Comparing 41 vendors in LIMS Software across 78 criteria.

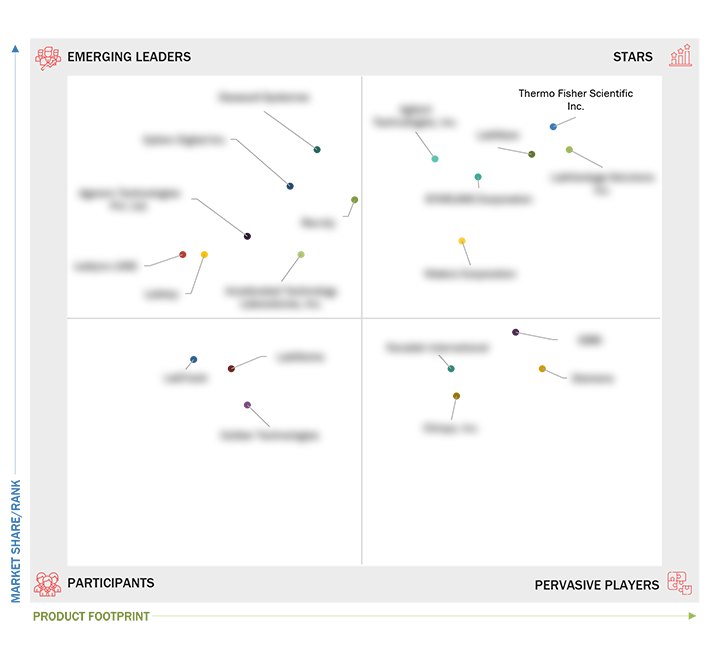

The Laboratory Informatics Solutions Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Laboratory Informatics Solutions. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 30 Laboratory Informatics Solutions Companies were categorized and recognized as the quadrant leaders.

Market Leadership Quadrant

- 1.1 Study Objectives

- 1.2 Market Definition

- 1.2.1 Inclusions And Exclusions

- 1.3 Market Scope

- 1.3.1 Market Segmentation

- 1.3.2 Regional Scope

- 1.3.3 Years Considered

2.1 Drivers

2.1.1 Growing need for laboratory automation

2.1.2 Increasing focus on multiple enterprise and integrated lab informatics solutions

2.1.3 Rising R&D expenditure in pharmaceutical and biotechnology companies

2.1.4 Stringent regulatory requirements for precilinical and Clinical tesing

2.1.5 Increased demand for highly configurable solutions and out of the box functionalities

Latest Industry News

Company List

Frequently Asked Questions (FAQs)

Laboratory informatics refers to the use of technology, software, and systems to manage, analyze, and store data collected in laboratories. This includes laboratory information management systems (LIMS), electronic laboratory notebooks (ELNs), scientific data management systems (SDMS), and laboratory execution systems (LES), which help streamline laboratory operations, improve efficiency, and ensure compliance with regulatory standards.

Laboratory informatics enables better data management, ensures accurate and timely results, enhances productivity, and supports compliance with industry standards such as Good Laboratory Practice (GLP). It also enables secure storage of data, facilitates data sharing, and supports decision-making processes, reducing the risk of errors and improving overall efficiency.

The key drivers include:

- Increasing demand for automation and digital transformation in laboratories.

- Need for efficient data management due to growing volumes of research data.

- Stringent regulatory requirements driving the adoption of compliant systems.

- Advancements in technologies like cloud computing, AI, and machine learning.

- Rising need for real-time data analysis and enhanced decision-making capabilities.

- LIMS (Laboratory Information Management Systems): Manages samples, data, and laboratory workflows.

- ELN (Electronic Laboratory Notebooks): Digital version of traditional laboratory notebooks for recording and storing data.

- SDMS (Scientific Data Management Systems): Helps organize, store, and retrieve scientific data.

- LES (Laboratory Execution Systems): Manages and documents experimental protocols, helping ensure consistency in results.

- CDS (Chromatography Data Systems): Used for managing data from chromatography instruments.

Laboratory informatics solutions are used across various industries, including:

- Pharmaceutical and biotechnology

- Healthcare and clinical diagnostics

- Environmental testing

- Food and beverage safety

- Forensic analysis

- Chemicals and materials science

- Academic research institutions

Challenges may include:

- High initial investment and implementation costs.

- Complexity of integration with existing systems and infrastructure.

- Resistance to change from laboratory staff accustomed to traditional workflows.

- Data security and privacy concerns.

- Training requirements for staff to effectively use new technologies.

Key trends include:

- Integration of artificial intelligence and machine learning to enhance data analysis and predictive capabilities.

- The shift toward cloud-based laboratory informatics solutions for scalability and remote accessibility.

- Increasing adoption of mobile solutions for data collection and analysis.

- Growing emphasis on data interoperability and systems integration across laboratory platforms.

- Focus on sustainability and reducing paper-based processes.

The laboratory informatics market is expected to grow significantly, driven by technological advancements, increasing research and development activities, and rising demand for more efficient and automated laboratory processes. This growth is also fueled by the increasing need for data-driven decision-making in various industries.

Laboratory informatics systems allow seamless data sharing, centralized data storage, and real-time updates, enabling better collaboration between researchers, analysts, and teams working across different locations. This also reduces duplication of efforts and ensures that all stakeholders have access to the most up-to-date information.

agilent

agilent

Dec 2025

Dec 2025