Comparing 19 vendors in AI Chip across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

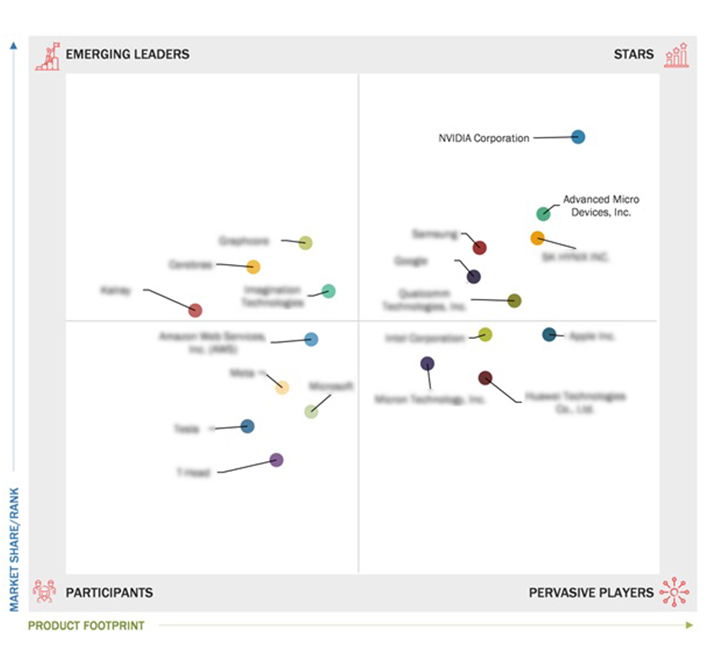

The AI Chip Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for AI Chip. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 19 AI Chip Companies were categorized and recognized as the quadrant leaders.

The AI chip market is experiencing significant growth, driven by the increasing adoption of AI servers by hyperscalers and the expanding use of generative AI technologies and applications, such as GenAI and AIoT, across industries like BFSI, healthcare, retail and e-commerce, and media and entertainment. AI chips enable high-speed parallel processing in AI servers, delivering exceptional performance and efficiently managing AI workloads within cloud data centres. Additionally, the rising adoption of edge AI computing and the growing emphasis on real-time data processing, supported by strong government investments in AI infrastructure particularly in the Asia-Pacific region are further fueling the market's expansion.

The 360 Quadrant maps the AI Chip companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the AI Chip quadrant. The top criteria for product footprint evaluation included By Offering (Discriminative Al, Generative Al, Hardware, Services), Technology (ML, NLP, Context-aware Al, Computer Vision), Business Function (Marketing & Sales, HR), By Deployment Type (Cloud, On-premise), Function (Training, Inference), End User (Cloud Service Providers, Enterprises, Government).

Key Players:

Major vendors in the AI chip market are NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), Intel Corporation (US), Micron Technology, Inc. (US), Google (US), SK HYNIX INC. (South Korea), Qualcomm Technologies, Inc. (US), Samsung (South Korea), Huawei Technologies Co., Ltd. (China), Apple Inc. (US), Imagination Technologies (UK), Graphcore (UK), and Cerebras (US). Apart from this, Mythic (US), Kalray (France), Blaize (US), Groq, Inc. (US), HAILO TECHNOLOGIES LTD (Israel), GreenWaves Technologies (France), SiMa Technologies, Inc. (US), Kneron, Inc. (US), Rain Neuromorphics Inc. (US), Tenstorrent (Canada), SambaNova Systems, Inc. (US), Taalas (Canada), SAPEON Inc. (US), Rebellions Inc. (South Korea), Rivos Inc. (US), and Shanghai BiRen Technology Co., Ltd. (China) are among a few emerging companies in the AI chip market.

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Pressing need for large-scale data handling and real-time analytics

