Comparing 25 vendors in Life Science Analytics across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

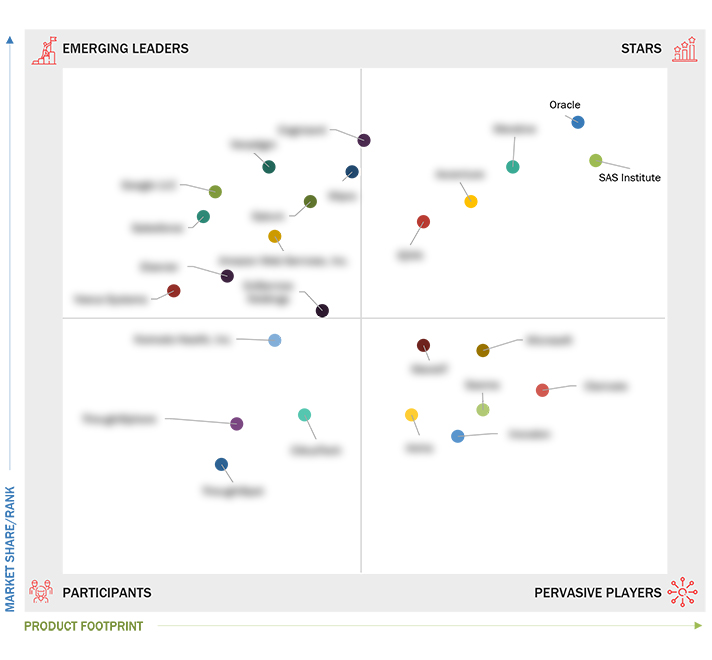

The Life Science Analytics Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Life Science Analytics. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 25 Life Science Analytics Companies were categorized and recognized as the quadrant leaders.

Several key factors drive the increasing adoption of analytics in the life sciences industry. These include the rise of advanced technologies such as artificial intelligence (AI), quantum computing, and cognitive computing, which transform vast amounts of raw data into actionable insights. These technologies simplify reporting, enable the creation of interactive dashboards, and streamline processes across various stages of research.

Analytics plays a growing role in areas like pre-clinical trials, drug discovery, and clinical trials, supporting tasks such as patient recruitment and site identification, thereby reducing the workload on researchers and investigators. Additionally, the standardization of diverse datasets from sources like clinical trials, electronic health records (EHRs), genomics, and real-world evidence facilitates efficient information exchange across platforms and regions. This standardisation enhances the efficiency of multi-site clinical trials and fosters cross-border research collaborations, further contributing to the widespread adoption of analytics in the industry.

The 360 Quadrant maps the Life Science Analytics companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the Life Science Analytics quadrant. The top criteria for product footprint evaluation included Type (Descriptive Analytics, Predictive Analytics and Prescriptive Analytics), Application(Research & Development, Commercial Analytics, Regulatory Compliance, Manufacturing & Supply Chain Optimization and Safety) and Component.

Key Market Players

Prominent companies in this market include Oracle (US), Merative (formerly IBM) (US), SAS Institute (US), Accenture (Ireland), IQVIA (US), Cognizant (US), Wipro (India), Veradigm (US), Optum (US), Microsoft (US), MaxisIT (US), ExlService Holdings (US), Inovalon (US), CitiusTech (US), Saama (US), Axtria (US), Clarivate (UK), ThoughtSphere (US), ThoughtSpot (US), Salesforce (US), Google LLC (US), Amazon Web Services, Inc. (US), Veeva Systems (US), Elsevier (Netherlands), and Komodo Health, Inc. (US).

