Comparing 9 vendors in Dental Implants and Prosthetics Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

The dental implants and prosthetics market is a dynamic and rapidly evolving sector within the healthcare industry. This market has witnessed significant growth over recent years, driven by advancements in technology, increasing demand for cosmetic dentistry, and the growing population of aging individuals requiring dental solutions. Dental implants offer a permanent and reliable solution for people with missing or damaged teeth, providing benefits such as enhanced oral aesthetics and functional efficiency. The prosthetics segment complements this by offering a variety of options that cater to different dental needs ranging from bridges to full dentures.

The integration of advanced technologies, particularly artificial intelligence (AI), has been a game-changer, enhancing precision, efficiency, and overall patient outcomes. AI helps streamline the complex workflow involved in dental implant procedures, reducing reliance on clinician expertise while improving accuracy. This technological advancement has also played a crucial role in improving the manufacturing processes of dental products, including 3D-printed surgical guides and implants. The ability of AI to employ deep learning techniques for analyzing extensive datasets has further allowed for personalized and evidence-based treatment strategies, thereby transforming the landscape of digital dentistry.

Players in the market are increasingly focusing on expanding their geographical presence, with significant investments in R&D to develop innovative product solutions. Strategy plays a critical role, with companies pursuing product launches, acquisitions, partnerships, and expansions to enhance their competitive stance. The market is well-established in North America and Europe, with companies now turning their attention to emerging markets in Asia Pacific, the Middle East, and Africa to capture new growth opportunities.

Despite the promising outlook, the market does face some challenges. The high cost of dental implants and limited reimbursement options pose significant constraints. Moreover, there is a dearth of trained dental practitioners, particularly in less developed regions, which could impact the adoption of advanced dental technologies. Companies must navigate these challenges while managing the pricing pressures prevalent in this competitive landscape.

Overall, the dental implants and prosthetics market represents a promising domain with robust growth potential, underpinned by technological advancements, strategic collaborations, and an ever-increasing demand for dental care solutions in both developed and emerging regions.

Key Developments

On feb 2025, Solventum™ Fluency™ for Imaging has been ranked #1 in the 2025 KLAS Research report for Speech Recognition: Front-End Imaging, marking its fifth overall win in this category. This AI-powered radiology reporting solution integrates advanced speech recognition with real-time clinical insights and workflow management tools, enhancing accuracy, efficiency, and compliance in radiology departments and imaging centers.

In April 2025, Needham & Company has downgraded ZimVie Inc. (NASDAQ: ZIMV) from a "Buy" to a "Hold" rating, citing concerns over the dental market's long-term growth prospects and recent signs of weakening U.S. consumer sentiment. The firm also removed its $23 price target for the stock. Analysts noted that both ZimVie and Dentsply Sirona have been experiencing growth rates below the market average, with Dentsply Sirona's stock trading near its 52-week low and showing a significant decline over the past year.

startups

Solventum

Based in the United States, Solventum is positioned as a strategic player in the dental prosthetics market. The company focuses on refining its product offerings through innovation, seeking to enhance the quality and durability of its prosthetic solutions.

ZimVie Inc.

ZimVie Inc., another US-based firm, is known for leveraging cutting-edge technologies to create advanced dental implants. Their focus remains on expanding their market reach and improving product efficacy through persistent R&D efforts.

Osstem Implant Co., Ltd.

Hailing from South Korea, Osstem Implant Co., Ltd. stands out for its use of AI in enhancing product development and optimizing manufacturing processes. The company aims to lead the market with high-precision dental solutions that cater to a global clientele.

Lycra ETK

Operating from Europe, Lycra ETK is noted for its commitment to innovation within the dental implants sphere. The startup emphasizes research and development to provide end-users with the latest in implant technology.

Medigma Biomedical GmbH

This Germany-based entity focuses on producing reliable and efficient dental prosthetics and is making strides in improving accessibility to high-quality dental solutions across Europe.

