Comparing 15 vendors in Mass Spectrometry Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

The mass spectrometry market is an essential segment of the analytical instrumentation industry, renowned for its precision in identifying and quantifying complex mixtures at the molecular level. It plays a critical role in various fields, notably in pharmaceuticals, biotechnology, environmental testing, and forensic sciences. Over the past decades, mass spectrometry has evolved significantly, driven by continuous technological advancements and growing applications in diverse areas.

In the pharmaceutical and biotechnology sectors, mass spectrometry is integral for quality control, drug development, and ensuring compliance with stringent regulatory standards. Its ability to provide detailed molecular information enhances the reliability of research and development processes. Environmental applications have expanded with regulatory emphasis on pollution monitoring, particularly in water testing, where techniques like LC-MS and GC-MS are prevalent .

Investment in research and development remains a pivotal driver, reflecting in the incremental innovations in mass spectrometric technologies. From novel ion sources and enhanced sensor technologies to AI integration for data analysis, the field is poised for exponential growth. Emerging economies present lucrative opportunities for expansion due to increasing demand for sophisticated analytical tools .

Furthermore, the market landscape is shaped by competitive dynamics, with leading companies such as Agilent Technologies and Thermo Fisher Scientific strategically positioning themselves through mergers, acquisitions, and expansions . Startups and SMEs are increasingly contributing to this landscape by bringing innovative concepts and niche technologies, making the market vibrant and highly competitive.

Key Developments

On Oct 2023, Spacetek Technology AG, a Swiss company specializing in time-of-flight mass spectrometers (TOF-MS) inspired by space technology, successfully closed its seed financing round in October 2023. Led by Swisscom Ventures, the company secured CHF 5.8 million from a group of financial investors, with the Spectrum Moonshot Fund joining as a co-investor alongside existing shareholders. The funding will support Spacetek's mission to enhance semiconductor manufacturing processes by providing real-time analysis of process gases, thereby reducing waste and improving performance.

In April 2025, The QuickTOCuv™ by Process Insights is a high-performance online analyzer designed for continuous monitoring of Total Organic Carbon (TOC) in various water types. Using UV persulfate oxidation, it provides accurate measurements with low maintenance and chemical use. Ideal for industries like water treatment, pharmaceuticals, and power plants, it supports applications in both standard and hazardous environments.

Startups in the Market

1. Spacetek Technology AG (Switzerland): Founded in 2018 and headquartered in Switzerland, Spacetek Technology is a promising startup focused on venture capital-backed development of mass spectrometric solutions. With its innovative approaches, the company seeks to make strides in seed-stage funding to enhance its technology offerings .

2. YoungIn Chromass (South Korea): Established in 1987, this South Korean company has carved a niche in providing mass spectrometric products with a strong presence in the Asia-Pacific region. Its focus on innovation and customer-centric solutions positions it well in the SME sector .

3. Process Insights, Inc. (US): Based in North Carolina and founded in 2017, Process Insights focuses on producing robust mass spectrometric products for industrial applications. Their innovative approach is poised to capture significant market share by addressing diverse analytical needs .

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation and Regions Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing regulatory emphasis and privatization of

