Healthcare analytics is the efficient use of data and related business insights developed through statistical, quantitative, predictive, comparative, cognitive, and other emerging applied analytical models. Healthcare analytics tools help reveal and understand historical data patterns, predict future outcomes, and provide actionable insights to drive fact-based decision making for improved clinical, financial, and operational performance of healthcare organizations. The use of analytics helps healthcare systems reduce healthcare costs and improve the quality of care.

The competitive leadership mapping is based on parameters such as strength of product portfolio and business strategy excellence. These parameters have a significant impact on the growth and development of the company in the healthcare analytics market. On the basis of these parameters, the companies have been categorized into four categories namely; visionary, dynamic, innovators, and emerging companies.

Visionary companies are the leading market players in terms of new developments and the adoption of growth strategies. This quadrant receives high scores for most evaluation criteria. They have a strong product portfolio, a very strong market presence, and robust business strategies. The healthcare analytics market is majorly dominated by tier one players. These players have a broad range of product offerings that cater to the requirements of a majority of end users. Vanguards primarily focus on acquiring the leading market position through their strong financial capabilities and their well-established brand equity.

Dynamic players are established vendors with very strong business strategies and market presence. However, their product portfolio may not be as vast as the vanguards. They generally offer specialized healthcare analytics solutions (pertaining to specialized applications or delivery models).

Innovators demonstrate substantial product innovations compared to their competitors. They focus on their product portfolio but do not have very strong growth strategies for overall business and often have a limited geographical presence. They also show considerable investments in research and development activities compared to their competitors.

Emerging vendors have niche product offerings and are starting to gain traction in the market. They do not have strong business strategies compared to other established vendors. They might be new entrants in the market and require some more time before getting significant traction. Emerging companies usually do not have a wide market presence. With the growing number of regulations and rising economic burden across the globe, healthcare organizations are increasingly focusing on cutting costs and implementing practices that will help their operations remain profitable. Financial analytics provides healthcare payers and providers with relevant data for effective revenue cycle management (RCM), budgeting, and forecasting. It enables healthcare organizations to understand profitability and make informed investment decisions. Financial analytics is mainly used by payers for processing claims to prevent payment errors, analyze data, and manage revenue cycles. Providers use financial analytics mainly for future capital investments in equipment, facilities, or human resources; analyzing insurance risks for a defined population; hospital budgeting; and RCM. The financial analytics market is further segmented into RCM, claims processing, payment integrity & FWA (Fraud, Waste & Abuse), and risk adjustment & assessment. In the past few years, healthcare providers have figured out ways to manage their operational and financial data; however, the concept of managing and utilizing clinical data is relatively new. Clinical data contains information about patients such as diagnoses, treatments administered, medicines prescribed, procedures and lab tests conducted, and hospitalizations. This data is collected from a variety of sources such as EHRs, disease registries, patient surveys, and information exchanges among care providers. Effective analytics makes this exhaustive data more usable. Clinical analytics encourages preventive care over reactive care and helps provide evidence-based treatment and personalized care to patients, thereby enhancing healthcare quality and making it cost-effective. Clinical analytics tools capture and use clinical data to provide critical data insights for retrospective performance measures and predictive analytics, comparative effectiveness, quality improvement & clinical benchmarking, clinical decision support (CDS), and regulatory reporting & compliance. Population health analytics is a part of the overall population health management (PHM) market. Various solutions such as data integration, visualization, and analytics are used for PHM. Population health analytics is considered as a separate application segment in this report as it includes both clinical and financial applications. Population health analytics solutions help improve population health outcomes and lower costs through data aggregation and insight-driven prioritization, risk stratification, coordination, and management of patient-centered care. This segment focuses on analytics tools used for PHM that continuously aggregate and analyze clinical and financial data across enterprises and provide actionable insights to healthcare providers and payers. These insights help them view population health trends and care patterns, understand high-risk patient populations, and identify clinical gaps in care, so as to take preventive measures before their care becomes costly. Population risk management, population care management, patient engagement, clinical outcome engagement, and activity-based costing are some of the areas where PHM analytics solution are used frequently.

