Comparing 10 vendors in Sodium-Ion Battery across 0 criteria.

✔️ What You Get with This Report

- 📊

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

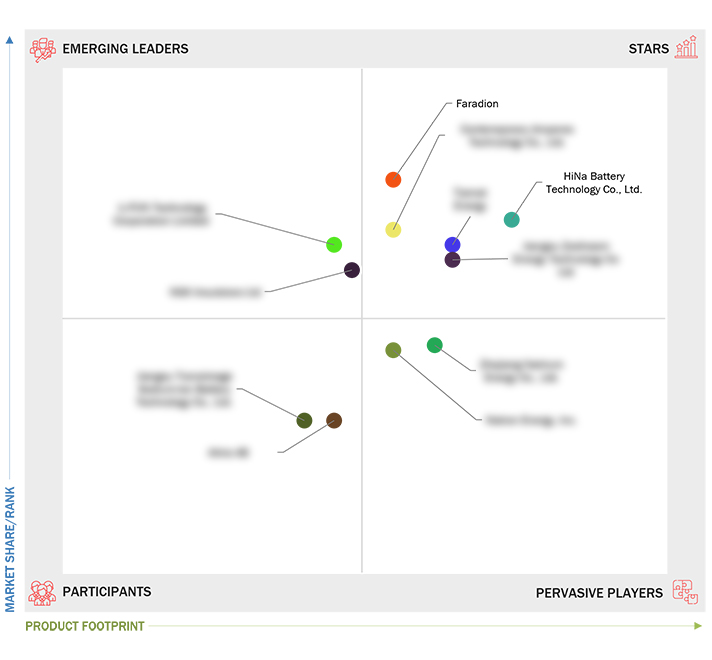

The Sodium-ion battery Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Sodium-ion battery. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and industry trends. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 11 Sodium-ion Battery Companies were categorized and recognized as the quadrant leaders.

Sodium-ion batteries are gaining traction in the market due to their cost-effectiveness compared to alternatives like lithium-ion batteries, which is a key factor driving market growth. These batteries are used across various industries, including automotive, consumer electronics, industrial applications, and energy storage. Market expansion is further fueled by technological advancements, with ongoing research focused on improving the performance and efficiency of sodium-ion batteries. Government support through incentives and regulations also plays a significant role in promoting their adoption. Additionally, the growth of the electric vehicle sector and the increasing use of sodium-ion batteries in industries such as telecommunications, aerospace, and healthcare are further accelerating the market's growth.

The 360 Quadrant maps the Sodium-ion battery companies based on criteria such as revenue, geographic presence, growth strategies, investments, and sales strategies for the market presence of the Sodium ion battery quadrant. The top criteria for product footprint evaluation included Battery Type (Sodium-Sulfur, and Sodium-Salt), Technology Type (Aqueous and Non-Aqueous), and End-Use (Energy Storage, Automotive, Industrial, and Consumer Electronics).

Key Players:

Major companies in the Sodium-ion battery Market include Faradion (UK), Contemporary Amperex Technology Co., Ltd. (China), Tiamet Energy (France), HiNa Battery Technology Co., Ltd. (China) and Jiangsu Zoolnasm Energy Technology Co Ltd (China) and others. A total of 18 players have been covered. These players have adopted product launches, agreements, joint ventures, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market. 1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Need for cost-effective alternative to lithium-ion batteries

