Comparing 8 vendors in Medical Humidifier Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

The Medical Humidifier Market represents a significant segment of the broader respiratory care landscape, driven by innovations geared towards improving patient outcomes in critical care settings. As healthcare systems worldwide struggle to keep pace with an aging population and the increasing prevalence of respiratory diseases, the demand for efficient medical devices is correspondingly intensifying. The medical humidifier market is particularly pivotal, providing crucial support to mechanically ventilated and long-term care patients by delivering stable humidity levels, which helps prevent respiratory complications.

Recent years have witnessed considerable advancements in medical humidifier technologies, propelled by the rising incidence of premature births, the subsequent need for advanced neonatal care, and the ongoing challenges posed by chronic respiratory diseases such as COPD. As a result, medical humidifiers are utilized widely in hospitals and acute care settings. Still, they are also expanding into homecare sectors where patients benefit from continuous respiratory support outside hospital environments.

This market also presents an intricate tapestry of competitive dynamics, marked by the presence of established multinational corporations alongside emerging startups and SMEs, each vying for greater market share. The competitive rivalry in this field is moderate to high, necessitating continual product innovations and strategic expansions to maintain and grow market positions. Furthermore, as artificial intelligence begins to permeate various aspects of healthcare, its integration within medical humidifiers promises to revolutionize how respiratory therapies are administered, offering real-time data analysis and enhancing patient safety and treatment efficacy. This ongoing transformation underscores the burgeoning opportunities for companies agile enough to adapt to these technological shifts, highlighting the vibrance and potential of the medical humidifier market as it evolves in response to global healthcare needs.

Key Developments

In April 2025, Researchers identified collagen type V as a potential target for precision medicine in treating chronic kidney disease (CKD). Their study, published in Science Translational Medicine, highlights collagen V's significant role in kidney fibrosis. In mouse models, they observed that collagen V influences myofibroblast activation, fibrosis extent, and renal function. These findings suggest that targeting collagen V expression and its associated signaling pathways could lead to personalized treatments for CKD patients.

Startups in the Market

VADI Medical Technology Co., LTD (Taiwan): As a dynamic company, VADI focuses on specific technological advancements within the medical humidifier market. Although they have not reached the breadth of product excellence compared to more established players, their focus on niche innovations marks them as a company to watch.

Shenyang RMS Medical Tech Co., Ltd (China): Positioned in the early stages of market presence, Shenyang RMS Medical Tech is beginning to establish itself through niche offerings. Though currently lacking in both business and product excellence compared to more established startups, it has the potential to grow as it refines its strategies and product range.

Precision Medical, Inc. (US): Known for its commitment to developing medical humidifiers that cater to the specific needs of healthcare providers, Precision Medical focuses on product innovation and quality. This emphasis ensures its competitive positioning within the market, although it, too, has room to expand and deepen its market share.

GREAT GROUP MEDICAL CO., LTD. (Taiwan): This startup is making strides by catering to niche requirements within the medical humidifier sector. Despite its current challenges in establishing a broad market presence, ongoing product enhancements and strategic focus could facilitate future growth.

Heyer Medical AG (Germany): Similar to its peers, Heyer Medical is working towards solidifying its position in the market. Its focus remains on developing reliable products that meet specific industry needs, which could eventually elevate its stature in the competitive landscape.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered & Regions Considered

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

1.4.1 Impact of AI/Generative AI

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising Use of Medical Humidifiers in Ventilation Therapy

