Healthcare IT Consulting Services, also known as HCIT advisory services, focuses on advising healthcare organizations including healthcare providers and payers among others, about best possible utilization of information technology (IT) in achieving their business objectives. Healthcare IT solutions are emerging as powerful tools to curtail the rising costs while improving the overall healthcare quality. They help to deliver quality healthcare and lead to improved clinical outcomes.

Best Healthcare IT Consulting Providers in 2020

- Accenture

- Microsoft

- Cerner

- Atos

- IBM

- Wipro

- McKessen

- NTT Data Group

- Optimum Healthcare

- Impact Advisors

Market Overview

The global Healthcare IT Consulting Services market is projected to rgrow at a higher CAGR during the forecast period. A number of factors, such as growing digitization in healthcare, rapidly changing HCIT landscape, government support for healthcare IT solutions, growing HCIT expenditure, lack of skilled IT professionals in the healthcare industry, growing venture capital investments in health IT, and the need for data security are driving the growth of this market. On the other hand, end-user concerns regarding the confidentiality of vital information and issues in vendor selection are restraining the growth of this market.

Based on type, the global HCIT Services market is categorized into HCIT strategy and project/program management; healthcare application analysis, design, and development; HCIT integration and migration; change management; healthcare/ medical system & security set-up and risk assessment; healthcare enterprise reporting and data analytics services; production go-live/post go-live support; healthcare business process management; regulatory compliance; and other consulting services.

Market Dynamics

The global Healthcare IT Consulting Services market is projected to grow at an excellent CAGR during the forecast period of 2016 to 2021. A number of factors, such as growing digitization in healthcare, changes in the HCIT landscape, government support for healthcare IT solutions, growing HCIT expenditure, a lack of skilled IT professionals in the healthcare industry, growing venture capital investments in health IT, and the need for data security are driving the growth of this market. On the other hand, end-user concerns regarding the confidentiality of vital information are restraining the growth of this market.

Drivers

Increasing Digitization in Healthcare

Recent advancements in healthcare have greatly increased overall patient volumes; this has forced the industry to confront significant challenges, such as the need to transition to more scalable business models that are designed to handle higher volumes of consumers. Given the current drive on ensuring the faster delivery of quality healthcare, the adoption of digitization is expected to witness a significant rise due to its potential for greatly saving time and costs. Moreover, a number of fields in healthcare have moved from processes to analytics, operations, and entirely digital products, largely due to the growing capabilities of cloud-computing and mobile technologies that provide users a platform to access a wider range of services for ongoing care. Additionally, the thrust to digitize healthcare has also gained support from governments and stakeholders. For instance, in 2015, the U.S. federal government granted USD 6.5 billion in incentives for healthcare providers to develop infrastructure for the digitization of health records. Growing digitization in healthcare, along with incentives and support for the same, will increase the demand for HCIT consulting services during the forecast period.

Electronic Medical Records

Keeping in mind the benefits of EMRs—minimization of errors due to the easy availability of patient data, and the potential for improving the quality of healthcare—their adoption has witnessed significant growth. In the U.S., government regulations incentivize Eligible Professionals (EPs) or Eligible Hospitals (EHs) that demonstrate efforts to adopt, implement, or upgrade certified EHR technology. As the foundation of HCIT, EHR is a major recipient of government funding. As of December 2015, a huge amount of incentives was paid to providers to adopt her, under the HITECH Act. The HITECH Act is credited with substantially boosting the adoption of EHRs to the point of near-saturation among providers in the U.S. As of 2014, more than 80% of U.S. physicians use EHR. However, the implementation process can be difficult, and it is crucial that all staff members are properly educated and have educational resources available. This is where HCIT consulting can be used, as these professionals will guide doctors, nurses, and technicians through the new systems. Without assistance, it can be difficult to integrate EHRs properly into daily operations. HCIT consulting can also be applied in other cases, such as the merger of two providers (at which point EHRs will be consolidated under a single vendor) and the drive to meet meaningful use criteria and ensure interoperability. All of these point to an environment that favors consulting companies. EHR consultants work closely with the healthcare organizations and support them through the entire EHR lifecycle, including solution implementation strategy and planning, Go-live support, Meaningful use attestation, staff training and post implementation support.

