Comparing 15 vendors in Medical Lasers across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

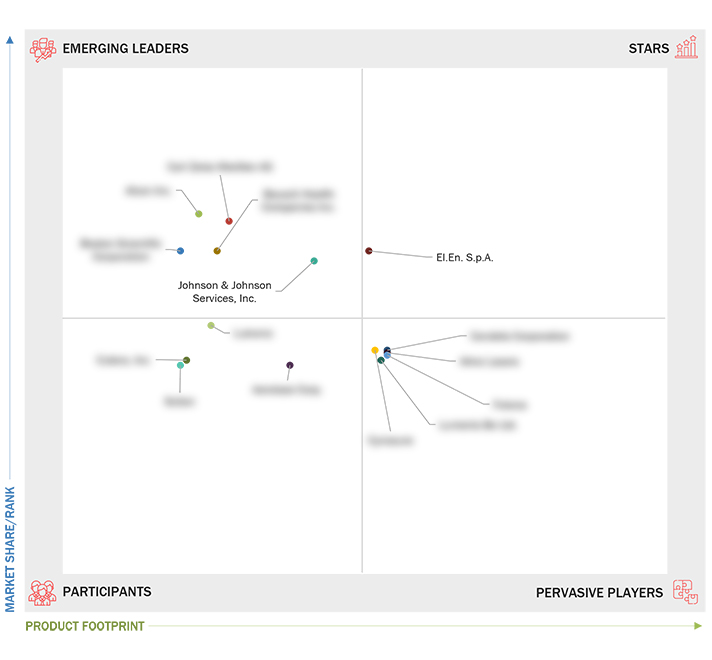

The Medical Lasers Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Medical Lasers. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 10 Medical Lasers Companies were categorized and recognized as the quadrant leaders.

The medical lasers market is expected to experience significant growth during the forecast period, driven by two primary factors. First, there is a growing demand for non-surgical cosmetic procedures, encouraging more individuals to explore and undergo these treatments. Second, the increasing preference for minimally invasive devices is fueling market expansion. These devices are gaining popularity among patients due to their lower risks, faster recovery times, and ability to deliver more precise results. This combination of rising awareness and acceptance of minimally invasive options is set to be a key driver of market growth in the coming years.

The 360 Quadrant maps the Medical Lasers companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the Medical Lasers quadrant. The top criteria for product footprint evaluation included Technology (solid-state laser systems, gas laser systems, pulsed dye laser systems, diode laser systems, other technologies laser devices), Application(aesthetic/cosmetic applications , dermatology applications, urology applications, ophthalmology applications, dental applications, ob/gyn applications, oncology applications, cardiovascular applications, other applications) and End-User.

Key Players:

Some of the prominent players are Cynosure. (US), Candela Medical (US), Lumenis Be Ltd. (US), Cutera (US), El.En. S.p.A (Italy), Alma laser (Israel), and Fotona (Slovenia) and others. These players are increasingly focusing on product launches and enhancements, investments, partnerships, collaborations, joint ventures, funding, acquisition, expansions, agreements, sales contracts, and alliances to strengthen their presence in the global market. 1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Technological advancements in medical laser technology

2.1.2 Increasing number of non-surgical cosmetic procedures

2.1.3 Rising demand for minimally invasive surgical procedures

2.1.4 Increasing incidence and prevalence of target diseases

2.1.5 Favorable reimbursement scenario

2.2 RESTRAINTS

2.2.1 High cost of medical laser products and treatment

2.2.2 Stringent safety regulations

2.3 OPPORTUNITIES

2.3.1 Growth of medical tourism

2.3.2 Growing applications of laser-based devices in diverse clinical areas

2.4 CHALLENGES

2.4.1 Risks associated with lasers

2.5 REGULATORY ANALYSIS

2.5.1 KEY REGULATORY BODIES AND GOVERNMENT AGENCIES

3.1 OVERVIEW

3.2 STRATEGIES ADOPTED BY KEY PLAYERS

3.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL LASERS MARKET

3.3 REVENUE SHARE ANALYSIS

3.4 MARKET SHARE ANALYSIS

3.4.1 DENTAL PRODUCTS MARKET SHARE

3.4.2 AESTHETIC AND DERMATOLOGY PRODUCTS MARKET SHARE

3.4.3 OPHTHALMOLOGY PRODUCTS MARKET SHARE

3.5 COMPANY EVALUATION MATRIX

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.6 COMPETITIVE SCENARIO AND TRENDS

3.6.1 PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–NOVEMBER 2023)

3.6.2 DEALS (JANUARY 2020–NOVEMBER 2023)

4.1 KEY PLAYERS

4.1.2 BOSTON SCIENTIFIC CORPORATION

4.1.2.1 Business overview

4.1.2.2 Products offered

4.1.2.3 MnM view

4.1.3 JOHNSON & JOHNSON VISION CARE, INC.

4.1.3.1 Business overview

4.1.3.2 Products offered

4.1.3.3 Recent developments

4.1.3.4 MnM view

4.1.4 ALCON INC.

4.1.4.1 Business overview

4.1.4.2 Products offered

4.1.4.3 Recent developments

4.1.4.4 MnM view

4.1.5 CYNOSURE

4.1.5.1 Business overview

4.1.5.2 Products offered

4.1.5.3 Recent developments

4.1.6 CARL ZEISS MEDITEC AG

4.1.6.1 Business overview

4.1.6.2 Products offered

4.1.6.3 Recent developments

4.1.7 CANDELA CORPORATION

4.1.7.1 Business overview

4.1.7.2 Products offered

4.1.7.3 Recent developments

4.1.8 LUMENIS BE LTD.

4.1.8.1 Business overview

4.1.8.2 Products offered

4.1.8.3 Recent developments

4.1.9 CUTERA, INC.

4.1.9.1 Business overview

4.1.9.2 Products offered

4.1.9.3 Recent developments

4.1.10 BAUSCH HEALTH COMPANIES INC.

4.1.10.1 Business overview

4.1.10.2 Products offered

4.1.10.3 Recent developments

4.1.11 EL.EN. S.P.A.

4.1.11.1 Business overview

4.1.11.2 Products offered

4.1.11.3 Recent developments

4.1.12 ALMA LASERS

4.1.12.1 Business overview

4.1.12.2 Products offered

4.1.12.3 Recent developments

4.1.13 FOTONA

4.1.13.1 Business overview

4.1.13.2 Products offered

4.1.13.3 Recent developments

4.1.14 AEROLASE CORP.

4.1.14.1 Business overview

4.1.14.2 Products offered

4.1.14.3 Recent developments

4.1.15 SCITON

4.1.15.1 Business overview

4.1.15.2 Products offered

4.1.16 LUTRONIC

4.1.16.1 Business overview

4.1.16.2 Products offered

Latest

Aerolase Further Extends Treatment Range for Its Universal Skin Laser Technology

Mar 2022

Mar 2022 prnewswire.com

prnewswire.comAlcon Inc. Reports Strong Q2 2023 Earnings

Aug 2023

Aug 2023 Clayton County Register

Clayton County RegisterKala Pharmaceuticals Completes Sale of EYSUVIS® and INVELTYS® to Alcon Inc

Jul 2022

Jul 2022 GlobeNewswire

GlobeNewswireAlcon Inc. (ALC) CEO David Endicott on Q4 2021 Results - Earning Call Transcript

Feb 2022

Feb 2022 Seeking Alpha

Seeking AlphaCompany List