Comparing 10 vendors in Biopsy Devices Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

Summary

The biopsy device market is undergoing significant transformations driven by advances in medical technology, increased awareness of early cancer detection, and a growing prevalence of cancer. As global health systems increasingly prioritize early diagnosis and minimally invasive procedures, the demand for advanced biopsy devices continues to rise. With an increase in cancer incidences, the need for more precise and efficient diagnostic tools becomes critical. Despite their challenges with underdeveloped infrastructure, emerging economies offer substantial growth opportunities due to rising health awareness and improving healthcare delivery systems.

In line with these dynamics, innovative technologies such as liquid and robotic-assisted biopsies are reshaping the landscape of diagnostic procedures. Liquid biopsies, in particular, are gaining traction as they offer non-invasive methods for detecting cancer-specific biomarkers in blood, expanding the frontier of cancer diagnostics. Companies are harnessing generative AI to enhance the precision of biopsy devices, streamline procedures, and offer personalized diagnostic solutions that improve patient outcomes.

Moreover, investments in research and development, strategic collaborations, and expansions into new geographical regions underscore the market's forward momentum. Key players continuously refine their strategies to align with these evolving trends by launching novel products and forming alliances to broaden their market reach. As a result, the biopsy devices market is well-positioned for sustained growth, with innovations promising to enhance diagnostic accuracy, reduce procedural risks, and ultimately improve patient care globally.

Key Developments

In October 2024, Medtronic, a leading medical device company, actively integrated artificial intelligence (AI) across all its departments to enhance productivity and patient outcomes. The company has generated over 200 AI initiatives, several of which received initial funding. Tools like Microsoft 365 Copilot and MedtronicGPT, an internal chatbot, are being utilized to streamline operations.

Startups in the Market

Devicor Medical Products

Devicor Medical Products, known for its Mammotome brand, focuses on minimally invasive breast biopsy solutions. Leveraging a strong R&D background and a wide distribution network, it offers reliable diagnostic tools that enhance precision. The company's recent products, like the Mammotome AutoCore, have established new standards in the biopsy field.

Medtronic

BD (Becton, Dickinson, and Company)

BD showcases a robust product portfolio within its Peripheral Intervention division, focusing on developing biopsy devices that improve efficiency and diagnostic accuracy. The company invests heavily in partnerships to enhance its product offerings and maintain its competitive edge in the market.

Trivitron Healthcare

As a significant player in emerging markets, Trivitron Healthcare delivers cost-effective biopsy devices aimed at increasing accessibility and improving healthcare standards in regions like Asia and Africa. Their focus on affordable solutions caters predominantly to the rising healthcare demands of these developing economies.