Revenue Cycle Management

In the face of growing financial pressures and changing legislative requirements, healthcare providers need to manage increasing financial pressures and changing legislative requirements. They need to control operating costs while providing high-quality care to the communities they serve. There is a growing realization amongst providers that this can be achieved through effective RCM. Hence, various providers look forward to partner with consultants specializing in RCM. According to industry experts, the hospital RCM software and services industry has hospitals and physician practices increasingly opting for RCM consultants for help in aspects such as business shifts encountered from reimbursement and payment reforms, accountable care participation, ICD-10 coding challenges, problem collections, and declining margins. Some of the leading RCM consulting providers are Access Healthcare (U.S.), athenahealth Inc. (U.S.), FTI Consulting (U.S.) and GE Healthcare (U.S.).

Electronic Health Information Exchange

The push to adopt solutions such as HIE is mainly due to the need to achieve interoperability—a key objective in MU stage 2. Most of the U.S. hospitals practiced the electronic exchange of health information with outside providers. In the U.S., the share of hospitals that electronically share information with other hospitals and external ambulatory providers respectively has increased. On the physician side, most of the physicians electronically share health information with their patients. In 2015 the Office of the National Coordinator for Health IT (ONC) (U.S.), rolled out the Shared Nationwide Interoperability Roadmap, a comprehensive agenda and action plan for achieving nationwide interoperability by 2024. Another trend observed in interoperability is the adoption of Fast Healthcare Interoperability Resources (FHIR), an emerging interoperability protocol for exchanging EHRs. This standard, created by the Health Level Seven International (HL7, a healthcare standards organization), has witnessed growing adoption among leading providers. As the adoption of FHIR increases across the healthcare industry, it can be expected to create a growing demand for domain experts with proven implementation consultants. Implementing Health Information Technology (HIT) project required a coordinated approach to its execution and adoption of specific strategies and tools.IT consultants assist the organization in designing, implementing and managing the project throughout its life cycle. Some of the leading providers in this segment are Cerner Corporation LLC (U.S.), Orion Health (New Zealand), Aetna Medicity (U.S.) and InterSystems Corporation (U.S.).

Population Health Management

The U.S. healthcare system is moving from the fee-for-service model to a valued-based reimbursement structure with a population health approach. With this changing scenario, many healthcare systems are investing in PHM. Healthcare providers need IT solutions to help them manage, monitor and engage patients, and to provide analytical support and care coordination. According to a survey conducted by the HIMSS Analytics Essentials Brief, out of 104 hospitals, 75% were pursuing some sort of PHM initiative in 2016. The successful implementation of PHM often requires a comprehensive solution and much support and guidance. Hence, various providers look to engage IT consultants by entering into long-term partnerships with consulting companies. Some of the major companies in this segment are Cerner Corporation (U.S.), Mckesson Corporation (U.S.), llscripts Healthcare Solutions, Inc. (U.S.), Epic Corporation, Inc. and IBM Corporation (U.S.).

Growing Need for Data Security

Healthcare records are among the most hacked data in the world. According to estimates by the Ponemon Institute, data breaches cost the healthcare industry USD 6.2 billion annually. According to Ponemon’s study published in May 2016, nearly 90% of the healthcare organizations surveyed had a data breach incident in the previous two years, and 45% had over five breaches in the same time period. This has prompted healthcare providers to make considerable investments in IT security. Moreover, data privacy is also a major concern for patients willing to share personal data to improve care coordination. According to the survey, over 65% of patients claimed that data security was more important to them than convenient access to imaging, test results, doctors’ notes, diagnoses, or even prescriptions. Hence, a majority of organizations are employing multiple practices to mitigate data security risks by partnering with IT consulting firms. Consequently, the growing need for data security is likely to boost the market for HCIT consulting services.