environmental testing services

2.2.1.2 Growing application of mass spectrometry in clinical and

forensic settings

2.2.1.3 Rising focus on drug safety

2.2.1.4 Increasing investments in pharmaceutical research &

development

2.2.2 Restraints

2.2.2.1 Capital-intensive investments for high-end equipment

2.2.2.2 Time-consuming sample preparation steps

2.2.3 Opportunities

2.2.3.1 Development of novel mass sensors and nanopore ion sources

2.2.3.2 Growth opportunities in emerging economies

2.2.4 Challenges

2.2.4.1 Inadequate infrastructure and shortage of skilled

professionals

2.3 Trends/Disruptions Impacting Customer Business

2.4 Pricing Analysis

2.4.1 Average Selling Price Trend, By Key Player

2.4.2 Average Selling Price Trend, By Region

2.5 Value Chain Analysis

2.5.1 R&D

2.5.2 Raw Material Procurement and Product Development

2.5.3 Marketing, Sales, and Distribution

2.5.4 Aftermarket Services

2.6 Supply Chain Analysis

2.6.1 Prominent Companies

2.6.2 Small and Medium-Sized Enterprises

2.6.3 End Users

2.6.4 Sales and Distribution

2.7 Ecosystem Analysis

2.8 Investment and Funding Scenario

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Quadrupole mass analyzers

2.9.1.2 Time-of-flight mass analyzers

2.9.1.3 Ion trap mass analyzers

2.9.2 Complementary Technologies

2.9.2.1 LC-MS

2.9.2.2 GC-MS

2.9.3 Adjacent Technologies

2.9.3.1 Mass spectrometry imaging

2.10 Patent Analysis

2.11 Trade Analysis

2.11.1 Import Scenario for HS Code 2027

2.11.2 Export Scenario for HS Code 2027

2.12 Key Conferences and Events, 2025–2026

2.13 Case Study Analysis

2.13.1 Use of Mass Spectrometry Instruments for Clinical Diagnostics

2.14 Regulatory Landscape

2.14.1 Regulatory Analysis

2.14.1.1 North America

2.14.1.2 Europe

2.14.1.3 Asia Pacific

2.14.2 Regulatory Bodies, Government Agencies, and Other Organizations

2.15 Porter’s Five Force Analysis

2.15.1 Bargaining Power of Suppliers

2.15.2 Bargaining Power of Buyers

2.15.3 Threat of New Entrants

2.15.4 Threat of Substitutes

2.15.5 Intensity of Competitive Rivalry

2.16 Key Stakeholders and Buying Criteria

2.16.1 Key Stakeholders in Buying Process

2.16.2 Key Buying Criteria

2.17 Unmet Needs

2.18 Impact of AI/Gen AI on Mass Spectrometry Market

2.18.1 Introduction

2.18.2 Market Potential of Mass Spectrometry

2.18.3 AI Use Cases

2.18.4 Key Companies Implementing AI

2.18.5 Future of AI/Gen AI in Mass Spectrometry Ecosystem

3 COMPETITIVE LANDSCAPE

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Players in Mass Spectrometry

Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis,2023

3.5 Market Ranking Analysis,2023

3.6 Company Valuation and Financial Metrics

3.7 Brand/Product Comparison

3.8 Company Evaluation Matrix: Key Players,2023

3.8.1 Stars

3.8.2 Emerging Leaders

3.8.3 Pervasive Players

3.8.4 Participants

3.8.5 Company Footprint: Key Players,2023

3.8.5.1 Company footprint

3.8.5.2 Region footprint

3.8.5.3 Product footprint

3.8.5.4 Application footprint

3.8.5.5 End-User footprint

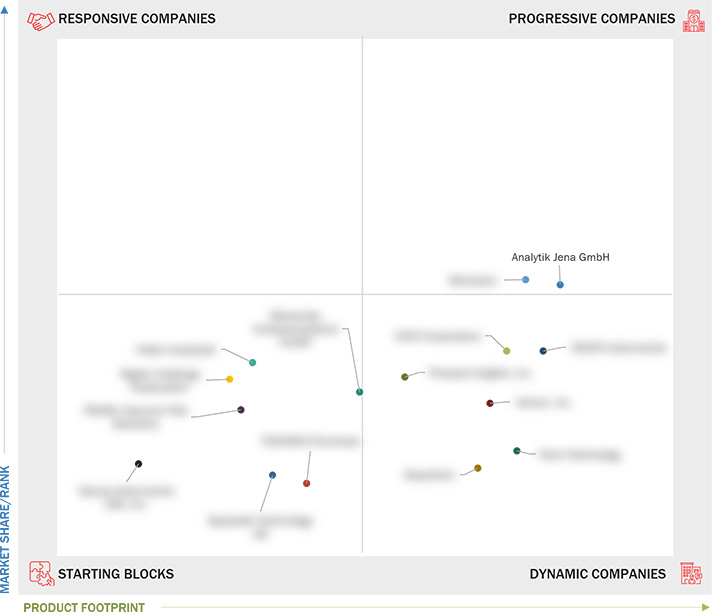

3.9 Company Evaluation Matrix: Startups/SMEs,2023

3.9.1 Progressive Companies

3.9.2 Responsive Companies

3.9.3 Dynamic Companies

3.9.4 Starting Blocks

3.9.5 Competitive Benchmarking of Startups/SMEs,2023

3.9.5.1 Detailed list of key startups/SMEs

3.9.5.2 Competitive benchmarking of key startups/SMEs

3.10 Competitive Scenario

3.10.1 Product Launches and Approvals

3.10.2 Deals

3.10.3 Expansions

4 COMPANY PROFILES

4.1 ANALYTIK JENA GMBH+CO. KG

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 HIDEN ANALYTICAL

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 LECO CORPORATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 RIGAKU HOLDINGS CORPORATION

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 YOUNGIN CHROMASS

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 SCION INSTRUMENTS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 KORE TECHNOLOGY

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 PROCESS INSIGHTS, INC.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 MASSTECH

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ADVION, INC.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 SPACETEK TECHNOLOGY AG

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 ELEMENTAR ANALYSENSYSTEME GMBH

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 SKYRAY INSTRUMENTS USA, INC.

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 MICROSAIC

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 PFEIFFER VACUUM+FAB SOLUTIONS

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

Latest

Surplus Unused LECO Carbon Nitrogen Determinator - CN628 in Bay Point

Mar 2025

Mar 2025 GovPlanet

GovPlanetSri Lanka’s CEB and LECO borrows from ADB under Treasury guarantees

Dec 2024

Dec 2024 EconomyNext

EconomyNextLECO’s Pegasus® BTX Honored with Innovation Award

Dec 2024

Dec 2024 azom

azomPfeiffer Vacuum+Fab Solutions Presents the New HiScroll 46

Feb 2025

Feb 2025 einpresswire

einpresswirePfeiffer Vacuum Technology (ETR:PFV) Trading 0.5% Higher - What's Next?

Feb 2025

Feb 2025 MarketBeat

MarketBeatMarket Surprises! Pfeiffer Vacuum Technology’s Stock Sees an Unexpected Rise

Jan 2025

Jan 2025 smartphonemagazine.nl

smartphonemagazine.nlCompany List