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION & GEOGRAPHIC SPREAD

1.3.2 INCLUSIONS & EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.2.1 DRIVERS

2.2.1.1 Rising prevalence of cancer

2.2.1.2 Increasing preference for minimally invasive surgeries

2.2.1.3 Initiatives undertaken by governments and global health

organizations

2.2.1.4 Increased number of hospitals and diagnostic centers

2.2.1.5 Improved reimbursement policies

2.2.2 RESTRAINTS

2.2.2.1 Increasing product recalls

2.2.2.2 High risk of infections

2.2.3 OPPORTUNITIES

2.2.3.1 Technological advancements

2.2.3.2 Growing investments in emerging economies

2.2.4 CHALLENGES

2.2.4.1 Underdeveloped healthcare infrastructure in emerging

economies

2.3 INDUSTRY TRENDS

2.3.1 MINIMALLY INVASIVE PROCEDURES

2.3.2 ROBOTIC-ASSISTED BIOPSY DEVICES

2.3.3 LIQUID BIOPSY TECHNOLOGY

2.4 TECHNOLOGY ANALYSIS

2.4.1 KEY TECHNOLOGIES

2.4.1.1 Robotic-assisted biopsy devices

2.4.1.2 Optical biopsy technologies

2.4.1.3 Minimally invasive biopsy devices

2.4.2 COMPLEMENTARY TECHNOLOGIES

2.4.2.1 Imaging technologies

2.4.2.2 Tissue analysis technologies

2.4.2.3 Artificial intelligence

2.4.3 ADJACENT TECHNOLOGIES

2.4.3.1 Digital pathology and AI integration

2.4.3.2 Precision medicine tools

2.4.3.3 Advanced needle and probe technologies

2.5 PORTER’S FIVE FORCES ANALYSIS

2.5.1 THREAT FROM NEW ENTRANTS

2.5.2 BARGAINING POWER OF SUPPLIERS

2.5.3 BARGAINING POWER OF BUYERS

2.5.4 THREAT FROM SUBSTITUTES

2.5.5 INTENSITY OF COMPETITIVE RIVALRY

2.6 REGULATORY LANDSCAPE

2.6.1 REGULATIONS, BY REGION

2.6.1.1 North America

2.6.1.1.1 US

2.6.1.1.2 Canada

2.6.1.2 Europe

2.6.1.3 Asia Pacific

2.6.1.4 Latin America

2.6.1.5 Middle East & Africa

2.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

2.7 PATENT ANALYSIS

2.7.1 PATENT PUBLICATION TRENDS IN BIOPSY DEVICES MARKET

2.7.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

2.8 TRADE ANALYSIS

2.9 PRICING ANALYSIS

2.9.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY KEY PRODUCT

2.9.2 AVERAGE SELLING PRICE TREND OF BIOPSY DEVICES, BY REGION

2.10 KEY CONFERENCES & EVENTS

2.11 KEY STAKEHOLDERS & BUYING CRITERIA

2.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

2.11.2 BUYING CRITERIA

2.12 BIOPSY DEVICES MARKET: UNMET NEEDS/EXPECTATIONS OF END USERS

2.13 ECOSYSTEM ANALYSIS

2.14 CASE STUDY ANALYSIS

2.14.1 CASE STUDY 1: DEVICELAB COLLABORATED WITH CLINICAL EXPERTS TO

IDENTIFY LIMITATIONS OF EXISTING BREAST BIOPSY PROCEDURES

2.14.2 CASE STUDY 2: RESEARCHERS AT UNIVERSITY OF TWENTE DESIGNED

ROBOTIC SETUP AND SOFTWARE ARCHITECTURE TO ASSIST RADIOLOGISTS

IN TARGETING MRI-DETECTED SUSPICIOUS TUMORS

2.14.3 CASE STUDY 3: RESEARCH TEAM DESIGNED FLEXIBLE ROBOTIC SYSTEM FOR

BIOPSY SAMPLING APPLIED TO HUMAN CORPSES PLACED INSIDE

PROTECTIVE BODY BAGS

2.15 SUPPLY CHAIN ANALYSIS

2.16 ADJACENT MARKET ANALYSIS

2.16.1 BREAST BIOPSY DEVICES MARKET

2.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

2.18 INVESTMENT & FUNDING SCENARIO

2.19 IMPACT OF AI ON BIOPSY DEVICES MARKET

3 COMPETITIVE LANDSCAPE

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BIOPSY DEVICES

MARKET

3.3 REVENUE ANALYSIS

3.4 MARKET SHARE ANALYSIS

3.5 COMPANY EVALUATION MATRIX: KEY PLAYERS

3.5.1 STARS

3.5.2 EMERGING LEADERS

3.5.3 PERVASIVE PLAYERS

3.5.4 PARTICIPANTS

3.5.5 COMPANY FOOTPRINT: KEY PLAYERS

3.5.5.1 Company footprint

3.5.5.2 Region footprint

3.5.5.3 Product footprint

3.5.5.4 Technology footprint

3.5.5.5 Application footprint

3.5.5.6 End user footprint

3.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES

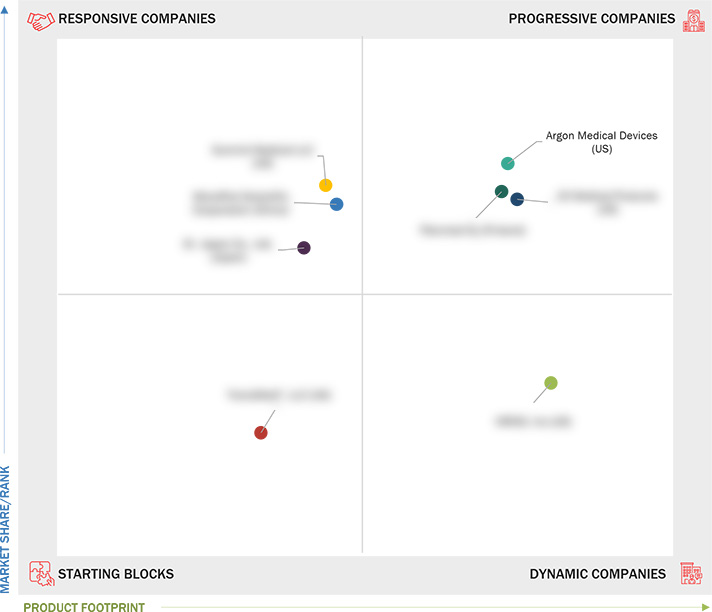

3.6.1 PROGRESSIVE COMPANIES

3.6.2 RESPONSIVE COMPANIES

3.6.3 DYNAMIC COMPANIES

3.6.4 STARTING BLOCKS

3.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

3.7 COMPANY VALUATION & FINANCIAL METRICS

3.7.1 COMPANY VALUATION

3.7.2 FINANCIAL METRICS

3.8 BRAND/PRODUCT COMPARISON

3.9 COMPETITIVE SCENARIO

3.9.1 PRODUCT LAUNCHES & APPROVALS

3.9.2 DEALS

3.9.3 EXPANSIONS

4 COMPANY PROFILES

4.1 MICROPORT SCIENTIFIC CORPORATION

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 ARGON MEDICAL DEVICES

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 INRAD, INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 SUMMIT MEDICAL LLC

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TRANSMED7, LLC

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 DR. JAPAN CO., LTD

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 IZI MEDICAL PRODUCTS

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 PLANMED OY

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 ADVIN HEALTH CARE

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 TRIVITRON HEALTHCARE

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

Latest

Argon Medical Acquires 2 Microcatheters to Boost Oncology Biz

Jan 2025

Jan 2025 Medical Product Outsourcing

Medical Product OutsourcingArgon Medical Launches CLEANER Vac Thrombectomy System

Sep 2024

Sep 2024 Medical Product Outsourcing

Medical Product OutsourcingSK Capital’s Luxium to acquire Inrad optics for US$ 19 million

Apr 2024

Apr 2024 indianchemicalnews

indianchemicalnewsIZI Medical Products Announces the Launch of Vertefix® HV Cement with Insite™ Tracking Beads

Aug 2021

Aug 2021 IZI Medical Products

IZI Medical Products

Company List