Restraints

Data Confidentiality Problems

Data confidentiality is a major challenge for healthcare systems across the globe. Most healthcare systems generate large volumes of confidential data, driven mainly by record-keeping and mandatory requirements. With the potential to improve the overall quality of care provided, this data supports a wide range of functions—from clinical decision support to disease surveillance and population health management. Patient information is highly sensitive, and a high degree of privacy needs to be maintained so that this information is accessible only to authorized users. When a healthcare organization hires an external IT consultant, the confidentiality of this data may be compromised. Apart from patient records, the consultant is also exposed to the internal operations of the organization, which includes vital information about business strategies, financial information, information about advanced medical devices and equipment, contractual information with third parties, and maintenance and lease contracts. Vital information, if leaked through consultants, may lead to financial losses for organizations. Hence, concerns among end users regarding the confidentiality of crucial information may limit market growth to a certain extent.

Opportunities

Cloud Consulting

Currently, healthcare organizations are increasingly embracing cloud-based healthcare IT solutions. These solutions are finding greater acceptance among healthcare organizations across the globe as they help share information that is stored across disparate information systems in real time and can free up IT staff to focus on more critical tasks. This approach significantly increases the productivity and cost-efficiency of operations in healthcare organizations. One of the benefits associated with the cloud computing environment is that it can easily be adjusted and scaled up or down by service providers without incurring any capital expenditure. With the growing demand for cloud-based solutions from healthcare organizations, an increasing number of market players are emphasizing on helping healthcare providers in terms of the successful adoption of cloud solutions by offering cloud consulting services. Consulting partners help healthcare providers in identifying opportunities for current IT environments to leverage the advantages of cloud-based solutions. These firms also provide consulting services for defining a cloud strategy roadmap for their clients, assess the readiness of clients for the adoption of cloud-based solutions, determine the suitability of IT resources for cloud migration, coordinate the creation of the whole cloud infrastructure required for business applications, as well as finalize the right cloud platform and deployment model. Considering these factors, the increasing deployment of cloud-based healthcare IT solutions is expected to offer potential growth opportunities to HCIT consulting services companies in the coming years.

Growing Conslidation in Healthcare Industry

Over the last few years, there has been a consistent rise in the number of merger and acquisition activities in the healthcare industry. During merger activities, synchronizing the IT infrastructure of multiple entities is a very challenging task. In this regard, IT departments have to handle data migration and synchronization, along with the ongoing management of electronic medical records. In addition, old and incompatible systems are required to be remodified across the expanding enterprise, which is an expensive and time-consuming process. There also are challenges in terms of intra-enterprise communication and data sharing, along with the growing demand for anytime-anywhere access to patient data. The involvement of experienced IT consultants in these activities can help in synchronizing and standardizing IT systems across the enterprise. This approach also allows consolidation of patient medical records and associated data from multiple departments and locations into a unified system, which helps in standardizing patient data access and archiving across the enterprise, thus enabling advanced data mining, simplified data management, and optimized disaster recover. With the increasing number of mergers and acquisitions in the healthcare industry, an increasing number of clients are expected to require the support of IT consultants to overcome merger-related challenges in a seamless, cost-effective manner.

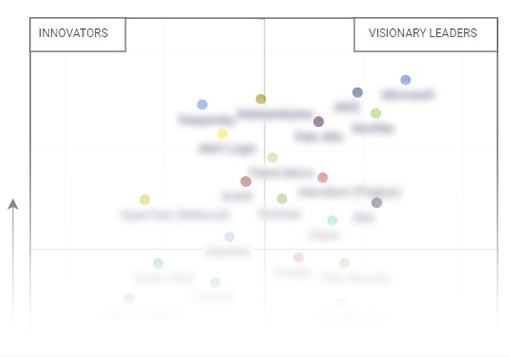

The Healthcare IT Consulting Market vendors are placed into 4 categories based on their performance and reviews in each criterion: “visionary leaders,” “innovators,” “dynamic differentiators,” and “emerging companies".

