Comparing 24 vendors in AI in Drug Discovery across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

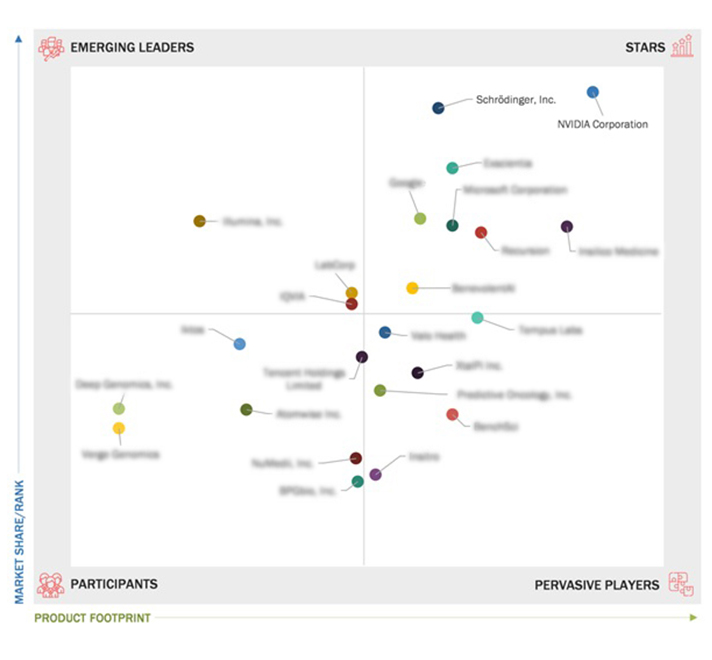

The Artificial Intelligence (AI) in drug discovery Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Artificial Intelligence (AI) in drug discovery. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 24 Artificial Intelligence (AI) in drug discovery Companies were categorized and recognized as the quadrant leaders.

The integration of Artificial Intelligence (AI) in drug discovery has the potential to significantly strengthen the market landscape. By optimizing experiments, prioritizing critical targets, and enabling virtual screening, AI accelerates research, facilitates faster identification of failures, and broadens testing diversity. It also revolutionizes drug discovery workflows by streamlining processes, automating tasks, minimizing in-process decision-making, and advancing parallel property optimization. Additionally, AI-driven tools for epitope selection, prediction, and binding analysis are expediting the development of new vaccines and therapeutics.

However, AI faces limitations, such as a lack of the nuanced understanding and creative insights that experienced researchers bring. Its application can be constrained by insufficient depth, dimensionality, and scale in data, as well as missing metadata on experimental conditions like cell culture or assay parameters. Furthermore, ethical concerns, including data privacy, algorithmic bias, and transparency in decision-making, pose challenges that may hinder market growth in the years ahead.

The 360 Quadrant maps the Artificial Intelligence (AI) in drug discovery companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the Artificial Intelligence (AI) in drug discovery quadrant. The top criteria for product footprint evaluation included Offering (Software and Services), Technology (Machine Learning, Natural Language Processing, Context-aware Processing and Other Technologies ), Therapeutic Area(Oncology, Infectious Diseases, Neurology, Metabolic Diseases, Cardiovascular Diseases, Immunology and Other Therapeutic Areas.),Process, Use Cases and End-User.

Key Players:

Some of the prominent players are NVIDIA Corporation (US), Exscientia (UK), BenevolentAI (UK), Recursion (US), Insilico Medicine (US), Schrödinger, Inc. (US), Microsoft Corporation (US), Google (US), Atomwise Inc. (US), Illumina, Inc. (US), NuMedii, Inc. (US), XtalPi Inc. (US), Iktos (France), Tempus Labs (US), Deep Genomics, Inc. (Canada), Verge Genomics (US), BenchSci (Canada), Insitro (US), Valo Health (US), BPGbio, Inc. (US), IQVIA Inc (US), Labcorp (US), Tencent Holdings Limited (China), Predictive Oncology, Inc. (US), Celsius Therapeutics (US), CytoReason (Israel), Owkin, Inc. (US), Cloud Pharmaceuticals (US), Evaxion Biotech (Denmark), Standigm (South Korea), BIOAGE (US), Envisagenics (US), and Aria Pharmaceuticals, Inc. (US). These players are increasingly focusing on product launches and enhancements, investments, partnerships, collaborations, joint ventures, funding, acquisition, expansions, agreements, sales contracts, and alliances to strengthen their presence in the global market.1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Growing cross-industry collaborations and partnerships