1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regions Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Patient Pool for Dental Treatments

2.2.1.2 Increasing Demand for Advanced Cosmetic Dental Procedures

2.2.1.3 Growing Preference for Same-Day Dentistry

2.2.1.4 Rising Focus On Aesthetics

2.2.2 Restraints

2.2.2.1 High Cost of Dental Implants and Limited Reimbursement

2.2.2.2 Higher Risk of Tooth Loss Associated with Dental Bridges

2.2.3 Opportunities

2.2.3.1 Growth Potential In Emerging Economies

2.2.3.2 Rapid Growth of Dental Service Organizations

2.2.4 Challenges

2.2.4.1 Dearth of Trained Dental Practitioners

2.2.4.2 Pricing Pressure

2.3 Trends/Disruptions Impacting Customer Business

2.4 Pricing Analysis

2.4.1 Average Selling Price Trend, By Key Player

2.4.2 Average Selling Price Trend, By Region

2.5 Value Chain Analysis

2.6 Supply Chain Analysis

2.7 Ecosystem Analysis

2.8 Investment and Funding Scenario

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Immediacy Solutions/Immediate Loading

2.9.1.2 Novel Biocompatible Materials

2.9.1.3 Apically Tapered Implants

2.9.2 Complementary Technologies

2.9.2.1 Implant Coatings

2.9.2.1.1 Antibacterial Coatings

2.9.2.1.2 Osseointegration-Enhancing Coatings

2.9.2.1.3 Combination Coatings

2.9.2.2 Osseointegrative Surface Technology

2.9.3 Adjacent Technologies

2.9.3.1 Cone-Beam Computed Tomography

2.10 Industry Trends

2.10.1 Market Consolidation

2.10.2 Industry-Academia Collaborations

2.10.3 High Investments In Dental Practices

2.10.4 Bioactive Implants

2.11 Patent Analysis

2.11.1 Patent Publication Trends

2.11.2 Jurisdiction Analysis

2.12 Trade Analysis

2.12.1 Trade Analysis for Dental Implant Products

2.12.2 Trade Analysis for Dental Prosthetic Products

2.13 Key Conferences and Events, 2025–2026

2.14 Case Study Analysis

2.14.1 Case Study 1: Self-Drilling Implants for Immediate Loading of

Full-Arch Prostheses

2.14.2 Case Study 2: Guided Surgical Approach for Precise Implant

Placement

2.14.3 Case Study 3: Complex Full-Arch Rehabilitation Using Molecular

Precision Implant System

2.15 Regulatory Landscape

2.15.1 Regulatory Bodies, Government Agencies, and Other Organizations

2.15.2 Regulatory Framework

2.15.2.1 North America

2.15.2.1.1 US

2.15.2.1.2 Canada

2.15.2.2 Europe

2.15.2.3 Asia Pacific

2.15.2.3.1 China

2.15.2.3.2 Japan

2.15.2.3.3 India

2.15.2.4 Latin America

2.15.2.4.1 Brazil

2.15.2.4.2 Mexico

2.15.2.5 Middle East

2.15.2.6 Africa

2.16 Porter’s Five Forces Analysis

2.16.1 Bargaining Power of Suppliers

2.16.2 Bargaining Power of Buyers

2.16.3 Threat of New Entrants

