Comparing 3 vendors in Screw Compressor Startups across 0 criteria.

✔️ What You Get with This Report

- 📊

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

The screw compressor market is undergoing significant evolution driven by a blend of technological advancements, market dynamics, and a growing emphasis on sustainability and energy efficiency. As industries across the globe strive to optimize their operations for better energy consumption and reduced environmental impact, screw compressors have emerged as pivotal tools in accomplishing these goals. These devices play a critical role in various sectors by facilitating better pressure and temperature control, which is crucial for processes in food and beverages, automotive, oil and gas, and chemicals. The global demand for screw compressors is further propelled by their applications in refrigeration and cooling systems, which are essential for maintaining high standards in food processing and storage.

Notably, the advent of technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and innovative energy-efficient solutions are reshaping the landscape of the screw compressor market. These advancements have enhanced compressors' design and operational efficiency, reduced maintenance costs, and improved system reliability. AI applications offer predictive maintenance capabilities that minimize downtime and optimize energy use, aligning with the stringent regulatory requirements focusing on energy efficiency.

Key Developments

In August 2024, BigRentz, the nation’s leading construction procurement software platform, was honored with the “Best Construction Equipment & Technology Platform 2024 — Western USA” award by BUILD Magazine’s Facilities Management Awards. This accolade highlights BigRentz’s dedication to advancing technology in the equipment rental space, including screw compressors, through innovation, seamless integration, and top-tier customer service. The recognition reinforces the company's position as a digital leader in supporting the evolving needs of the facilities and construction management industries.

In March 2023, Cooper Equipment Rentals Limited, Canada’s largest independent construction equipment rental company, announced the successful acquisition of Action Equipment Rentals Inc., based in Red Deer, Alberta. This strategic move enhances Cooper’s presence in Western Canada. It expands its portfolio of available equipment — including critical air systems such as screw compressors — to serve contractors and industrial clients better.

Startups in the Market

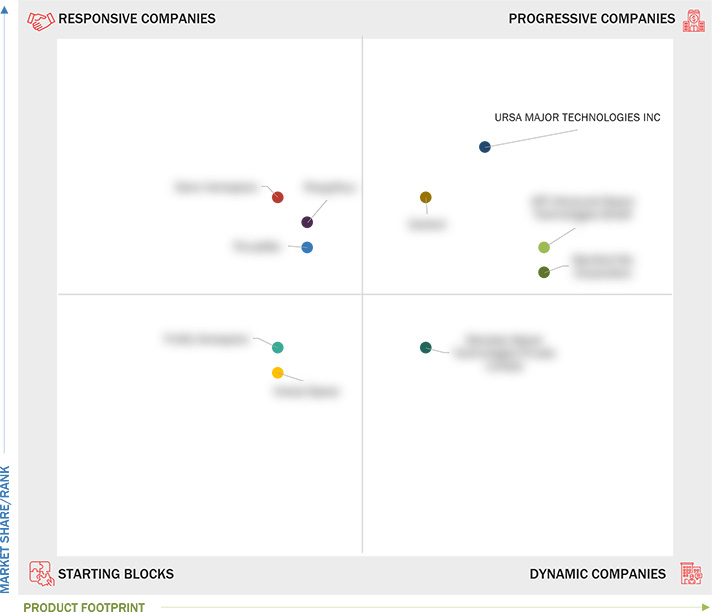

BigRentz, Inc.: Established in the US, BigRentz is a dynamic service provider that leverages innovative solutions to expand its presence across various sectors. The company's strategic operations in California highlight its role in meeting market demands with flexible offerings.

Cooper Equipment Rentals: Based in Ontario, Canada, this company is recognized as a responsive entity in the screw compressor market. It specializes in providing tailored services and solutions to fulfill the diverse needs of its clientele.

Indo-Air Compressors Pvt. Ltd.: Positioned in Ahmedabad, India, Indo-Air is classified under progressive companies, noted for its customization capabilities and a strong market presence within its domain.1 INTRODUCTION

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Unit Considered

1.5 Currency Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 MARKET OVERVIEW

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Strong focus of businesses on achieving sustainability

goals and long-term energy savings

2.2.1.2 Surging demand for energy-efficient solutions due to

stringent regulations

2.2.1.3 Rapid industrialization in emerging economies and thriving

manufacturing sector globally

2.2.2 Restraints

2.2.2.1 High installation and ownership costs

2.2.2.2 Fluctuating prices of raw materials

2.2.3 Opportunities

2.2.3.1 Growing demand for oil-free compressors in oil & gas and

chemicals & petrochemical sectors

2.2.3.2 Industrial automation and smart manufacturing

2.2.3.3 Increasing investments in infrastructure development and

clean energy projects

2.2.4 Challenges

2.2.4.1 Rising cost of sustainability and regulatory compliance in

screw compressors

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Technology Analysis

2.6.1 Key Technologies

2.6.1.1 Advanced cooling technologies

2.6.1.2 IOT-based monitoring systems

2.6.2 Complementary Technologies

2.6.2.1 Variable frequency drivers

2.7 Trade Analysis

2.7.1 Import Scenario (HS Code 8414)

2.7.2 Export Scenario (HS Code 8414)

2.8 Patent Analysis

2.9 Key Conferences and Events, 2025

2.10 Investment and Funding Scenario, 2024

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of Substitutes

2.11.2 Bargaining Power of Suppliers

2.11.3 Bargaining Power of Buyers

2.11.4 Threat of New Entrants

2.11.5 Intensity of Competitive Rivalry

2.12 Impact of Generative Ai/Ai on Screw Compressor Market

2.12.1 Use Cases of Generative Ai/Ai in Screw Compressor Market

2.12.2 Impact of Generative Ai/Ai on Key End Users, By Region

2.13 Global Macroeconomic Outlook

2.13.1 Introduction

2.13.2 GDP Trends and Forecast

2.13.3 Impact of Inflation on Screw Compressor Market

3 COMPETITIVE LANDSCAPE

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4 COMPANY PROFILES

4.1 INDO-AIR COMPRESSORS PVT. LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BIGRENTZ, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 COOPER EQUIPEMENT RENTALS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

Company List