Companies recognized as visionary leaders in the Healthcare IT Consulting Services market are: Accenture, Microsoft, Atos, Cerner, and IBM.

Dynamic players in the Healthcare IT Consulting Services market are: Wipro, NTT Data Corp, McKesson and HCL Technologies.

Innovators in the Healthcare IT Cosulting Services market are: Optimum Healthcare, General Electric, Impact Advisors and ROI Healthcare Solutions.

Emerging vendors in the Healthcare IT Consulting Services Market have been recognized as: Cisco Systems, Hexaware Technologies, West Monroe Partners, Nordic Consulting, Cumberland Conssulting and Lichlyter Consulting.

What are the various services offered by Healthcare IT Consulting firms?

Based on type, the global Healthcare IT Consulting Services market is categorized into HCIT strategy and project/program management; healthcare application analysis, design, and development; HCIT Consulting Services integration and migration; HCIT change management; healthcare/ medical system & security set-up and risk assessment; healthcare enterprise reporting and data analytics services; production go-live/post go-live support; healthcare business process management; regulatory compliance; and others consulting services.

The healthcare application analysis, design, and development segment is estimated to command the largest share of the HCIT Consulting Services market . It is also expected to be the fastest growing segment during the forecast period. The large share and growth rate of this segment can be attributed to the fact that HCIT applications form the major component of all It solution implementation projects. Additionally, every healthcare provider facility has different requirements which need careful designing, development and implementation of customized solutions.

HCIT Strategy Program / Project Management

Healthcare organizations are highly dependent on IT to accomplish many administrative and clinical functions. Various factors need to be taken care of when it comes to the IT planning of a healthcare organization like, optimizing workflows, staff requirements, quality of care, and enhancing patient experience, among others. Uncertainty in the Healthcare IT Consulting Services environment due to rapid advancements in technology, changing regulations, and competitive pressures make it difficult for health organizations to plan their IT architecture. Healthcare organizations need to have a strong, sustainable, and flexible IT infrastructure but creating a comprehensive, sophisticated and long-term IT strategy is a complex process with multiple constraints.

Various IT aspects of a healthcare organization can be complex and time-consuming to handle, like implementation of an electronic health record (EHR) system, modifying billing systems to meet revised International ICD codes, setting up telemedicine services, setting up websites by payers to help subscribers make decisions regarding medical care options, and more. HCIT project/program management, which is the process of planning, organizing and defining responsibility for the completion of organization specific IT goals, is a significantly challenging task, and improper guidance may lead to IT project failures causing significant financial losses. This has caused HCIT strategy and program/project management consulting to become one of the largest services demanded by healthcare organizations when it comes to their IT infrastructure.

Healthcare organizations tend to partner with consulting service providers on a long term basis for successful project management and implementation. For instance, in February 2017, San Juan Regional Medical Center (U.S.) partnered with Cerner Corp. (U.S.) to replace its health IT applications with an integrated clinical, financial, and population health management system. Likewise, in March 2016, Virtua Health System (U.S.) entered into a two- year contract with Epic Corp. (U.S.) for implementation of Epic HER system. The challenging and time-consuming nature of formulating HCIT strategies is the key factor driving this market segment, however, the execution of IT strategies and projects often requires large capital investment which may restrain the growth of this segment to a certain extent.

HCIT Application Analysis, Design, And Development

HCIT application analysis, design, and development is expected to hold the largest share of the HCIT Services market. Consultation for HCIT application analysis, design, and development involves providing comprehensive guidance to achieve visibility and control across all areas of an organization to improve efficiency. To meet highly specific requirements, healthcare organizations prefer to build custom applications. The current healthcare systems demand applications that deliver hyper-connectivity, extreme personalization, and real-time customizations.

With emerging technology trends like packaged solutions, SMAC (social, mobile, analytics, and cloud) technologies, open source tools and automation, organizations are looking for IT partners that can co-create systems and engage with them as strategic partners to help them enhance business value.