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Rising pressure to curb healthcare spending

2.1.2 Need for improved data standardization

2.1.3 Technological advancements in analytical solutions

2.1.4 Heterogeneity and complexity of big data in life sciences

2.1.5 Growing adoption of analytical solutions in clinical trials

2.1.6 Increasing R&D expenditure in pharmaceutical & biotechnology companies

2.2 RESTRAINTS

2.2.1 High implementation costs of advanced analytical solutions

2.2.2 Data privacy concerns

2.3 OPPORTUNITIES

2.3.1 Growing focus on value-based care

2.3.2 Use of analytics in precision & personalized medicine

2.3.3 Big data analytics for R&D productivity

2.3.4 Growing adoption of cloud-based analytics

2.4 CHALLENGES

2.4.1 Issues associated with data integration

2.4.2 Shortage of skilled personnel

2.4.3 Reluctance to adopt life science analytics solutions in emerging countries

2.5 INDUSTRY TRENDS

2.5.1 GROWING ADOPTION OF ANALYTICS IN COMMERCIAL OPERATIONS

2.5.2 LEVERAGING DATA & ANALYTICS TO ACCELERATE DRUG DISCOVERY & DEVELOPMENT

2.5.3 FOCUS ON REAL-TIME DATA ANALYTICS

2.6 ECOSYSTEM ANALYSIS

2.7 VALUE CHAIN ANALYSIS

2.8 PORTER’S FIVE FORCES ANALYSIS

2.8.1 THREAT OF NEW ENTRANTS

2.8.2 THREAT OF SUBSTITUTES

2.8.3 BARGAINING POWER OF SUPPLIERS

2.8.4 BARGAINING POWER OF BUYERS

2.8.5 INTENSITY OF COMPETITIVE RIVALRY

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN LIFE SCIENCE ANALYTICS MARKET

