Comparing 3 vendors in Variable Frequency Drive Startups across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

The variable frequency drive (VFD) market has become a pivotal component in the drive for energy efficiency and automation across various industries. These drives are essential in managing motors' speed and torque, which form the backbone of many industrial and commercial applications. The increasing demand for energy-efficient solutions and the growing emphasis on automation in manufacturing and production settings are major drivers propelling the VFD market forward. As industries prioritize sustainable practices, VFDs have emerged as crucial instruments to reduce energy consumption and optimize operational efficiency.

They provide significant energy savings and enhance equipment safety and performance, extending the lifespan of machinery and reducing maintenance costs. Moreover, technological advancements and innovations in IoT and AI are reshaping the landscape of the VFD market, enabling more robust control over electrical systems. This integration facilitates predictive maintenance and real-time data monitoring, which is critical for efficient operation in modern industry. Furthermore, government regulations on energy efficiency and emissions are compelling industries to adapt to technologies like VFDs that meet these stringent standards. Despite high initial installation costs and the need for skilled personnel, the long-term savings and benefits VFDs offer to support their adoption. This dynamic market continues to evolve with emerging trends, such as the increasing adoption of the Internet of Things (IoT) and robotics, enhancing the capabilities and applications of VFDs in various sectors.

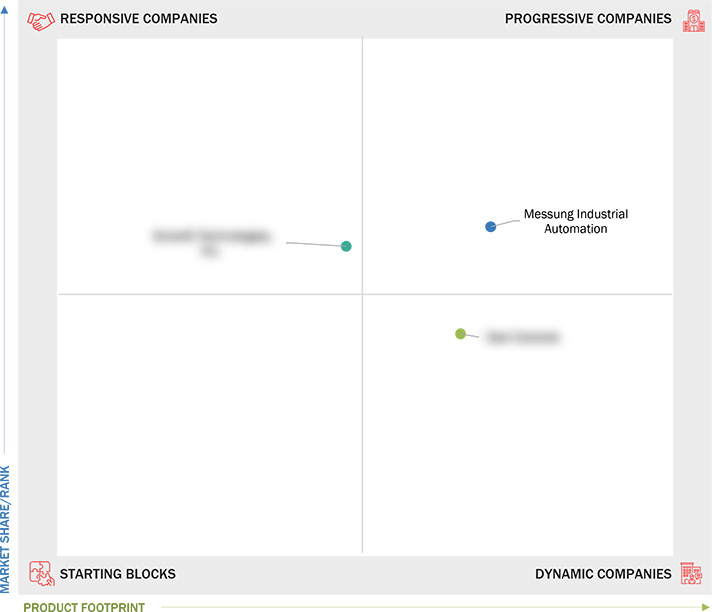

Startups in the Market

Messung Industrial Automation

Messung Industrial Automation is an SME based in India that has made its mark by delivering tailored solutions in the VFD market. Known for its expansive reach within the country, the company is categorized as a progressive entity because it can provide customized solutions that meet specific client needs.

SmartD Technologies, Inc.

SmartD Technologies, founded in Canada in 2018, represents a responsive company in the startup landscape. With a workforce focusing on innovation, SmartD emphasizes developing advanced solutions tailored to the evolving demands of VFD applications, particularly noted for securing a successful Series A funding round.

Dart Controls

Based in the United States, Dart Controls has remained dynamic in its approach to the VFD market. This SME excels through a vast network of resellers and channel partners that help distribute its products widely across various industries, enhancing its market presence.1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising need for enhancing energy efficiency and decreasing

energy consumption

2.2.1.2 Increasing need for motion control systems in automated

production plants

2.2.1.3 Growing need for energy efficiency and process optimization

in chemicals industry

2.2.2 Restraints

2.2.2.1 High installation and maintenance costs

2.2.2.2 Stagnant growth of oil & gas industry

2.2.3 Opportunities

2.2.3.1 Government regulations for sustainability

2.2.3.2 Growing Use of Industrial Internet of Things and robotics

technologies

2.2.4 Challenges

2.2.4.1 Lack of skilled workforce for installation, programming,

and maintenance of variable frequency drives

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.4.1 Raw Material Providers/Component Manufacturers/ Suppliers

2.4.2 Variable Frequency Drive Manufacturers/Assemblers

2.4.3 Distributors/ Resellers

2.4.4 End Users

2.4.5 Maintenance/Service Providers

2.5 Ecosystem Analysis

2.6 Case Study Analysis

2.6.1 Medium-Voltage Variable Frequency Drive for Preheater Helped

Cement Plant Achieve Substantial Energy Savings

2.6.2 Adapting 11kV Motor for 6.6kV Variable Frequency Drive with Star-

Delta Solution

2.6.3 Enhancing Ball Mill Efficiency in Iron ORE Mining with Invertek

Drives Ltd.’S Optidrive P2 Variable Frequency Drive

2.7 Technology Analysis

2.7.1 Key Technology

2.7.1.1 Direct torque control

2.7.2 Adjacent Technology

2.7.2.1 Harmonic filtering

2.7.3 Complementary Technology

2.7.3.1 Internet of Things

2.8 Pricing Analysis

2.8.1 Average Selling Price of Variable Frequency Drives, By Power

Rating, 2021–2024

2.8.2 Average Selling Price of Variable Frequency Drives, By Region,

2021–2024

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 850110)

2.9.2 Export Scenario (HS Code 850110)

2.9.3 Import Scenario (HS Code 850120)

2.9.4 Export Scenario (HS Code 850120)

2.10 Patent Analysis

2.11 Key Conferences and Events,2025

2.12 Investment and Funding Scenario

2.13 Tariff and Regulatory Landscape

2.13.1 Tariffs Related to Variable Frequency Drive

2.13.2 Regulatory Bodies, Government Agencies, and Other Organizations

2.14 Porter’s Five Forces Analysis

2.14.1 Threat of Substitutes

2.14.2 Bargaining Power of Suppliers

2.14.3 Bargaining Power of Buyers

2.14.4 Threat of New Entrants

2.14.5 Intensity of Competitive Rivalry

2.15 Key Stakeholders and Buying Criteria

2.15.1 Key Stakeholders in Buying Process

2.15.2 Buying Criteria

2.16 Impact of AI/Generative AI in Variable Frequency Drive Market

2.16.1 Adoption of AI/Generative AI in Variable Frequency Drive Market

2.16.2 Impact of AI/Generative AI on Drive Types, By Region

2.16.3 Impact of AI/Generative AI on Variable Frequency Drive Market,

By Region

2.17 Macroeconomic Outlook

2.17.1 Introduction

2.17.2 GDP Trends and Forecast

2.17.3 Inflation

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis,2023

3.5 Company Valuation and Financial Metrics,2025

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Key Players,2023

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint: Key Players,2023

3.7.5.1 Company footprint

3.7.5.2 Region footprint

3.7.5.3 Power rating footprint

3.7.6.4 Type Footprint

3.7.6.5 Application footprint

3.8 Company Evaluation Matrix: Startups/SMEs,2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs,2023

3.8.5.1 List of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4 COMPANY PROFILES

4.1 DART CONTROLS

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SMARTD TECHNOLOGIES, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 MESSUNG INTERNATIONAL AUTOMATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

Company List