Comparing 6 vendors in Crystal Oscillator Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

Summary

The crystal oscillator market has long been integral to the functionality of various electronic devices, playing a crucial role in ensuring precise timing and frequency control in circuits. As the world rapidly advances with technological innovations, the demand for reliable timing solutions continues to grow exponentially across several sectors. From telecommunications and consumer electronics to the burgeoning fields of automotive electronics and aerospace & defense, crystal oscillators serve as foundational components. Each market sector demands varying specifications for oscillators, influenced by applications ranging from engine control units in vehicles to GPS systems in smartphones.

The global market landscape for crystal oscillators has been shaped by several key dynamics. Firstly, there is an increasing deployment in aerospace & defense applications, where precision and durability are paramount. The automotive sector is also seeing a heightened use of crystal oscillators as the push towards advanced vehicles and electric cars progresses. Moreover, with the proliferation of 5G and the anticipated arrival of 6G networks, the need for highly stable and efficient oscillators becomes even more pronounced. On the other hand, the growth of the market faces some resistance from the availability of alternative technologies that can deliver similar functionalities at potentially lower costs.

Despite these challenges, the market is surging with opportunities, particularly given the rising demand for miniature electronic devices that combine power efficiency with high performance. As these devices become more integrated into everyday life, the oscillators' role becomes indispensable. Furthermore, innovations in automotive electronics and their applications in safety and infotainment systems present untapped opportunities for expansion. Overall, the crystal oscillator market is poised to witness steady growth as industry players continue to innovate and meet the evolving needs of technology-driven environments.

Startups:

1. Fuji Crystal (Hong Kong) Electronics Co., Ltd.: This Hong Kong-based startup is recognized for its extensive product portfolio and strategic solutions catering to diverse end-user requirements. Its growth strategy focuses on leveraging existing market trends to solidify its presence in the industry.

2. TAITIEN Electronics Co., Ltd.: Based in Taiwan, TAITIEN Electronics is noted for its progressive technology and consistent market growth. The company has positioned itself strongly by integrating innovative solutions that align with customer expectations.

3. Shenzhen Crystal Technology Industrial Co., Ltd.: Operating out of China, this company thrives on its prowess in developing innovative products for various sectors. Their adaptive strategies keep them competitive with more established market players.

4. AXTAL GmbH: As a newer entrant from Germany, AXTAL is still in its nascent stages but is gradually gaining traction. The company is focusing on building a strong foundation to boost its presence in the burgeoning crystal oscillator market.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing adoption of crystal oscillators in aerospace &

defense applications

2.2.1.2 Growing Use of crystal oscillators in automotive sector

2.2.1.3 Surging implementation of crystal oscillators in consumer

electronics

2.2.1.4 Rising deployment of crystal oscillators in 5G and 6G

networks

2.2.2 Restraints

2.2.2.1 Availability of cost-effective and more reliable

alternative technologies

2.2.3 Opportunities

2.2.3.1 Growing demand for miniature electronic devices with

improved performance

2.2.3.2 Increasing adoption of advanced automotive electronics

2.2.4 Challenges

2.2.4.1 Frequency drift issues in crystal oscillators after

extended Use

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.5 Pricing Analysis

2.5.1 Average Selling Price of General Circuitry Crystal Oscillator

Products, By Key Player, 2024

2.5.2 Average Selling Price Trend of Crystal Oscillators, By General

Circuitry, 2021–2024

2.5.3 Average Selling Price Trend of Oven-Controlled Crystal

Oscillators, By Region, 2021–2024

2.6 Investment and Funding Scenario

2.7 Trends/Disruptions Impacting Customer Business

2.8 Impact of AI on Crystal Oscillator Market

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 MEMS-based oscillator

2.9.2 Complementary Technologies

2.9.2.1 Hybrid microcircuit technology

2.9.3 Adjacent Technologies

2.9.3.1 Green crystal technology

2.10 Patent Analysis

2.11 Trade Analysis

2.11.1 Import Data (HS Code 854160)

2.11.2 Export Data (HS Code 854160)

2.12 Tariff and Regulatory Landscape

2.12.1 Tariff Analysis

2.12.2 Regulatory Bodies, Government Agencies, and Other Organizations

2.12.3 Standards

2.13 Porter’s Five Forces Analysis

2.13.1 Bargaining Power of Suppliers

2.13.2 Bargaining Power of Buyers

2.13.3 Threat of New Entrants

2.13.4 Threat of Substitutes

2.13.5 Intensity of Competitive Rivalry

2.14 Key Stakeholders and Buying Criteria

2.14.1 Key Stakeholders in Buying Process

2.14.2 Buying Criteria

2.15 Key Conferences and Events, 2025

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2021–2024

3.3 Revenue Analysis of Top 3 Players, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Valuation and Financial Metrics, 2024

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2024

3.7.5.1 Company footprint

3.7.5.2 Region footprint

3.7.5.3 Mounting scheme footprint

3.7.5.4 Application footprint

3.7.5.5 General circuitry footprint

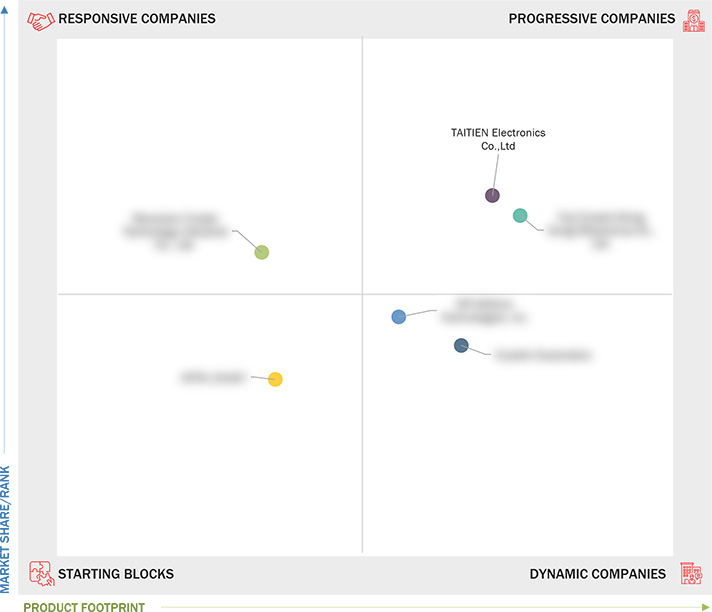

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed list of startups/SMEs

3.8.5.2 Competitive benchmarking of startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

4 COMPANY PROFILES

4.1 MTI-MILLIREN TECHNOLOGIES, INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 FUJI CRYSTAL (HONG KONG) ELECTRONICS CO., LTD.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SHENZHEN CRYSTAL TECHNOLOGY INDUSTRIAL CO., LTD.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 AXTAL GMBH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TAITIEN ELECTRONICS CO., LTD

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 CRYSTEK CORPORATION

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

Company List