2.1.2 Increasing demand for sustainable energy storage solutions

2.2 RESTRAINTS

2.2.1 Lower energy density compared to lithium-ion batteries

2.2.2 Limited cycle life of sodium-ion batteries

2.3 OPPORTUNITIES

2.3.1 Abundance of sodium resources

2.3.2 Innovation and technological advances in sodium-ion batteries

2.4 CHALLENGES

2.4.1 Limited availability of high-performance materials for sodium-ion batteries

2.4.2 Wide application of lithium-ion batteries in various industries

2.5 PORTER’S FIVE FORCES ANALYSIS

2.5.1 BARGAINING POWER OF SUPPLIERS

2.5.2 BARGAINING POWER OF BUYERS

2.5.3 THREAT OF NEW ENTRANTS

2.5.4 THREAT OF SUBSTITUTES

2.5.5 INTENSITY OF COMPETITIVE RIVALRY

2.6 ECOSYSTEM

3.1 INTRODUCTION

3.2 STRATEGIES ADOPTED BY KEY PLAYERS

3.3 REVENUE ANALYSIS

3.4 MARKET SHARE ANALYSIS

3.5 RANKING OF KEY MARKET PLAYERS, 2022

3.6 MARKET SHARE OF KEY PLAYERS

3.6.1 Faradion (UK)

3.6.2 Contemporary Amperex Technology Co., Ltd (China)

3.6.3 Tiamat Energy (France)

3.6.4 HiNa Battery Technology Co., Ltd. (China)

3.6.5 Jiangsu Zoolnasm Energy Technology Co., Ltd. (China)

3.7 BRAND/PRODUCT COMPARISON

3.7.1 SODIUM-ION BATTERIES BY FARADION

3.7.2 SODIUM-ION BATTERIES BY CONTEMPORARY AMPEREX TECHNOLOGY CO., LTD.

3.7.3 SODIUM ION BATTERIES BY TIAMAT ENERGY

3.7.4 SODIUM ION BATTERIES BY HINA BATTERY TECHNOLOGY CO., LTD.

3.7.5 SODIUM ION BATTERIES BY JIANGSU ZOOLNASM ENERGY TECHNOLOGY CO., LTD

3.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.8.1 STARS

3.8.2 EMERGING LEADERS

3.8.3 PERVASIVE PLAYERS

3.8.4 PARTICIPANTS

3.8.5 COMPANY FOOTPRINT

3.9 COMPETITIVE SCENARIO AND TRENDS

3.9.1 PRODUCT LAUNCHES

3.9.2 DEALS

3.9.3 EXPANSIONS

4.1 KEY PLAYERS

4.1.1 FARADION

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.4 MnM view

4.1.2 CONTEMPORARY AMPEREX TECHNOLOGY CO., LTD.

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.4 MnM view

4.1.3 TIAMAT ENERGY

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.4 MnM view

4.1.4 HINA BATTERY TECHNOLOGY CO., LTD.

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.4 MnM view

4.1.5 JIANGSU ZOOLNASM ENERGY TECHNOLOGY CO., LTD.

4.1.5.1 Business overview

4.1.5.2 Products/Solutions/Services offered

4.1.5.3 MnM view

4.1.6 ALTRIS AB

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.6.4 MnM view

4.1.7 NATRON ENERGY, INC.

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.7.4 MnM view

4.1.8 NGK INSULATORS, LTD.

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offered

4.1.8.3 Recent developments

4.1.8.4 MnM view

4.1.9 LI-FUN TECHNOLOGY CORPORATION LIMITED

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.10 JIANGSU TRANSIMAGE TECHNOLOGY CO., LTD.

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.10.4 MnM view

4.1.11 ZHEJIANG NATRIUM ENERGY CO., LTD.

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.11.3 Recent developments

Latest

CATL launches latest TENER Li-ion ESS solution with a larger capacity and cheaper deployment costs

May 2025

May 2025 www.bestmag.co.uk

www.bestmag.co.ukUS allies forced to adapt after CATL unveils salt battery breakthrough

May 2025

May 2025 Interesting Engineering

Interesting EngineeringDraslovka enters sodium-ion battery sector with Natron Energy

Mar 2025

Mar 2025 Investing.com

Investing.comDraslovka expands into sodium-ion batteries in partnership with Natron Energy

Mar 2025

Mar 2025 canadianminingjournal

canadianminingjournalNatron Energy Announces Appointment of Wendell Brooks as Chief Executive Officer

Dec 2024

Dec 2024 businesswire

businesswireCompany List