Comparing 9 vendors in Industrial Metrology Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

Summary

The report on the industrial metrology market elucidates the dynamic interplay of various factors propelling its growth, particularly in adopting advanced technologies across several sectors. The industry's evolution is driven by the increasing need for precision engineering and accuracy to maintain the integrity and performance of manufactured products and systems. As traditional manufacturing shifts towards digitization, industries like automotive, aerospace, electronics, and healthcare are at the forefront, demanding higher precision tools to ensure product quality and reliability. This shift underscores the critical role of metrology in modern manufacturing, where the reliance on precise measurements ensures compliance with stringent regulatory standards and enhanced product functionalities.

The global push towards automation is intersecting significantly with industrial metrology. Companies are embracing IoT, AI, and cloud technologies to enhance metrological data analysis and storage capabilities. This trend is further bolstered by the growing emphasis on Industry 4.0 and 5.0 technologies, which prioritize seamless integration and advanced data application. These technological strides enhance quality control processes and facilitate real-time decision-making, consequently expanding metrology's applicability from traditional sectors into emerging fields like autonomous vehicle production and smart manufacturing.

However, the transition is not without challenges. The industry faces concerns over integrating complex systems, handling big data, and ensuring cyber security. Additionally, the limited availability of intuitive 3D metrology software solutions presents a bottleneck in optimizing its broad deployment. Conversely, these challenges also present opportunities for further innovation to cater to evolving market needs and enhance competitive positioning.

The report also highlights startups and SMEs as vital contributors to industry advancements, characterized by their agility in innovation and strategy deployment. These entities drive competition, fuel technological advancements, and expand service capabilities, thus playing a crucial role in shaping the industrial metrology future.

Startups in the Market

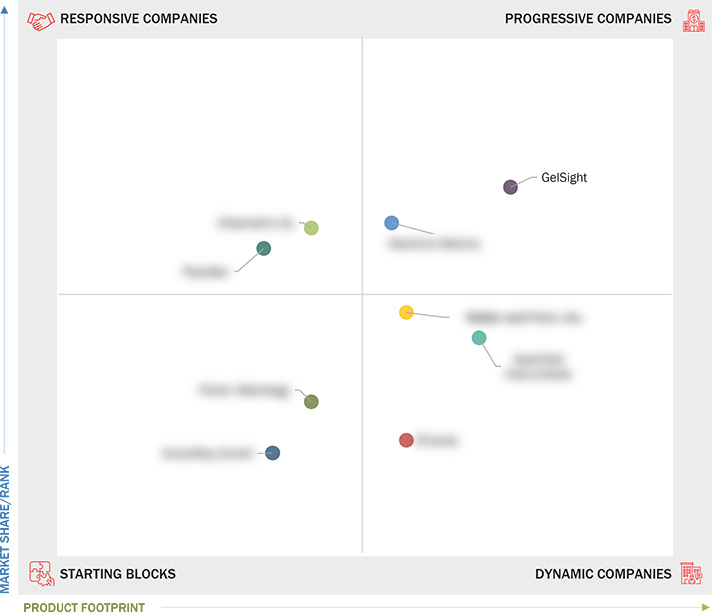

GelSight (US): As a progressive company, GelSight focuses on developing advanced systems tailored for industrial metrology. They have leveraged their strong product portfolio to become a notable player in the market by offering customized solutions that meet varied customer requirements.

Machine Metrics (US): This SME has made significant strides with a robust range of metrology solutions, backed by effective growth strategies. They are marking a significant presence in the market thanks to their innovative approach and adaptability.

Chipmetric Oy (Finland): Recognized as a responsive company, Chipmetric Oy is known for its innovative metrology solutions and dedicated to enhancing its product portfolio for potential market expansion.

FourJaw (UK): Operating as a responsive company, FourJaw is focused on innovating within the industrial metrology sector. Their strategic growth efforts are significant in positioning them alongside more established companies.

Silveray (UK): As a dynamic startup, Silveray is leveraging its extensive networks and partnerships to enhance deployment of advanced metrology systems across various verticals.

Pollen Metrology (France): Positioned in the starting blocks, Pollen Metrology is exploring new markets with niche products to bolster its services and sales capabilities across different regions.

SmartRay GmbH (Germany): SmartRay focuses on providing niche products and exploring new geographic markets and currently represents a significant presence in the sector's starting blocks.

