Comparing 15 vendors in Battery Material across 0 criteria.

Become a Client

- Access Exclusive Reports, expert insights and tailored support to drive growth.

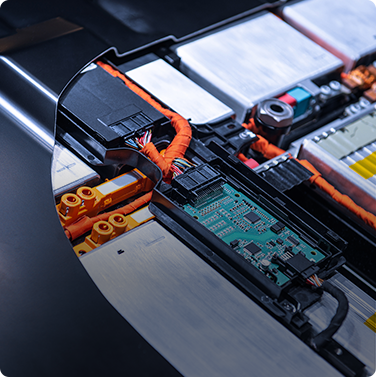

- The battery material market has grown significantly in recent years, owing to the rising use of batteries in numerous industries. The market is likely to grow further as demand for energy storage solutions develops, notably in EVs and renewable energy systems. Technological improvements, government incentives, and reducing battery costs are all helping to drive market expansion.

- Battery materials were worth USD 57.82 billion in 2022 and are expected to be worth USD 120.39 billion by 2027, growing at a CAGR of 15.8% over the forecast period.

- The battery material market is a dynamic and rapidly evolving sector, driven by the increasing demand for energy storage solutions in various industries. Here are some key trends in the battery material market:

Lithium-ion dominance: Lithium-ion batteries continue to dominate the battery material market due to their high energy density, longer lifespan, and wide range of applications. The demand for lithium-ion batteries is fuelled by the growing adoption of electric vehicles (EVs), portable electronics, and energy storage systems.

Cobalt reduction strategies: Due to ethical concerns and price volatility, there is a strong push to reduce or eliminate the use of cobalt in battery materials. Battery manufacturers are actively developing cobalt-free or low-cobalt chemistries, such as NMC 811 (with reduced cobalt content) and exploring alternative materials to improve sustainability and cost-effectiveness.

Recycling and sustainability: With the increasing number of batteries reaching the end of their life, recycling and sustainability are gaining importance. Efforts are being made to develop efficient and environmentally friendly recycling technologies to recover valuable materials from used batteries. Additionally, battery manufacturers are exploring sustainable sourcing practices and incorporating recycled materials in battery production. -

Battery material companies employ various growth strategies to expand their market presence, increase revenue, and capitalize on emerging opportunities in the energy storage sector. Here are some growth strategies commonly adopted by battery material companies:

Strategic Partnerships and Collaborations: Battery material companies often enter strategic partnerships and collaborations with other organizations, including battery manufacturers, research institutions, and suppliers. These partnerships enable knowledge sharing, technology exchange, and joint development of innovative battery materials or manufacturing processes.

Umicore, a leading materials technology company, has entered collaborations with various battery manufacturers, including Samsung SDI and LG Chem, to develop and supply advanced cathode materials for lithium-ion batteries. These partnerships enable Umicore to leverage its expertise in materials science while working closely with battery manufacturers to meet their specific requirements.

Sustainable and Responsible Practices: Battery material companies are focusing on sustainability and responsible sourcing practices to meet evolving environmental and social expectations. This includes incorporating recycled materials, minimizing the use of critical or environmentally sensitive materials, and adopting environmentally friendly manufacturing processes. BASF, a leading chemical company, has established a sustainability strategy for its battery materials. They prioritize the responsible sourcing of raw materials, including cobalt, and are actively engaged in efforts to increase the recycling of batteries. BASF's sustainability efforts aim to meet the growing demand for sustainable battery materials while minimizing environmental impacts.

- Government rules and subsidies play a significant role in shaping the battery material market by providing incentives, regulations, and support for the development and adoption of batteries and energy storage technologies. Here's an example of government rules and subsidies in the battery material market:Electric Vehicle (EV) Subsidies: Many governments worldwide have implemented subsidies and incentives to promote the adoption of electric vehicles. These measures often include financial incentives or tax credits for EV purchases, reduced registration fees, and exemption from certain taxes or tolls. By encouraging the adoption of EVs, governments indirectly support the demand for battery materials used in EV batteries. The federal government of the United States offers a federal tax credit for qualified plug-in electric vehicles. The tax credit ranges from $2,500 to $7,500, depending on the battery capacity of the vehicle. This subsidy helps make electric vehicles more affordable for consumers and stimulates the demand for battery materials used in EV batteries.

Latest

Asahi Kasei holds opening ceremony for sewage-biogas purification demonstration plant

Feb 2025

Feb 2025 chemengonline

chemengonlineAsahi Kasei Plastics North America Ends Sale of 3D Printing Filaments

Feb 2025

Feb 2025 3D Printing Industry

3D Printing IndustryMitsubishi Chemical Advanced Materials, AMAC cooperate on thermoplastics business in Europe

Apr 2022

Apr 2022 CompositesWorld

CompositesWorldCompany List