The growth of this segment can be attributed to the fact that IT application analysis, design and development forms the major component of all IT solution implementation projects. Additionally, every healthcare facility has different requirements which need careful designing, development, and implementation of customized solutions.

HCIT Integration and Migration

Healthcare is an extremely complex and highly regulated industry with large amounts of data spread across multiple systems and technologies. If this data is not readily available, healthcare decisions are taken without complete information. Therefore, to deliver excellent patient care and keep hospital operations efficient, healthcare organizations need to make the right data available whenever required. Implementing this exchange of data is a major challenge, however, integrating healthcare systems allows the providers and clinicians to readily access patient data to improve the efficiency of hospital operations. Integrating data from a number of clinical systems is critical to achieve quality improvement goals and to reduce costs.

Data integrating consultants, who are professional healthcare technology experts, help healthcare organizations to plan, implement, and manage large or small integration projects. They help in connecting diverse systems, implementing or connecting health information exchange (HIE), and integrating medical devices with the EHR system. They analyze an organization’s needs and can provide custom solutions based on a client’s demand or an expert consultant’s suggestion.

Data migration, like data integration, also requires expert consultation. Replacing or updating a healthcare organization’s EHR is a complex process. It requires maintaining historical patient data while integrating other information systems such as EDIS, OR, PACS or LIS. Migrating to a new EHR vendor presents many challenges like handling format file changes, vocabulary mapping, patient, identity updates, connectivity and viewing, and archiving old data. Consulting related to data migration takes into account storing and archiving historical data, migrating data to new system, interfacing disparate systems, and providing project management services. Consultants can significantly smoothen the migration process and enable faster implementation, ensure migration of accurate data, and reduce the risk of unwanted interruptions during the migration process, these advantages are driving the market for this segment.

HCIT Change Management

HCIT consulting services for change management addresses IT changes required throughout the life of any HCIT project. The change management process begins at the onset of strategy development and continues throughout the implementation stage. Change management and communication can make the difference between the successful acceptance or the rejection of new processes and supporting technology.

Change management is a critical component of most software implementation projects. Changes driven by reforms in the healthcare environment impact the care delivery process adopted by healthcare organizations, causing them to transform their IT tools. Change management, if properly implemented can reduce expenditure and make sure that the HCIT systems are updated with the most relevant IT tools. To make the transition easier, healthcare entities are embracing HCIT change management consultation as the tool to enable the required paradigm shifts.

Successful IT changes need methods, techniques, strategies, and implementation tactics to be tailored to the requirements of a particular organization. Hence, consulting plays an important role in HCIT change management. Change management experts recognize the importance of establishing departmental readiness for change and recommend various strategies for project execution. This expertise enhances the speed and the adoption level of any new change that takes place at both, the departmental and organizational, levels. All these factors drive the market for this segment.

Healthcare/Medical System Security Set-Up and Risk Assessment

Healthcare records are among the most hacked databases in the world. The healthcare industry is facing serious breaches like public breaches of electronic records and numerous HIPAA violations (Source: NCBI). Data privacy is also a major concern for patients who share personal data to improve care coordination. Therefore, various healthcare providers are starting to make considerable investments in IT security.

Healthcare organizations are partnering with consulting firms to mitigate data security risk. These firms help providers manage and direct security and safety programs in healthcare facilities by performing security risk assessments.

Risk assessment can help prevent breaches, reduce the impact of a breach if one occurs, and provide a clear roadmap to achieving compliance with the HIPAA-HITECH regulations and mandates. Risk assessment also helps healthcare organizations to identify areas where health information could be at risk, evaluate vulnerabilities, and take adequate measures to reduce risk. In the U.S., it also allows organizations to benefit from the meaningful use program, thereby receiving Medicare and Medicaid EHR incentives after completing the analysis, correcting security deficiencies, and attesting meaningful use. According to industry experts, performing a healthcare IT risk assessment is an initial and crucial step for achieving HIPAA compliance, and is the most important measure to repeat on an ongoing basis. Engaging with consultants for IT risk assessment helps healthcare organizations to formulate tailor-made processes which fit specific requirements.