Healthcare Analytics/Medical Analytics

- Enterprise

- SME

- Startups

Healthcare Analytics offers insight into hospital management, patient records, costs, diagnoses, among others, on a macro and micro level. Combined with business intelligence suites and data visualization tools, healthcare analytics helps healthcare providers operate better by providing real-time information that can support decisions and deliver actionable insights.

Healthcare Analytics offers insight into hospital management, patient records, costs, diagnoses, among others, on a macro and micro level. Combined with business intelligence suites and data visualization tools, healthcare analytics helps healthcare providers operate better by providing real-time information that can support decisions and deliver actionable insights.

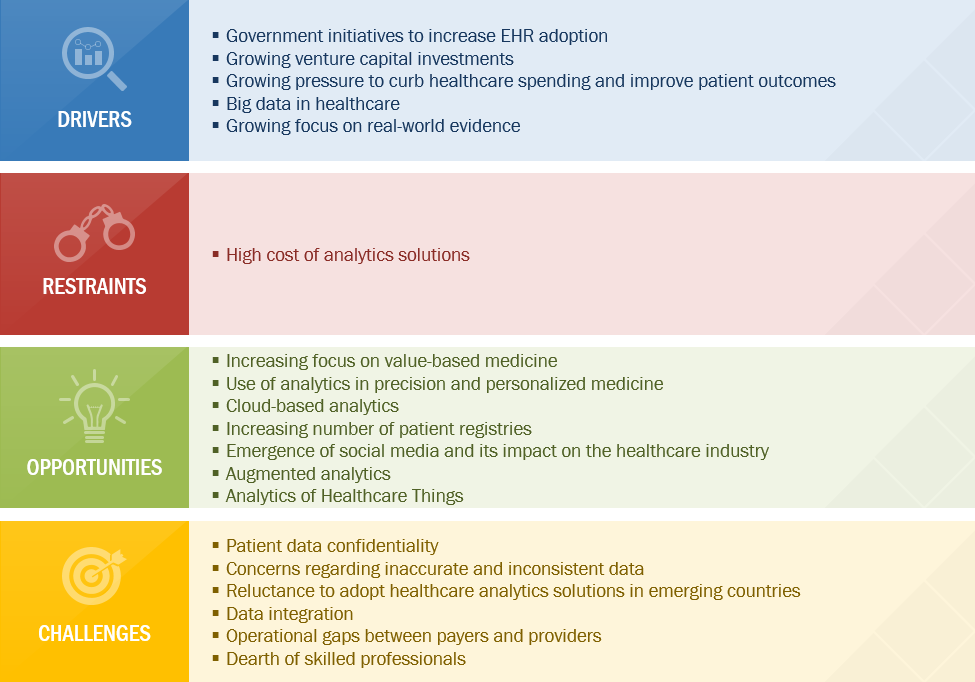

The healthcare analytics market is expected to reach USD 50 billion by 2024. Initiatives undertaken by the government to increase EHR adoption, substantial venture capital investments, increasing need to curb healthcare spending and improve patient outcomes, rapid advancements of big data analytics in healthcare, and rising importance of real-world evidence are some of the major factors driving the growth of this market.

FIGURE 1 BIG DATA IN HEALTHCARE TO DRIVE THE GROWTH OF THE HEALTHCARE ANALYTICS MARKET

Major industry applications that are adopting healthcare analytics include financial analytics, clinical analytics, operational and administrative analytics, and population health analytics. Top Healthcare Analytics companies that are profiled in the report include IBM Corporation (US), Optum, Inc (US), Cerner Corporation (US), SAS Institute, Inc. (US), Allscripts Health Solutions (US).

The report evaluates key players in the Healthcare Analytics market based on business strategy excellence and strength of product portfolio, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

The report includes market-specific company profiles of 15 key players and assesses the recent developments that shape the competitive landscape of this highly fragmented market.

This report identifies and benchmarks the key market players in the Healthcare Analytics Market including Allscripts (US), Cerner (US), Citius Tech (US), Cotiviti (Verscend Technologies), Health Catalyst (US), and evaluates them based on business strategy excellence and strength of product portfolio within the Healthcare Analytics ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on a 2x2 matrix, called as ‘Company Evaluation Quadrant,’ and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More