2.1.2 Rising adoption of autonomous vehicles

2.1.3 Surging use of GPUs and ASICs in AI servers

2.1.4 Continuous advancements in machine learning and deep learning technologies

2.1.5 Increasing penetration of AI servers

2.2 RESTRAINTS

2.2.1 Shortage of skilled workforce with technical know-how

2.2.2 Computational workloads and power consumption in AI Chip

2.2.3 Unreliability of AI algorithms

2.3 OPPORTUNITIES

2.3.1 Elevating demand for AI-based FPGA chips

2.3.2 Government initiatives to deploy AI-enabled defense systems

2.3.3 Rising trend of AI-driven diagnostics and treatments

2.3.4 Increasing investments in AI-enabled data centers by cloud service providers

2.3.5 Rise in adoption of AI-based ASIC technology

2.4 CHALLENGES

2.4.1 Data privacy concerns associated with AI platforms

2.4.2 Availability of limited structured data to develop efficient AI systems

2.4.3 Supply chain disruptions

2.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

2.6 VALUE CHAIN ANALYSIS

2.7 ECOSYSTEM ANALYSIS

3 COMPETITIVE LANDSCAPE

3.1 INTRODUCTION

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024

3.3 REVENUE ANALYSIS, 2021–2023

3.4 MARKET SHARE ANALYSIS, 2023

3.2 COMPANY VALUATION AND FINANCIAL METRICS

3.6 BRAND/PRODUCT COMPARISON

3.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.7.1 STARS

3.7.2 EMERGING LEADERS

3.7.3 PERVASIVE PLAYERS

3.7.4 PARTICIPANTS

3.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.7.5.1 Company footprint

3.7.5.2 Compute footprint

3.7.5.3 Memory footprint

3.7.5.4 Network footprint

3.7.5.5 Technology footprint

3.7.5.6 Function footprint

3.7.5.7 End user footprint

3.7.5.8 Region footprint

3.8 COMPETITIVE SCENARIO

3.8.1 PRODUCT LAUNCHES

3.8.2 DEALS

4.1 KEY PLAYERS

4.1.1 NVIDIA CORPORATION

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.3.1 Product launches

4.1.1.3.2 Deals

4.1.1.4 MnM view

4.1.1.4.1 Key strengths

4.1.1.4.2 Strategic choices

4.1.1.4.3 Weaknesses and competitive threats

4.1.2 ADVANCED MICRO DEVICES, INC.

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.3 INTEL CORPORATION

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches

4.1.3.3.2 Deals

4.1.3.3.3 Other developments

4.1.3.4 MnM view

4.1.3.4.1 Key strengths

4.1.3.4.2 Strategic choices

4.1.3.4.3 Weaknesses and competitive threats

4.1.4 SK HYNIX INC.

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches

4.1.4.3.2 Deals

4.1.4.3.3 Other developments

4.1.4.4 MnM view

4.1.4.4.1 Key strengths

4.1.4.4.2 Strategic choices

4.1.4.4.3 Weaknesses and competitive threats

4.1.5 SAMSUNG

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.3.1 Product launches

4.1.2.3.2 Deals

4.1.2.4 MnM view

4.1.2.4.1 Key strengths

4.1.2.4.2 Strategic choices

4.1.2.4.3 Weaknesses and competitive threats

4.1.6 MICRON TECHNOLOGY, INC.

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.6.3.1 Product launches

4.1.6.3.2 Deals

4.1.7 APPLE INC.

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.7.3.1 Product launches

4.1.7.3.2 Deals

4.1.8 QUALCOMM TECHNOLOGIES, INC.

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offered

4.1.8.3 Recent developments

4.1.8.3.1 Product launches

4.1.8.3.2 Deals

4.1.9 HUAWEI TECHNOLOGIES CO., LTD.

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.9.3.1 Product launches

4.1.9.3.2 Deals

4.1.10 GOOGLE

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.10.3.1 Product launches

4.1.10.3.2 Deals

4.1.11 AMAZON WEB SERVICES, INC.

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.11.3 Recent development

4.1.11.3.1 Product launches

4.1.11.3.2 Deals

4.1.12 TESLA

4.1.12.1 Business overview

4.1.12.2 Products/Solutions/Services offered

4.1.13 MICROSOFT

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.3.1 Product launches

4.1.3.3.2 Deals

4.1.14 META

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.3.1 Product launches

4.1.4.3.2 Deals

4.1.15 T-HEAD

4.1.12.1 Business overview

4.1.12.2 Products/Solutions/Services offered

4.1.16 IMAGINATION TECHNOLOGIES

4.1.16.1 Business overview

4.1.16.2 Products/Solutions/Services offered

4.1.16.3 Recent developments

4.1.16.3.1 Product launches

4.1.16.3.2 Deals

4.1.17 GRAPHCORE

4.1.17.1 Business overview

4.1.17.2 Products/Solutions/Services offered

4.1.17.3 Recent developments

4.1.17.3.1 Product launches

4.1.17.3.2 Deals

4.1.18 CEREBRAS

4.1.18.1 Business overview

4.1.18.2 Products/Solutions/Services offered

4.1.18.3 Recent developments

4.1.18.3.1 Product launches

4.1.18.3.2 Deals

4.1.19 KALRAY

4.1.19.1 Business overview

Latest

Apple Watch saves life

Apr 2025

Apr 2025 Udaipur Kiran

Udaipur KiranAfter iPhone Fold, Apple could launch foldable iPad next year- All details

Apr 2025

Apr 2025 Hindustan Times

Hindustan Times

AIX25: Airbus partners with Amazon and "Project Kuiper"

Apr 2025

Apr 2025 Economy Class & Beyond -

Economy Class & Beyond -Airbus pairs with Amazon for inflight connectivity deal

Apr 2025

Apr 2025 Data Center Dynamics

Data Center DynamicsCompany List