2.1.2 Growing need to reduce time and cost of drug discovery and development

2.1.3 Patent expiry of several drugs

2.2 RESTRAINTS

2.2.1 Shortage of AI workforce and ambiguous regulatory guidelines for medical software

2.3 OPPORTUNITIES

2.3.1 Growing biotechnology industry

2.3.2 Emerging markets

2.3.3 Focus on developing human-aware AI systems

2.4 CHALLENGES

2.4.1 Limited availability of data sets

2.5 PORTER’S FIVE FORCES ANALYSIS

2.5.1 INTENSITY OF COMPETITIVE RIVALRY

2.5.2 BARGAINING POWER OF BUYERS

2.5.3 BARGAINING POWER OF SUPPLIERS

2.5.4 THREAT OF SUBSTITUTES

2.5.5 THREAT OF NEW ENTRANTS

2.6 ECOSYSTEM/MARKET MAP

3.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.2 REVENUE ANALYSIS

3.3 MARKET SHARE ANALYSIS

3.4 COMPANY EVALUATION MATRIX

3.4.1 STARS

3.4.2 EMERGING LEADERS

3.4.3 PERVASIVE PLAYERS

3.4.4 PARTICIPANTS

3.4.5 COMPANY FOOTPRINT

3.6 COMPETITIVE SCENARIOS AND TRENDS

3.6.1 PRODUCT LAUNCHES & ENHANCEMENTS

3.6.2 DEALS

3.6.3 OTHER DEVELOPMENTS

4.1 KEY PLAYERS

4.1.1 NVIDIA CORPORATION

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.4 MnM view

4.1.1.4.1 Key Strengths/Right to win

4.1.1.4.2 Strategic choices made

4.1.1.4.3 Weaknesses & competitive threats

4.1.2 EXSCIENTIA

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.4 MnM view

4.1.2.4.1 Key Strengths/Right to win

4.1.2.4.2 Strategic choices made

4.1.2.4.3 Weaknesses & competitive threats

4.1.3 GOOGLE

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.4 MnM view

4.1.3.4.1 Key Strengths/Right to win

4.1.3.4.2 Strategic choices made

4.1.3.4.3 Weaknesses & competitive threats

4.1.4 BENEVOLENTAI

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.4 MnM view

4.1.4.4.1 Key Strengths/Right to win

4.1.4.4.2 Strategic choices made

4.1.4.4.3 Weaknesses & competitive threats

4.1.5 RECURSION

4.1.5.1 Business overview

4.1.5.2 Products/Solutions/Services offered

4.1.5.3 Recent developments

4.1.5.4 MnM view

4.1.5.4.1 Key Strengths/Right to win

4.1.5.4.2 Strategic choices made

4.1.5.4.3 Weaknesses & competitive threats

4.1.6 INSILICO MEDICINE

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.7 SCHRÖDINGER, INC.

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.8 MICROSOFT CORPORATION

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offered

4.1.8.3 Recent developments

4.1.9 ATOMWISE INC.

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.10 ILLUMINA, INC.

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.11 NUMEDII, INC.

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.12 XTALPI INC.

4.1.12.1 Business overview

4.1.12.2 Products/Solutions/Services offered

4.1.12.3 Recent developments

4.1.13 IKTOS

4.1.13.1 Business overview

4.1.13.2 Products/Solutions/Services offered

4.1.13.3 Recent developments

4.1.14 TEMPUS LABS

4.1.14.1 Business overview

4.1.14.2 Products/Solutions/Services offered

4.1.14.3 Recent developments

4.1.15 DEEP GENOMICS, INC.

4.1.15.1 Business overview

4.1.15.2 Products/Solutions/Services offered

4.1.15.3 Recent developments

4.1.16 VERGE GENOMICS

4.1.16.1 Business overview

4.1.16.2 Products/Solutions/Services offered

4.1.16.3 Recent developments

4.1.17 BENCHSCI

4.1.17.1 Business overview

4.1.17.2 Products/Solutions/Services offered

4.1.17.3 Recent developments

4.1.18 INSITRO

4.1.18.1 Business overview

4.1.18.2 Products/Solutions/Services offered

4.1.18.3 Recent developments

4.1.19 VALO HEALTH

4.1.19.1 Business overview

4.1.19.2 Products/Solutions/Services offered

4.1.19.3 Recent developments

4.1.20 BPGBIO, INC.

4.1.20.1 Business overview

4.1.20.2 Products/Solutions/Services offered

4.1.20.3 Recent development

4.2 OTHER EMERGING PLAYERS

4.2.1 PREDICTIVE ONCOLOGY, INC.

4.2.2 IQVIA INC.

4.2.3 TENCENT HOLDINGS LIMITED

4.2.4 BIOAGE LABS

4.2.5 ARIA PHARMACEUTICALS, IN

Latest

cc-TDI and Atomwise Forge Global AI Collaboration in Cancer Research

Apr 2024

Apr 2024 azorobotics

azoroboticsAI-Based Drug Discovery Company Atomwise Sets Its Sights on ...

Oct 2023

Oct 2023 Genetic Engineering & Biotechnology News

Genetic Engineering & Biotechnology NewsBenchSci opens UK base in Cambridge

Jul 2023

Jul 2023 cambridgeindependent

cambridgeindependentBenevolentAI Unveils Major Strategic Overhaul With Return to Original Mission

Dec 2024

Dec 2024 businesswire

businesswireBenevolentAI to Present on Explainable AI for Drug Discovery at BioTechX Europe 2024

Oct 2024

Oct 2024 businesswire

businesswireCompany List