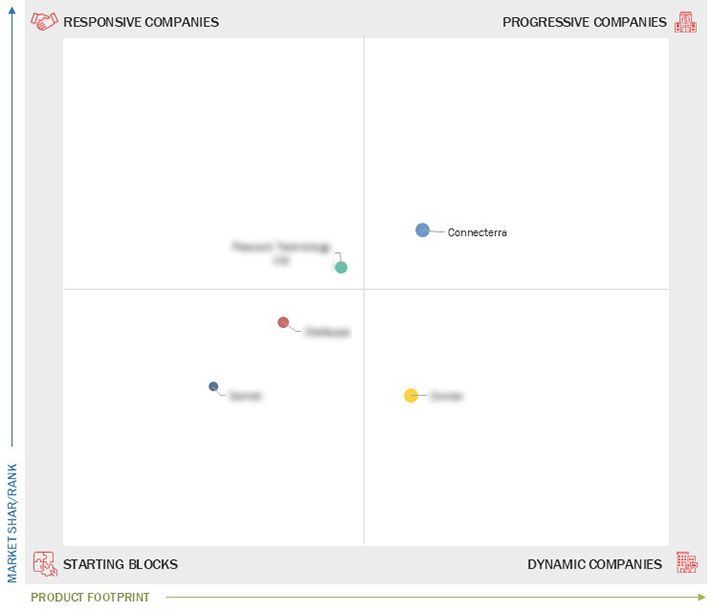

Companies like HerdDogg, Inc., mOOvement, and HerdX Inc. represent the diversity in strategic positioning within the market. HerdDogg, Inc., recognized as a progressive company, offers a robust product portfolio with advanced identification systems tailored to customer needs and strategic market growth. In contrast, mOOvement, categorized as a responsive company, focuses on innovative solutions with potential for expansion in both product and geographical markets. HerdX Inc. exemplifies dynamic companies with extensive network channels and consistent revenue growth, offering technologically advanced identification solutions.

STARTUPS IN THE MARKET

1. HerdDogg, Inc.: Established in 2015 and based in Nebraska, USA, HerdDogg, Inc. is a private company offering a venture-backed Series A funding of $6 million. They stand out for their strong product range tailored to meet customer needs in livestock identification, enabling significant market presence.

2. moovement: As a responsive startup, mOOvement is based in Queensland, Australia, and is backed by seed funding, facilitating its focus on innovative identification solutions. Their strategic position allows them to compete closely with more established companies.

3. HerdX Inc.: A Texas-based company established in 2010, HerdX Inc. supports its market activities through Series A funding of $5.9 million. Known for its innovative solutions and market expansion via reseller networks, HerdX Inc. has consistently demonstrated positive revenue growth.

4. smartAhc Technology: Based in Shanghai, China, smartAhc Technology is in the Series B funding stage with an investment of $1.6 million. The company is exploring new regions and focusing on niche products to expand its sales capabilities.

5. Identis: An SME operating from Hyderabad, India, Identis engages in manufacturing with a focus on seed-funded niche market products for local and international client.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Years Considered

1.3.3 Inclusions and Exclusions

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing focus of farmers on reducing mortality and

optimizing herd health and productivity

2.2.1.2 Rising inclination of livestock industry players toward

data-driven decision-making

2.2.1.3 Surging deployment of automated and IoT-enabled livestock

identification devices

2.2.1.4 Growing emphasis of livestock farmers on real-time tracking

and identification of animals

2.2.2 Restraints

2.2.2.1 Limited adoption among small farmers due to budget

constraints

2.2.2.2 Rise of vegan dining trend in Europe

2.2.3 Opportunities

2.2.3.1 Integration of blockchain technology into livestock

identification tools

2.2.3.2 Government initiatives encouraging Use of livestock

identification technology

2.2.3.3 Growing Use of livestock identification solutions in

developing countries

2.2.4 Challenges

2.2.4.1 Minimizing greenhouse gas emissions from livestock

2.3 Trends/Disruptions Impacting Customer Business

2.4 Pricing Analysis

2.4.1 Average Selling Price Trend of Livestock Identification Hardware

Products, By Key Player, 2024

2.4.2 Average Selling Price Trend of Visual Identification Tags, By Key

Player, 2021–2024

2.4.3 Average Selling Price Trend of Applicators, By Key Player,

2021–2024

2.4.4 Average Selling Price Trend of Visual Identification Tags, By

Region, 2020–2024

2.4.5 Average Selling Price Trend of Applicators, By Region, 2020–2024

2.5 Value Chain Analysis

2.6 Ecosystem Analysis

2.7 Investment and Funding Scenario

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Radio frequency identification (RFID)

2.8.2 Complementary Technologies

2.8.2.1 AI and blockchain

2.8.2.2 BLE

2.8.2.3 GPS

2.8.2.4 Big data

2.8.3 Adjacent Technologies

2.8.3.1 Tissue sampling

2.9 Patent Analysis

2.10 Trade Analysis

2.10.1 Import Data (HS Code 847190)

2.10.2 Export Data (HS Code 847190)

2.11 Key Conferences and Events, 2025

2.12 Case Study Analysis

2.12.1 Gallagher’s Electronic Identification Technology Helps

Streamline Process of Recording Heifer Data

2.12.2 Techvantage Systems’ Moo Id Product Assists in Tracking

Behavior, Eating Patterns, and Health of Cows

2.12.3 Gallagher’s HR5 Handheld Eid Tag Reader and Data Collector

Improves Dairy Farm Management

2.13 Regulatory Landscape

2.13.1 Regulatory Bodies, Government Agencies, and Other Organizations

2.13.2 Standards

2.14 Porter’s Five Forces Analysis

2.14.1 Intensity of Competitive Rivalry

2.14.2 Bargaining Power of Suppliers

2.14.3 Bargaining Power of Buyers

2.14.4 Threat of Substitutes

2.14.5 Threat of New Entrants

2.15 Key Stakeholders and Buying Criteria

2.15.1 Key Stakeholders in Buying Process

2.15.2 Buying Criteria

2.16 Impact of AI/Generative AI on Livestock Identification Market

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2019–2023

3.5 Company Valuation and Financial Metrics, 2024

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2024

3.7.5.1 Company footprint

3.7.5.2 Region footprint

3.7.5.3 Farm size footprint

3.7.5.4 Offering footprint

3.7.5.5 Livestock type footprint

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

4 COMPANY PROFILES

4.1 MOOVEMENT

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 IDENTIS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SMARTAHC TECHNOLOGY

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 HERDOGG, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 HERDX

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

Latest

IdentiSys Announces Acquisition of California-Based Capture Technologies

Jan 2025

Jan 2025 isStories

isStoriesMilk Moovement closes $3.2M funding round

Apr 2021

Apr 2021 freightwaves

freightwavesCompany List