Nearfield Instruments (Netherlands): This dynamic company is recognized for offering technologically advanced systems through a robust network that supports increased deployment across multiple markets.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing R&D investment in 3D metrology

2.2.1.2 Rising integration of IoT sensors into industrial metrology

solutions

2.2.1.3 Growing focus on quality control and inspection in

precision manufacturing

2.2.1.4 Mounting deployment of autonomous driving technologies

2.2.2 Restraints

2.2.2.1 Limited technical knowledge regarding integration of

industrial metrology with robots and 3D models

2.2.2.2 Concerns regarding big data handling and manufacturing unit

configuration

2.2.3 Opportunities

2.2.3.1 Growing emphasis on quality control and regulatory

compliance in food industry

2.2.3.2 Increasing adoption of cloud-based, IIoT, and AI

technologies to store and analyze metrological data

2.0 technologies

2.2.4 Challenges

2.2.4.1 Growing concern about cyber security

2.2.4.2 Shortage of easy-to-Use 3D metrology software solutions

2.3 Supply Chain Analysis

2.4 Porter’s Five Forces Analysis

2.4.1 Threat of New Entrants

2.4.2 Threat of Substitutes

2.4.3 Bargaining Power of Buyers

2.4.4 Bargaining Power of Suppliers

2.4.5 Intensity of Competitive Rivalry

2.5 Key Stakeholders and Buying Criteria

2.5.1 Key Stakeholders in Buying Process

2.5.2 Buying Criteria

2.6 Investment and Funding Scenario

2.7 Pricing Analysis

2.7.1 Indicative Pricing of Industrial Metrology Solutions Offered By

Key Players, By Equipment, 2024

2.7.2 Average Selling Price Trend of Industrial Metrology Solutions, By

Equipment, 2021–2024

2.7.3 Average Selling Price Trend of CMMs, By Region, 2021–2024

2.8 Trade Analysis

2.9 Ecosystem Analysis

2.10 Trends/Disruptions Impacting Customer Business

2.11 Case Study Analysis

2.11.1 Volumetric Accuracy Research Institute Uses Renishaw Xm-60

Multi-Axis Calibrator to Reduce Spatial Accuracy Measurement

Time

2.11.2 Hexagon’s Aicon Stereoscan Neo-Structured Light Scanner and

Leica Absolute Tracker Help Create 3D Printed Replica of

Michelangelo’s David Sculpture

2.11.3 Alloy Specialties Deploys Hexagon’s Tempo Technology to Improve

Production Capacity

2.11.4 Kawasaki’s Maryville Plant Installs Renishaw’s Revo 5-Axis

Systems to Reduce Daily Inspection Time

2.11.5 Dawn Machinery Adopts Renishaw’s XK10 Alignment Laser System to

Increase Custom Machine Tool Production Efficiency

2.11.6 Ford Motor Company Uses Zygo Nexviewtm NX2TM to Monitor Gear

Surface Processing

2.12 Patent Analysis

2.13 Technology Analysis

2.13.1.2 Optical metrology

2.13.2 Complementary Technologies

2.13.2.1 Digital twin

2.13.2.2 Industrial Internet of Things (IIoT)

2.13.3 Adjacent Technologies

2.13.3.1 Artificial intelligence (AI) and machine learning (ML)

2.13.3.2 Edge computing

2.14 Regulatory Landscape

2.14.1 Regulatory Bodies, Government Agencies, and Other Organizations

2.14.2 Regulations

2.14.3 Standards

2.15 Key Conferences and Events, 2025–2026

2.16 Impact of AI/Gen AI on Industrial Metrology Market

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2022–2024

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2024

3.7.5.1 Company footprint

3.7.5.2 Region footprint

3.7.5.3 Offering footprint

3.7.5.4 Equipment footprint

3.7.5.5 Application footprint

3.7.5.6 End-Use industry footprint

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Other Developments

4 COMPANY PROFILES

4.1 CHIPMETRIC OY

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 FOURJAW

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 POLLEN METROLOGY

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SMARTRAY GMBH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 GELSIGHT

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 MACHINE METRICS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 MATTER AND FORM, INC.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 NEARFIELD INSTRUMENTS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 SILVERAY

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

Latest

SmartRay extends its groundbreaking X sensor series with versatile new ECCO X 100

Dec 2024

Dec 2024 MVPro Media

MVPro MediaSmartRay’s New Versatile X Scanning Sensor Offers Two Laser Wavelengths

Dec 2024

Dec 2024 Metrology and Quality News

Metrology and Quality NewsCompany List