Healthcare Enterprise Reporting anf Data Analysis

Data reporting and analytics have become an important part of healthcare management. It is critical for healthcare organizations to know the relevant statistics about their business units, core processes, and performance of their employees.

Despite an abundance of available data in the enterprise, health organizations struggle to turn data into real insights that inform operational execution. Enterprise reporting is a business intelligence discipline that extends reporting and analysis capabilities beyond the scope of IT staff, business analysts, and power users. With enterprise reporting, any personnel (executives, managers, analysts, and frontline workers) that impact the business has immediate access to the vital information they need to perform their jobs with maximum productivity. However, enterprise reporting initiative is a massive undertaking, as different user groups need different information sets in different formats. Hence, health organizations partner with consulting firms that provide enterprise reporting services. This allows organizations to leverage any data asset, transform it into useful information, and deliver it in an actionable format to a large. Access to this sort of data-driven information aids decision-making and improves productivity. These factors are likely to drive the market for this segment.

Product Go-Live/Post Go-Live Support

Most organizations need additional, qualified go-live support resources for a period to support both, the users and the system, when a healthcare IT system goes live. Go-live and post-Go-live consultants work with provider organizations to successfully deploy clinical applications by supporting clinicians and developing the infrastructure necessary to avoid the negative performance that often occurs with new IT system deployments. Go-live consulting includes services like, at-the-elbow go-live support for the organization’s end users, command center support, help desk ticket resolution and classroom training.

Additionally, Go-live consultants help an organization maintain pre Go-Live volumes while increasing provider, staff, and patient satisfaction during and after an IT system deployment. Engaging with Go-live support providers allows healthcare organizations to save time and capital which they would otherwise invest in hiring short-term staff while trying to introduce the organization to a new system. These factors are responsible for driving the market for the production Go-live/Post Go-live support segment.

Healthcare Business Process Management (BPM)

Healthcare business process management (BPM) is a well-designed, integrated, monitored, and controlled management approach to continuously analyze and improve key operations in-line with a health organizations’ strategies. Healthcare BPM systems, which include workflow management, integration, and analytics can significantly improve the quality, efficiency, and flexibility of healthcare information systems. Improvement in overall business process and automation can eradicate inefficiencies and reduce costs, while process intelligence can provide improved decision-making and patient care quality.

The integration of healthcare BPM with the HIS/EHR systems allows healthcare workers to focus on the patient as it takes care of various other processes. Healthcare BPM can help manage processes and data across all aspects of patient care and also provide the organization with the ability to adapt processes to changing requirements rapidly. Healthcare BPM consultants enable healthcare stakeholders to optimize processes and respond quickly to changing legislative and regulatory requirements. They also help modernize core processes and systems to support new clinical practices, administrative standards, cost reimbursement methods, and government regulations. Consulting experts help the healthcare providers to better reach their objectives through thoroughly documented processes, risks, controls and performance measures. They work closely with the providers to help them meet all of their governance and compliance needs. Hence, there is a growing need for consulting services pertaining to healthcare BPM.

Who are the typical end users of Healthcare IT Consulting Services?

Based on end user, the global healthcare IT consulting services market is broadly segmented into healthcare providers, healthcare payers, and other end users. The healthcare providers segment is expected to dominate the market in 2017. The large share of this segment can be attributed to factors such as rising healthcare costs, growing adoption of HCIT solutions as a means to bring down costs, growing adoption of electronic medical records (EMRs) to improve patient care, increasing hospital consolidation, changing and increasing stringency of regulations for HCIT solutions, and growing adoption of HCIT solutions by ACCs, home healthcare centers and diagnostic centers.

The healthcare payers segment is expected to witness the highest growth during the forecast period. Factors such as growing adoption of healthcare IT solutions by private and public payers, growing need for insurance payers to comply with various federal and regional laws and regulations, and growing focusing of payers on reforming their business models for improved patient care delivery are expected to drive growth in this segment.