2.16.4 Threat of Substitutes

2.16.5 Intensity of Competitive Rivalry

2.17 Key Stakeholders and Buying Criteria

2.17.1 Key Stakeholders In Buying Process

2.17.2 Buying Criteria

2.18 Adjacent Market Analysis

2.19 Reimbursement Scenario

2.20 Unmet Needs/End-User Expectations

2.21 Impact of Ai/Generative AI On Dental Implants and Prosthetics Market

2.21.1 Introduction

2.21.2 Market Potential of AI In Market

3 COMPETITIVE LANDSCAPE

3.1 Introduction

3.2 Key Player Strategies/Right to Win,2024

3.2.1 Overview of Strategies Adopted By Key Players In Dental Implants

and Prosthetics Market

3.3 Revenue Analysis, 2018–2023

3.4 Market Share Analysis (Overall Market),2024

3.4.1 Ranking of Key Market Players

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation

3.5.2 Financial Metrics

3.6 Dental Implants Market

3.6.1 Brand/Product Comparison

3.7 Dental Prosthetics Market

3.7.1 Brand/Product Comparison

3.8 Company Evaluation Matrix (Dental Implants Market): Key Players,2024

3.8.1 Stars

3.8.2 Emerging Leaders

3.8.3 Pervasive Players

3.8.4 Participants

3.9 Company Evaluation Matrix (Dental Prosthetics Market): Key Players,2024

3.9.1 Stars

3.9.2 Emerging Leaders

3.9.3 Pervasive Players

3.9.4 Participants

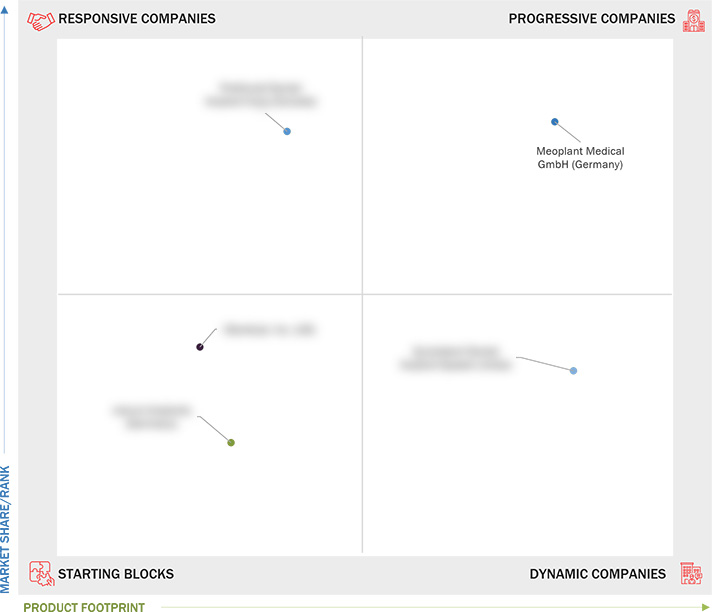

3.10 Company Evaluation Matrix (Dental Implants Market): Startups/Smes,2024

3.10.1 Progressive Companies

3.10.2 Responsive Companies

3.10.3 Dynamic Companies

3.10.4 Starting Blocks

3.10.5 Competitive Benchmarking

3.10.5.1 Detailed List of Key Startups/Smes

3.10.5.2 Competitive Benchmarking of Key Startups/Smes

3.11 Company Evaluation Matrix (Dental Prosthetics Market): Startups/Smes 2024

3.11.1 Progressive Companies

3.11.2 Responsive Companies

3.11.3 Dynamic Companies

3.11.4 Starting Blocks

3.11.5 Competitive Benchmarking

3.11.5.1 Detailed List of Key Startups/Smes

3.11.5.2 Competitive Benchmarking of Key Startups/Smes

3.12 Dental Implants and Prosthetics Market: Company Footprint

3.13 Dental Implants and Prosthetics Market: R&D Expenditure

3.14 Competitive Scenario

3.14.1 Product Launches and Approvals

3.14.2 Deals

3.14.3 Expansions

3.14.4 Other Developments

4 COMPANY PROFILES

4.1 PREFERRED DENTAL IMPLANT CORP (CANADA)

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 iDENTICAL, INC. (US)

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 NATURE IMPLANTS (GERMANY)

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 MEOPLANT MEDICAL GmbH (GERMANY)

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 QUICKDENT DENTAL IMPLANT SYSTEM (INDIA)

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

Company List