Comparing 11 vendors in Urinary Incontinence Devices Startups across 0 criteria.

✔️ What You Get with This Report

- 📊

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

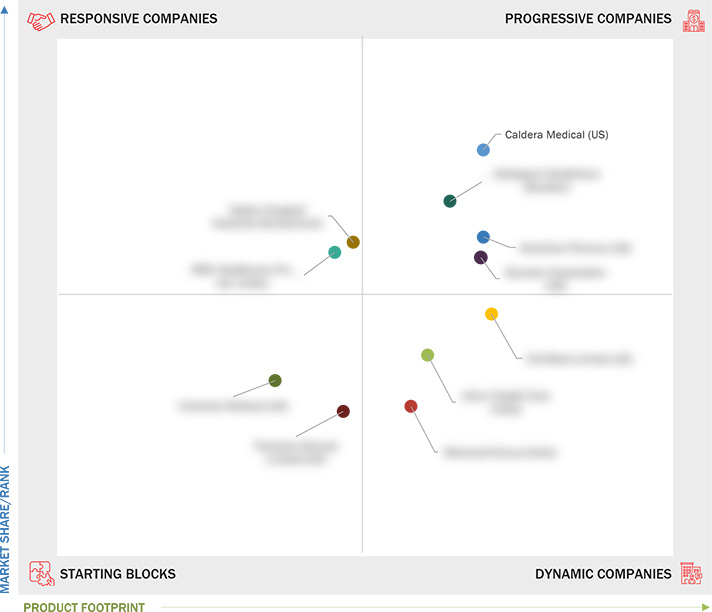

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

Summary

The urinary incontinence devices market exhibits a rapidly evolving landscape characterized by growing technological advancements and increasing healthcare demands. This market exhibits significant potential due to several factors that are shaping its trajectory. Primarily driven by the rising prevalence of urinary incontinence, the expanding geriatric population, and growing awareness about personal hygiene, the market is experiencing robust growth. Incontinence affects millions globally, prompting healthcare providers and device manufacturers to continuously innovate and improve treatment options available to patients.

This market is highly structured, with dominant players having a strong foothold, particularly in well-established regions like Europe and North America. However, there is a concerted effort by these players to penetrate emerging markets in Asia Pacific and Latin America, in response to rising healthcare standards and increasing disposable incomes across these regions. Companies are leveraging both organic strategies like product developments and inorganic movements including acquisitions and partnerships, to maintain and expand their market shares.

The presence of key players such as Coloplast Corp. (Denmark), Boston Scientific Corporation (US), and Medtronic (Ireland) further consolidates the market. These companies are known for their innovative product lines and strategic expansions which not only boost their product portfolios but also enhance their geographic reach. Additionally, technological innovations, specifically through AI and generative AI, are making significant inroads by personalizing treatment plans, enhancing device efficiency, and improving patient outcomes.

Amid these dynamics, startups and SMEs are also carving a niche for themselves, focusing on innovation and accessibility. Despite the challenges of social stigma and potential environmental concerns stemming from incontinence products, the market is steering towards more sustainable solutions. Overall, the urinary incontinence devices market stands on the brink of significant growth, backed by continuous innovation, strategic partnerships, and expanding patient demographics.

Startups in the Market

Caldera Medical (US)

Caldera Medical stands as a progressive company with a robust product excellence and business acumen. With extensive funding and a strong partner ecosystem, it actively drives innovation to meet growth aspirations.

AdvaCare Pharma (US)

AdvaCare Pharma has carved a niche by leveraging its powerful partner networks and well-structured marketing channels. As a progressive company, it focuses on developing high-attractiveness solutions for partners.

Wellspect HealthCare (Sweden)

Known for its exceptional product and business excellence, Wellspect HealthCare is a pivotal player in introducing innovative healthcare solutions, supported by extensive international presence.

Dynarex Corporation (US)

Dynarex Corporation excels by continuously expanding its product portfolio and pushing the boundaries of product innovation, making them a leading entity in achieving high partner attractiveness.

Zephyr Surgical Implants (Switzerland)

A responsive company, Zephyr Surgical Implants, is admired for its disruptive technologies that are comparable to leaders in the industry. It emphasizes continual innovation in its offerings.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered & Regions Considered

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising prevalence of urinary incontinence

2.2.1.2 Expanding geriatric population

2.2.1.3 Growing attention to personal hygiene

2.2.1.4 Advancements in home healthcare solutions

2.2.2 Restraints

2.2.2.1 Social stigma associated with incontinence care products

2.2.2.2 Environmental concerns related to disposal of urinary

incontinence products

2.2.2.3 Potential side-effects & complications

2.2.3 Opportunities

2.2.3.1 Technological advancements in urinary incontinence devices

2.2.3.2 Rapid urbanization and rising disposable income

2.2.4 Challenges

2.2.4.1 Use of alternative treatment options

2.3 Value Chain Analysis

2.4 Supply Chain Analysis

2.5 Ecosystem Analysis

2.6 Porter’s Five Forces Analysis

2.6.1 Threat of New Entrants

2.6.2 Threat of Substitutes

2.6.3 Bargaining Power of Buyers

2.6.4 Bargaining Power of Suppliers

2.6.5 Intensity of Competitive Rivalry

2.7 Trade Analysis

2.7.1 Import Data for HS Code 901839

2.7.2 Export Data for HS Code 901839

2.8 Patent Analysis

2.8.1 List of Major Patents

2.9 Key Conferences & Events, 2025–2026

2.10 Trends/Disruptions Impacting Customers’ Businesses

2.11 Technology Analysis

2.11.1 Key Technologies

2.11.1.1 Surgical & implantable devices

2.11.2 Complementary Technologies

2.11.2.1 Electrical stimulation devices

2.12 Investment & Funding Scenario

2.13 Impact of AI/Gen AI on Urinary Incontinence Devices Market

2.13.1 AI Use Cases

3 COMPETITIVE LANDSCAPE

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Key Players in Urinary

Incontinence Devices Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Startups/SMEs, 2023

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, 2023

3.5.5.1 Detailed list of key startup/SME players

3.5.5.2 Competitive benchmarking of key emerging players/startups

3.6 Company Valuation & Financial Metrics

3.7 Brand/Product Comparison

3.8 Competitive Scenario

3.8.1 Product Launches & Approvals

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4 COMPANY PROFILES

4.1 WELLSPECT HEALTHCARE

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 CALDERA MEDICAL

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 DYNAREX CORPORATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 ADVACARE PHARMA

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 MRK HEALTHCARE PVT. LTD.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ADVIN HEALTH CARE

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 CLINIMED LIMITED

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 STERIMED GROUP

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 INCONTROL MEDICAL

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ZEPHYR SURGICAL IMPLANTS

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 FLEXICARE (GROUP) LIMITED

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

Latest

Dynarex Corporation Expands Recall to Include Additional Products Due to Possible Health Risk

Oct 2024

Oct 2024 Dynarex Corporation

Dynarex CorporationDynarex Corporation Recalls Product Due to Possible Health Risk

Sep 2024

Sep 2024 Dynarex Corporation

Dynarex CorporationDynarex Corporation Broadens Respiratory Therapy Offerings

Apr 2022

Apr 2022 homecaremag

homecaremagCompany List