Healthcare Providers

Healthcare providers include hospitals, physician groups, and integrated delivery networks (IDNs); ambulatory care centers; home healthcare agencies, nursing homes, and assisted living facilities; diagnostic and imaging centers; and other healthcare providers such as pharmacies and diagnostic and pathological laboratories.

Of all the end users in the healthcare IT consulting services market, healthcare providers are expected to command the largest share of 73.4% of the market in 2017. The large share of this segment can be attributed to factors such as rising healthcare costs, growing adoption of HCIT solutions as a means to bring down costs, growing adoption of electronic medical records (EMRs) to improve patient care, and increasing hospital consolidation. The rapidly changing and increasing stringency of regulatory requirements for healthcare IT solutions have also been propelling the demand for HCIT consulting services by healthcare providers.

Healthcare Payers

Healthcare payers finance or reimburse the cost of health services. Healthcare IT solutions help healthcare payers increase the efficiency of their operations and minimize errors by transitioning their operations from paper-based records to electronic records. Healthcare IT systems enable insurance providers to accelerate their medical claims processing tasks, enhance customer care, and improve documentation activities. Deployment of healthcare IT solutions is vital for healthcare insurance providers, as it helps in the effective management of claims processing and reimbursement.

Insurance providers need to comply with various federal and regional laws and regulations. Many of these regulations have privacy and security concerns relating to patient information, and strict auditing and reporting requirements. With the help of healthcare IT systems, insurance providers adhere to regulatory requirements and reduce unnecessary penalties and punishments. The growing stringency of regulations for payers is a major factor driving the adoption of various HCIT systems by healthcare payers, which has a positive impact on the demand for HCIT consultants.

Some of the major healthcare IT solutions for payers include claims processing, billing, fraud mitigation, transactional processing, documentation management, health insurance exchange, payer testing solutions, and tracking and reporting.

Other End Users

Other end users mainly include third-party administrators, research centers, academic medical centers, and government bodies. Increasing government initiatives across the globe to improve the quality of care and patient safety, rising usage of Big Data and analytics, and various benefits offered by HCIT solutions in research and medical studies are encouraging the adoption of healthcare IT solutions in this segment, thus driving the demand for HCIT consulting services.

Healthcare IT Consulting Services

360Quadrant For Healthcare IT Consulting Services, Q2 2022

The 20 Companies That Matter Most And How They Stack Up

599,864 professionals have used our research since 2010

Oracle Corporation is a provider of enterprise software and computer hardware products and services. The company operates in three business areas— Cloud and On-premise Software, Hardware, and Services. The company’s business operations include software license updates & product support like providing software as a service (SaaS); platform as a service (PaaS); cloud infrastructure as a service; software license updates & product support, hardware products, and hardware support. The company has a strong software & cloud business and has a geographic presence and customer base in North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

SAP intends to create Intelligent Enterprises in order to enable healthcare service providers become highly competent at saving and enhancing lives, provide a smooth patient experience, and guarantee value-based care with ground-breaking technologies. The company also helps patients in making more informed decisions about their care through high-quality info sharing, active outreach, and education.

Siemens Healthineers, a division of Siemens AG, is one of the largest suppliers of healthcare technologies worldwide. Siemens Healthcare provides a comprehensive portfolio of medical solutions, ranging from medical imaging and in vitro diagnostics to interventional systems and clinical information technology systems. The company operates in four business segments, namely, Imaging & Therapy Systems, Clinical Products, Diagnostics, and Customer Solutions. Siemens Healthcare is an important player HCIT consulting services market. The company has specific expertise in the sphere of independent and competent health IT consulting support.

TCS’ healthcare services are based on excellent understanding in systematizing big hospitals, assimilating state-level medical set-ups, and allowing health insurance provisioning for deprived citizens. The company’s solutions enable enhancements in telemedicine and citizen lifecycle healthcare with electronic patient accounts, unified preventive disease observation, remote discussions to decrease outpatient appointments, and higher drug supply chain competence.