Comparing 8 vendors in Precipitated Silica Startups across 0 criteria.

✔️ What You Get with This Report

- 📊

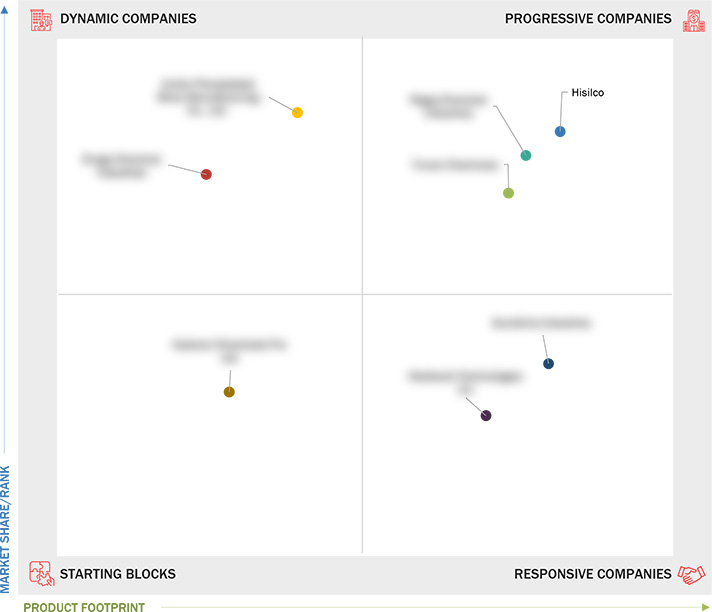

Comprehensive Company Analysis - Business strategy, SWOT, financials, growth areas, M&A moves

- 🏆

Market Position & Share Insights - Visual competitive landscape (like the quadrant above)

- 🔍

Segment-level Benchmarking - Product, region, and end-user vertical

- 📁

Image & Report PDF Downloads - Ready-to-use for presentations and strategy sessions

- 📈

Demand Generation [Optional Buy] - License quadrant to drive demand & showcase leadership

✔️ Analyst-led

✔️ One-time payment

👉 Get Instant Access

The precipitated silica market is a dynamic and rapidly evolving sector poised for substantial growth driven by increasing demand across various industries. As of 2025, the market is expected to reach USD 5,900.9 million from USD 4,206.1 million in 2024, reflecting a compound annual growth rate (CAGR) of 5.8% during the forecast period. Precipitated silica, known for its amorphous structure and high porosity, is a versatile material used extensively in applications ranging from reinforcement in rubber and tires to anti-caking agents in food products. Its adaptability makes it an integral component in numerous industries, including automotive, agriculture, and cosmetics. The Asia Pacific region is forecast to dominate the global market, spurred by rising demands in China, Japan, and South Korea. This surge is largely attributed to the adoption of sustainable vehicles and advancements in energy storage systems, where precipitated silica plays a crucial role. This growth trajectory underscores the material's significance and the increasing importance of eco-friendly manufacturing processes.

Key drivers of the market include the booming rubber and tire sectors, expanded agricultural applications, and the burgeoning cosmetics industry. However, the market faces challenges such as stringent environmental regulations and health and safety concerns that must be navigated to sustain growth. Furthermore, innovations in the precipitated silica industry are expected to be propelled by advancements in AI and generative AI (Gen AI), enhancing production efficiency, material innovation, and quality control.

Key Developments

The precipitated silica market has witnessed several key developments from 2021 to 2025 focused on strategic partnerships, acquisition, and expansions by leading players. The industry is notably consolidated, with major players engaging in strategic moves like mergers and acquisitions to bolster their market positions. For instance, Evonik Industries expanded its production capacity by 50% at its Charleston site to meet the rising demand from the tire industry. AI and Gen AI technologies have played pivotal roles in revolutionizing the industry by enhancing production efficiencies and promoting sustainable practices.

Startups in the Market

Kadvani Chemicals Pvt. Ltd: Established in 1981 in Jamnagar, India, Kadvani Chemicals has emerged as a niche player focusing on localized manufacturing and sustainability practices. This startup is beginning to gain traction despite lacking a strong initial business strategy.

Multisorb Technologies Inc.: Headquartered in New York, this company stands out for its innovative product offerings, particularly in the manufacturing and packaging sectors. Despite strong technological capabilities, Multisorb operates with fewer robust business strategies.

Sunshine Industries: As a startup established in 2009 in Ankleshwar, India, Sunshine Industries is recognized for its responsive strategies and innovative product development, focusing on creating niche market offerings.

Jinsha Precipitated Silica Manufacturing Co., Ltd: This dynamic company, operating since 1996 in China, has made significant strides in the silica technology space, emphasizing technology over comprehensive product strategies.

Durga Chemical Industries: Durga Chemicals has maintained a focus on product-specific technology, contributing significantly to the local market growth.1 INTRODUCTION

1.1 Study objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Stakeholders

2 MARKET OVERVIEW

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.3 DRIVERS

2.3.1 Increasing demand from rubber and tire industries

2.3.2 Increased agricultural applications

2.3.3 Expansion in cosmetics and personal care industry

2.4 RESTRAINTS

2.4.1 Environmental and regulatory challenges

2.4.2 Health and safety concerns

2.5 OPPORTUNITIES

2.5.1 Increasing demand for processed and packaged foods

2.5.2 Expansion in electric vehicle (EV) market

2.6 CHALLENGES

2.6.1 Volatility in raw material supply

2.6.2 Competition from substitutes

2.7 VALUE CHAIN ANALYSIS

2.8 ECOSYSTEM ANALYSIS

2.9 INVESTMENT AND FUNDING SCENARIO

2.10 TECHNOLOGY ANALYSIS

2.10.1 KEY TECHNOLOGIES

2.10.2 COMPLEMENTARY TECHNOLOGIES

2.10.3 ADJACENT TECHNOLOGIES

3 COMPETITIVE LANDSCAPE

3.1 Introduction

3.2 Key Player Strategy/Right to Win, 2021-2025

3.2.1 Overview of Strategies Adopted By Players in Precipitated Silica

Market, 2021–2025

3.3 Revenue Analysis, 2021–2023

3.4 Market Share Analysis, 2023

3.4.1 Ranking of Key Market Players, 2023

3.5 Product Comparison

3.6 Company Valuation and Financial Metrics

3.6.1 Company Valuation

3.7 Company Evaluation Matrix: Key Players, 2023

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.7.5 Company Footprint, Key Players, 2023

3.7.5.1 Company Footprint

3.7.5.2 Region Footprint

3.7.5.3 Grade Footprint

3.7.5.4 Application Footprint

3.7.5.5 End-use Industry Footprint

3.8 Company Evaluation Matrix: Startups/SMEs, 2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking of Startup/SME Players, 2023

3.9 Competitive Scenario

3.9.1 Deals

3.9.2 Expansions

4 COMPANY PROFILES

4.1 MULTISORB

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SUNSHINE INDUSTRIES

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 JINSHA PRECIPITATED SILICA MANUFACTURING CO., LTD.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 HISILCO

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 REGOJ CHEMICAL INDUSTRIES

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 TRIVENI CHEMICALS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 DURGA CHEMICAL INDUSTRIES

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 KADVANI CHEMICALS PVT. LTD.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

Company List