3.3 REVENUE ANALYSIS

3.4 MARKET SHARE ANALYSIS

3.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

3.5.5.1 Company footprint

3.5.5.2 Type footprint

3.5.5.3 Application footprint

3.5.5.4 Component footprint

3.5.5.5 End-user footprint

3.5.5.6 Region footprint

3.7 BRAND/SOFTWARE COMPARATIVE ANALYSIS

3.8 COMPETITIVE SCENARIO

3.8.1 PRODUCT LAUNCHES & APPROVALS

3.8.2 DEALS

4.1 KEY PLAYERS

4.1.1 ORACLE

4.1.1.1 Business overview

4.1.1.2 Products & services offered

4.1.1.3 Recent developments

4.1.1.3.Deals

4.1.1.5 MnM view

4.1.1.6 Key strengths

4.1.1.7 Strategic choices

4.1.1.8 Weaknesses & competitive threats

4.1.2 MERATIVE

4.1.2.1 Business overview

4.1.2.2 Products & services offered

4.1.2.3 Deals

4.1.2.4 MnM view

4.1.2.5 Right to win

4.1.2.6 Strategic choices

4.1.2.7 Weaknesses & competitive threats

4.1.3 SAS INSTITUTE INC.

4.1.3.1 Business overview

4.1.3.2 Products & services offered

4.1.3.3 Recent developments

4.1.3.4 Product launches & approvals

4.1.3.5 Deals

4.1.3.6 MnM view

4.1.3.7 Right to win

4.1.3.8 Strategic choices

4.1.3.9 Weaknesses & competitive threats

4.1.4 ACCENTURE

4.1.4.1 Business overview

4.1.4.2 Products offered

4.1.4.3 Recent developments

4.1.4.4 Deals

4.1.4.5 MnM view

4.1.4.6 Right to win

4.1.4.7 Strategic choices

4.1.4.8 Weaknesses & competitive threats

4.1.5 IQVIA INC.

4.1.5.1 Business overview

4.1.5.2 Products & services offered

4.1.5.3 Recent developments

4.1.5.3 Product launches & approvals

4.1.5.3 Deals

4.1.5.3 Other developments

4.1.5.4 MnM view

4.1.5.4 Right to win

4.1.5.4 Strategic choices

4.1.5.4 Weaknesses & competitive threats

4.1.6 COGNIZANT

4.1.6.1 Business overview

4.1.6.2 Products & services offered

4.1.6.3 Recent developments

4.1.6.4 Product launches & approvals

4.1.6.5 Deals

4.1.7 WIPRO

4.1.7.1 Business overview

4.1.7.2 Products & services offered

4.1.7.3 Recent developments

4.1.7.4 Deals

4.1.8 VERADIGM LLC

4.1.8.1 Business overview

4.1.8.2 Products & services offered

4.1.8.3 Recent developments

4.1.8.4 Deals

4.1.9 OPTUM, INC.

4.1.9.1 Business overview

4.1.9.2 Products & services offered

4.1.9.3 Recent developments

4.1.9.4 Deals

4.1.10 MICROSOFT

4.1.10.1 Business overview

4.1.10.2 Products & services offered

4.1.10.3 Recent developments

4.1.10.4 Product & service launches & enhancements

4.1.10.5 Deals

4.1.11 MAXISIT

4.1.11.1 Business overview

4.1.11.2 Products & services offered

4.1.11.3 Recent developments

4.1.11.4 Product launches

4.1.11.5 Deals

4.1.12 EXLSERVICE HOLDINGS, INC.

4.1.12.1 Business overview

4.1.12.2 Products & services offered

4.1.12.3 Recent developments

4.1.12.4 Product launches

4.1.12.5 Deals

4.1.13 INOVALON

4.1.13.1 Business overview

4.1.13.2 Products & services offered

4.1.13.3 Recent developments

4.1.13.4 Product launches

4.1.13.5 Deals

4.1.14 CITIUSTECH INC.

4.1.14.1 Business overview

4.1.14.2 Products & services offered

4.1.14.3 Recent developments

4.1.14.4 Product launches

4.1.14.5 Deals

4.1.14.6 Expansions

4.1.15 SAAMA

4.1.15.1 Business overview

4.1.15.2 Products & services offered

4.1.15.3 Recent developments

4.1.15.4 Deals

4.1.16 AXTRIA

4.1.16.1 Business overview

4.1.16.2 Products & services offered

4.1.16.3 Recent developments

4.1.16.4 Product launches

4.1.16.5 Deals

4.1.16.6 Expansions

4.1.17 CLARIVATE

4.1.17.1 Business overview

4.1.17.2 Products & services offered

4.1.17.3 Recent developments

4.1.17.4 Product enhancements

4.1.17.5 Deals

4.1.18 THOUGHTSPHERE

4.1.18.1 Business overview

4.1.18.2 Products & services offered

4.1.18.3 Recent developments

4.1.18.4 Deals

4.1.19 THOUGHTSPOT INC.

4.1.19.1 Business overview

4.1.19.2 Products & services offered

4.1.19.3 Recent developments

4.1.19.4 Deals

4.1.19.5 Expansions

4.1.20 SALESFORCE, INC.

4.1.20.1 Business overview

4.1.20.2 Products & services offered

4.1.20.3 Recent developments

4.1.20.4 Deals

4.2 OTHER PLAYERS

4.2.1 GOOGLE LLC

4.2.2 AMAZON WEB SERVICES, INC.

4.2.3 VEEVA SYSTEMS

4.2.4 ELSEVIER

4.2.5 KOMODO HEALTH, INC.

Latest

Fortune and Accenture Set the Stage for 2025 Brainstorm AI Global Series of Conferences

Apr 2025

Apr 2025 Fortune Media (USA) Corporation

Fortune Media (USA) CorporationAccenture buys TalentSprint from NSE Academy

Apr 2025

Apr 2025 vccircle

vccircle

Company List

Life science analytics refers to the use of data analysis, statistical tools, and predictive models to extract insights from biological, clinical, and healthcare data. It supports decision-making in areas like drug development, patient care, and market strategy.

Industries such as pharmaceuticals, biotechnology, medical devices, healthcare providers, and research institutions rely heavily on life science analytics.

It accelerates the drug development process by identifying potential drug candidates, optimizing clinical trials, and analyzing patient data for safety and efficacy.

- Descriptive Analytics: Understand historical data trends.

- Predictive Analytics: Forecast outcomes using machine learning and statistical models.

- Prescriptive Analytics: Suggest optimal courses of action.

- Drug discovery and development

- Clinical trial optimization

- Patient engagement and personalized medicine

- Market analysis and sales forecasting

- Supply chain management

By analyzing patient data, it helps in early disease detection, personalized treatment plans, and monitoring treatment efficacy, leading to better patient care.

- Increased adoption of artificial intelligence (AI) and machine learning (ML)

- Growing focus on real-world evidence (RWE)

- Expansion of cloud computing in healthcare

- Use of blockchain for secure data sharing

The future involves more integration of AI, real-time analytics, and personalized medicine, alongside broader adoption of digital health tools and IoT for data collection and analysis.