2.2.1.2 Increasing Prevalence of Respiratory Diseases

2.2.1.3 Rising Incidence of Premature Births and Advances in

Neonatal Care

2.2.1.4 Rapid Growth in Geriatric Population

2.2.2 Restraints

2.2.2.1 Frequent Replacement of Disposable Components, Increasing

Operational Costs

2.2.2.2 Low Awareness of Threat of Respiratory Diseases

2.2.3 Opportunities

2.2.3.1 Post-Pandemic Demand for Respiratory Care

2.2.3.2 Government and Non-Government Initiatives in Respiratory

Health

2.2.3.3 Increasing Investments in Hospital Infrastructure in

Emerging Markets

2.2.4 Challenges

2.2.4.1 Risk of Infections Due to Improper Maintenance

2.2.4.2 High Cost of Advanced Humidifiers to Limit Adoption

2.3 Pricing Analysis

2.3.1 Average Selling Price Trend, By Key Player

2.3.2 Average Selling Price Trend, By Region

2.3.3 Average Selling Price Trend, By Product

2.4 Value Chain Analysis

2.4.1 Research & Development (R&D)

2.4.2 Manufacturing

2.4.3 Distribution and Marketing & Sales

2.4.4 Post-Sales Services

2.5 Supply Chain Analysis

2.5.1 Prominent Companies

2.5.2 Small and Medium-Sized Enterprises

2.5.3 End Users

2.6 Ecosystem Analysis

2.7 Regulatory Landscape

2.7.1 Regulatory Bodies, Government Agencies, and Other Organizations

2.7.2 Regulatory Framework

2.7.2.1 North America

2.7.2.1.1 US

2.7.2.1.2 Canada

2.7.2.2 Europe

2.7.2.3 Asia Pacific

2.7.2.3.1 China

2.7.2.3.2 Japan

2.7.2.3.3 India

2.7.2.4 Latin America

2.7.2.4.1 Brazil

2.8 Patent Analysis

2.9 Trade Analysis

2.9.1 Import Data for HS Code 901920

2.9.2 Export Data for HS Code 901920

2.10 Key Conferences & Events, 2025–2026

2.11 Trends/Disruptions Impacting Customers’ Businesses

2.12 Technology Analysis

2.12.1 Key Technologies

2.12.1.1 Heating Technology

2.12.2 Complementary Technologies

2.12.2.1 Bubble Diffusion Technology

2.13 Porter’s Five Forces Analysis

2.13.1 Threat of New Entrants

2.13.2 Threat of Substitutes

2.13.3 Bargaining Power of Suppliers

2.13.4 Bargaining Power of Buyers

2.13.5 Intensity of Competitive Rivalry

2.14 Key Stakeholders & Buying Criteria

2.14.1 Key Stakeholders in Buying Process

2.14.2 Buying Criteria

2.15 Investment & Funding Scenario

2.16 Impact of AI/Generative AI on Medical Humidifier Market

2.16.1 Introduction

2.16.2 AI Use Cases

2.16.3 AI in Medical Humidifiers

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2022–2025

3.3 Overview of Strategies Adopted By Key Players

3.4 Revenue Analysis, 2021–2023

3.5 Market Share Analysis, 2023

3.5.1 Ranking of Key Market Players

3.6 Company Share Analysis, By Product

3.7 Company Evaluation Matrix: Key Players, 2023

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players, 2023

3.7.5.1 Company Footprint

3.7.5.2 Region Footprint

3.7.5.3 Product Footprint

3.7.5.4 Application Footprint

3.7.5.5 End-User Footprint

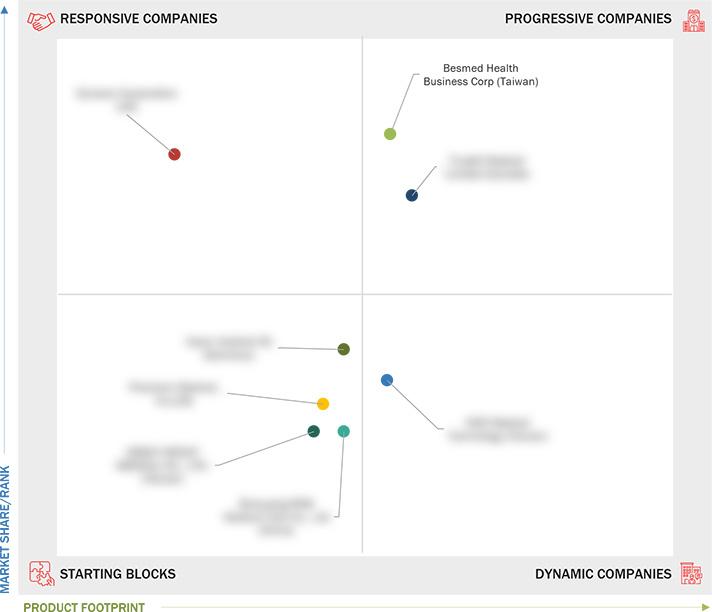

3.8 Company Evaluation Matrix: Startups/Smes, 2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/Smes, 2023

3.8.5.1 Detailed List of Key Startups/Smes

3.8.5.2 Competitive Benchmarking of Key Emerging Players/Startups

3.9 Company Valuation & Financial Metrics

3.9.1 Financial Metrics

3.9.2 Company Valuation

3.10 Brand/Product Comparison

3.11 Competitive Scenario

3.11.1 Product Launches

3.11.2 Deals

3.11.3 Expansions

4 COMPANY PROFILES

4.1 VADI MEDICAL TECHNOLOGY CO., LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SHENYANG RMS MEDICAL TECH CO., LTD

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 BESMED HEALTH BUSINESS CORP

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 PRECISION MEDICAL, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 DYNAREX CORPORATION

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 TRUDELL MEDICAL LIMITED

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GREAT GROUP MEDICAL CO., LTD.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 HEYER MEDICAL AG

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

Company List